Have you ever found yourself with funds on a prepaid card and wished you could just transfer that money straight into your bank account? If so, you’re not alone.

Many people face the inconvenience of juggling multiple payment methods and long for a simpler way to manage their finances. Imagine having the flexibility to move your money with ease, reducing stress and gaining more control over your financial life.

We’ll explore whether transferring money from a prepaid card to a bank account is possible and how you can do it efficiently. Stick around to discover practical tips that could save you both time and effort, making your financial transactions smoother than ever before.

Understanding Prepaid Cards

Understanding prepaid cards can seem complex. Yet, they simplify financial transactions. Prepaid cards offer a way to manage funds without a traditional bank account. This section will clarify what prepaid cards are and explore their types.

What Are Prepaid Cards?

Prepaid cards are payment cards preloaded with money. Use them to make purchases or pay bills. They work like debit cards but are not linked to a bank account. You can only spend the money loaded onto the card. Reloading is possible, making them flexible for users.

Types Of Prepaid Cards

Various prepaid card types exist. General-purpose reloadable cards are popular. They offer flexibility and can be used anywhere debit cards are accepted. Gift cards are another type. These have a fixed amount and are ideal for gifting.

Travel cards are designed for use abroad. They offer competitive exchange rates and are secure. Payroll cards are issued by employers for salary payments. They help employees without bank accounts access their wages.

Benefits Of Transferring Money

Transferring money from a prepaid card to a bank account offers convenience and security. It provides easy access to funds and helps in managing finances better. Prepaid card transfers simplify payments, making transactions seamless and efficient.

Transferring money from a prepaid card to a bank account can be a wise financial move. It offers numerous benefits that can streamline your money management and provide greater financial flexibility. Imagine having instant access to your funds without being restricted to a specific card or location. This transfer capability not only enhances your financial efficiency but also empowers you to take control of your budgeting and savings goals.

Convenience And Accessibility

Transferring money from a prepaid card to your bank account provides unmatched convenience. You can easily access your funds anytime without needing the physical card. This is particularly helpful if you misplace your card or forget it at home.

You also gain accessibility to a wider range of services. Your bank account can be linked to various online platforms, allowing seamless transactions and payments. This means you can shop, pay bills, or transfer money without hassle.

Having your money in a bank account also means you can withdraw cash from ATMs across the globe. You’re not tied to specific locations or limited by the prepaid card’s network.

Budgeting And Control

Transferring money to your bank account aids in budgeting and financial control. When your funds are consolidated in one account, it’s easier to track your spending and savings. You can set up automatic transfers to savings accounts, ensuring your financial goals are met.

Consider how easy it is to manage monthly expenses when all your transactions are in one place. You can categorize spending, identify patterns, and make informed decisions about where to cut costs.

Having control over your money allows you to avoid overspending. Prepaid cards can sometimes lead to impulsive purchases. With funds in your bank account, you’re more likely to stick to a budget and prioritize essential expenses.

Have you ever wondered how much peace of mind can come from knowing exactly where your money is going? Transferring funds to your bank account might just be the key to achieving that clarity.

Checking Transfer Eligibility

Transferring money from a prepaid card to a bank account sounds easy. But it’s not always straightforward. You need to check several things before you start. This ensures a smooth process. Two key factors affect this: the card issuer policies and the bank account requirements.

Card Issuer Policies

Card issuers have different rules. Some allow transfers to bank accounts. Others do not. Check your card’s terms and conditions. Look for transfer options. Call customer service if unsure. Ask about fees too. Some issuers charge for transfers. Know all costs before proceeding.

Bank Account Requirements

Banks have requirements for transfers. Your account must be in good standing. It should be active. Some banks need a minimum balance. Others may require verification steps. Provide accurate bank details. Double-check account numbers. Incorrect information causes delays.

Setting Up Online Access

Transferring money from a prepaid card to a bank account is easy. Start by checking if your card supports this transfer. Follow the card issuer’s instructions, usually involving online access or mobile apps. This process ensures quick and secure money management.

Setting up online access for transferring money from a prepaid card to a bank account simplifies the process. It provides a secure, convenient way to manage funds without visiting a bank. Many people prefer online access for its flexibility and ease. It allows you to monitor transactions anytime.

Registering Your Card

Begin by registering your prepaid card online. Visit the card issuer’s website. Look for the registration section. Enter the card details carefully. This often includes the card number, expiry date, and security code. Create an account using a strong password. Ensure your email address is valid. This step verifies your identity and provides access to the card features.

Linking To Bank Account

After registration, link the prepaid card to your bank account. Navigate to the linked accounts section on the website. Select the option to add a bank account. Provide your bank account details, like account number and routing number. Double-check the information for accuracy. Some platforms may require additional verification. This ensures that the account belongs to you. Once linked, you can transfer funds with ease.

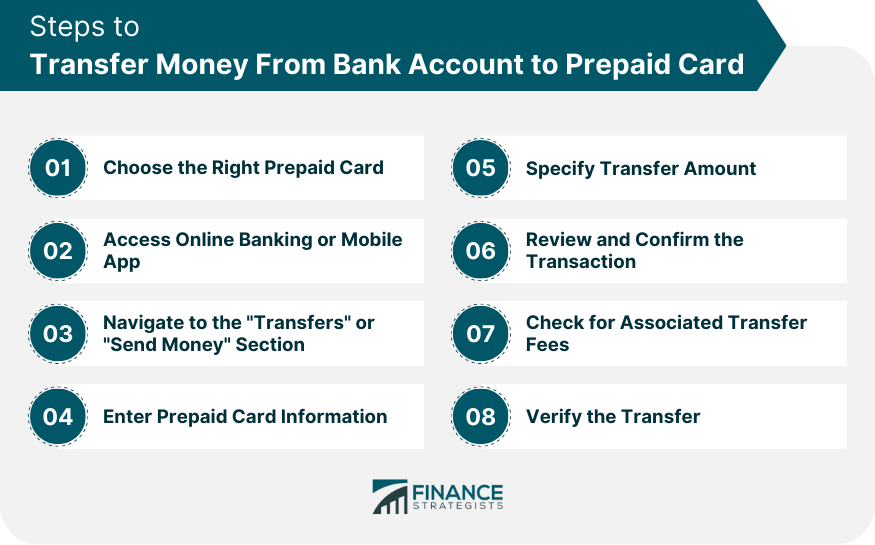

Step-by-step Transfer Process

Transferring money from a prepaid card to a bank account involves a few simple steps. Start by checking your card issuer’s options for transfers. Follow their instructions to link your bank account for easy transactions.

If you’ve ever wondered about transferring money from a prepaid card to a bank account, you’re not alone. Many people find themselves in situations where they need to move funds quickly and efficiently. The good news is that this process is often straightforward, but it does require careful attention to detail. By following a simple step-by-step process, you can ensure your money gets where it needs to go without a hitch.

###

Initiating The Transfer

The first step is initiating the transfer. Begin by logging into your prepaid card account online or through a mobile app.

Look for an option like “Transfer” or “Send Money.” Once you find it, click to start the process.

Select the option to send money to a bank account. You may need to enter your bank details, so keep your account number and routing number handy.

###

Verifying Transaction Details

After you’ve entered all necessary information, take a moment to verify the transaction details. Double-check the bank account number and routing number to ensure accuracy.

Mistakes here can lead to delays or misdirected funds. It’s crucial to confirm the amount you wish to transfer is correct.

Isn’t it better to spend an extra minute verifying than to deal with complications later?

Once you’re confident everything is in order, proceed to confirm the transaction. You should receive a confirmation message or email.

Remember, patience is key. Transfers can take a few days to process, depending on your bank and the prepaid card provider.

By following these steps, you’re not just moving money; you’re managing your finances with precision and care. Have you ever tried this transfer method before, or are you considering it for the first time? Share your thoughts or experiences in the comments below!

Common Challenges And Solutions

Transferring money from a prepaid card to a bank account can be tricky. Many people face challenges during this process. Knowing common issues and their solutions helps streamline transfers. This section focuses on troubleshooting errors and dealing with delays.

Troubleshooting Transfer Errors

Sometimes, errors occur during money transfers. Incorrect card details often cause problems. Double-check card and bank account numbers. Ensure they match the required fields.

Network issues might also interrupt transactions. Try again later if possible. Contact customer support for assistance if problems persist. They can guide you to fix the error.

Dealing With Delays

Delays are another common challenge. Transfers usually take a few days. Check if your bank has specific processing times. Each bank varies in how fast they process transactions.

Weekends and holidays can extend transfer times. Plan transfers during business days. If delays continue, contact your bank. They might help resolve the issue faster.

Knowing these challenges prepares you better. It helps to make transfers smoother and stress-free.

Security Considerations

Transferring money from a prepaid card to a bank account involves certain security considerations. Ensuring a safe transaction protects your funds and personal data. Understanding these aspects helps prevent issues and ensures a smooth transfer.

Protecting Personal Information

Guarding your personal information is crucial. Always keep your card details private. Never share your PIN or card number with anyone. Use secure networks when accessing online banking services. Avoid public Wi-Fi for financial transactions. Always check the website’s security protocols before entering your details.

Recognizing Fraudulent Activities

Fraud can happen at any time. Be vigilant for suspicious emails and calls. Never click on links from unknown sources. Monitor your account regularly for unusual activity. Report any discrepancies immediately to your bank. Keep your software updated to protect against security breaches.

Alternatives To Direct Transfers

Transferring money from a prepaid card to a bank account isn’t always direct. Sometimes, exploring alternative methods offers a more effective solution. These options can be handy when traditional transfer methods don’t work. Let’s delve into some practical alternatives.

Using Third-party Services

Third-party services offer reliable ways to move money. PayPal and Venmo are popular choices. They allow linking prepaid cards and bank accounts. Transfer funds to these platforms first. Then, send the money to your bank account. It’s a simple process with a few steps. Ensure the service supports your card type. Some services may charge fees. Read terms carefully to avoid surprises.

Exploring Other Payment Options

Consider using your prepaid card like a debit card. Pay bills directly with it. Many utility and service providers accept prepaid cards. This method avoids transfer fees. It also keeps your bank account free from unnecessary transactions. Another option is spending funds online. Use your card for online shopping. Many retailers accept prepaid cards. This way, you don’t need to transfer money at all.

Frequently Asked Questions

How To Transfer Money From Prepaid Card To Bank?

Transferring money from a prepaid card to a bank account is possible. First, check if your card supports direct transfers. Log into your online card account and navigate to the transfer section. Follow the instructions to complete the transaction. Ensure you have your bank details ready to facilitate the process.

Can Prepaid Cards Be Linked To Bank Accounts?

Yes, many prepaid cards can be linked to bank accounts. This feature allows for easier money management. You can set up transfers between the card and your bank account. Always confirm with the card issuer if linking is supported. This can often be done through the card’s online portal.

Are There Fees For Transferring Money To A Bank?

Yes, transferring money from a prepaid card to a bank may incur fees. These fees vary depending on the card issuer. Check the card’s terms and conditions for specific fee details. Some issuers may offer fee-free transfers, so it’s important to review your card’s policy.

What Details Are Needed For A Transfer?

To transfer money, you’ll need your bank account details. This typically includes your account number and routing number. Ensure your prepaid card is activated and has sufficient funds. Follow the transfer instructions provided by your card issuer. Double-check all details to avoid errors during the transfer.

Conclusion

Transferring money from a prepaid card to a bank account is possible. Understanding the process can save you time and stress. Start by checking if your card allows transfers. Some prepaid cards support this feature, while others don’t. Follow the necessary steps provided by your card issuer.

Be aware of any fees that may apply. Transferring funds can be a convenient option for managing finances. Always ensure the transfer is secure. Keep personal details private. With the right approach, transferring money becomes easier. It helps in managing your budget effectively.

Stay informed and make smart financial choices.