¿Cuánto hay que pagar de entrada para un condominio?: Guía esencial

Buying a condo can be an exciting step, but figuring out the down payment can feel overwhelming. How much should you actually set aside?

You might wonder if you have enough saved or if you’re on the right track to making your dream of owning a condo a reality. Understanding the required down payment is crucial, especially when you’re planning your finances and future home.

You deserve clarity and confidence in this decision. We’ll break down the essentials of condo down payments, giving you the insights you need to move forward with certainty. Ready to discover how much you really need? Let’s dive in and explore what it takes to make that condo yours!

Factors Influencing Down Payment

Different loans need different down payments. FHA loans often need less. Conventional loans might need more. VA loans sometimes require none. This affects how much money you save.

A good puntuación crediticia can lower the down payment. Lenders trust you more with higher scores. A bad score might mean more money upfront. Keep your credit healthy for better deals.

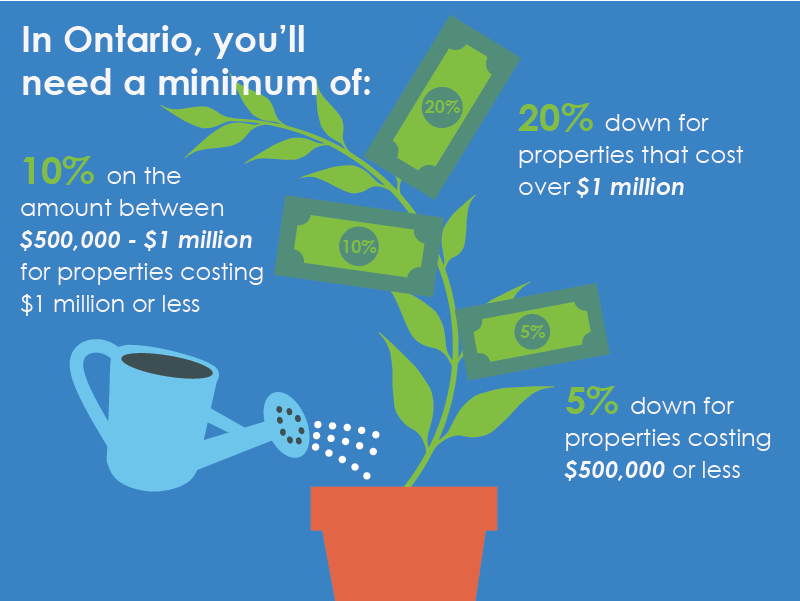

Ubicación changes the required down payment. Big cities often need more money. Smaller towns may need less. Know the market in your area. Prices can differ a lot.

Typical Down Payment Percentages

Conventional loans often need a 20% down payment. This means if a condo costs $200,000, you might need $40,000 as a down payment. Some lenders may allow as low as 5% down. But, lower down payments mean higher monthly bills. It’s important to plan wisely.

FHA loans are good for first-time buyers. The down payment is usually 3.5%. If your condo is $200,000, you might need only $7,000. FHA loans can be a helpful choice for many families. They often have easier rules to qualify.

VA and USDA loans often need no down payment. This is a big help for many buyers. VA loans are for veterans. USDA loans are for rural areas. These loans can make buying a condo easier. Always check if you qualify for these options.

Benefits Of A Larger Down Payment

Lower Monthly Payments make life easier. Paying more upfront means less to pay later. With a large down payment, the loan size shrinks. This results in smaller monthly bills. Families can save money each month. It leaves more cash for other needs.

Reduced Interest Rates can save money. Bigger down payments often mean better rates. Banks trust those who pay more upfront. They offer lower rates to them. This leads to less interest over the loan’s life. More savings for the future.

Avoiding Private Mortgage Insurance is smart. Paying a large amount upfront avoids PMI. PMI costs extra money every month. It protects the bank, not you. Without PMI, monthly costs drop. It means paying less each year.

Challenges Of Saving For A Down Payment

Real estate prices are very high. Many people struggle to save enough. Prices keep rising every year. Condos in cities cost a lot. Saving for a depósito becomes hard. Presupuesto is key. Families must plan carefully. Cutting expenses helps a lot.

Not everyone earns a high salary. Low income makes saving tough. Bills eat up most earnings. Saving requires discipline. Some take extra jobs. Earning more helps save faster. Planning is important. Every penny counts.

Many have debts to pay. Student loans, car loans, and credit cards. These obligations use up money. Saving becomes difficult. Prioritizing is essential. Paying off debts first helps. Gerente finances wisely is crucial.

Down Payment Assistance Programs

Many people need help to buy a condo. Government programs can provide that help. These programs often give loans o grants. They make it easier to pay the down payment. You might have to meet some normas to get the help. Always check if you qualify for these programs.

Alguno organizaciones sin fines de lucro can also help. They aim to make homes affordable for all. These groups may offer ayuda financiera o education. They teach you how to save for a condo. You can find many local y national groups willing to help.

Su employer might help with the down payment too. Some companies offer special programs for workers. They might give loans o grants. Check if your job offers this kind of support. It can make buying a condo much easier.

Tips For Saving For A Down Payment

Creating a budget is crucial. List your gastos mensuales. Find areas to cut costs. Prioritize saving for your down payment. Set a monthly savings goal. Keep track of your spending. Adjust as needed. Stick to your plan. It helps you save faster.

Automate your savings each month. Set up a depósito directo into a savings account. This helps you save without thinking. It reduces the temptation to spend. You save more without effort. It’s a simple way to reach your goal.

Consider putting money into safe investments. Look into low-risk bonds o cuentas de ahorro. These can grow your savings. Choose options with good returns. Keep your money safe. It can help you reach your down payment goal faster.

Impact Of Down Payment On Mortgage Terms

El loan-to-value (LTV) ratio affects mortgage terms. A higher down payment lowers this ratio. A lower LTV often means better interest rates. Lenders see less risk. This can save money over time.

Mortgage insurance is important when buying a condo. A small down payment might require insurance. This adds monthly costs. Larger down payments can avoid this expense. Saving upfront can reduce future fees.

Planning for the long term is smart. A bigger down payment helps with this. It can lead to less debt later. It also means building equity faster. This is good for future financial health. Think about retirement and savings. Consider how much you can pay now.

Preguntas frecuentes

What Is The Typical Down Payment For A Condo?

The typical down payment for a condo is usually around 20% of the purchase price. However, some lenders may offer options for as low as 3% to 5%. It’s important to research different loan programs and consult with a mortgage advisor to determine what works best for your situation.

Can I Buy A Condo With Less Than 20% Down?

Yes, it is possible to buy a condo with less than 20% down. Some loan programs, such as FHA or VA loans, offer lower down payment options. These can range from 3% to 5%. It’s important to check the eligibility criteria and any additional costs involved, like private mortgage insurance (PMI).

How Do I Calculate My Condo Down Payment?

To calculate your condo down payment, multiply the condo’s purchase price by the down payment percentage. For example, for a $300,000 condo with a 20% down payment, you’d need $60,000. Use online calculators to help, and consult with a mortgage advisor for accurate figures tailored to your situation.

Are There Programs To Help With Condo Down Payments?

Yes, there are programs to help with condo down payments. Many states offer down payment assistance programs for first-time buyers. These programs can include grants, loans, or tax credits. Eligibility varies, so it’s essential to research options available in your area and consult with a housing counselor.

Conclusión

Choosing the right down payment for a condo is vital. It impacts monthly costs and mortgage terms. Understand your finances first. Research different loan options. Speak with a trusted financial advisor. Planning ahead ensures better decisions. Remember, a larger down payment can lower your mortgage.

But it’s important to save for other expenses too. Keep your long-term goals in mind. Balancing financial health and condo dreams is key. Make informed choices and enjoy your new home.