Have you ever wondered if you can transfer money from your business account to your personal account? You’re not alone.

Many business owners find themselves pondering this exact question. It might seem like a simple task, but there are crucial factors to consider before making any moves. Imagine having the freedom to move your funds seamlessly, all while staying compliant with financial regulations.

Sounds great, right? But how do you ensure you’re doing it correctly without facing any legal hiccups? We’ll dive into the dos and don’ts, offering you a clear path to manage your finances smartly and safely. Let’s unravel the mystery and empower you with the knowledge you need!

Business And Personal Accounts

Understanding the differences between business and personal accounts is vital. Each serves unique financial needs and purposes. Knowing these distinctions helps in managing funds effectively.

Differences Between Accounts

Business accounts handle company finances. They separate business transactions from personal ones. These accounts often offer features tailored for businesses. Personal accounts, meanwhile, cater to individual financial needs. They help manage personal expenses and savings.

Business accounts usually require more documentation for setup. Personal accounts are easier to open, needing fewer documents. Business accounts may include merchant services, facilitating transactions with clients. Personal accounts lack these features, focusing on personal financial management.

Purpose Of Each Account

Business accounts track and manage company finances. They provide a clear picture of business income and expenses. This helps in maintaining transparency and accountability. Having a separate business account simplifies tax preparation.

Personal accounts serve to manage individual finances. They help in budgeting personal expenses and saving money. These accounts are essential for day-to-day financial activities. Keeping business and personal finances separate is crucial for financial health.

Legal Considerations

Transferring money from a business account to a personal account requires careful attention. Legal considerations are crucial to avoid complications. Businesses must adhere to specific laws and guidelines. Understanding these legal aspects helps in making informed decisions.

Regulations To Follow

Each country has its own banking regulations. These rules ensure proper financial conduct. Businesses must follow these regulations to avoid penalties. Ignoring these laws can lead to severe consequences. Always consult with a financial expert for guidance.

Tax Implications

Transferring funds between accounts can impact taxes. It may affect your personal tax liability. Misreporting transactions can lead to audits. Accurate record-keeping is essential for tax compliance. Consult a tax professional to understand potential tax effects.

Methods Of Transferring Funds

Understanding the methods to transfer money from a business account to a personal one is essential. This knowledge ensures compliance with financial regulations. It also helps maintain clarity in financial records. Different methods can be used based on convenience and security. Let’s explore these methods in detail.

Direct Bank Transfers

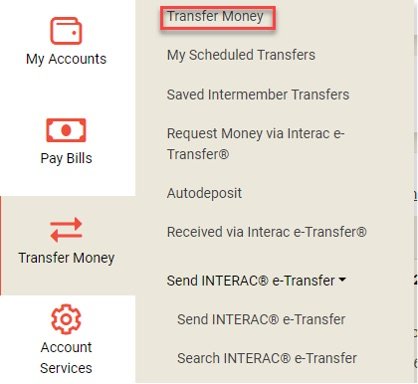

Direct bank transfers are straightforward. Log into your business account. Select the transfer option. Enter your personal account details. Confirm the amount you want to transfer. Banks usually process these transfers quickly. But, always check for any associated fees. Some banks may charge for this service. Ensure you have enough funds to cover these costs.

Using Third-party Services

Third-party services offer another way to move funds. These services often provide user-friendly platforms. Popular options include PayPal or Venmo. Set up your accounts with these services. Link both your business and personal accounts. Initiate the transfer through the service’s app or website. Be aware of any service fees. These can vary depending on the provider. Always read the terms before using these services. Ensure your transactions are secure and compliant.

Risks And Challenges

Transferring money from a business account to a personal account poses risks like potential tax issues and legal complications. Challenges include maintaining compliance with financial regulations and ensuring proper documentation. Navigating these hurdles requires careful consideration to avoid penalties and maintain financial integrity.

Transferring money from a business account to a personal account might seem like a straightforward task. However, this action can come with a host of risks and challenges. Understanding these can save you from potential financial pitfalls and ensure your business remains compliant with regulations.

Potential Penalties

Shifting funds between accounts can trigger penalties if not managed properly. Many banks and financial institutions have strict guidelines on account usage. Violating these could result in fines or restrictions. If you’re not careful, you might end up paying more than you initially expected.

Tax implications are another area to consider. Misusing business funds for personal expenses can lead to audits. Imagine the stress of dealing with tax authorities because of a simple transfer. It’s crucial to document every transaction accurately to avoid any legal repercussions.

Impact On Business Finances

Transferring money might seem harmless, but it can affect your business’s financial health. Every dollar moved is a dollar less for business operations. Have you considered how this might affect your cash flow? A shortfall could impact your ability to pay bills or invest in growth opportunities.

Furthermore, it can alter the perception of your business’s financial stability. Stakeholders may question your decisions if they notice irregularities in account balances. Could this affect your relationship with suppliers or partners? Maintaining transparency is key to sustaining trust and confidence.

Navigating these risks requires careful planning and consideration. Could there be alternative solutions to meet your needs without impacting your business? Always weigh the pros and cons before making financial decisions.

Best Practices For Safe Transfers

Transferring money from a business account to a personal account requires careful attention to legal guidelines. It’s crucial to maintain clear records to avoid tax issues. Always consult your accountant for advice and ensure all transactions are transparent.

Transferring money from a business account to a personal account is a common practice among business owners. However, it’s essential to handle these transfers with care to avoid potential financial or legal issues. By following best practices, you can ensure that your transactions are both safe and compliant.

Record-keeping Tips

Meticulous record-keeping is crucial when moving money between accounts. Always document the reason for the transfer. This will help you justify the transaction if questions arise later.

Use accounting software to track all transfers. This not only maintains accuracy but also saves time during tax season. Regularly review your records to ensure they align with your bank statements.

Think about maintaining a dedicated folder for these transactions. A simple spreadsheet or digital folder with scanned receipts and notes can provide a clear trail of your financial activities.

Consulting Financial Experts

Have you ever considered talking to a financial advisor before making these transfers? They can offer insights into how these moves might affect your taxes or personal financial health.

Tax laws can be complex and differ from one region to another. A financial expert can guide you on how to stay compliant with local regulations. Seeking their advice can prevent potential legal pitfalls.

Don’t hesitate to ask questions. An expert can also help you plan for future transfers, ensuring that your business and personal finances remain healthy and sustainable.

Safe transfers require careful planning and attention to detail. By keeping thorough records and consulting with professionals, you protect yourself and your business. What strategies do you use to ensure safe financial transfers?

Alternatives To Direct Transfers

Transferring money from a business account to a personal account isn’t always straightforward. Certain methods can help manage funds legally and efficiently. These alternatives ensure compliance with tax regulations and financial management practices.

Dividend Payments

Businesses structured as corporations can issue dividend payments. These payments represent profit sharing among shareholders. Dividends are a formal way to transfer funds. They require proper documentation and compliance with tax laws. The amount and frequency depend on the company’s earnings. This method ensures transparency and legal clarity.

Owner’s Draw

Sole proprietorships and partnerships often use owner’s draw. This option allows business owners to withdraw funds from business profits. The draw reflects personal income, not a company expense. It’s crucial to track these draws carefully. Proper accounting prevents tax complications and maintains financial health. Owner’s draw provides flexibility in accessing business funds.

Frequently Asked Questions

Is It Legal To Transfer Money From Business To Personal Account?

Yes, transferring money from a business to a personal account is legal. However, it must be documented properly. Ensure compliance with tax regulations and maintain accurate records. Mismanagement could lead to issues with tax authorities, so consult a financial advisor for best practices.

How Do I Transfer Money From A Business Account?

Transferring money from a business account can be done via bank transfer. Use online banking services for convenience and security. Ensure the transaction is recorded correctly for bookkeeping purposes. Consult your bank for specific procedures and fees related to transfers.

Are There Tax Implications For Transferring Funds?

Yes, transferring funds from business to personal accounts can have tax implications. Improper transfers might be seen as income, affecting your tax liabilities. It’s important to record transactions accurately and consult a tax professional to avoid potential legal issues.

Can I Use Business Funds For Personal Expenses?

Using business funds for personal expenses is not recommended. It can cause accounting discrepancies and legal issues. Keep business and personal finances separate to maintain financial clarity. Consult an accountant for advice on managing expenses and maintaining compliance.

Conclusion

Transferring money from a business to a personal account needs care. It’s vital to follow legal rules and maintain good records. Always consult with your accountant for guidance. Understand the tax implications involved. This helps avoid potential legal issues. Keep transactions clear and documented.

This practice ensures transparency and trust in your finances. Remember, managing finances wisely is key. It protects your business and personal interests. Ensure all transfers are justified and necessary. This approach builds financial stability and peace of mind. Stay informed and make decisions thoughtfully.

Your financial health depends on it.