Wondering if you can transfer money from your Non-Resident Ordinary (NRO) account to your Non-Resident External (NRE) account? You’re not alone.

Many non-resident Indians (NRIs) like you have questions about managing their finances efficiently across these two types of accounts. The good news is that understanding the ins and outs of this process can save you both time and money. This guide will walk you through everything you need to know about transferring funds from an NRO to an NRE account.

By the end of this article, you’ll feel confident about making the right moves with your money. Ready to simplify your financial journey? Let’s dive in!

Understanding Nro And Nre Accounts

Transferring money from an NRO to an NRE account is possible under certain conditions. Both accounts serve different purposes for Non-Resident Indians. Ensure compliance with the Reserve Bank of India’s regulations for smooth transfers.

Understanding NRO and NRE Accounts

Navigating the world of finance can be a bit overwhelming, especially when dealing with terms like NRO and NRE accounts. These accounts play a crucial role for Indians living abroad. They help manage finances back home while keeping the taxman happy. But what do these terms really mean? And how can they make your life easier?

What Is An Nro Account?

An NRO (Non-Resident Ordinary) account is designed for Indians living outside India. It allows you to manage income that originates in India. This includes rent, dividends, and pension. The beauty of an NRO account is its flexibility. You can deposit earnings from India and abroad, but remember, the funds in this account are repatriable only up to certain limits.

Imagine you’re living in London, earning a salary there, but also renting out your apartment in Mumbai. Your rental income goes into your NRO account. It’s straightforward and ensures your Indian earnings stay organized. However, taxes are deducted at source on the income deposited in this account.

What Is An Nre Account?

An NRE (Non-Resident External) account, on the other hand, is perfect for overseas earnings. It’s designed for foreign income converted into Indian rupees. If you want to bring your salary from New York into India, an NRE account is your best friend. It’s completely repatriable, meaning you can move your money freely without any hassle.

Picture this: You send money from your US salary to your family in India through your NRE account. It’s tax-free and easy to manage, providing peace of mind. Plus, the funds in an NRE account are protected from currency fluctuations. This gives you a stable financial environment.

Both accounts have their unique perks. It’s about understanding your financial goals and choosing what aligns best with your needs. Have you thought about the benefits of combining both NRO and NRE accounts to optimize your financial strategy?

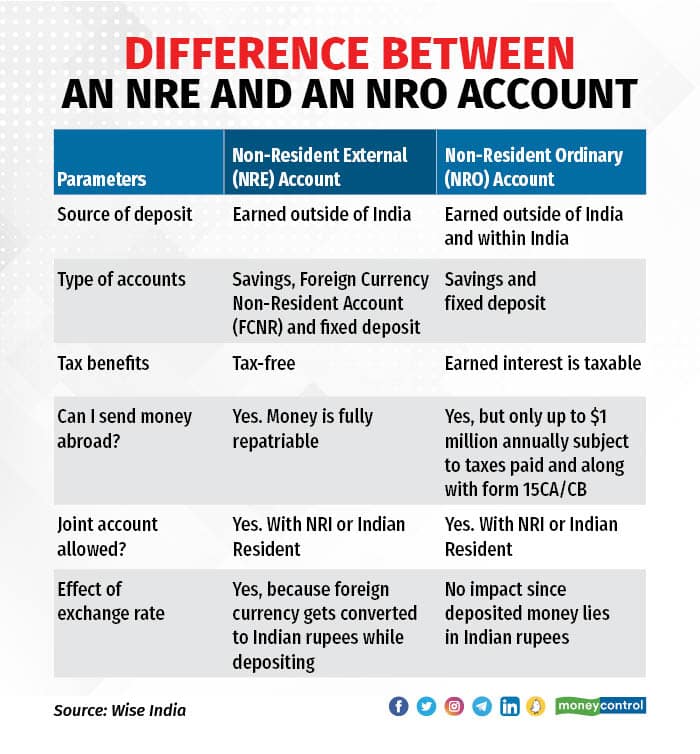

Differences Between Nro And Nre Accounts

Understanding the differences between NRO and NRE accounts is crucial for NRIs. Each account type serves specific financial needs. Knowing these differences helps in making informed decisions. Let’s delve into the key distinctions.

Tax Implications

NRO accounts are subject to Indian taxes. Interest earned is taxable in India. Tax rates can be high. NRE accounts offer tax-free interest. They are exempt from Indian taxes. This makes them attractive for NRIs.

Repatriation Rules

NRO accounts have repatriation limits. Funds can be repatriated up to $1 million per year. Approval from the bank is needed. NRE accounts allow free repatriation. Money can be transferred abroad without restrictions. This is ideal for NRIs who need flexibility.

Currency Type

NRO accounts deal in Indian Rupees. They are suitable for managing income in India. NRE accounts operate in foreign currency. They are great for international transactions. Choosing the right account depends on your currency needs.

Eligibility For Transferring Funds

Transferring money from an NRO to an NRE account is possible under specific conditions. Both accounts must belong to the same account holder. Ensure compliance with tax regulations and bank policies for a smooth transfer process.

Transferring money between an NRO (Non-Resident Ordinary) and an NRE (Non-Resident External) account can be a straightforward process if you meet the eligibility criteria. It’s crucial to understand who qualifies to make such transfers and what approvals are necessary. Let’s dive into the specifics of eligibility for transferring funds.

Who Can Transfer?

As a Non-Resident Indian (NRI), you can transfer funds from your NRO to your NRE account. This is particularly useful if you wish to consolidate your earnings in India into an account that allows full repatriation.

Consider this: if you recently moved abroad and have earnings in India, transferring funds to an NRE account can simplify your financial management. Are you leveraging this opportunity to streamline your finances?

Necessary Approvals

Before you start the transfer, ensure you have the necessary approvals. The Reserve Bank of India allows NRIs to transfer up to USD 1 million per financial year from NRO to NRE accounts, subject to certain conditions.

You will need to provide a certificate from a Chartered Accountant in India. This certificate ensures that the funds being transferred are compliant with tax regulations. Have you checked with your accountant about this requirement?

While this might seem like a hurdle, it’s a small step towards maintaining transparent and compliant financial transactions. Understanding these approvals can save you from future headaches and align your financial activities with regulatory standards.

In the realm of international finance, every detail counts. Are you prepared to navigate these steps to ensure a seamless transfer?

Process Of Transferring Money

Transferring money from an NRO (Non-Resident Ordinary) account to an NRE (Non-Resident External) account is a common need for many NRIs. This process allows you to manage funds efficiently while benefiting from the advantages of each account type. Understanding the process is essential for smooth transactions. Here’s a detailed guide to help you navigate the process.

Step-by-step Guide

First, ensure you have both NRO and NRE accounts. Check that your NRO account has funds available for transfer. Contact your bank to initiate the transfer. Some banks offer online transfer options. Log into your banking portal and select the transfer option. Choose the source as NRO and destination as NRE. Enter the amount you wish to transfer. Confirm the details and authorize the transfer.

Documentation Required

Certain documents are necessary for the transfer. You need a filled form for the transfer request. Submit your PAN card copy for verification. Provide your account details for both NRO and NRE accounts. Banks may ask for additional identification proofs. Ensure all documents are valid and up-to-date.

Timeframe For Transfer

The transfer time can vary. Some banks process the transfer in a few days. Others might take up to a week. Check with your bank for exact timelines. Keep track of your transfer status online. Contact your bank if there are delays or issues.

Regulatory Guidelines And Compliance

Transferring money between NRO and NRE accounts involves understanding regulatory guidelines. These guidelines ensure compliance with Indian financial laws. Navigating these rules can seem daunting. But, understanding them is key to a smooth transfer.

Rbi Rules

The Reserve Bank of India (RBI) sets the rules for money transfers. It’s crucial to adhere to these rules. RBI allows transfers from NRO to NRE accounts under specific conditions. This includes proof of tax payments in India. Transfer limits may apply, ensuring funds are legally moved.

Tax Regulations

Tax implications are important in transferring money. NRO account funds are subject to tax in India. You need to clear any tax dues before transferring. This ensures compliance with Indian tax laws. Obtain a certificate from a chartered accountant. This certifies that taxes have been paid. It’s a mandatory requirement.

Benefits Of Transferring To Nre Account

Transferring money from an NRO to an NRE account offers tax benefits and simplified repatriation. It allows easy management of foreign earnings in India. This transfer process provides more flexibility and convenience for non-resident Indians handling their finances.

Transferring money from your Non-Resident Ordinary (NRO) account to your Non-Resident External (NRE) account is a move that comes with several advantages. Whether you’re an expatriate managing finances across borders or simply someone looking for more efficient banking solutions, understanding these benefits can be a game-changer. What makes the NRE account so appealing? Let’s dive into the key benefits that could make transferring a smart choice for you.

###

Tax-free Interest

One of the most attractive benefits of transferring funds to an NRE account is the tax-free interest. Unlike the interest accrued in an NRO account, which is subject to income tax in India, the interest earned on an NRE account is completely tax-free.

Imagine the peace of mind knowing your hard-earned money is growing without the burden of taxes. This becomes particularly beneficial if you aim to accumulate savings without frequent deductions. Have you considered how much tax you could save annually?

###

Full Repatriation

Another significant advantage is the ability for full repatriation. Funds in your NRE account, including the principal and interest, can be transferred back to your foreign bank account without restrictions. This means you can move your money across borders seamlessly, offering you financial flexibility that NRO accounts do not.

Think about the freedom of moving your funds globally without complex procedures. Whether you’re planning to invest in your home country or need money for emergencies abroad, full repatriation ensures you are not tied down. Isn’t it comforting to know your finances are as mobile as you are?

These benefits make transferring to an NRE account not just a financial decision, but a strategic one. How do these advantages align with your financial goals?

Common Challenges And Solutions

Transferring money from an NRO account to an NRE account can be tricky. Many face challenges during the process. Understanding these challenges is essential. Knowing the solutions makes the transfer easier. Let’s dive into the common issues and how to tackle them.

Technical Issues

Technical problems are often encountered. Slow or unstable internet can disrupt online transactions. Ensure a stable connection before starting. Banking apps can freeze or crash unexpectedly. Regularly update apps to avoid such issues. Some banks have complex online interfaces. Simplify the process by using clear instructions. Contact bank support for help if needed.

Regulatory Hurdles

Regulations can pose challenges when transferring funds. Each bank has specific rules for NRO to NRE transfers. Understanding these rules is crucial. Some banks require detailed documentation. Gather all necessary documents beforehand. Exchange rates can affect transferred amounts. Check rates before proceeding. Monitor any changes in transfer policies. Staying informed helps in smooth transfers.

Expert Tips For A Smooth Transfer

Transferring money from an NRO to an NRE account can seem complex. But with the right guidance, it becomes smooth. Here are some expert tips to help you. These tips ensure your transfer process is hassle-free.

Consultation With Financial Advisors

Seek advice from financial advisors. They have expertise in account transfers. They can guide you through the process. Ensure you understand all the steps involved. This will help you avoid any mistakes. Advisors can also inform you about any hidden fees. This keeps your costs transparent and predictable.

Staying Updated With Rules

Keep yourself updated with the latest rules. Regulations can change frequently. Ensure you are aware of the current policies. This helps in avoiding any legal issues. Regular updates also ensure compliance with banking norms. Check bank websites or trusted financial news sources. This will keep you informed about any changes.

Frequently Asked Questions

How To Transfer Money From Nro To Nre Account?

Transferring money from NRO to NRE is possible under RBI guidelines. You need to submit Form 15CA and 15CB. It’s important to check your bank’s specific process and documentation requirements. Once approved, funds can be transferred seamlessly between accounts.

Is There A Limit On Nro To Nre Transfers?

Yes, there is a limit on transferring money from NRO to NRE. The limit is USD 1 million per financial year. This is subject to tax compliance and documentation. Always consult with your bank or financial advisor for specific regulations and procedures.

What Documents Are Needed For Nro To Nre Transfer?

For transferring funds, you need Form 15CA and Form 15CB. Form 15CA is a declaration of remittance. Form 15CB is certified by a Chartered Accountant. Banks may require additional documents depending on their policies. Verify requirements with your bank for a smooth transfer process.

Are Taxes Applicable On Nro To Nre Transfers?

Yes, taxes can apply on NRO to NRE transfers. Interest earned in NRO accounts is taxable. Ensure all tax obligations are met before transferring. Proper documentation like Form 15CA and 15CB is necessary. Consult a tax advisor for detailed information.

Conclusion

Transferring money from an NRO to an NRE account is possible. Understanding the rules helps you make informed decisions. Always check exchange rates and fees before transferring. This ensures you get the best value. Consult your bank for specific requirements.

They can guide you through the process. Keep your documents ready for a smooth transfer. Stay updated on any changes in banking regulations. This knowledge can save you time and effort. Managing your funds wisely is crucial. With the right information, you can handle your finances better.