Comment transférer de l'argent d'un compte professionnel vers un compte personnel

Comme le dit le vieil adage « ne mélangez pas affaires et plaisir », séparer vos finances professionnelles et personnelles est essentiel. Pourtant, il y a des moments où cela est nécessaire. transférer de l'argent de votre compte professionnel à votre compte personnel, et c'est là que les choses peuvent se compliquer. Assurez-vous de le faire correctement pour éviter toute erreur. implications fiscales ou des soucis de comptabilité. Mais avant d'initier le transfert, vous devrez prendre en compte plusieurs éléments, comme la méthode de transfert la plus adaptée et les éventuelles frais potentiels impliqué. Alors, par où commencer ?

Comprendre les types de comptes professionnels

Avant de pouvoir transférer de l'argent entre des comptes, vous devez comprendre les différents types de comptes d'entreprise impliqués, y compris leurs caractéristiques spécifiques, restrictions et exigences. Vous rencontrerez différents types de comptes, tels que les comptes chèques, les comptes d'épargne et les comptes du marché monétaire, chacun ayant ses propres règles et limitations. Par exemple, certains comptes peuvent avoir exigences de solde minimum, tandis que d'autres peuvent restreindre la fréquence des transactionsIl est essentiel de comprendre ces nuances pour garantir l'exécution fluide et sécurisée de vos transferts. Prenez le temps de consulter vos contrats de compte et de vous familiariser avec les modalités spécifiques. termes et conditions Gérer vos comptes professionnels. Ces connaissances vous aideront à gérer le processus de transfert en toute confiance et à éviter les pièges potentiels.

Choisissez la méthode de transfert

Lorsque vous transférez de l'argent entre des comptes, vous devrez décider lequel méthode de transfert est le plus adapté aux besoins de votre entreprise, compte tenu de facteurs tels que vitesse de transfert, frais, et sécurité. Vous devrez peser le pour et le contre entre les méthodes, comme virements électroniques, virements ACH ou virements en ligne. Les virements électroniques sont généralement les plus rapides, mais entraînent souvent des frais plus élevés. Les virements ACH sont plus abordables, mais leur traitement peut prendre quelques jours. Les virements en ligne via la plateforme de votre banque peuvent offrir un compromis entre rapidité et coût. Tenez compte de l'urgence du virement, du montant transféré et du budget de votre entreprise pour déterminer la meilleure approche. Assurez-vous également d'évaluer les mesures de sécurité mises en place pour chaque méthode afin de protéger les informations financières de votre entreprise.

Examen des implications comptables

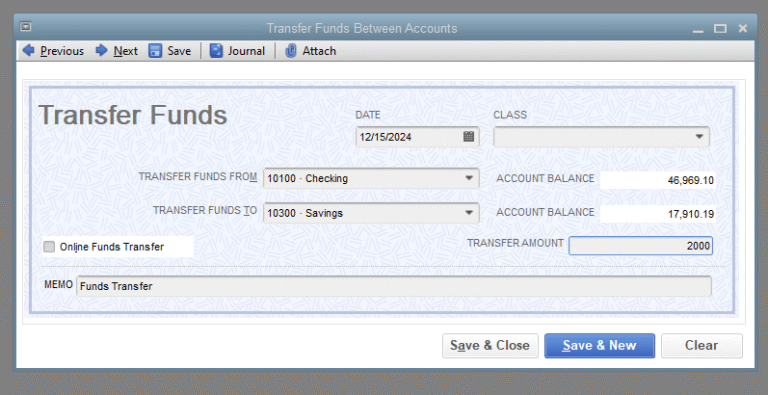

Au fur et à mesure que vous finalisez le méthode de transfert, vous devrez également réfléchir à la implications comptables de transfert de fonds entre comptes, y compris la manière dont la transaction sera enregistrée et reflétée dans votre états financiersLe transfert sera probablement classé comme une distribution et vous devrez en assurer le suivi. Cela implique de confirmer la transaction est datée et correctement étiquetés, ce qui facilite la distinction et le rapprochement dans vos grands livres. De plus, cette comptabilité détaillée permet d'éviter les divergences. Vous devrez également vérifier que les comptes peuvent gérer le transfert et que vos documents financiers sont exacts après le transfert. Assurez-vous que le logiciel de comptabilité et les bilans financiers concernés sont à jour pour éviter toute difficulté lors des futurs audits. Comptabilité organisée aide à éviter les conséquences imprévues.

Tenir compte des obligations fiscales

Vos transferts de fonds entre comptes peuvent entraîner des obligations fiscales, notamment sur les plus-values, l'impôt sur le revenu ou d'autres conséquences fiscales auxquelles vous devrez réfléchir. Il est essentiel d'évaluer ces obligations pour éviter les imprévus fiscaux. Le tableau suivant présente quelques conséquences fiscales potentielles :

| Type de taxe | Considérations |

|---|---|

| Impôt sur les plus-values | Les bénéfices provenant de la vente d’actifs, tels que des investissements ou des biens immobiliers, peuvent être soumis à l’impôt sur les plus-values. |

| Impôt sur le revenu | Le transfert de fonds d’un compte professionnel vers un compte personnel peut être considéré comme un revenu imposable. |

| Auto-évaluation fiscale | Vous devrez peut-être déclarer les fonds transférés dans votre déclaration d’impôt. |

| Taxe sur la valeur ajoutée (TVA) | Des implications en matière de TVA peuvent survenir si vous transférez des fonds liés à des activités commerciales.

Consultez un fiscaliste pour garantir le respect des lois et réglementations fiscales.

Vérifiez auprès de l'institution financière

Avant de procéder à un transfert, il est essentiel de vérifiez auprès de votre institution financière s'il y en a exigences ou restrictions spécifiques sur les transferts de fonds entre comptes. Vous devrez confirmer leur politiques et procédures Pour les virements inter-comptes, ces informations peuvent varier. Votre institution financière peut avoir des règles ou des limitations spécifiques concernant le montant que vous pouvez transférer, la fréquence des virements ou les types de comptes concernés. Elle peut également exiger un préavis ou des exigences de documentation spécifiques. De plus, renseignez-vous sur les éventuelles frais ou charges potentiels associés au transfert. En vérifiant ces informations, vous pouvez garantir une processus de transfert fluide et conforme qui répond aux exigences de votre institution financière.

Préparer la documentation de transfert

Après avoir confirmé les politiques et procédures de votre institution financière pour virements inter-comptes, vous devrez maintenant rassembler et préparer le documentation nécessaire pour lancer le processus de transfert. Cela comprend généralement numéros de compte et numéros de routage Pour vos comptes professionnels et personnels, ainsi qu'une pièce d'identité attestant de votre autorité à effectuer le virement. Assurez-vous de disposer d'informations exactes et à jour pour éviter tout retard ou erreur. Vous pourriez également être amené à fournir un justification du transfert ou une explication, en particulier pour les transferts importants ou fréquents. Il est essentiel de conserver un enregistrement de tous les documents de transfert pour à des fins d'audit et de conformitéAssurez-vous que toute la documentation est sécurisée et conforme aux réglementations financières afin de protéger vos comptes et vos informations sensibles.

Exécuter le transfert

Pour effectuer le transfert, vous devrez généralement accéder au compte de votre institution financière. plateforme bancaire en ligne, visitez une succursale en personne ou utilisez un application bancaire mobile, selon les méthodes de transfert disponibles dans l'établissement. Vous devrez initier le transfert en précisant le montant. compte source (entreprise), et compte de destination (personnel). Vérifiez l'exactitude des numéros de compte et d'acheminement afin d'éviter toute erreur. Si vous utilisez les services bancaires en ligne, vous devrez peut-être saisir un mot de passe à usage unique ou confirmez le virement via un jeton de sécurité. Si vous utilisez une application bancaire mobile, vous devrez peut-être autoriser le virement par authentification biométrique ou connexion sécurisée. Une fois le virement confirmé, il sera traité en temps réel ou selon le calendrier de virements de l'établissement.

Enregistrer la transaction

Maintenant que le transfert a été effectué avec succès, vous devez assurer une comptabilité précise en enregistrant la transaction dans vos documents financiers. Pour ce faire, connectez-vous à votre logiciel de comptabilité ou à votre tableur et créez une nouvelle écriture de transaction. Le tableau ci-dessous détaille les informations nécessaires à l'enregistrement :

| Champ | Description |

|---|---|

| Date | La date à laquelle le transfert a été exécuté |

| Montant | Le montant transféré du compte professionnel vers le compte personnel |

| Description | Une brève description du transfert (par exemple « Transfert vers un compte personnel pour des dépenses professionnelles ») |

Assurez-vous d'enregistrer la transaction et de rapprocher vos comptes afin de garantir son exactitude et d'éviter tout problème potentiel. En enregistrant correctement la transaction, vous conserverez une trace financière claire et transparente.

Surveiller les problèmes potentiels

Après avoir enregistré la transaction, vous devrez périodiquement revoir vos comptes pour identifier et traiter tout problèmes potentiels pouvant résulter du transfert, comme des écarts ou des découverts. Soyez attentifs activité inhabituelle, comme des frais ou des virements inattendus. Vérifiez que le compte du destinataire a reçu le montant correct et que votre compte professionnel a bien été débité. fonds suffisants pour couvrir vos futures transactions. Configurez des alertes de compte pour être informé de toute activité suspecte ou de tout solde de compte faible. Suivi régulier peut vous aider à détecter et résoudre rapidement les problèmes, à minimiser les pertes financières potentielles et à protéger vos comptes professionnels et personnels. En restant vigilant, vous garantirez un processus de transfert fluide et sécurisé.