How to Transfer Paypal Money to Bank Account: Easy Guide

Are you wondering how to transfer your PayPal money to your bank account? You’re not alone.

Many people find themselves puzzled by the process, unsure of where to start or worried about potential fees. But the good news is, it’s simpler than you might think. In this blog post, you’ll discover a straightforward, step-by-step guide that will have you confidently moving your money in no time.

Imagine the ease of accessing your funds when you need them, without the hassle or confusion. Keep reading to unlock the secrets to seamless money transfers, and take control of your financial transactions today.

Setting Up Your Paypal Account

Setting up your PayPal account is a crucial first step. This ensures secure and smooth money transfers to your bank account. It’s essential to verify and link your bank account details. This process guarantees that your funds reach the right destination. Follow these simple steps to set up your PayPal account properly.

Vérifiez votre compte

To start, verify your PayPal account. This step is necessary for account security. Log in to your PayPal account. Navigate to the ‘Settings’ or ‘Profile’ section. Look for the verification option. You may need to confirm your email address. Sometimes, PayPal asks for phone number verification too. Complete these steps to secure your account.

Liez votre compte bancaire

Next, link your bank account to PayPal. First, go to the ‘Wallet’ section on your PayPal dashboard. Click on ‘Link a Bank Account’. Enter your bank details carefully. PayPal may ask for your bank’s routing number. Double-check these details for accuracy. After entering details, PayPal will confirm your bank account. This might take a few days. PayPal often deposits small amounts to verify the account. Once verified, you can transfer money easily.

Lancement du transfert

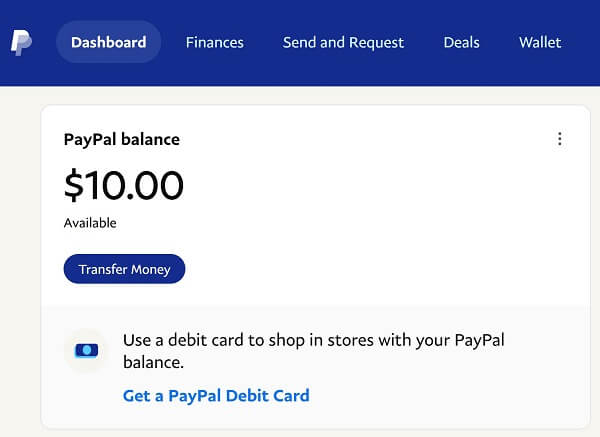

Start by logging into your PayPal account. Navigate to the “Transfer Money” option. Select your bank account, enter the amount, and confirm the transfer.

Log Into Paypal

Start by logging into your PayPal account. Use your email and password. If you have two-factor authentication, complete that step too. It’s crucial to ensure security before proceeding. Once logged in, you will be directed to your account dashboard. Here, you can see your balance and recent transactions.On your dashboard, locate the “Transfer Money” option. It’s typically found under the “Wallet” section. Click on it to open the transfer options. This section allows you to move funds to your bank account. Ensure you select the correct bank account for the transfer. Double-check the details to prevent any errors. Once confirmed, proceed with the transfer. Your money will usually arrive in a few business days.

Choosing The Transfer Method

Transferring money from PayPal to your bank account involves choosing the right method. Each method has its unique features. Some offer speed, while others focus on cost. Knowing your priorities helps in making an informed decision. Below are the two main transfer methods: Instant Transfer and Standard Transfer.

Transfert instantané

Instant Transfer sends money to your bank account quickly. Funds typically appear within minutes. This method is ideal for urgent needs. A small fee applies for this convenience. Make sure your bank accepts instant transfers. Not all banks support this feature. Check your bank’s policy before proceeding.

Transfert standard

Standard Transfer is a cost-effective option. It usually takes 1-3 business days. This method is free of charge. It’s suitable for non-urgent transactions. Ensure your bank information is correct. Errors can delay the process. Double-check your account details before initiating the transfer.

Confirmation de la transaction

Transferring money from your PayPal account to your bank account is a straightforward process. But confirming the transaction is a crucial step that ensures your money ends up exactly where you want it. This step involves a careful review and a final confirmation to safeguard your funds. Whether you’re moving a small amount or a hefty sum, paying attention to these details can prevent mistakes that could cost you time and effort.

Examiner les détails du transfert

Before hitting that confirm button, take a moment to review the transfer details. Double-check the amount you’re transferring. Is it the right figure? Sometimes, in haste, we might accidentally add an extra zero or miss one entirely.

Next, verify the bank account details. Is the account number correct? You wouldn’t want your hard-earned money ending up in someone else’s account due to a typo. PayPal usually saves your bank account information, but a quick glance can save you from unnecessary trouble.

Also, check the transfer fee if applicable. Knowing how much PayPal will charge for the transaction will help you manage your finances better. Is the fee worth the convenience, or would you prefer another method?

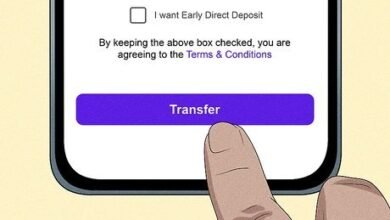

Confirm And Submit

Once you’ve reviewed everything, it’s time to confirm and submit the transaction. This step is simple yet crucial. Confirming means you’re giving PayPal the green light to move your money.

Before you click submit, ask yourself: Have I checked all the details thoroughly? It’s easy to overlook things when you’re confident, but a double-check never hurts.

After you submit, PayPal usually sends a confirmation email. Keep an eye out for it. This email is your proof that the transaction is underway. If you don’t receive it, something might be wrong, and you may need to follow up with PayPal support.

Confirming your transaction is more than just clicking a button; it’s a step to ensure your financial safety. Have you ever had an experience where you accidentally sent money to the wrong account? What did you learn from that situation? Share your thoughts in the comments below!

Suivi de votre transfert

Transferring money from PayPal to your bank account is straightforward. Log into your PayPal account and select ‘Transfer Money’ under ‘Wallet’. Follow the steps to link your bank account and initiate the transfer.

Vérifier l'état du transfert

Once you’ve initiated a transfer, the first step is to check the status. Log into your PayPal account and navigate to the “Activity” section. Here, you will see a list of your recent transactions. Look for the transaction labeled as a transfer to your bank. Click on it to view the details. You should see a status update like “Completed,” “Pending,” or “In Progress.” This gives you an instant snapshot of where your money is. Be proactive. If the status is pending longer than expected, consider reaching out to PayPal’s support for clarity.Understand Transfer Timelines

Knowing how long a transfer takes can help manage your expectations. Typically, PayPal transfers to your bank account can take 1-3 business days. However, it might feel longer if you’re in a hurry. Transfers initiated on weekends or holidays may take a bit longer, as banks process transactions only on business days. For instance, if you start a transfer on Friday evening, it might not hit your bank account until Tuesday. Have you ever wondered why some transfers seem faster than others? It could be due to your bank’s processing speed or PayPal’s security checks. Understanding these timelines helps you plan better, ensuring you never miss an important payment. Tracking your transfer is not just about waiting. It’s about staying informed and taking control of your finances. So, the next time you hit that transfer button, rest easy knowing you have the tools to track it every step of the way.Dépannage des problèmes courants

Transferring PayPal money to your bank can be confusing. Problems often arise with incorrect bank details or unverified accounts. Ensure information is correct and your account is verified to avoid issues.

Transferring money from PayPal to your bank account should be a straightforward process. However, sometimes things don’t go as planned, and you’re left wondering what went wrong. This section is designed to help you troubleshoot common issues that may arise during this process. Whether it’s a failed transfer or the need to contact PayPal support, knowing how to handle these situations is crucial. Let’s dive in and ensure your transactions go smoothly.Transferts échoués

A failed transfer can be frustrating, especially if you’re relying on the funds to meet a deadline or pay a bill. It’s essential to first check your internet connection. A weak connection might disrupt the transfer process. Next, ensure your bank account details are correct. Even a single digit error can prevent the transfer from going through. Double-check the account number and routing number you provided. If everything seems correct, consider if there are any restrictions on your PayPal account. Sometimes, account limitations can block transactions. Look into your account settings to see if any flags have been raised.Contacting Paypal Support

If you’ve tried everything and your money still won’t budge, it’s time to reach out to PayPal support. Start by visiting their Help Center, where you can find answers to frequently asked questions. If you can’t find a solution there, you can contact them directly. Use the live chat feature for immediate assistance or send them an email detailing your issue. When contacting support, be clear and concise. Include all relevant information about the transaction, including dates and error messages you’ve encountered. This will help them resolve your issue faster. Have you ever wondered how quick customer support can turn your day around? It might just be the key to unlocking your funds. Remember, patience is key. Sometimes resolving these issues takes time, but with the right steps, you’ll have your money safely in your bank account.Maximizing Security

Ensure safe transfers by linking your bank account with PayPal. Access the transfer option in PayPal’s dashboard. Follow the prompts to move funds securely to your bank account.

Enable Two-factor Authentication

Have you considered how easily someone could access your PayPal account if they guessed your password? To add an extra layer of protection, enable two-factor authentication (2FA) on your account. This means that even if someone knows your password, they’ll also need a second piece of information, like a code sent to your phone. Setting up 2FA is quick and provides peace of mind. Just go to your PayPal account settings and follow the prompts to enable it. Remember, a few minutes spent today can save you from potential headaches in the future. ###Regularly Update Security Settings

When was the last time you reviewed your security settings? You might be surprised how often platforms like PayPal update their security features. Make it a habit to check your settings regularly and update them as needed. This includes changing your password frequently and reviewing connected devices and applications. If something seems off or you don’t recognize a device, it’s time to act. Removing unfamiliar devices can prevent unauthorized access to your account. Staying proactive about security means you’re always a step ahead of potential threats. How confident do you feel about your account’s security right now? Taking these steps can help you ensure that your money transfers are as safe as possible.

Questions fréquemment posées

How Do I Link My Bank To Paypal?

To link your bank, log into your PayPal account. Go to “Wallet” and select “Link a bank account. ” Enter your bank details and confirm. Follow any additional verification steps. This process ensures you can easily transfer funds between PayPal and your bank.

Is There A Fee To Transfer Paypal Money?

Transferring money from PayPal to your bank is usually free. Standard transfers are fee-free but might take a few days. Instant transfers incur a small fee for faster processing. Check PayPal’s latest policies for any changes in fees to ensure accurate information.

How Long Does A Transfer Take?

Standard transfers from PayPal to your bank usually take 1-3 business days. Instant transfers, though faster, may incur a fee. Transfer times can vary based on bank processing times and holidays. Always check your bank’s policy for more accurate transfer durations.

Can I Transfer Money To Any Bank?

Yes, you can transfer PayPal money to most bank accounts. Ensure your bank supports electronic transfers. Some international or smaller banks may have restrictions. Double-check with your bank to confirm compatibility and any specific requirements for receiving funds.

Conclusion

Transferring money from PayPal to a bank is straightforward. First, link your bank account. Then, select the transfer option on PayPal. Enter the amount you want to move. Finally, confirm the transaction. Funds usually arrive in a few days. Remember to check for any fees.

Always keep your account details safe. This process helps manage your finances better. Regular transfers can simplify budgeting. Now, you can enjoy easier access to your funds. Keep track of your transactions for peace of mind. This method is reliable and secure for everyone.

Bonnes opérations bancaires !