Transférer de l'argent d'un compte personnel vers un compte professionnel : guide simple

Transferring money from your personal account to your business account might seem like a simple task, but it’s a crucial step that can impact the financial health and legality of your business operations. Whether you’re a small business owner just starting out or an established entrepreneur, understanding the ins and outs of this process can save you from potential headaches down the road.

Imagine having clear, organized finances that not only make tax season a breeze but also help you make informed decisions for growing your business. By mastering the art of transferring funds between your personal and business accounts, you not only ensure compliance with tax regulations but also maintain a professional image in front of clients and partners.

We’ll guide you through the best practices and considerations for making these transfers seamless and efficient. You’ll discover how to avoid common pitfalls, protect your business’s integrity, and ultimately, keep your financial world in perfect harmony. Ready to take control of your business finances? Let’s dive in.

Understanding Account Types

Transferring money between accounts requires clear understanding of each type. Personal accounts manage individual finances, while business accounts handle company transactions. Ensure compliance with legal and tax regulations when moving funds between these accounts.

Transferring money from your personal account to your business account might seem like a simple task, but understanding the different account types is crucial. This knowledge not only ensures smooth transactions but also helps in managing finances effectively. Knowing the unique features of each account type can help you make informed decisions.Personal Account Features

A personal account is tailored for your individual needs. It offers easy access to your funds through ATMs, online banking, and mobile apps. You can manage your day-to-day transactions with minimal fees. Personal accounts often come with features like savings and checking options. You can set up automatic bill payments and track your spending patterns. However, they typically have lower transaction limits compared to business accounts. Using a personal account for business transactions might seem convenient. But it can complicate your financial records and make tax time a hassle. Have you ever found yourself sifting through personal expenses to find business ones?Business Account Features

Business accounts, on the other hand, are designed with your company’s needs in mind. They provide higher transaction limits and specialized services. These accounts often include merchant services, payroll processing, and business loans. Opening a business account can help you maintain clear financial records. This separation makes it easier to track profits, manage expenses, and prepare for tax season. Plus, it boosts your professional image when clients pay into a business account rather than a personal one. Business accounts may come with additional fees, but they offer benefits that can outweigh the costs. Are you ready to enhance your business credibility and streamline your financial management?Considérations juridiques

Transferring money from a personal to a business account requires understanding legal rules. Ensure compliance with tax laws and maintain clear records. Always consult a legal expert to avoid potential issues.

Conséquences fiscales

Transferring money between accounts might seem harmless, but there are tax implications to consider. You need to be aware of how these transactions affect your taxable income. If you’re not careful, you might end up overstating your income or underpaying taxes, both of which can lead to penalties. Keep detailed records of all transfers. Documentation helps if the IRS ever questions your transactions. This is particularly important for sole proprietors who might blur the lines between personal and business expenses. ###Compliance Requirements

Every business must comply with specific legal requirements. These can vary by region and business type. Are you aware of your local regulations for business finances? Ensure that your transfers comply with anti-money laundering regulations. This often means providing documentation and justifications for larger transfers. Failure to comply can lead to hefty fines and other legal issues. Consider consulting with a financial advisor or legal expert. They can help you navigate the complexities and ensure your business is on the right side of the law. This small investment in professional advice can save you from costly mistakes down the road. In short, while transferring money between your personal and business accounts might seem mundane, it requires careful attention to legal details. Are you ready to take the necessary steps to protect your business legally?Choisir la bonne méthode de transfert

Choosing the right method to transfer money from your personal account to your business account is crucial. Different methods offer unique benefits, costs, and processing times. Understanding these options helps in making an informed decision. Let’s explore the most common methods.

Virements bancaires

Bank transfers are straightforward and secure. Most banks offer this service through their online platforms or in person. Fees are often low, especially for transfers within the same bank. Transfers between different banks may take a few days. Always check with your bank for specific terms and conditions.

Online Payment Platforms

Online payment platforms like PayPal or Venmo provide convenience. They offer quick transfers between accounts. These platforms are user-friendly and accessible via mobile or computer. Keep in mind, transaction fees may apply. Always review their security measures and user agreements.

Virements bancaires

Wire transfers are reliable for large amounts. They are fast and allow for international transactions. Banks typically charge a fee for this service. Ensure you have the correct recipient information to avoid delays. Wire transfers are ideal for urgent business needs.

Preparing For The Transfer

Transferring money from a personal account to a business account requires preparation. This ensures a smooth process with no hitches. Understand the steps involved and gather necessary items beforehand.

Documentation nécessaire

Gather all required documents. These include identification, bank statements, and business registration papers. Ensure you have them ready before starting the process. Proper documentation speeds up the transfer.

Having your tax identification number handy is important. This number links your business to the financial system. Organize these documents in a folder. Easy access helps during the transfer.

Setting Up Accounts

Ensure both personal and business accounts are set up correctly. Verify that your business account is active and ready to receive funds. Check all account details twice for accuracy. This prevents errors during the transfer.

Many banks offer online account management. Use these tools to check your account status. Make sure you have access to online banking. This simplifies the process significantly.

Executing The Transfer

Transferring money from a personal account to a business account is important. It helps keep personal and business finances separate. This ensures clear financial records. It also helps in accurate tax reporting. Let’s explore the process of executing this transfer.

Step-by-step Process

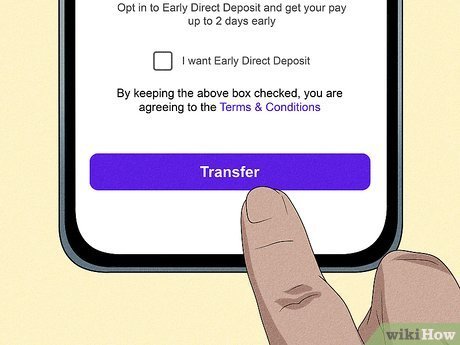

First, log into your online banking account. Locate the transfer option. This is usually in the main menu. Choose the account you want to transfer from. This will be your personal account. Next, select the business account as the recipient. Enter the amount you wish to transfer.

Double-check the details before proceeding. Click confirm to complete the transfer. You will receive a confirmation message. This means your transfer was successful. Save this confirmation for your records.

Erreurs courantes à éviter

Do not mix personal and business transactions. It can complicate tax filings. Avoid transferring without verifying account details. Incorrect details can lead to failed transactions. Check if there are any transfer limits. Exceeding limits can cause delays.

Be mindful of transfer fees. Some banks charge for such transfers. Ensure there are sufficient funds in your personal account. An overdraft can incur extra charges. Keep records of all transactions for future reference.

Post-transfer Actions

Ensure smooth business operations by transferring funds from your personal account to the business account. Check transaction confirmations and update financial records. Monitor account balances regularly to maintain financial stability.

Transferring money from a personal to a business account requires careful attention. Post-transfer actions are crucial to maintain financial clarity. They help ensure compliance and track business expenses effectively. Following these steps can simplify your financial management.Tenue de registres

Proper record keeping is vital after any transaction. Document every transfer with detailed notes. Record the date, amount, and purpose of the transfer. Use accounting software or spreadsheets for accuracy. Keep digital copies of all receipts and confirmations. These records help during audits and tax filings. They provide clear evidence of your financial activities. Organized records can save time and reduce stress.Monitoring Account Activity

Regularly monitor your business account activity. Check for any unusual or unauthorized transactions. Set up alerts for large or unexpected withdrawals. This helps detect fraud early and protects your funds. Review monthly statements for accuracy. Ensure all transactions align with your records. Consistent monitoring keeps your finances secure. It also improves your understanding of cash flow patterns.Troubleshooting Issues

Transferring money from a personal account to a business account can sometimes be tricky. Double-check account details to avoid errors. Ensure your bank supports this transfer type and follow their specific guidelines.

Failed Transactions

Failed transactions can be frustrating, especially when you’re trying to move funds to support business needs. The reasons for failures can vary widely—from insufficient funds to incorrect account details. Double-check your account information before initiating a transfer to avoid mistakes. Ensure your bank allows transfers between these accounts. Some banks have restrictions or require additional verification steps. What should you do if your transaction fails repeatedly? Contact your bank’s customer service. They can provide insights into why the transaction is not processing and offer solutions. ###Discrepancies In Amounts

Have you ever transferred money only to find the amount doesn’t match what you sent? Such discrepancies can be alarming. They can occur due to fees, currency conversion rates, or simple input errors. Review your transaction history and fees associated with transfers. Many banks charge a fee that may deduct from the transferred amount. Consider keeping a log of your transfers. This helps spot patterns or issues quickly, allowing you to address them with your bank. What steps do you take if you notice repeated discrepancies? Discuss the issue with your bank’s representative to understand their processes and ensure your transfers are accurate. Troubleshooting these common issues not only saves time but also ensures your business finances are in order. Have you ever faced these challenges? How did you overcome them? Sharing your experiences could provide invaluable insights to others facing similar situations.

Benefits Of Keeping Accounts Separate

Keeping your personal and business finances separate is not just a good practice; it’s essential for smooth financial operations. When you transfer money from your personal account to your business account, you create a clear boundary between the two. This separation brings several benefits that can save you time, reduce stress, and even save you money. Let’s dive into the advantages of maintaining distinct accounts for personal and business transactions.

Simplified Accounting

When personal and business transactions mix, untangling them can become a headache. By keeping your accounts separate, you simplify your accounting processes. Imagine preparing for tax season with a single account for both types of expenses. It’s a nightmare. Separate accounts mean you can easily track your business expenses, making bookkeeping a breeze.

With distinct accounts, every transaction is straightforward. You don’t need to sift through personal expenses to find business ones. This clarity ensures that your financial records are accurate and that you can provide clear evidence if audited. Wouldn’t you prefer a stress-free accounting experience?

Improved Financial Management

Managing your finances effectively can be challenging when everything is mixed. By keeping your accounts separate, you gain a clearer picture of your business’s financial health. You can easily track income, monitor expenses, and analyze cash flow. This clarity helps you make informed decisions for your business.

Consider the peace of mind you gain when you know exactly how much your business earns and spends. You can plan better and allocate resources more effectively. Separate accounts empower you to manage your finances proactively. How much more confident would you feel making financial decisions with this information at your fingertips?

In conclusion, maintaining separate personal and business accounts offers numerous advantages. Simplified accounting and improved financial management are just the start. Take the step to separate your accounts today and experience the peace and clarity it brings.

Questions fréquemment posées

How To Transfer Money To A Business Account?

Transferring money to a business account is straightforward. Log into your online banking, select ‘Transfer Funds,’ and enter the business account details. Ensure the details are correct, choose the amount, and confirm the transfer. Most banks provide instant transfers, but check the processing time with your bank.

Y a-t-il des frais pour transférer de l’argent ?

Yes, fees may apply when transferring money between accounts. Fees depend on your bank and account type. Some banks offer free transfers within the same bank, while others charge a nominal fee. Always check your bank’s fee schedule to avoid unexpected charges during the transfer process.

Est-il sûr de transférer de l’argent en ligne ?

Yes, online transfers are safe when done through secure banking platforms. Banks use encryption and security protocols to protect your information. Always ensure you are using a secure internet connection and keep your login credentials confidential. Monitor your account for any unauthorized transactions after transfers.

How Long Does A Transfer Take?

Transfer time varies by bank and method. Instant transfers occur within minutes, while others take up to 3 business days. Factors include bank policies, transfer method, and domestic or international transfers. Always check with your bank for specific timeframes to ensure timely fund availability.

Conclusion

Transferring money from a personal to a business account can be easy. Follow the steps carefully and ensure all information is correct. This helps avoid errors and keeps your business running smoothly. Always check fees and limits to manage costs.

Use secure methods to protect your funds. Monitor transactions regularly to maintain financial health. Adopting these practices keeps your business finances organized. It also reduces stress and saves time. Stay informed about banking rules and updates. This ensures compliance and efficient financial management.

Bonnes opérations bancaires !