Can You Make Payments on Delinquent Property Taxes: A Guide

Are you feeling the weight of delinquent property taxes? You’re not alone, and the good news is, there are solutions.

When you’re behind on property taxes, the situation can feel overwhelming, leading to stress and uncertainty about your financial future. But what if there was a way to lighten that burden and regain control? We’ll explore whether you can make payments on delinquent property taxes and how doing so could save your property and peace of mind.

You’ll discover practical steps that not only help you manage those overdue taxes but also lead you toward financial stability. Ready to take back control? Keep reading to find out how.

Understanding Delinquent Property Taxes

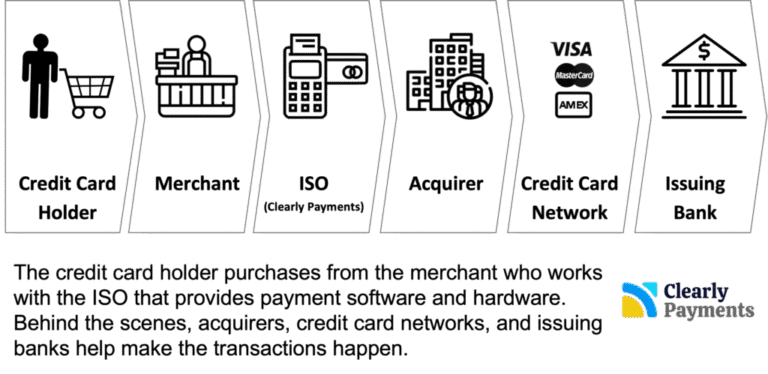

Delinquent property taxes are taxes not paid on time. Property owners must pay taxes each year. Missing the payment deadline leads to delinquency. Interest and penalties grow if not paid promptly. These extra costs make the total tax higher.

Paying on time is very important. Government uses tax money for public services. Roads, schools, and parks need these funds. If taxes go unpaid, services suffer. Property owners face consequences too. Legal actions might be taken against them.

Some places offer payment plans. These help property owners catch up. Monthly payments make it easier to pay off debt. Check with local tax offices for options. Kommunikation is key. Reach out for help if struggling with payments.

Consequences Of Delinquent Taxes

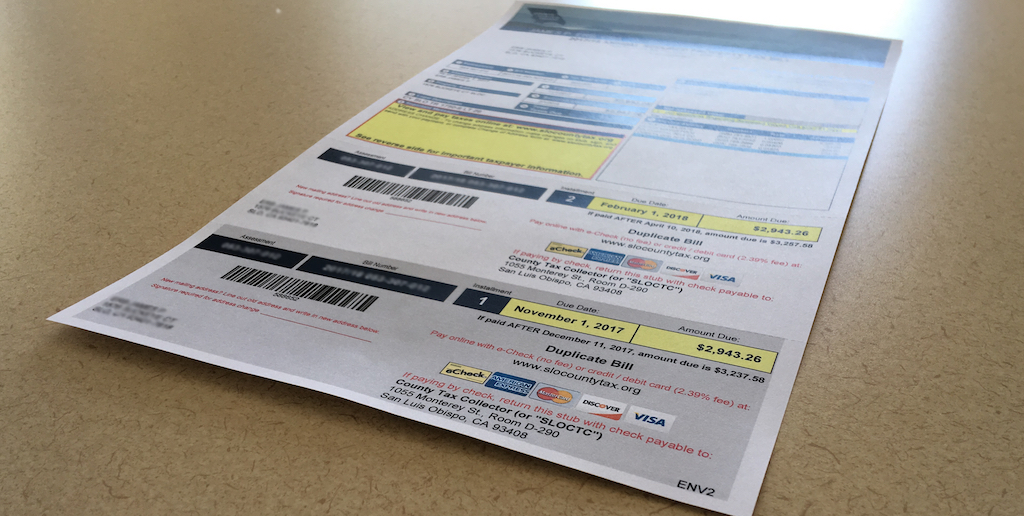

Delinquent taxes come with extra costs. Penalties add up fast. Interest also increases. This makes the debt grow quickly. Paying late can be expensive. It is important to pay on time. This helps avoid extra charges. Failing to do so can be costly. Understand the terms to manage well.

Unpaid taxes can lead to losing your home. The government can take your property. They may sell it to get money. This process is called Zwangsvollstreckung. It is serious and can happen fast. To avoid this, pay taxes on time. It keeps your property safe. Protect your home by staying current with payments.

Payment Options For Delinquent Taxes

Paying a large amount at once can clear your debt. This method requires vollständige Zahlung upfront. It can help avoid extra fees and interest. Some people save money to pay in one go. This way, they settle their taxes quickly. It is a simple and direct method.

Installment plans allow for smaller, regular payments. You do not pay everything at once. These plans divide the total tax amount into parts. This option makes it easier for many people. Paying in parts helps manage finances better. It is a common choice for many families.

Government Programs And Assistance

Homestead exemptions can lower property taxes. Homeowners can apply for this. It reduces the taxable value of a home. This helps in saving money. Many states offer this exemption. It is important to check eligibility. Senior citizens often get more benefits. Some places offer full exemptions. Others offer partial ones. It varies by state. Understanding these rules is crucial. Always apply early to avoid issues.

Tax relief programs offer support for overdue taxes. Many governments provide these. Payment plans can be arranged. This helps spread the cost. Penalties may reduce with these plans. Some programs offer interest reductions. Each program has unique rules. Always check local regulations. Non-profit organizations might assist too. They offer guidance and support. These programs aim to help families. Avoid tax liens by using them.

Working With Tax Authorities

First, find the phone number of the tax office. Then, call them. Ask about your delinquent property taxes. Write down all details. You need to know how much you owe. Also, ask for a list of Zahlungsmöglichkeiten.

After you understand your debt, discuss Zahlungsbedingungen. Request a Zahlungsplan. Try to agree on monthly payments. Make sure the amount fits your budget. If possible, ask for a niedrigerer Zinssatz. Always confirm the details. Keep records of your conversations.

Rechtliche Hinweise

Understanding Tax Liens is important. A tax lien is a legal claim. It is placed on property when taxes aren’t paid. The government can sell the property. They do this to get the unpaid taxes. Property owners should know their rights. They can pay off the debt. This can remove the lien. Understanding these rules is key. It helps owners protect their property.

Rights of Property Owners are essential. Owners can challenge the lien. They might negotiate payment plans. Paying taxes on time is crucial. It avoids problems with liens. Property owners have rights. They can appeal if the lien is wrong. Protecting property is very important. Owners should know their rights. They should act quickly if a lien appears.

Preventing Future Delinquencies

Paying delinquent property taxes helps prevent future delinquencies. Set up payment plans to manage overdue taxes effectively. Regular payments can ease financial strain, ensuring property retention and avoiding penalties.

Budgeting For Property Taxes

Setting aside money for property taxes is very important. First, know how much you owe. Then, divide this amount by twelve months. Save a little each month. This makes it easier to pay on time. Use a separate bank account for tax savings. This avoids spending the money on other things. Remember, budgeting helps keep track of finances. Stay organized to avoid surprises.

Setting Up Automatic Payments

Automatic payments can prevent late fees. Sign up with your bank or tax office. This ensures payments are made on time. You won’t forget to pay. Automatic payments are very convenient. They save time and reduce stress. Always check your bank balance before setting up. Ensure you have enough funds. Automatic payments protect against missed deadlines.

.png)

Resources For Property Owners

Financial counseling can help manage delinquent property taxes. Many organizations offer these services. They help you understand your Finanzielle Optionen. Counselors can guide you in creating a Zahlungsplan. This plan can make payments easier. They can also negotiate with tax authorities for you. This can reduce stress. Always choose a reputable counselor. Check for licenses and reviews. This ensures quality and trust.

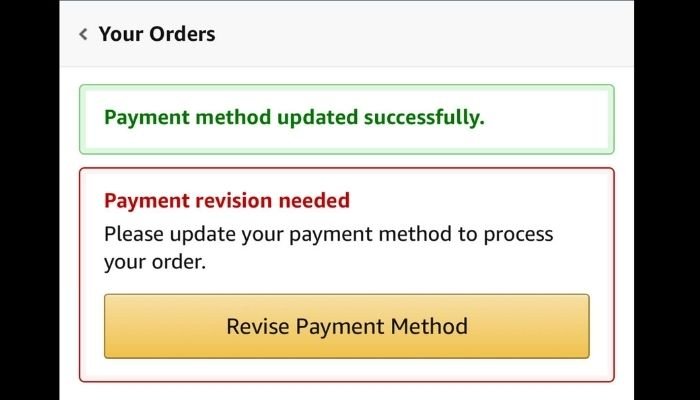

Paying taxes online is simple. Many sites offer safe payment methods. These tools save time. No need to visit the office. Payments can be done from home. Ensure the site is sicher. Look for a lock symbol in the address bar. This shows the site is safe. Some tools offer reminders. They alert you when payments are due. This helps avoid late fees. Always keep a Quittung of your payment. It is proof of your transaction.

Häufig gestellte Fragen

How Can I Pay Delinquent Property Taxes?

You can pay delinquent property taxes through online portals or in-person at local tax offices. Most jurisdictions accept credit cards, checks, and cash. Make sure to check if there are any additional fees or penalties. It’s crucial to contact your local tax authority for specific payment methods and deadlines.

What Happens If Property Taxes Are Unpaid?

Unpaid property taxes can lead to severe consequences. The government may impose penalties and interest on the outstanding amount. Eventually, it could result in a tax lien or even foreclosure. It’s essential to address delinquent taxes promptly to avoid losing your property.

Can I Set Up A Payment Plan For Taxes?

Yes, many local tax authorities offer payment plans for delinquent taxes. These plans allow you to pay your overdue taxes in installments over time. Contact your local tax office for more information on eligibility and terms. Setting up a plan can help avoid further penalties.

Are There Penalties For Late Property Tax Payments?

Yes, late property tax payments typically incur penalties and interest. The exact amount depends on your local jurisdiction’s rules. Penalties increase the longer the taxes remain unpaid. It’s important to contact your local tax office to understand the specific penalties involved.

Abschluss

Paying delinquent property taxes is crucial to avoid penalties. Act quickly to set up a payment plan. This can help manage your finances better. Contact your local tax authority for guidance. They can offer options tailored to your needs. Staying informed helps prevent future tax issues.

Keep records of all payments. This ensures transparency and peace of mind. Remember, proactive steps today secure your financial future. Don’t delay. Take control of your property taxes now. It’s an essential part of maintaining home ownership.