Pouvez-vous transférer de l'argent de Dasher directement vers un compte bancaire ?

Let's say you've had a busy week of dashing for DoorDash and you've accumulated a sizeable amount in your Compte Dasher Direct. You might be wondering if you can transfer some of that money to your bank account to cover some expenses. Well, the answer is yes, you can. But before you initiate the transfer, there are some details you'll want to confirm, such as your informations sur le compte bancaire, transfer limits, and frais potentiels. As you prepare to make the transfer, you might be curious about how long it'll take for the funds to be available in your bank account.

What Is Dasher Direct Account

Ton Compte Dasher Direct est un carte de débit prépayée account created by DoorDash, which allows you to receive your Dasher earnings and transfer them to your bank account. It's a secure way to manage your earnings, and you can use the card to make purchases online or in-store. You'll receive a physical card and have access to a mobile app to track your transactions. With Dasher Direct, you don't need to share your bank account information with DoorDash, adding an extra layer of security. Your funds are also Assuré par la FDIC, which means they're insured up to $250,000. This provides you with tranquillité d'esprit, knowing your earnings are safe and easily accessible. You're in control of your finances with Dasher Direct.

Transferring Money to Bank Account

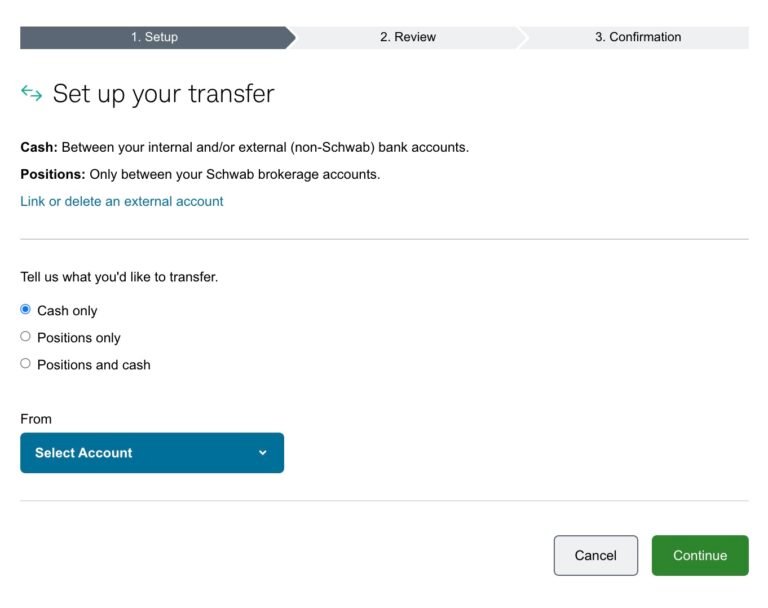

All funds in the Compte Dasher Direct can be transferred to a bank account, allowing you to access and manage your earnings more easily. To initiate a transfer, you'll need to lier votre compte bancaire to your Dasher Direct account. You can do this by logging into your Dasher Direct account and following the prompts to add a new bank account. Once your bank account is linked, you can transférer des fonds from your Dasher Direct account to your bank account. Transfers are typically processed within a few business days. You'll want to verify that your bank account information is accurate and up-to-date to avoid any transfer issues. It's also a good idea to review your limites de transfert and any potential transfer fees.

Benefits of Dasher Direct Account

In addition to facilitating easy transfers to your bank account, having a Compte Dasher Direct offers several benefits that can enhance your overall experience as a Dasher. You'll get instant access to your earnings, which you can use to pay bills, send money to friends, or make purchases online. With a Dasher Direct account, you'll also éviter les tracas of dealing with traditional banking hours or waiting for checks to clear. Additionally, Dasher Direct accounts are Assuré par la FDIC, which means your funds are protected up to $250,000. This provides an added layer of security and peace of mind. By taking advantage of these benefits, you'll be able to gérer vos finances more efficiently and safely.

How to Set Up Dasher Direct

Setting up Dasher Direct is a straightforward process that requires a few simple steps to link the account to your Dasher profile. Here's what you need to do:

- You'll receive an invite to set up Dasher Direct on your Dasher app.

- Open the app, navigate to the Gains tab, and tap Set Up Dasher Direct.

- Follow the prompts to review and agree to the terms and conditions.

- Provide some basic personal info to verify your identity.

After completing these steps, you're all set to start using Dasher Direct. Your Dasher earnings will be automatically deposited into this account, making it easy to track and manage your funds securely.

Linking Bank Account to Dasher

Maintenant que votre Compte Dasher Direct is set up, you'll need to lier un compte bancaire to transfer your earnings out of Dasher Direct. To do this, navigate to the 'Banking' or 'Transfer' section within your Dasher Direct app or dashboard. You'll be prompted to enter your bank account details, including your numéro de compte et numéro de routage. Make sure you have this information readily available and accurate to avoid any linking issues. It's also crucial to guarantee the bank account is in your name, as Dasher Direct may require verification to comply with financial regulations. Once you've entered your bank account details, confirm the information is correct and authorize the linking process. Your bank account should then be successfully linked to your Dasher Direct account.

Dasher Direct Transfer Fees

Because transferring your earnings from Dasher Direct to your bank account often involves some costs, you'll want to understand the fees associated with this process. While Dasher Direct doesn't charge a monthly maintenance fee, there are some frais de transfert to evaluate. Here are some potential costs:

- No frais d'entretien mensuels are charged by Dasher Direct.

- You'll pay a $2.50 fee per ATM withdrawal at Allpoint ATMs and no fees at MoneyPass ATMs.

- Some businesses may charge a small fee for card transactions.

- Le card replacement fee is currently $5.

Délais et limites de transfert

When transferring funds from Dasher Direct to your bank account, you'll encounter varying transfer times and limits that depend on the transfer method you choose. Here's a breakdown:

| Méthode de transfert | Délais et limites de transfert |

|---|---|

| Transfert instantané | Up to 30 minutes, $2,999.99 limit |

| Transfert standard | 1-3 business days, $9,999.99 limit |

| Auto Transfer | 1-2 business days, $9,999.99 limit |

As you can see, the transfer time and limits differ considerably depending on your chosen method. Be certain to review the details before initiating a transfer to guarantee it meets your needs. Keep in mind that these times and limits are subject to change, so it's crucial to check the Dasher Direct app for the most up-to-date information.

Common Transfer Issues Solved

Troubleshooting common transfer issues can help you resolve problems quickly and get your funds transferred from Dasher Direct to your bank account efficiently. When experiencing difficulties, you can identify and solve the issue by considering a few key factors.

- Incorrect bank account information can prevent transfers from going through. Double-check your account details to verify accuracy.

- Fonds insuffisants in your Dasher Direct account can also cause transfer issues. Verify your balance before attempting a transfer.

- Limites de transfert may be exceeded, blocking the transaction.

- Server and technical issues can also occur.

Dasher Direct Customer Support

If you've checked for common transfer issues and still can't resolve the problem, it's time to reach out to Dasher Direct's équipe de support client for further assistance. You can contact them through the app, by phone, or via email. Be prepared to provide your informations sur le compte et un detailed description of the issue you're experiencing. They'll work with you to troubleshoot the problem and find a solution. Remember to only share sensitive information through secure channels, like the app or phone, to maintain your account's security. Dasher Direct's customer support team is available to help you, and with their assistance, you should be able to resolve the issue and accéder à vos fonds.

Alternatives to Dasher Direct Transfers

Besides relying on Dasher Direct transfers, you have other options for accessing your earnings, which can serve as backup methods in case of transfer issues or as alternative financial management strategies. Here are some alternatives to evaluate:

- Use the Dasher Direct carte de débit for in-store or online purchases

- Withdraw cash at an ATM using the Dasher Direct debit card

- Take advantage of instant cash-out options through services like DoorDash's Fast Pay

- Load your earnings onto a prepaid debit card

These alternatives offer flexibility and convenience, ensuring you can access your earnings when you need them. By exploring these options, you can manage your finances effectively and minimize reliance on traditional bank transfers.