Cómo dividir pagos en línea: Soluciones sencillas

Imagine this: You’ve just found the perfect gift online. It’s everything you wanted, but there’s a catch.

It’s a bit pricey, and you wish you could just split the payment with a friend or family member. What if you could? Splitting payments online can make your shopping experience smoother and more budget-friendly. Whether you’re planning a group purchase, sharing a subscription, or simply want to manage your finances better, learning how to split payments online is a game-changer.

In this guide, you’ll discover straightforward tips and tools to help you divide costs with ease. Dive in to find out how you can take control of your spending and make online shopping more collaborative and enjoyable.

Benefits Of Splitting Payments

Splitting payments can make buying easier. It lets you pay in parts. You don’t need to pay all at once. This helps when money is tight. You can buy things even if you don’t have full amount now. Budget becomes simple. You can plan better. It helps in managing expenses. You don’t feel burdened. Flexibilidad is key. You choose how much to pay. You set the terms. This method is useful for big purchases. You can buy things without worry. Less stress in paying. It also helps in sharing costs. Group buying becomes easy. Everyone pays their part. No one feels left out. Everyone contributes fairly.

Popular Payment Platforms

PayPal is a trusted and safe way to send money. Users can link their bank accounts or credit cards. It is easy to split bills with friends. Just enter the amount and email address. Money gets transferred quickly.

Venmo is very popular for splitting payments among friends. It connects with your bank account. You can also add a card. Venmo lets you add notes to payments. This makes it fun to use. It is also secure.

Cash App is another way to send and receive money. Users can split costs easily. You can link your bank account or card. Cash App also lets you buy things. Sending money is fast and easy.

Zelle works with many banks. It helps you transferir dinero quickly. You do not need to download another app. Just use your bank’s app. Zelle is fast and secure. It is great for splitting bills.

Using Payment Apps

Setting up a payment app account is easy. First, download the app. Find it in your app store. Then, open the app and click “Create Account”. Enter your email and password. Verify your email. Follow the steps. Finally, your account is ready. You can start using the app.

Linking your bank account is important. It helps to send money. Open the app and go to settings. Find the “Link Bank” option. Click on it. Enter your bank details. Follow the instructions. Your bank account will be linked. Now, you can send and receive money.

Understanding the app interface is simple. Look at the main screen. Find the “Send” or “Request” buttons. Tap on them to use. Check your balance on the home screen. Find settings and help options easily. Explore the app to learn more. You will be comfortable using it soon.

Splitting Bills With Friends

Friends often share costs. Making a group payment helps. Online tools allow this. Each friend pays their part. Everyone sees the total. Apps like Splitwise work well. Enter each friend’s email. Add the bill amount. Everyone gets a link. Paying is simple. No confusion.

Equal sharing is fair. Each friend pays the same. Online calculators make this easy. Enter total bill. Add number of friends. Each gets their share. Mistakes are rare. Everyone pays the same. It is quick and easy.

Sometimes shares are different. Customizing payment helps. Maybe one friend ate more. Or another ordered extra. Online apps can adjust this. Set each person’s share. Everyone pays their fair part. No arguing or confusion. Everyone is happy.

Security And Privacy Concerns

Always keep your datos personales safe online. Use a contraseña segura for your accounts. Never share your password with others. Keep your device locked and updated. Enable autenticación de dos factores if possible. This adds an extra layer of safety. Check if the website is seguro. Look for “https” in the URL.

Be careful with correos electrónicos asking for money. They might be scams. Do not click on unknown links. They can steal your info. Check the sender’s email address. Scammers can look real. Trust your gut. If it feels wrong, it might be.

Use métodos de pago confiables only. Credit cards and PayPal are safe. Avoid public Wi-Fi when paying. It can be risky. Look for secure symbols. A padlock icon is a good sign. Keep a record of your transactions. This helps track your money.

Business Use Cases

Group projects often need shared expenses. Online payment splitting helps divide costs easily. This method ensures everyone pays their part. It removes the hassle of collecting money. Use apps to track and manage payments. They show who has paid and who hasn’t. This keeps things fair and transparent. Teams can focus on work, not money issues.

Many people share subscriptions like Netflix or Spotify. Splitting payments makes it easier to manage costs. Everyone can enjoy services without stress. Apps help send reminders when payments are due. They calculate each person’s share automatically. No need for manual math. This makes sharing fair and simple. Everyone gets access without worry.

Planning events involves many costs. Venue fees, catering, decorations, and more. Splitting payments online helps manage these expenses. Everyone can contribute their share. This ensures no one pays too much. Use tools to keep track of payments. They show who has paid and how much is left. Events become easier to plan and enjoy.

Future Trends In Payment Splitting

Exploring future trends in online payment splitting offers exciting possibilities. Apps simplify dividing costs among friends or family. Secure, user-friendly platforms make sharing expenses straightforward, enhancing convenience for everyone involved.

Innovative Technologies

Payment splitting is changing fast. New technologies make it easy to divide costs. Aplicaciones móviles allow quick sharing of bills. Blockchain offers secure transactions. Many people trust these methods. They are safe and fast. Artificial Intelligence helps understand spending habits. This technology predicts future expenses. It helps users plan better. Technology is making splitting payments smarter.

Growing Popularity

More people use payment splitting tools. They are convenient for group expenses. Friends and families find them useful. They save time and reduce stress. Everyone can pay their share easily. These tools are popular with young people. They like apps that simplify life. Splitting payments is now part of everyday tasks. Popularity grows as more people try these tools.

Integration With Other Services

Payment splitting works well with other services. bancos y plataformas de pago offer new features. They allow users to split costs directly. Social media apps include payment options. Users can share expenses while chatting. This integration makes life easier. People enjoy seamless experiences. Different services work together smoothly. This trend is likely to grow in the future.

Preguntas frecuentes

What Is Online Payment Splitting?

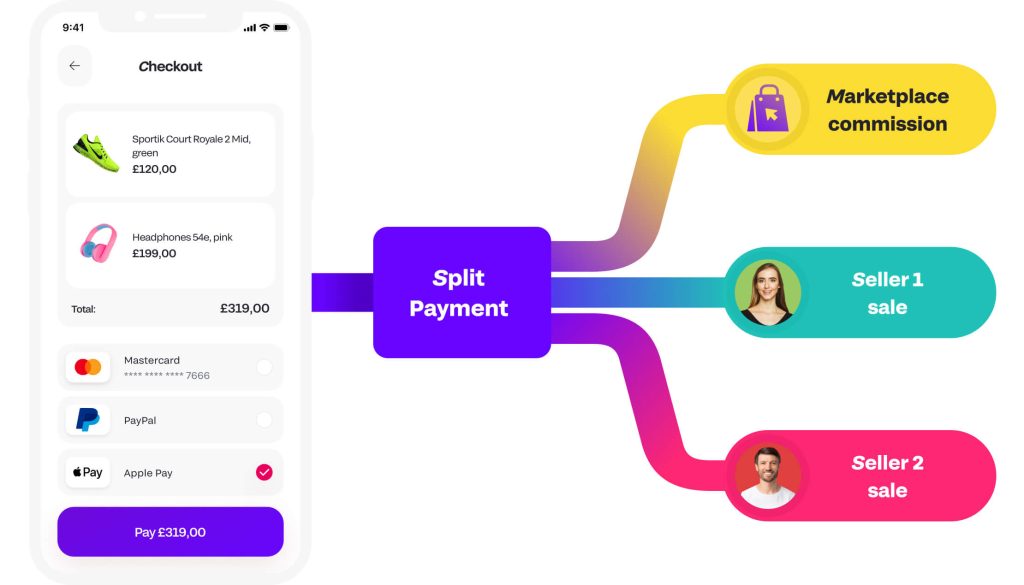

Online payment splitting allows multiple payers to share a single transaction. It divides the total cost among participants. This method is convenient for shared expenses like bills or group purchases. Various apps and platforms facilitate easy and secure payment splitting online.

How Do I Split Payments Online?

To split payments online, use platforms like PayPal, Venmo, or Splitwise. These services offer user-friendly interfaces for dividing costs. You can specify amounts for each participant. Secure transactions ensure peace of mind when managing shared expenses.

Is Splitting Payments Online Safe?

Yes, splitting payments online is generally safe. Most platforms use encryption to protect transactions. Always choose reputable services with good reviews. Ensure your account is secure with strong passwords and two-factor authentication for added safety.

Can I Split Payments On E-commerce Sites?

Some e-commerce sites allow payment splitting directly. Check if the site offers this feature during checkout. Alternatively, use third-party apps to share the cost among friends. Always verify the site’s security measures before proceeding with transactions.

Conclusión

Splitting payments online is simple and convenient. It helps manage finances easily. Various platforms offer secure options. You can share costs effortlessly with friends or family. Always choose trusted apps for your transactions. Check user reviews before you proceed. Understanding the process ensures smooth experiences.

It saves time and minimizes stress. Many people find this method helpful. Explore different options to find what suits you best. Stay informed about any associated fees. Remember, practice makes perfect. Start with small transactions to build confidence. Enjoy the ease of modern payment solutions.