Are you worried about missing a car payment? You’re not alone.

Many people face financial hiccups that make it difficult to keep up with their bills. When it comes to your car, knowing how far behind you can fall before facing repossession is crucial. This knowledge can be the difference between keeping your vehicle and facing the stress of losing it.

Imagine the inconvenience and disruption repossession could cause in your daily life. But don’t worry, we’re here to guide you through this situation. By understanding the repossession process, you can take steps to avoid it and regain control over your finances. Read on to discover what you need to know to protect your car and your peace of mind.

Car Payment Basics

Loan agreements are important. They tell you how much you owe. They show your monthly payment. Interest rates are included. They can make payments grow. Late fees are also listed. They add more money if you are late. Some agreements have special terms. These terms are called grace periods.

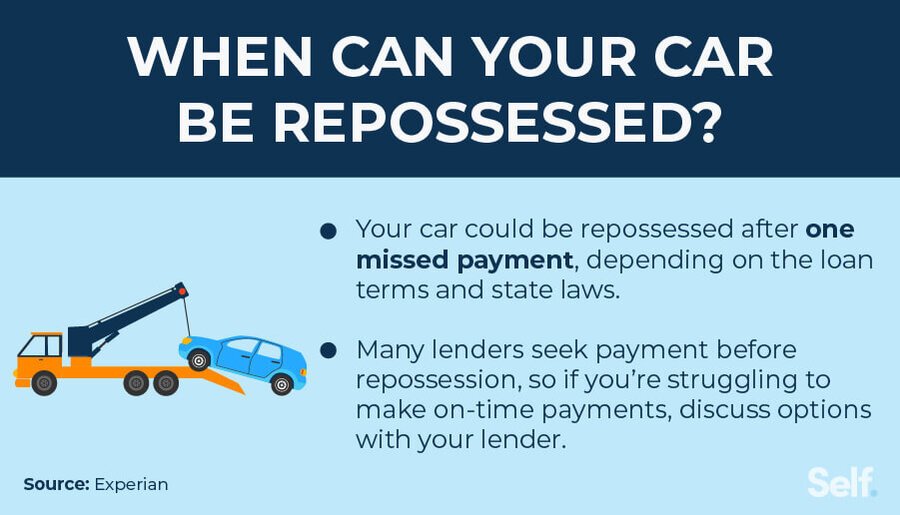

Grace periods give you extra time. They help when you can’t pay on time. Most lenders offer 10 to 15 days. It’s a short time. After this, fees start. Repossession can happen if you are too late. The car gets taken back. It’s important to read your loan terms. Knowing them helps avoid problems. Keep track of payment dates.

Repossession Process

The legal framework for car repossession varies by state. Every state has different rules. Lenders can take your car if you miss payments. They follow state laws. Notice is often required. You might get a letter first. It warns you about missing payments. This letter is important. It explains your rights. Lenders must follow the rules strictly. They can’t break the law. It’s unfair to hide the rules. You should know your rights. Always read the letters carefully. Understand what they mean. It helps you prepare.

Repossession starts when you miss a payment. First, you get a warning letter. This letter tells you the next steps. Then, the lender might send a repo agent. The agent takes your car. They can come anytime. Sometimes late at night. They take the car to a lot. You might pay to get it back. It’s called redeeming. Your car can be sold later. If you can’t pay, they sell it. The sale helps pay your debt. Your lender tells you about the sale. You might lose your car forever. Always try to pay on time. It avoids trouble.

Timeline Of Missed Payments

Missing a car payment can start a chain reaction. The first missed payment will likely result in a late fee. This fee adds to your total amount due. Car lenders often give a grace period. This period is usually 10 to 15 days. During this time, you can pay without extra penalty. It’s important to pay as soon as possible. Missing more payments will make it worse.

After missing a payment, you may get a late payment notice. This notice is a reminder from your lender. It tells you how much you owe. It also tells you the new due date. Ignoring these notices is risky. Your lender might try to contact you more often. They may call or send letters. This is to remind you of your debt.

Pre-repossession warnings occur if you continue to miss payments. These warnings come before your car gets taken. They are serious alerts from your lender. The letter will state the risk of repossession. It means they might take your car back. Paying your debts quickly is very important now. Otherwise, you might lose your car.

Impact Of Repossession

Missing car payments can hurt your credit score. Each missed payment lowers your score. Repossession has a bigger impact. It stays on your credit report for years. This makes it hard to get loans later. Credit card companies may also raise interest rates. Paying bills on time is important to keep a good credit score.

Repossession brings big financial problems. You could lose money from selling the car. The lender might charge extra fees. You might owe more than the car is worth. This leaves you in debt. Buying a new car becomes hard. Your budget feels tight. Planning ahead can help avoid these troubles.

Avoiding Repossession

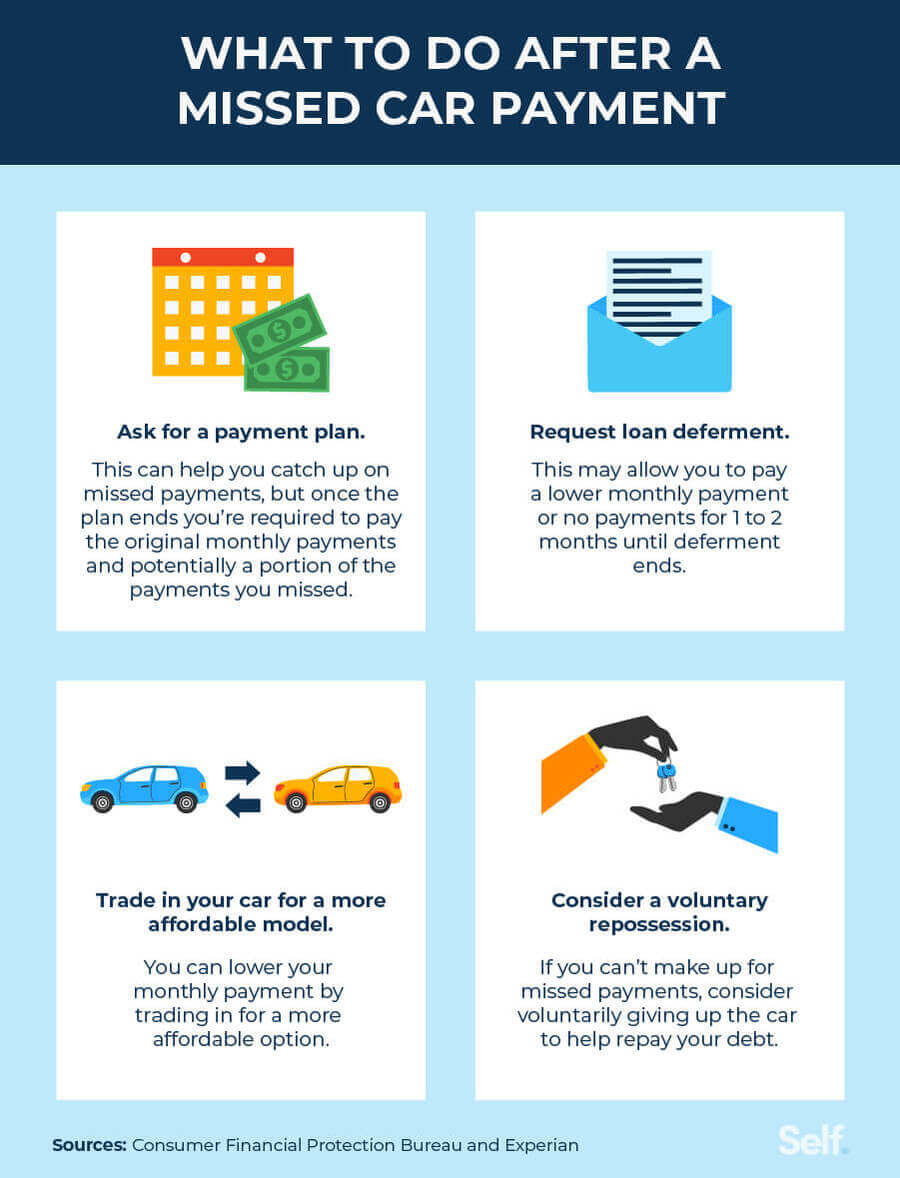

Talk to your lender if you can’t pay. Be honest about your situation.

Explain your problems. Lenders might give you more time. They might lower

payments. Communication is key to avoid car repossession. It shows you

care about paying.

Refinancing can help lower your payments. New loan terms might be better.

Check interest rates. A lower rate means lower payments. Ask your lender

about refinancing. It can make payments easier.

Make a budget to see where money goes. List all income and expenses. Find

areas to save money. Payment plans can help manage debts. Ask your

lender about setting up a plan. Stick to your budget and plan to avoid

problems.

Legal Rights And Protections

Consumer protection laws offer help to car owners. They ensure fair treatment. Lenders must follow rules. They cannot cheat or lie. Laws protect against unfair repossession. Repossession can happen if payments are missed. But laws give warnings first. Owners must know their rights. Knowing rights helps in tough situations.

States have different rules for car payments. Some states allow quick repossession. Others need longer time. Each state has its own laws. It’s important to learn these laws. Knowing state regulations can be helpful. It keeps owners informed. Understanding rules can prevent surprises.

Seeking Professional Help

Falling behind on car payments can lead to repossession. Lenders typically act after two or three missed payments. Staying informed and seeking professional advice can help manage financial challenges and prevent losing your vehicle.

Credit Counseling Services

Struggling with car payments can be overwhelming. Credit counseling services offer guidance. They help manage debts better. Experts provide personalized advice. This can prevent repossession. It’s crucial to act quickly. Early intervention stops problems from worsening. They assist in creating manageable payment plans. This can bring relief. They negotiate with lenders on your behalf. A good counselor can make a big difference. They also offer education on financial planning. This knowledge helps avoid future issues.

Legal Assistance

Legal help can be essential. Lawyers understand your rights. They protect you from unfair practices. Assistance may prevent repossession. They can advise on legal options. Lawyers negotiate with lenders too. They ensure fair treatment. Legal advice can be a lifeline. It provides clarity in confusing situations. They help you understand the contract. It’s important to know what you signed. Legal help can be crucial in tough times.

Alternative Solutions

Voluntary repossession means you give back the car yourself. This choice can help avoid extra fees. It might be less harmful to your credit score. But remember, you might still owe money. The loan balance could be higher than the car’s value. Always talk with your lender first. They might offer other solutions. Consider all options before deciding.

Selling the car can be a smart move. You could get more money than a dealer offers. Use the money to pay off your loan. This way, you avoid repossession. Check the car’s value online. Make sure to sell for a fair price. This option can be a relief. No more worrying about payments. But ensure you understand the sales process.

Frequently Asked Questions

How Many Payments Can You Miss Before Repossession?

Typically, after missing two or three payments, your car may be at risk of repossession. However, policies vary by lender. It’s crucial to communicate with your lender if you’re struggling. Some lenders may offer payment extensions or alternative options to avoid repossession.

Always review your loan agreement for specific terms.

What Are The Signs Of Impending Car Repossession?

Signs include frequent calls or letters from your lender regarding missed payments. A lender might also send a notice of intent to repossess. If your car loan account is severely delinquent, it’s a clear warning. Be proactive and contact your lender to discuss possible solutions or payment arrangements.

Can You Negotiate With The Lender To Avoid Repo?

Yes, you can negotiate with your lender to avoid repossession. Lenders often prefer to work out a solution rather than repossess the vehicle. Options may include restructuring your payment plan or deferring payments. Communication is key, so reach out to your lender as soon as possible.

What Happens After Your Car Is Repossessed?

After repossession, the lender typically sells the vehicle at auction. If the sale doesn’t cover the loan balance, you might owe a deficiency balance. This balance includes the difference and any additional fees. It’s essential to understand your rights and obligations by reviewing your loan agreement carefully.

Conclusion

Falling behind on car payments can lead to repossession. Stay informed to avoid this. Always communicate with your lender if you’re struggling. They might offer solutions. Prioritize your budget to ensure timely payments. Understanding your contract terms is crucial. It helps in managing expectations.

Consider speaking with a financial advisor. They can provide guidance tailored to your situation. Remember, taking proactive steps can prevent loss of your vehicle. Stay diligent. Protect your investment.