Have you ever wondered how to transfer your PayPal money to your bank account? It’s a question many of us have, especially when we’re eager to access our funds quickly and easily.

Whether you’re selling items online, receiving payments, or simply storing money in your PayPal account, knowing how to move it to your bank can make your financial life a lot smoother. Imagine the convenience of having your PayPal balance available for everyday spending, bills, or savings.

This guide will walk you through the process step-by-step, ensuring you can transfer your funds with confidence and ease. Stick around to discover how you can make your money work for you!

Setting Up Your Paypal Account

Setting up your PayPal account is the first step to transferring your money seamlessly to your bank account. A well-configured account ensures smooth transactions and reduces the chance of errors. Whether you’re new to PayPal or looking to refine your setup, understanding the basics can make all the difference.

Linking A Bank Account

Adding your bank account to PayPal is a straightforward process. You’ll need your bank’s routing number and your account number. It’s similar to setting up direct deposit, and you probably have these details handy.

Navigate to the PayPal wallet section, where you’ll find the option to link a new bank account. Follow the prompts to input your details. Double-check your entries—accuracy is key here.

What was your experience when you first linked your bank account? It’s often smoother than expected, but any hiccups can be resolved by revisiting your entries. This step is crucial to ensure you don’t face delays when transferring money.

Verifying Your Bank Details

Verification is the next crucial step after linking your bank account. PayPal will send small deposits to your bank account, usually two tiny amounts. This is a security measure to confirm the account truly belongs to you.

Once you see these deposits in your bank account, log back into PayPal. Enter the amounts when prompted; this confirms your account details are correct and that you have access to the account.

Have you ever wondered why this verification step is necessary? It protects you from unauthorized access and ensures your funds are secure. Taking the time to verify your bank details guarantees peace of mind and smoother transactions.

Transferring Money From Paypal

Moving PayPal funds to a bank account is simple. Users can link their bank accounts to transfer money seamlessly. With just a few clicks, money can be sent directly from PayPal to the bank account, making access to funds convenient and fast.

Transferring money from your PayPal account to your bank account is a convenient way to access your funds for everyday use. Whether you’re looking to cover bills, save for a rainy day, or simply enjoy your hard-earned money, PayPal makes it straightforward. The process is simple, but understanding each step can ensure a smooth transaction every time.

###

Initiating A Transfer

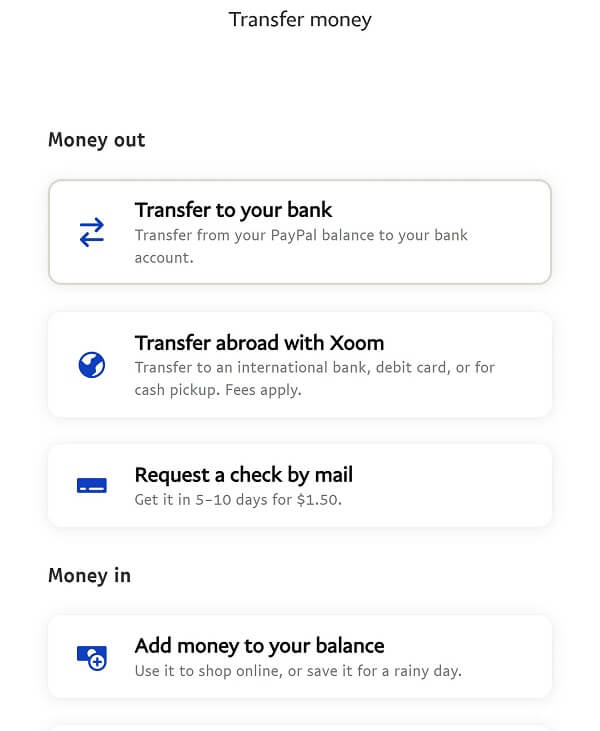

To start transferring money from PayPal to your bank account, first, log in to your PayPal account. Once inside, head to your “Wallet” section. Here, you will see your available balance and linked bank accounts.

Click on “Transfer Money.” You will then be guided through a few steps to complete the transfer. It’s important to double-check your bank details to avoid any hiccups.

A friend of mine once mistyped a bank account number and had to wait several days for the issue to be resolved. Learn from this and ensure your details are correct.

###

Choosing Transfer Speed

After initiating a transfer, you’ll need to decide how quickly you’d like your money to arrive. PayPal offers two main options: standard transfer and instant transfer.

Standard transfer is free but may take 1-3 business days to complete. It’s a great option if you’re not in a rush.

Instant transfer can have your money in your account within minutes. However, it comes with a small fee. This choice is perfect for those times when an unexpected expense arises, and you need funds quickly.

Have you ever been caught in a situation where you needed cash instantly? Knowing you have the option for an instant transfer can provide peace of mind.

In navigating these choices, always consider your current needs and plan accordingly. Each option serves its own purpose based on how promptly you need the funds.

What works best for you may depend on your lifestyle and financial priorities. Taking a moment to reflect on these can help you make the best decision for your situation.

Potential Fees And Charges

Transferring money from PayPal to your bank is usually simple. But, understanding potential fees and charges is crucial. Knowing the costs helps you avoid surprises. Fees can vary based on transfer types. Below, we explain the possible costs involved.

Standard Transfer Costs

Standard transfers from PayPal to a bank account are often free. This makes it an appealing option for many. But, your bank might charge a fee for receiving funds. Always check with your bank to confirm any charges. Generally, standard transfers take 1-3 business days. This delay is something to consider if you need funds quickly.

Instant Transfer Fees

For faster access, PayPal offers instant transfers. This service moves funds to your bank within minutes. But, there’s a cost. Instant transfer fees are usually a percentage of the amount. Typically, around 1% of the total, with a set minimum fee. It’s essential to weigh speed against cost. Choose instant transfer only if the fee is justified by urgency.

Troubleshooting Common Issues

Transferring PayPal money to your bank account is simple. Ensure your bank is linked to your PayPal. If issues arise, check for any account limitations or errors in bank details.

Transferring money from your PayPal account to your bank can be a straightforward process, but sometimes issues can arise. Whether it’s a delay in the transfer or problems with account verification, these hurdles can be frustrating. Let’s dive into some common problems and explore practical solutions.

Transfer Delays

Have you ever tried to transfer money and noticed it’s taking longer than expected? Transfer delays can happen for several reasons. One common issue is a higher-than-usual transaction volume. If you’re transferring money during peak times, it might take longer to process.

Another reason could be technical glitches. Sometimes, the system needs a little patience and a couple of refreshes. Make sure your internet connection is stable, and try again later. If delays persist, check for any updates from PayPal about system maintenance or disruptions.

Account Verification Problems

Verification issues can stop you in your tracks when you’re trying to transfer funds. If PayPal is unable to verify your bank account, it could be due to incorrect information. Double-check your bank details to ensure everything matches perfectly.

Sometimes, it’s not about what you do wrong but rather what you don’t do. Make sure you’ve completed all verification steps that PayPal requires. If you’ve recently changed your bank account, verify it again. If PayPal can’t verify your account, it might be worth contacting their customer support for help.

Have you ever wondered how often people face these issues? You are not alone. Many users encounter similar problems, and PayPal usually resolves them quickly. What steps have you taken to troubleshoot your issues? Sharing your experiences might help others too.

Tips For Smooth Transactions

Transferring PayPal money to your bank account can be simple. Just link your bank account to PayPal. Follow on-screen instructions to complete the transfer securely.

Transferring your PayPal money to your bank account can be a straightforward process, but to ensure smooth transactions, a few thoughtful strategies can make all the difference. Understanding the nuances of this process can save you time and prevent potential hiccups. Here are some crucial tips to help you navigate this financial task with ease.

###

Regular Account Updates

Keeping your PayPal and bank account information up-to-date is crucial for smooth transactions. Double-check your bank account number and routing details for any changes or inaccuracies. If you’ve recently moved or changed banks, ensure that these updates are reflected in your PayPal account.

Staying on top of any updates or changes in your account can prevent transaction errors. Have you ever faced the frustration of a delayed transfer due to outdated information? Regular checks can help avoid such situations.

###

Security Best Practices

Security should always be a priority when transferring money. Use strong, unique passwords for both your PayPal and bank accounts and update them regularly. Enable two-factor authentication to add an extra layer of protection.

Be vigilant against phishing attempts. If you receive an email or message that seems suspicious, avoid clicking on any links and verify the source directly through your PayPal account. This simple step could save you from potential fraud.

Consider setting up alerts for transactions. These notifications can help you quickly spot any unauthorized activity. What could be more reassuring than knowing your transactions are secure and under your control?

By implementing these strategies, you can ensure that transferring your PayPal money to your bank account becomes a seamless and secure experience.

Frequently Asked Questions

How Do I Transfer Money From Paypal To My Bank?

To transfer money from PayPal to your bank account, log into your PayPal account. Click on “Transfer Money” under your PayPal balance. Follow the prompts to select your bank account and complete the transfer. The process is straightforward and usually takes 1-3 business days.

Is There A Fee For Transferring Paypal Money?

Transferring money from PayPal to your bank account is typically free. However, if you opt for an instant transfer, PayPal charges a small fee. The fee is usually a percentage of the transferred amount, so it’s important to check PayPal’s latest fee structure before initiating the transfer.

How Long Does Paypal Transfer To Bank Take?

A standard PayPal transfer to your bank account usually takes 1-3 business days. The timing can vary based on your bank’s processing times. If you choose an instant transfer, the funds should appear in your bank account within minutes, though this service incurs a fee.

Can I Transfer Paypal Money Instantly?

Yes, you can transfer money instantly from PayPal to your bank. For an instant transfer, PayPal charges a small fee. This service allows you to access your funds within minutes. Ensure your bank is eligible for instant transfers to avoid delays.

Conclusion

Transferring PayPal money to your bank is simple. Follow the steps provided. Ensure your bank account is linked correctly. Check for any fees. This process is quick and secure. Many people do it daily. You can track your funds easily.

PayPal makes it straightforward. Remember to verify your bank details. This avoids errors. Your money moves safely. It’s a convenient option for many. Enjoy the ease of managing funds online. With a few clicks, your money transfers efficiently. Keep your finances organized with PayPal.

Happy banking!