Transfer Money from Business Account to Personal: A Simple Guide

Are you wondering how to transfer money from your business account to your personal account without getting tangled in financial confusion? You’re not alone.

Many business owners like you face this challenge, and getting it wrong can lead to unnecessary stress and financial errors. But don’t worry, mastering this process is easier than you think. Imagine having a seamless, stress-free way to manage your funds, ensuring your personal finances are always in perfect harmony with your business accounts.

You’ll discover straightforward steps and practical tips that make transferring money from your business account to your personal account not just easy, but also beneficial for your financial health. Let’s dive into the details that can transform how you handle your finances!

Reasons For Transferring Funds

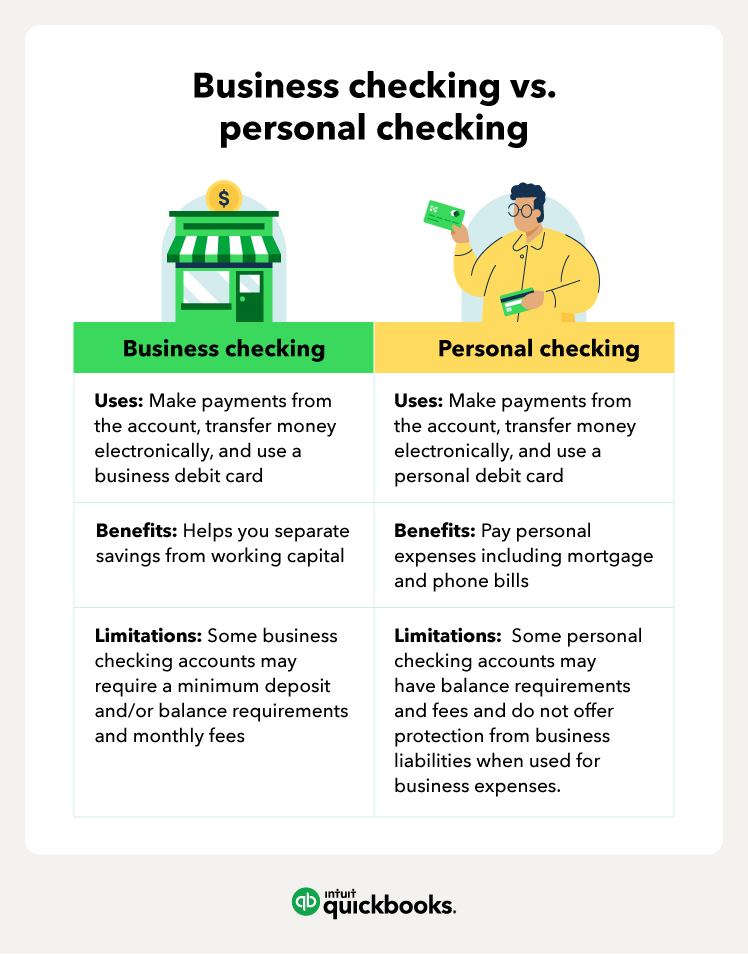

Transferring money from a business account to a personal account is common. This process can serve various purposes, depending on the needs of the business owner. Understanding these reasons can help manage finances effectively. Below are some key reasons why funds are transferred from business to personal accounts.

Personal Expenses

Business owners often face personal expenses that need immediate attention. Using funds from a business account can be convenient. This approach ensures personal bills are paid on time. It helps avoid late fees and penalties. Sometimes, unexpected expenses arise, demanding quick financial solutions. Access to business funds can provide that necessary relief.

Business Reimbursement

Expenses incurred personally for business purposes need reimbursement. Business owners might use their personal funds for business travel. They may buy supplies or cover other business-related costs. Transferring funds from business to personal accounts reimburses these expenses. This helps maintain accurate financial records. It ensures business finances are not intermingled with personal expenses.

Owner’s Draw

Owners draw funds for their labor and investment in the business. This is a common practice among sole proprietors. It compensates the owner for their time and effort. The draw is taken from the business profits. This transfer reflects the owner’s share of the business earnings. Regular draws help maintain personal financial stability.

Considérations juridiques

Transferring money from a business account to a personal one involves careful legal considerations. Ensure compliance with tax laws and maintain clear records. Consult with a financial advisor to avoid potential legal issues and penalties.

Transferring money from a business account to a personal account might seem straightforward, but the legal considerations are crucial. Ensuring that you’re compliant with regulations and aware of tax implications can save you from potential headaches. Let’s break down what you need to know to handle these transfers legally and efficiently.Conséquences fiscales

When you transfer money from a business account to a personal account, taxes should be a primary concern. Depending on your business structure, such as an LLC or corporation, these transfers could be considered dividends or salary. This means they might be subject to personal income tax. Failing to report these correctly can lead to penalties. It’s wise to consult with a tax professional who can guide you on how to record these transactions in a way that minimizes your tax liability.Compliance Regulations

Staying compliant with financial regulations is essential when moving money between accounts. Businesses must ensure that all transfers are documented properly, maintaining transparency and accountability. For example, if you’re an owner of a corporation, transferring funds without proper documentation might be viewed as embezzlement. It’s crucial to have clear records explaining the purpose of each transfer. Ask yourself: Are you following the correct process for your business type? Keeping detailed records not only helps in audits but also supports financial planning. Understanding the legal implications of transferring funds is not just about avoiding trouble—it’s about running a smart, efficient business. Always prioritize compliance and proper documentation to protect both your personal and business interests.Methods Of Transfer

Transferring money from a business account to a personal one can be done through various methods. Bank transfers, checks, and electronic payments are common options. Always ensure to follow legal guidelines to avoid issues.

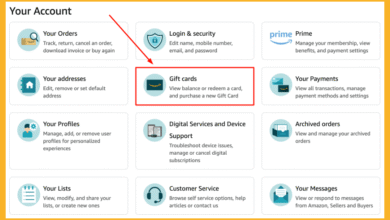

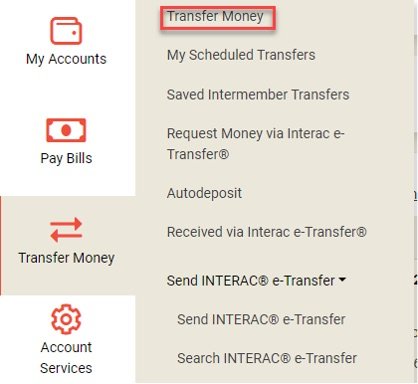

Virements bancaires

Bank transfers are a straightforward method for moving funds from your business account to your personal account. This method is reliable and usually quick, often processing within the same day. To initiate a bank transfer, you typically need to set up your personal account as an approved recipient within your online banking system. This might seem tedious initially, but once it’s set up, transferring funds becomes a seamless process. The ease of use and speed make it a popular choice among small business owners.chèques

Writing a check is a traditional yet effective way to transfer money. Despite the rise of digital solutions, checks still offer a tangible sense of security for many. When writing a check from your business account, it’s essential to keep accurate records. Make sure you note the transaction details in your accounting software to maintain clear financial records. This step is crucial for tax purposes and to avoid any potential issues with audits.Digital Payment Platforms

Digital payment platforms like PayPal, Venmo, or Zelle provide a modern alternative for transferring funds. These platforms are user-friendly and can be accessed via mobile apps or online. They often offer instant transfer options, though sometimes at a small fee. If you’re someone who values convenience and speed, digital payment platforms might be the perfect fit. However, it’s essential to consider any transaction fees associated with these services to ensure they align with your financial strategy. Have you considered which method might work best for your situation? Your choice can impact both your business operations and personal finances.Documenting Transactions

Documenting transactions is crucial for managing your business finances effectively. It ensures transparency and helps in maintaining accurate records. Proper documentation prevents errors and supports compliance with financial regulations. This process involves recording every transfer from your business account to your personal account. It helps in tracking cash flow and understanding financial trends.

Tenue de registres

Record keeping is the backbone of financial management. Maintain detailed logs of each transaction. Include dates, amounts, and the purpose of transfers. Use accounting software or spreadsheets to organize your records. This practice helps in auditing and reviewing your financial activities. It also provides clarity during tax season. Consistent record keeping builds trust and credibility with stakeholders.

Financial Statements

Financial statements are vital for assessing your business health. They reflect your transactions and overall financial position. Regularly update these statements to include every transfer. Balance sheets, income statements, and cash flow statements are essential. They help in making informed business decisions. Accurate statements support strategic planning. They also assist in securing loans and investments.

Potential Risks

Transferring money from a business account to a personal one carries potential risks. Understanding these risks is vital for financial health. Some risks can affect your taxes and business finances. Let’s explore the potential pitfalls.

Financial Mismanagement

Transferring funds incorrectly can lead to financial mismanagement. Mixing personal and business finances often causes confusion. It becomes hard to track business expenses. This confusion can lead to overspending without realizing it. Business cash flow might suffer as a result. Keeping clear records is crucial.

Tax Penalties

Improper transfers may attract tax penalties. Authorities may view these transactions as income. This can increase your taxable income unexpectedly. Proper documentation is essential for every transfer. Without it, audits become a risk. Always consult a tax professional before large transfers. They ensure compliance with tax laws.

Meilleures pratiques

Transferring money from a business account to a personal account demands careful attention to tax implications. Ensure documentation is thorough to avoid issues. Consult with financial advisors to maintain compliance and safeguard against penalties.

Transferring money from a business account to a personal account can be a delicate process. It requires careful attention to detail and adherence to best practices to ensure compliance and financial stability. It’s not just about moving funds; it’s about maintaining integrity in your financial management. Below, we’ll explore some crucial practices that can help you navigate this process effectively.Maintain Separate Accounts

Keeping your business and personal finances separate is not just a good idea; it’s essential. Imagine trying to balance your checkbook when all your transactions are mixed together. It becomes a headache, right? Separate accounts provide clarity. They make tracking expenses and income a breeze. Plus, during tax season, you’ll thank yourself for this simple organization. Consider this: if your business faces an audit, having distinct accounts can save you time and stress. It’s a straightforward measure that protects you and your business.Consult With Financial Advisors

Would you attempt to fix a car engine without consulting a mechanic? Probably not. The same applies to financial transfers. Consulting with a financial advisor is invaluable. They can offer insights that you might overlook. An advisor will ensure your transfer complies with tax laws and banking regulations. Here’s an example: a friend of mine once unknowingly exceeded transfer limits, incurring hefty fees. A quick consultation with a financial advisor could have prevented that costly mistake. Financial advisors bring expertise that helps you make informed decisions. Their advice can be the difference between smooth sailing and financial mishaps. Isn’t it worth asking yourself if you’re doing everything possible to safeguard your finances? Engaging with an advisor could be your smartest move yet. Implementing these practices not only streamlines your financial management but also safeguards your interests. Are you ready to refine your money transfer strategy?

Questions fréquemment posées

How Can I Transfer Money From Business To Personal Account?

Transferring money from a business to a personal account requires proper documentation and adherence to tax regulations. Consult with a financial advisor to ensure compliance. Utilize online banking or direct transfers for convenience. Always record the transaction details for future reference and ensure it aligns with your business’s financial policies.

Is It Legal To Move Funds Between Accounts?

Yes, it’s legal to transfer funds between business and personal accounts. However, it’s crucial to follow tax laws and accounting practices. Ensure all transactions are documented and justified. Consult a tax professional to avoid any legal issues and ensure compliance with financial regulations.

What Are The Tax Implications Of Such Transfers?

Transferring money from business to personal accounts can have tax implications. Funds must be documented and reported appropriately. Consult a tax advisor to understand the potential impact on your tax situation. Ensure compliance with IRS regulations to avoid penalties and maintain accurate financial records.

Can I Use Business Funds For Personal Expenses?

Using business funds for personal expenses can lead to financial and legal issues. It’s essential to separate personal and business finances. Consult a financial advisor for guidance on proper accounting practices. Ensure all transactions are documented and justified to avoid potential complications.

Conclusion

Transferring money from a business account to a personal one requires care. Always follow legal guidelines to avoid any issues. This ensures your finances remain transparent and organized. Remember to keep records of every transaction. It helps in managing your finances better.

Consult a financial advisor if you’re unsure about the process. They can offer valuable insights. Balancing personal and business finances is crucial. It keeps your business healthy and your finances in check. Stay informed and make wise decisions. Your financial future depends on it.

Keep learning and stay compliant with regulations.