¿Son ilegales los pagos del auto? ¡Descubre la verdad hoy mismo!

Are you wondering whether car payments are illegal? Maybe you’ve heard whispers of new laws or seen some confusing headlines.

It’s a topic that can make anyone stop in their tracks and question their financial decisions. We’ll clear up the confusion and get right to the facts. You’ll discover why car payments are a common part of buying a vehicle and what you need to know to avoid any legal pitfalls.

Stick with us to unravel the truth and ensure you’re on the right side of the law when it comes to your car payments. Curious? Read on and put your mind at ease.

Car Payments: Legal Perspective

Car payments start with contratos. A buyer agrees to pay a set amount. This agreement is signed by both parties. It is a documento legal. The contract states the payment terms. It includes tasas de interés y due dates. Breaking the contract can lead to sanciones. Both sides must follow the rules.

Consumer laws proteger buyers. These laws ensure fair deals. They stop unfair practices. Laws help if a seller cheats. They offer help in disputes. Consumers have rights. They can complain if treated unfairly. Laws ensure transparencia in transactions.

Lenders give money for cars. They charge interest on loans. The lender sets condiciones de pago. They ensure payments are made on time. Prestamistas have strict rules. They can take back cars if payments fail. It’s called recuperación. They are key players in car deals.

Conceptos erróneos comunes

Many people believe that car payments are illegal. This is not true. Car payments are common and legal. They help people buy cars over time. Some think signing a car loan is risky. But, loans are safe with good terms. Always read the contract carefully. Know your monthly payment and interest rate. This avoids surprises later.

Some myths say car loans are scams. This is a myth. Reputable lenders follow the law. They provide clear terms. Another myth is all lenders are the same. In reality, lenders differ. Compare offers before choosing. This saves money and stress. Always ask questions. Never sign if unsure. This ensures a smart decision.

Consumer Rights

Buying a car involves many details. Information must be clear. Every cost should be shown to the buyer. Hidden fees confuse people. Transparencia builds trust. Contracts should be easy to read. Sellers should explain all terms. Buyers deserve to know the total price. This includes interest rates. Knowing these helps buyers plan better. No surprises means peace of mind.

Fraud is a big worry. Consumers need protection. Fraud can cost buyers money. Sellers should not lie about car history. Honesty is key. Buyers must check car details. Trustworthy dealers help avoid scams. Papers should be checked carefully. This ensures the car matches what was promised. Buyers should report any fraud. This keeps the market safe for everyone.

Consecuencias legales

Car payments are legal transactions involving monthly installments for vehicle purchases. Legal consequences arise if payments are missed or contracts are breached. Consumers should understand their financial responsibilities to avoid potential legal issues.

Default And Repossession

Missing car payments can lead to serious troubles. Lenders have the right to take back the car. This is called recuperación. It happens when payments stop. Repossession can hurt your puntuación crediticia. A low score makes it hard to get loans later. Avoiding default is important. Paying on time helps a lot. Always read your contrato de préstamo. Know your rights and duties.

Legal Recourse For Consumers

If a car is taken wrongly, you can fight back. Laws protect buyers from unfair actions. Talk to a lawyer if needed. Lawyers can explain your options. You might get your car back. Or you could get money for damages. Always keep records of payments. This helps prove your side. Stay informed about your rights. Knowing them is key to protection.

Alternatives To Traditional Car Payments

Leasing a car is like renting. You pay to use it. Buying means you own the car. Leasing often has lower pagos mensuales. But, you never own the car. Buying costs more each month. But, you keep the car forever.

Leasing is good for new cars. You change cars every few years. Buying is better if you keep cars long. Think about what you need. Both choices have good points. Both have bad points too.

Some companies offer car subscriptions. It’s like Netflix for cars. You pay a monthly fee. You can change cars often. Seguro is included. Maintenance is included too. You do not own the car. But, you can try different cars. It’s easy and flexible.

This option is new. It costs more than buying. But, it’s less hassle. Decide what suits you best. Think about your lifestyle.

Future Of Car Financing

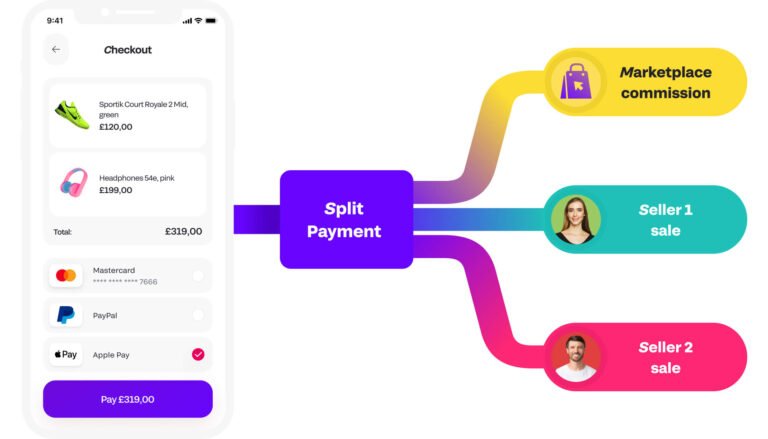

Technology is changing car financing. Online tools make it easy to compare deals. People can find better options without leaving home. Digital platforms help buyers understand costs. This saves time and money. Apps track payments and remind users. Smart contracts can automate payments. This reduces errors and delays. Blockchain technology promises secure transactions. It builds trust and transparency.

Consumers want different things now. Many prefer short-term leases. This gives them flexibility. Subscription models are gaining popularity. They allow easy switching between cars. People value eco-friendly options more. Electric and hybrid cars are in demand. Cost-effective solutions attract buyers. Consumers look for low-interest deals. They want simple, clear terms. Personalized financing is becoming important. It meets individual needs and budgets.

Preguntas frecuentes

Are Car Payments Considered Illegal?

Car payments are not illegal. They are a standard part of vehicle financing agreements. Buyers make monthly payments to lenders until the loan is fully paid. These payments are part of the contract when purchasing a car with financing. Ensure to understand all terms before agreeing to a loan.

Can I Stop Making Car Payments Legally?

You cannot stop making car payments without consequences. Defaulting can lead to repossession of the vehicle. If facing financial difficulties, contact your lender. They may offer solutions like refinancing or adjusting payment plans. Always communicate proactively to avoid negative impacts on your credit score.

What Happens If I Don’t Make Car Payments?

If you don’t make car payments, your vehicle may be repossessed. Missing payments can damage your credit score. Lenders might also take legal action to recover the owed amount. It’s crucial to communicate with your lender if you encounter financial issues to explore possible solutions.

Are There Laws Protecting Car Buyers?

Yes, consumer protection laws safeguard car buyers. These laws ensure transparency in financing agreements and protect against unfair practices. The Truth in Lending Act requires lenders to disclose loan terms clearly. Always review contracts carefully and know your rights as a consumer.

Conclusión

Car payments are not illegal. They are common in many countries. Understanding the terms is crucial. Always read the contract carefully. This helps avoid future issues. Consult a financial advisor if needed. Knowing your rights is important. Stay informed about local laws.

This ensures you make wise decisions. Budget wisely for car payments. This prevents financial strain. Responsible financial planning is key. Keep learning and stay aware. Educated choices lead to better outcomes. Always prioritize your financial health.