A Monthly Fixed Rate Mortgage Payment Quizlet: Ace Your Knowledge

Are you ready to unlock the secrets of your monthly mortgage payments? Understanding how your fixed rate mortgage works can be a game-changer for your financial planning.

You might think you know all there is to know about your mortgage payments, but there’s always more to uncover. With our Monthly Fixed Rate Mortgage Payment Quizlet, you’ll discover insights that will empower you to manage your money smarter.

Imagine having the confidence and clarity to make decisions that could save you thousands over the life of your loan. Intrigued? Let’s dive in and transform the way you think about your mortgage, one question at a time.

Understanding Fixed Rate Mortgages

Fixed rate mortgages offer a consistent monthly payment. The interest rate never changes. This helps in easy planning. People know how much they will pay each month. The loan can be for 15 or 30 years. Longer loans have smaller payments. Shorter loans finish faster. This is important for families. It helps them manage their budget well. Banks often give these loans.

Benefits: Stable payments make life easy. No surprises in costs. People like this security. It is good for long-term plans.

Drawbacks: Rates can be higher. Sometimes, they are not flexible. If rates fall, payments stay the same. It may not be good for short-term goals.

Components Of A Mortgage Payment

Paying a mortgage has two main parts: the principal und die interest. The principal is the amount you borrow from the bank. The interest is the fee you pay to borrow the money. Over time, the principal gets smaller. But the interest changes based on the principal left. Each month, you pay both principal and interest. This keeps the balance going down. The goal is to pay off the loan completely.

There are two other important parts: taxes Und Versicherung. Taxes go to the local government. They use it for schools and roads. Insurance protects your home. If there is a fire or storm, insurance helps fix things. The bank adds taxes and insurance to your monthly payment. This makes sure they are paid on time. It’s important for keeping your home safe and secure.

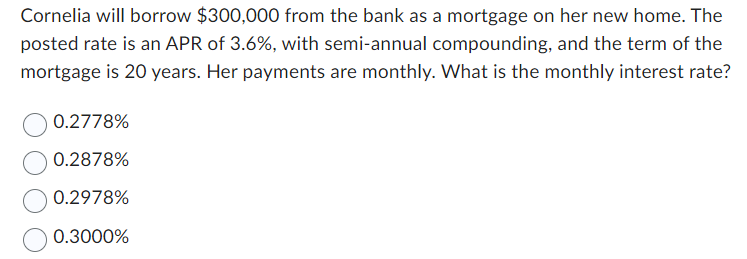

Calculating Monthly Payments

Der amortization formula helps find monthly mortgage payments. It considers loan amount, interest rate, and loan term. Monthly payment equals principal plus interest. This formula divides the loan into equal payments. Each payment reduces the loan balance. Over time, interest reduces and principal increases.

Many factors affect mortgage payments. Interest rate is the biggest factor. Higher rates mean higher payments. Loan term length also matters. Longer terms have smaller payments. Down payment size affects payments too. Bigger down payments reduce loan amounts. Property taxes Und Versicherung add to monthly costs. These costs vary by location. These factors make payments different for everyone.

Common Mortgage Terms

Mortgage loans come in different term lengths. The most common are 15 and 30 years. Shorter loan terms usually mean higher monthly payments. Longer terms often have lower payments. But, you may pay more interest over time. Choose a term that fits your budget and goals.

There are two main types of interest rates. Fixed ratesAdjustable rates

Strategies For Managing Payments

Refinancing can help lower your monthly payment. It replaces your old loan with a new one. This new loan might have a lower interest rate. Lower interest means you pay less over time. Check if you qualify for refinancing. Talk to your bank or lender. They can guide you. Compare different offers. Pick the one that suits you best. Always read the terms carefully.

Budgeting helps manage your money better. Start by listing your monthly income. Then, list all your expenses. This includes your mortgage payment. See where you can save. Maybe cut down on eating out. Or cancel unused subscriptions. Set a small amount aside for savings. This can help in emergencies. Stick to your budget. It keeps your finances on track.

Quizlet Tips For Mastering The Topic

Reading notes can help. Highlight key points while reading. Use flashcards for quick revision. Repeat information often. Visualize terms with diagrams. Group similar ideas together. This helps memory recall. Take short breaks. Rest your mind often.

Practice quizzes are important. They test your knowledge. Quizzes show what you know. They help identify gaps. Review wrong answers. Understand why they are wrong. Learn from mistakes. Take quizzes regularly. Keep improving your score.

Resources For Further Learning

Books can help you learn about fixed rate mortgages. Many authors write about mortgage payments. Articles in magazines give klare Informationen. They show how Zinssätze affect payments. Reading helps you understand important concepts.

Online courses are useful for learning. They offer step-by-step guides. Tools like calculators help with monatliche Zahlungen. These courses are easy to follow. You can learn at your own pace. Many websites offer free resources. They help you practice Berechnungen.

Häufig gestellte Fragen

What Is A Monthly Fixed Rate Mortgage?

A monthly fixed rate mortgage is a loan with consistent interest. Payments remain the same throughout the loan term. This stability helps homeowners budget effectively, without worrying about fluctuating rates.

How Is A Fixed Rate Mortgage Calculated?

A fixed rate mortgage is calculated using the loan amount, interest rate, and term. Lenders use an amortization formula. This ensures consistent payments over the loan’s duration, balancing principal and interest.

Why Choose A Fixed Rate Mortgage?

Fixed rate mortgages offer payment predictability. Homeowners benefit from stable monthly payments. This stability protects against interest rate increases, making budgeting easier and more predictable.

Are Fixed Rate Mortgages Better Than Adjustable Rates?

Fixed rate mortgages offer stability, while adjustable rates can fluctuate. They are better for those seeking consistent payments. Adjustable rates might be lower initially but can increase over time.

Abschluss

Understanding fixed-rate mortgage payments is crucial for financial planning. This quizlet helps simplify complex terms. It tests your knowledge in a fun, engaging way. Learning about mortgages empowers you to make better decisions. It also boosts confidence when discussing loans.

Use these insights to secure a favorable mortgage deal. Remember, every small step counts in financial literacy. Keep exploring and stay informed. Knowledge is key to managing your finances well. Always stay curious and keep learning. This journey of understanding brings you closer to your financial goals.

Happy learning!