Wie hoch ist die Anzahlung für eine Eigentumswohnung? Kostenübersicht

Are you dreaming of owning a condo but unsure about the down payment? Understanding the cost is a crucial step in your home-buying journey.

The down payment can feel like a daunting mystery, filled with numbers and percentages that might seem overwhelming. But don’t worry—this guide is here to simplify the process for you. Imagine the peace of mind knowing exactly what you need to save.

Picture yourself stepping into a space that’s truly yours. By the end of this article, you’ll have a clear picture of how much you need for a condo down payment. Ready to unlock the door to your future? Let’s dive in and demystify the numbers together.

Understanding Condo Down Payments

Buying a condo requires a down payment. This is the first big payment. It is usually a percentage of the condo price. Most lenders ask for at least 20%. This means a $200,000 condo needs a $40,000 down payment. Some loans need only 3% down. These are special loans. They help people with less money. But less down payment means more monthly costs. Higher down payment can mean lower monthly payments. It can also lower long-term costs. Saving for a down payment takes time. Planning is important. Making a budget helps. It shows how much can be saved each month.

Factors Influencing Down Payment Amounts

Standort plays a big role in the down payment. In busy cities, prices are higher. So, more money is needed. Market trends can change the price too. If many want to buy, prices rise. In small towns, prices may be lower. So, less money is needed.

The type of condo affects the payment. A big condo costs more. A small one costs less. Luxury condos need more money. Simple condos need less. Size matters too. A bigger condo means a bigger payment.

A buyer’s financial profile is important. Savings affect the payment. A good credit score helps. It means lower payments. High debt can make payments bigger. Einkommen also matters. More income can mean a smaller down payment.

Common Down Payment Percentages

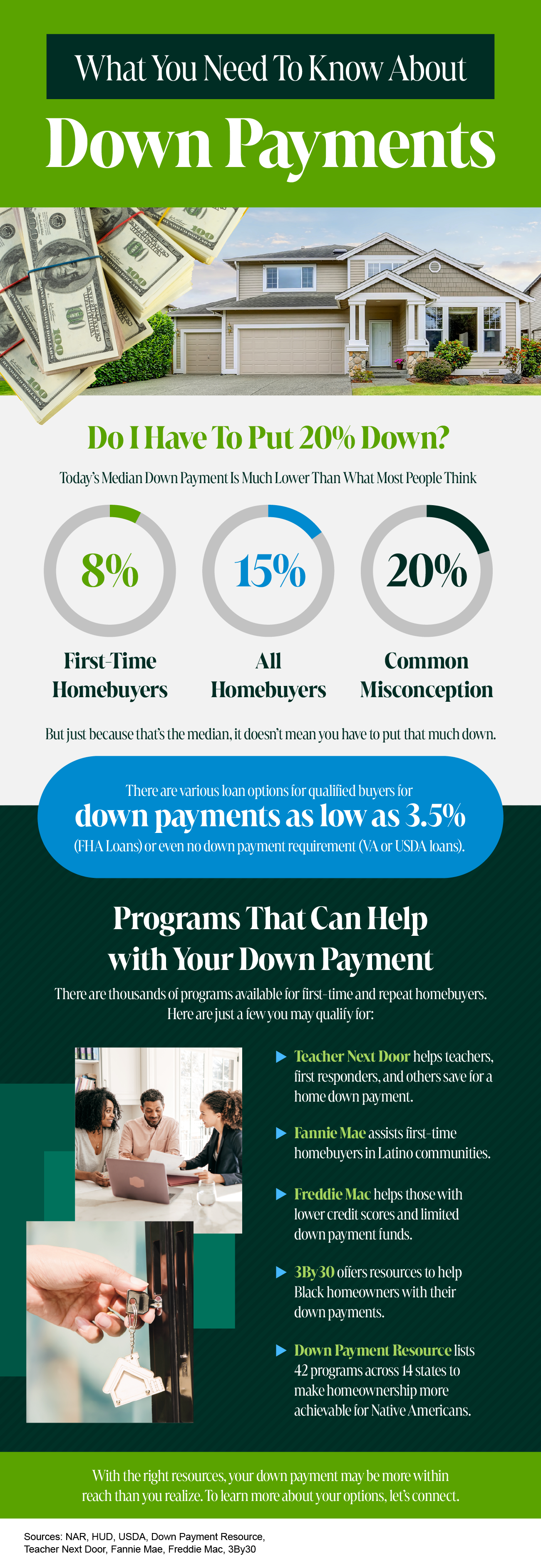

Most people pay a 20% down payment for a condo. This is the standard. It is common and expected. Banks often require this amount. It helps them feel secure. Paying 20% can lower monthly payments. It also might get you better loan rates. Many save for years for this payment. It can be a big step toward owning a condo.

Some loans need less than 20%. FHA loans sometimes need just 3.5%. This helps people with less money. It can make buying easier. VA loans and USDA loans can also require less. These are for certain groups. Low down payments may mean higher monthly costs. But they help many people buy homes.

Some buyers can pay zero down payment. VA loans offer this for veterans. USDA loans help in rural areas. They support those with less money. Zero down means no large payment upfront. But monthly payments might be more. Only a few can use these options. They are special cases.

Pros And Cons Of Different Down Payment Sizes

Larger down payments give you many benefits. Lower monthly payments are one big plus. Paying more upfront means borrowing less. This saves money over time. Better loan rates might be another bonus. Lenders like big down payments. They may offer you a niedrigerer Zinssatz. You build equity faster too. Owning more of your condo feels good. Less risk is involved. Big down payments mean less owed. This can be safer for your future.

Small down payments can be risky. Higher monthly costs are likely. Borrowing more means paying more each month. Interest rates may be less friendly. Lenders see bigger risks and charge more. Slow equity growth happens. Owning less of your condo takes time. Financial Sicherheit may be lower. Owing more can be stressful. Unexpected costs might surprise you. Small payments leave less room for emergencies. Careful planning is needed.

Saving Strategies For A Condo Down Payment

Start by making a list of your monthly expenses. Track every dollar you spend. This helps you see where you can save. Cut down on things you don’t need. Eat out less or cancel unused subscriptions. Use a budget app to help you stay on track. Set a clear goal for your condo down payment. Stick to your budget no matter what.

Open a special savings account just for your condo fund. Look for accounts with good interest rates. This helps your money grow while you save. Set up automatic transfers from your main account. This way, you save without thinking. Keep this money separate from your other savings. Don’t touch it until you’re ready to buy.

Some programs help you pay for your condo. Check if you qualify for first-time buyer programs. These programs offer grants or loans with low interest. Visit local housing offices for information. They can guide you on available options. Always read the terms carefully. Make sure you understand what you are signing.

Impact On Mortgage And Monthly Payments

A big down payment lowers the loan amount. This means lower monthly payments. Less money borrowed makes the loan less expensive. Shorter loan terms can save money over time. Longer terms might mean smaller payments each month, but more interest paid overall. Choose wisely.

A larger down payment kann dazu führen, bessere Zinsen. This saves money on the loan. Lower rates mean lower monthly payments. Insurance costs are also affected. Less borrowed means less risk for the lender. Lower risk can mean lower insurance costs. Think about the savings.

Exploring financial assistance options for condo down payments can ease the buying process. Typically, a down payment ranges from 3% to 20% of the condo’s price, depending on loan type and lender requirements. Understanding these options helps in planning and saving effectively for a future investment.

Government Programs

Government programs can help with condo down payments. These programs offer grants oder zinsgünstige Kredite. Many people use them to buy their first home. Some programs focus on low-income families. Others help first-time buyers. It’s important to check Teilnahmeberechtigung requirements. Not everyone qualifies for these programs. Visit local government websites for more details. They provide guidance Und application steps. Assistance can reduce initial costs. This makes buying a condo easier.

Private Lenders

Private lenders offer different options. They can provide loans for condo down payments. Interest rates may vary. It depends on Kreditwürdigkeit Und Finanzgeschichte. Some lenders offer flexible payment plans. This helps in managing finances better. Be careful when choosing a lender. Read all Bedingungen Und conditions. Compare offers from various lenders. This ensures the best deal. Private lenders are a popular choice for many buyers. They offer quick Und einfach solutions.

Finalizing Your Down Payment Decision

Assessing personal financial health is important. Know how much money you have. Check your savings. Check your monthly income. Think about your debts. Do you owe money? Make a list. This helps you know what you can spend.

Talk with a real estate expert. They know about homes. They can help you make smart choices. Ask about the market. Is it a good time to buy? Experts can answer these questions. They give advice that helps.

Use your knowledge to decide. Your Anzahlung should fit your money plan. Make sure you can pay it. This makes buying a home easier.

Häufig gestellte Fragen

What Is The Average Condo Down Payment?

The average down payment for a condo typically ranges from 10% to 20% of the purchase price. This amount can vary based on factors like location and lender requirements. Some buyers may qualify for lower down payments through specific programs.

Are There Low Down Payment Options For Condos?

Yes, there are low down payment options available for condos. Some programs, like FHA loans, allow down payments as low as 3. 5%. These options are ideal for first-time buyers with limited savings.

How Does Credit Score Affect Condo Down Payment?

A good credit score can significantly impact your down payment requirement. Higher credit scores often qualify buyers for lower down payments. Lenders view buyers with strong credit as less risky, allowing for more favorable terms.

Can Down Payment Assistance Be Used For Condos?

Yes, down payment assistance programs can be used for purchasing condos. These programs provide financial aid to help cover down payment costs. Eligibility and availability vary, so research local options and requirements.

Abschluss

Understanding condo down payments is crucial for future buyers. Saving enough can ease the buying process. Costs vary based on location and condo price. Research is key. Compare different condos and their requirements. Plan your budget wisely. Seek advice from real estate experts.

They can offer valuable insights. A clear financial plan helps avoid surprises. Aim for a comfortable down payment. It reduces future financial stress. Homeownership is a significant step. Make informed choices to enjoy the journey. With the right preparation, owning a condo becomes achievable.

Start planning today for a brighter tomorrow.