Imagine the weight of unpaid bills looming over you, each one a reminder of financial stress. Falling behind on house payments can feel like a sinking ship, pulling you deeper into anxiety with each passing day.

But there’s a lifeline many don’t realize they have. Have you ever wondered if selling your house could be the answer, even when you’re behind on payments? The good news is that it might just be the solution you’ve been searching for.

We’ll explore how you can navigate this challenging situation, providing you with actionable steps and insider tips to regain control and maybe even turn a stressful situation into a fresh start. Keep reading to discover the possibilities and the peace of mind that could be just around the corner.

Options For Homeowners Behind On Payments

Selling a home can be a good option. Find a trusted real estate agent. They can help you price your home correctly. You might need to make repairs. Clean the house well. Marketing is key. Good pictures attract buyers. Be ready to show the house often. Offers might come fast. Review offers carefully. Choose the best one. A quick sale can ease stress.

Short sales need lender approval. Your home value is less than the loan. Talk to your lender early. Negotiate with them. A short sale can protect your credit. It might take longer than normal sales. Be patient. Legal help may be needed. Understand all terms. Financial relief is possible. But it’s not always easy.

Foreclosure means losing your home. It’s a last resort. The lender takes back the property. You can try to stop foreclosure. Talk to your lender. Payment plans might help. Avoid ignoring lender letters. Seek legal advice. Foreclosure affects your credit. It stays on your record for years. Explore other options first.

Understanding The Mortgage Agreement

Loan terms are very important. They tell you how much you owe. They also show how long you have to pay. Look for the interest rate. This is the extra money you pay back. Terms may include penalties. These happen if you pay late. Understanding these terms helps you know what you agreed to.

Talking to your lender is very important. Tell them if you have problems. They might help you. They can change the payment plan. This can make payments easier. Lenders want to help you. They want you to keep your house. So, always keep in touch with them.

Short Sale Process

Not every homeowner can do a short sale. Banks usually ask for proof. Show them financial hardship. You must owe more than the house’s value. No equity in the home is a must. Some banks may have other rules. Check with your lender for details. A short sale is not a quick fix. It is a solution for those in need.

Talk to your lender about a short sale. Negotiation is key. You need to explain your situation. Tell them why you can’t pay. Convince them a short sale is better than foreclosure. Be patient. Lenders have their own processes. They may ask for documents. Be ready to provide everything they need.

A short sale will affect your credit score. It is better than foreclosure. Still, it can lower your score significantly. Credit damage can last for years. Prepare for this impact. A short sale is not a clean slate. You might face future challenges in borrowing. Understand the risks. Make informed choices for your financial health.

Alternatives To Selling

A loan modification can help adjust your mortgage terms. It can lower your monthly payments. This option can make your mortgage more manageable. Lenders may change the interest rate or extend the loan term. It provides relief from financial pressure. Always check with your lender. They will explain your options.

Refinancing can help lower your interest rate. It can also extend your loan term. This means smaller monthly payments. It may cost some fees upfront. But it can save money over time. Speak with a financial expert. They can guide you through the process.

Some government programs offer help with payments. These programs can provide temporary relief. They may reduce your mortgage payments. Eligibility depends on your situation. Check online for available programs. You might qualify for assistance. This can ease your financial burden.

Legal And Financial Implications

Selling a house with missed payments can lead to tax issues. You might owe taxes on the sale amount. This is if it is more than what you owe. The IRS might see this as income. You should talk to a tax expert. They can help you understand your tax duties.

Being behind on payments affects your legal rights. The bank may have the right to take your house. But you have rights too. You can negotiate with the bank. A lawyer can help you know your rights. It’s important to act quickly. Delays can lead to more issues.

Working With Real Estate Professionals

Struggling with mortgage payments doesn’t mean you’re stuck. Selling your house is possible, even if you’re behind. Real estate professionals can guide you through the process, helping find solutions and buyers quickly.

Choosing A Real Estate Agent

Picking the right real estate agent is crucial. You need someone who knows the market. Look for agents with good reviews. Ask friends for recommendations. An experienced agent can help sell your house fast. They know how to attract buyers. Agents handle negotiations and paperwork. This makes the process easier for you. Check their credentials before hiring. A licensed agent is always a safer choice. Meet with them to discuss your needs. Ask about their past sales.

Role Of A Financial Advisor

A financial advisor offers guidance on money matters. They help manage debts. Advisors suggest ways to handle payments. Their advice can ease financial stress. It’s wise to consult one before selling your house. They evaluate your current financial situation. Advisors can recommend the best course of action. They assist in planning for future expenses. Having a financial advisor on your team is beneficial. They ensure you make sound financial decisions.

Emotional Considerations

Coping with Stress can be tough when selling a home. The fear of losing a home is real. Stress affects sleep and mood. It makes people feel sad or worried. Taking deep breaths can help. Talking to friends or family might ease the burden. Finding support groups is a good idea. They understand and offer help. Some people find comfort in hobbies. Painting or reading can distract from worries. Seeking professional advice is wise. Experts know how to manage stress.

Family Impact is significant in these situations. Moving affects children the most. They may feel scared or confused. It’s important to talk to them. Explain the situation in simple words. Family can stick together in hard times. Sharing feelings is good. It brings everyone closer. Planning fun activities can lift the mood. It helps kids adjust to changes. Remember, a united family can face challenges better.

Frequently Asked Questions

Can I Sell My House While Behind On Payments?

Yes, you can sell your house even if you’re behind on payments. It’s important to act quickly to avoid foreclosure. Selling your house can help settle outstanding debts and prevent further financial issues. Consider consulting with a real estate agent for guidance on the best approach.

What Are My Options If I’m Behind On Payments?

If you’re behind on payments, you can consider selling your house, refinancing, or negotiating with lenders. Selling can prevent foreclosure and help resolve debts. Refinancing might lower monthly payments. Negotiations with lenders can sometimes lead to adjusted payment plans or temporary relief.

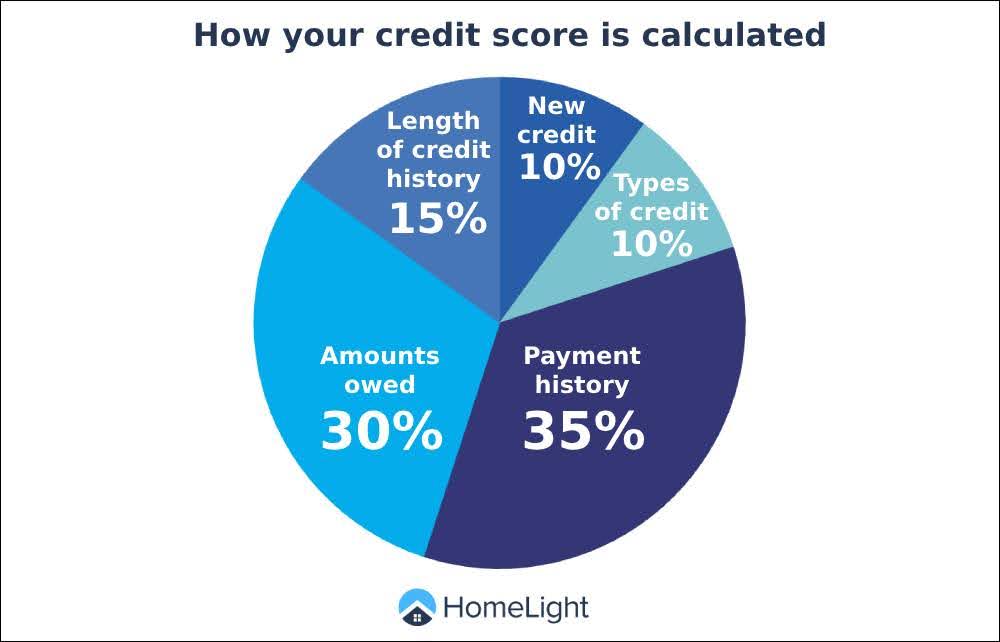

How Does Selling Affect My Credit Score?

Selling your house can positively impact your credit score if it prevents foreclosure. Foreclosure significantly damages credit scores. By selling before reaching that point, you protect your credit standing. Timely communication with lenders and seeking professional advice can also help safeguard your credit.

Can A Real Estate Agent Help In This Situation?

Yes, a real estate agent can provide valuable assistance when selling your house behind on payments. They offer market insights, pricing strategies, and negotiate with buyers. Their expertise can expedite the selling process and help you achieve the best possible outcome for your financial situation.

Conclusion

Selling your house while behind on payments is possible. Understanding your options helps. Communicate with your lender first. Explore alternatives like short sales or loan modifications. Consult a real estate expert for guidance. Each situation is unique, so tailor your approach.

Act quickly to prevent foreclosure. Stay informed about the housing market trends. Keep all paperwork organized and accessible. You can find a solution that works for you. Selling your house doesn’t have to be overwhelming. With the right strategy, you can move forward confidently.