Buying a home in California is a dream for many, but understanding the financial aspects can be daunting. One of the most critical factors in this process is the down payment.

How much do you actually need for a down payment on a house in California? This question likely sparks a mix of excitement and anxiety as you navigate the real estate landscape. The good news is, you’re not alone in this journey, and with the right information, you can make informed decisions that bring you closer to owning your dream home.

We’ll break down what you need to know about down payments in California. Whether you’re a first-time homebuyer or looking to upgrade, this guide will arm you with the knowledge to confidently step into the housing market. Get ready to take control of your home-buying journey and discover the keys to financial readiness.

Factors Influencing Down Payment

The type of property affects the down payment. Single-family homes often need a higher down payment than condos. Luxury homes require even more. Choosing a condo might reduce initial costs.

A good credit score lowers the down payment. Scores above 700 are ideal. Bad scores might increase the payment needed. Improving your score can help save money.

Different loans need different down payments. FHA loans often ask for only 3.5%. Conventional loans might need up to 20%. Knowing your loan type is important. VA loans might not need any down payment.

Average Down Payment In California

In California, the average down payment is often 20% of the home’s price. This means if a house costs $500,000, the down payment would be around $100,000. Some buyers pay less, maybe 10% or even 5%. But paying more means borrowing less. This can make monthly payments smaller. It’s important to save as much as possible before buying.

Different areas in California have different home prices. In Los Angeles, homes might cost more than in Fresno. This means down payments can vary a lot. In cities, homes are often more expensive. This makes the down payment higher. In smaller towns, prices are lower. So, the down payment is less. Always check local prices before planning your budget.

Loan Programs And Down Payment Assistance

FHA loans are popular for buying a house. They need a low down payment. Often, you only need 3.5% of the home price. This helps many people buy homes. Even if they don’t have much money saved.

VA loans are for military members. They offer a zero down payment. This is a big help for veterans. VA loans also have low-interest rates. This makes buying a home easier for military families.

First-time buyer programs offer special deals. These programs help new buyers save money. Often, they have low down payment options. Some programs even offer financial help with closing costs.

California offers state assistance for buyers. These programs provide down payment help. They aim to help more people buy homes. State assistance can make buying a home more affordable.

Saving Strategies For Down Payment

Making a budget helps save money. Know what you earn each month. List all things you spend on. Cut extra expenses like eating out. Save that money for your house. Put money aside first. Save before spending on fun things. Small savings add up.

Invest your savings to grow your money. Banks have savings accounts. Interest makes your money grow. Mutual funds are good too. They have low risks. Put money in safe places. Watch it grow over time.

Look for government help to buy a home. Some programs lower down payments. Ask about first-time buyer programs. They help with money. You may get tax benefits. Check local rules. They can help you save more.

Impact Of Down Payment On Mortgage

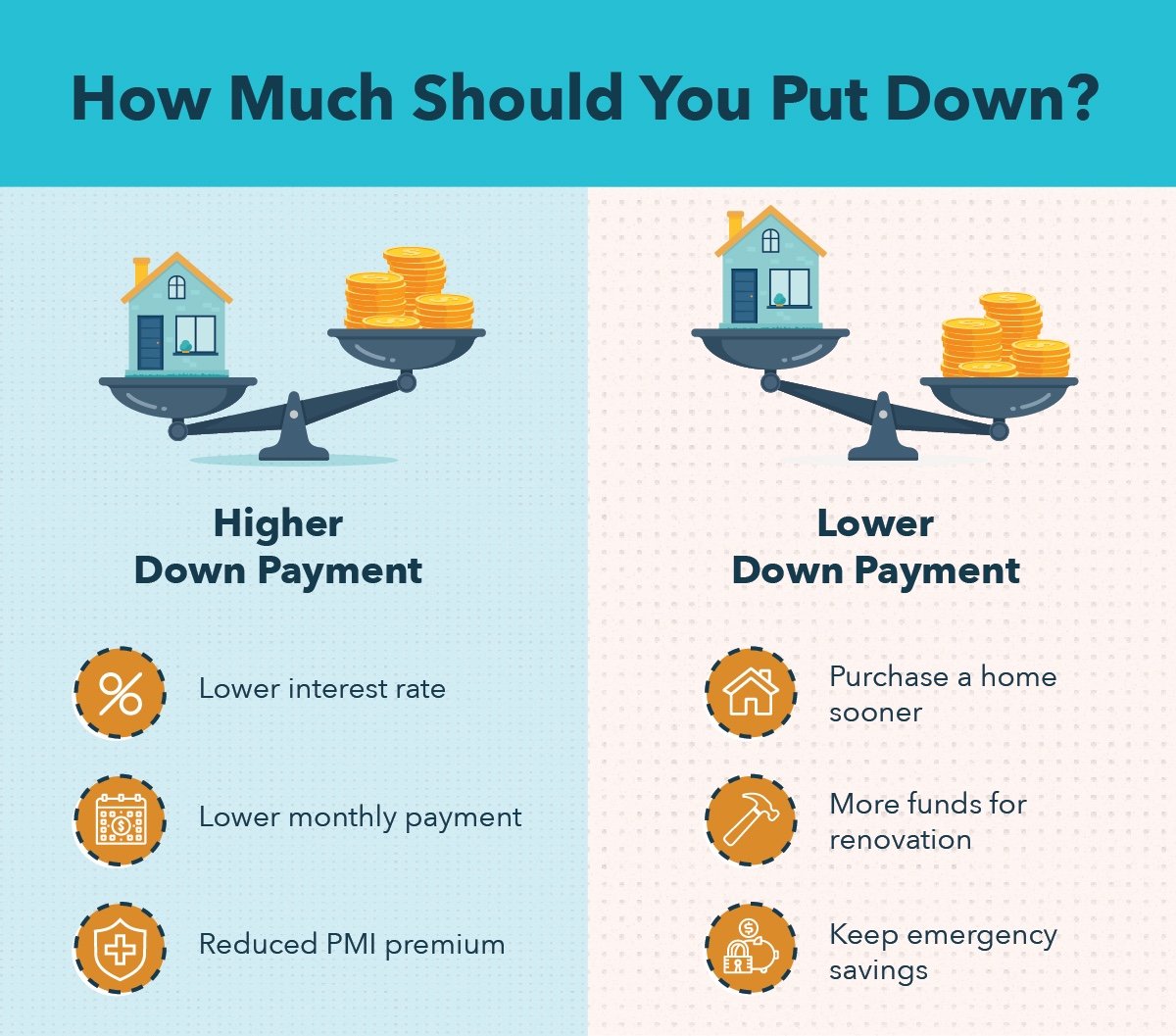

Down payments affect mortgage terms significantly. In California, typical down payments range from 3% to 20% of the home’s price. A larger down payment could mean lower monthly payments and better loan conditions.

Loan-to-value Ratio

A bigger down payment lowers the loan-to-value ratio. This means you owe less compared to the home’s value. A lower ratio can make you a safer choice for lenders. This might help you get a loan more easily.

Interest Rate Effects

A larger down payment might get you a better interest rate. Lenders see you as less risky. This can save money over the loan’s life. Paying less interest means more savings.

Monthly Payment Calculations

A big down payment can lower monthly payments. You borrow less money. Monthly bills become smaller. This helps manage your budget better. Smaller payments leave room for other expenses.

Common Down Payment Myths

Many believe a 20% down payment is a must for buying a house. This is not always true. Some loans ask for much less. First-time buyers can pay as little as 3%. The 20% rule is common but not required.

A bigger down payment can lower monthly payments. But it doesn’t always mean you own more of the house. Paying less upfront can still lead to owning the home. Loan terms matter more than the down payment size.

Expert Tips For Home Buyers

Asking a financial advisor is smart before buying a home. They help with budget planning. Knowing what you can afford is important. You learn how much to save. Advisors explain down payment details. They offer advice on loan options. You can ask them about interest rates. Understanding these helps you make better choices. Your advisor guides you step by step. They make buying a home easier. You feel more confident with their help.

It’s wise to check the real estate market. Trends change often. Knowing the market helps in making decisions. Prices go up and down. See how the market is doing. You can find good deals this way. Look at home values in different areas. Some places are more expensive. Others are cheaper. Understanding trends can save money. It helps in choosing the right time to buy. You should always stay informed.

Frequently Asked Questions

How Much Is The Average Down Payment In California?

The average down payment for a house in California is typically 20% of the purchase price. However, many buyers opt for a lower percentage, like 3% to 5%, depending on the loan type. It’s important to explore different financing options and programs available to first-time homebuyers.

What Is The Minimum Down Payment For A House?

In California, the minimum down payment can be as low as 3% for first-time buyers. This is often possible through certain loan programs like FHA or conventional loans. It’s advisable to consult with a mortgage advisor to understand the requirements and benefits of each option.

Are There Down Payment Assistance Programs In California?

Yes, California offers various down payment assistance programs for homebuyers. These programs are designed to help with the initial costs of purchasing a home. They are especially beneficial for first-time buyers. Researching local and state programs can provide valuable financial support.

Can I Buy A House With No Down Payment?

Buying a house with no down payment is possible but challenging. Some loan programs, like VA loans for veterans, offer zero down payment options. However, these programs have specific eligibility criteria. Consulting with a mortgage professional can help you explore available options tailored to your situation.

Conclusion

Buying a house in California is a big step. Down payments vary by location and lender. Typically, they range from 3% to 20% of the home’s price. Understanding this cost helps you plan better. Savings and budget are key factors.

A higher down payment means lower monthly payments. So, consider your financial situation carefully. Talk to a mortgage advisor for personalized advice. This ensures you make the best decision for your future home. Preparing well today secures your tomorrow. Good luck on your home buying journey!