Are unapplied cash payment incomes causing chaos in your financial records? You’re not alone.

Many individuals and businesses find themselves puzzled by this common accounting hiccup. But don’t worry, there’s a solution within your reach. Imagine the relief of untangling these confusing financial knots, ensuring your books are not only accurate but also stress-free.

In this guide, we’ll walk you through simple, effective steps to fix unapplied cash payment income. You’ll gain clarity and control over your finances, transforming potential headaches into opportunities for seamless accounting. By addressing these issues head-on, you can prevent future mishaps and maintain a smooth financial flow. Ready to dive in and take charge of your financial health? Let’s get started and turn what seems complex into something incredibly manageable. With clear guidance and practical tips, you’ll soon be on your way to impeccable financial records. Stay with us and discover how straightforward resolving unapplied cash payment income can be.

Unapplied Cash Payment Income Explained

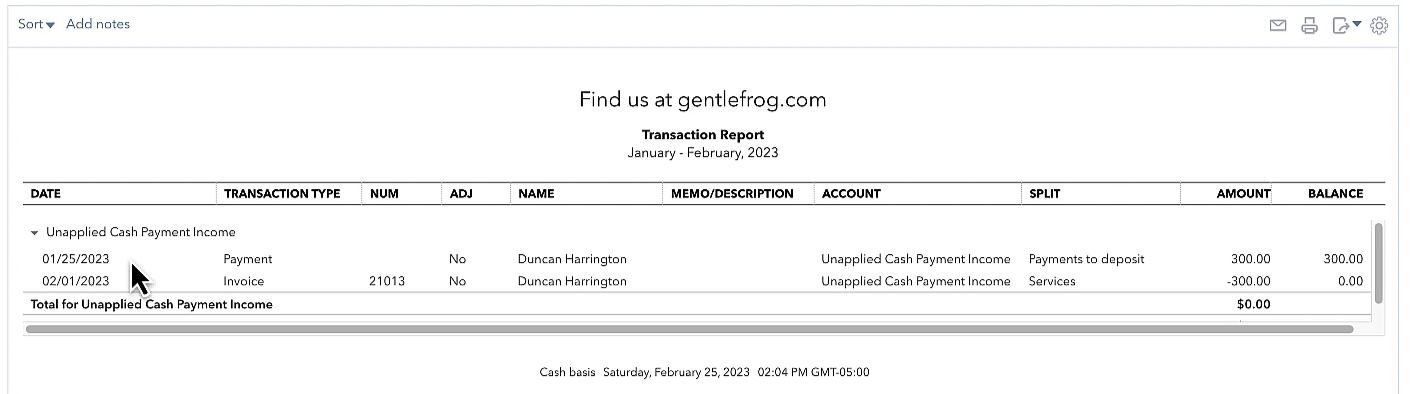

Unapplied cash payment income occurs when money is received but not matched to invoices. This can happen due to errors or timing issues. Businesses often struggle with this problem. It can affect financial records and reports. Understanding the cause is crucial.

One common cause is invoice entry mistakes. Payments might be received for invoices not yet entered. Another cause is incorrect payment allocation. Money might be assigned to the wrong account. Ensuring accurate bookkeeping can prevent these issues.

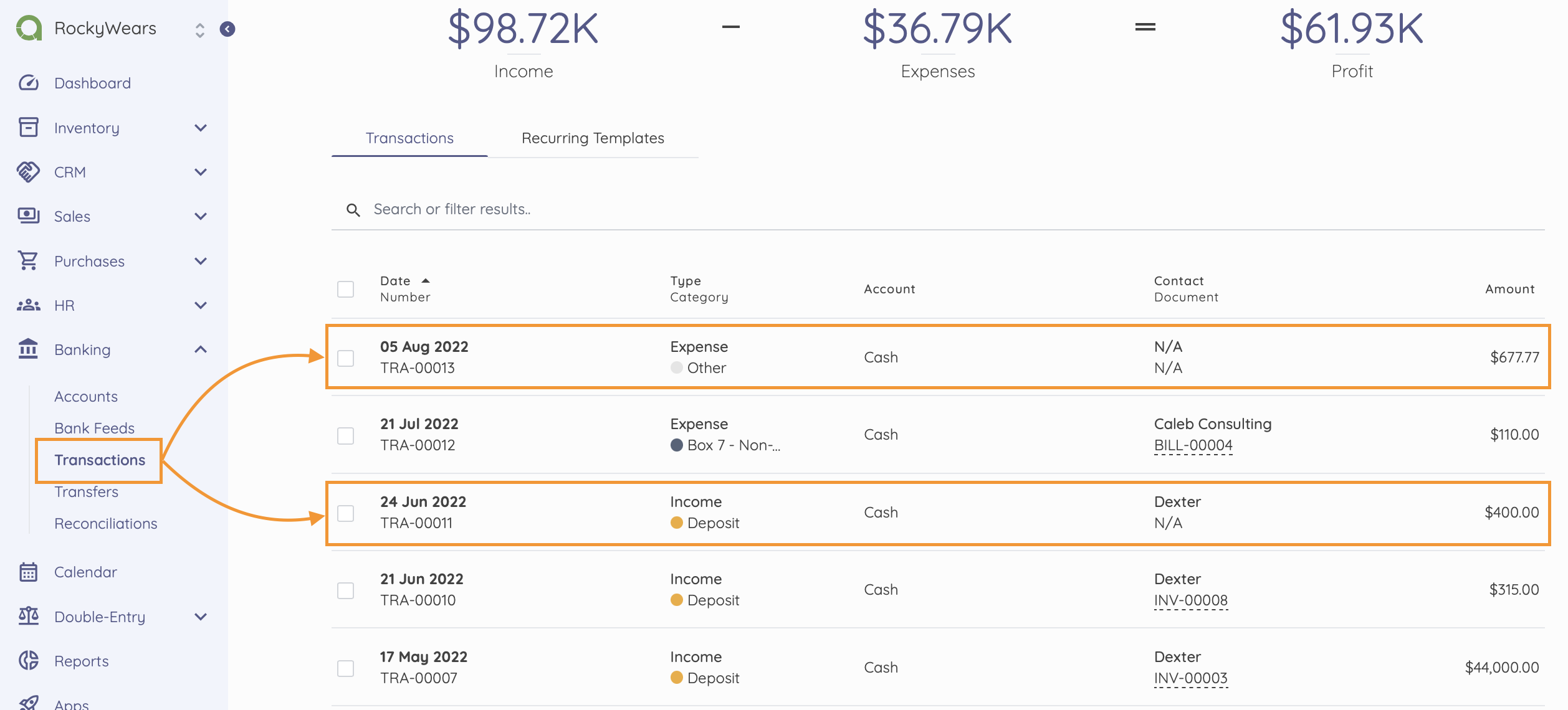

Resolving unapplied cash involves reviewing transactions. Matching payments to correct invoices is essential. Regular account audits help find and fix discrepancies. Training staff can reduce errors. Proper software tools also aid in managing payments efficiently.

Common Causes Of Unapplied Cash Payments

Unapplied cash payments happen for many reasons. One cause is incorrect billing information. If details do not match, payment stays unapplied. Another reason is missing invoice numbers. Without these, it is hard to link payments. System errors can also lead to this issue. Sometimes, systems do not update properly. This creates confusion. Miscommunication with clients might cause unapplied payments too. Clients may pay for wrong items or amounts. Manual data entry mistakes can also lead to problems. Humans make errors when entering data.

Each of these causes leads to unapplied payments. Fixing them requires careful checks. Ensure all information is accurate. Use automation where possible. This reduces manual mistakes. Clear communication with clients helps. Make sure they know correct details. Regular system updates are important. They keep errors at bay. Addressing these causes can solve many issues.

Identifying Unapplied Cash Payments

Unapplied cash payments can disrupt income tracking in financial systems. Correct this by matching payments with invoices accurately. Regular audits and clear communication with clients help prevent future discrepancies.

Reviewing Financial Statements

Start by checking your financial statements. Look for cash payments that are not applied.

These payments might sit in the wrong account. They can cause confusion later. Each payment should match an account.

This keeps everything clear.

Spotting Discrepancies In Accounts

Discrepancies can be tricky. Look for mismatches between payments and accounts. A payment might not show in the right place.

This happens often. It can mess up the records. Fixing it early helps a lot. Check each account carefully.

Match every cash payment. This ensures accuracy.

Steps To Correct Unapplied Cash Payments

First, gather all payment records. These include bank statements and receipts. Compare each payment with invoices. Ensure amounts match exactly. Check dates and descriptions carefully. Mistakes happen here often. Spot any discrepancies quickly.

Next, adjust your records. Correct any wrong entries. Use accounting software if possible. Update each invoice status. Mark them as paid correctly. This prevents future errors. It is important to keep records tidy.

Identify each payment source. Know who paid and why. Match payments to invoices precisely. Apply payments to correct accounts. This keeps your books accurate. Double-check allocation details. Mistakes can lead to confusion.

Communicate with your team. Share updates on payments often. Ensure everyone knows the process. This helps prevent errors. Proper allocation is crucial for business health.

Tools And Software For Managing Cash Payments

Choosing the right accounting software can be tricky. Many options exist. Look for software that is easy to use. It should handle cash payments well. Some software gives reminders. This helps track overdue payments.

The software should provide clear reports. These reports help you understand your money flow. Also, check if the software has a mobile app. A mobile app lets you manage cash on the go. It is good if the software works with your bank. This makes cash management easier.

Some popular choices are QuickBooks and FreshBooks. They offer many features. Both are user-friendly. But, always try a demo first. This helps you know if it fits your needs.

Best Practices For Avoiding Future Issues

Fixing unapplied cash payment income involves regular checks and updates in accounting records. Ensure accurate data entry and timely reconciliation to prevent errors. Proper training for staff on financial procedures can help maintain records effectively and avoid future issues.

Regular Audits

Regular audits keep track of cash payments. They help find mistakes early. Audits make sure records match. Double-checking is important. Check often to catch errors. Monthly audits are a good idea. They keep things in order. Use checklists for audits. A checklist helps not miss anything. Keep audit results safe. Review them before making changes.

Effective Communication With Clients

Good communication builds trust. Listen to clients carefully. Ask questions if unsure. Share updates with clients. Clear updates keep everyone informed. Use simple words when talking. Avoid confusion and misunderstandings. Respond quickly to queries. Quick replies show care. Use emails for clear communication. Emails are easy to refer back to. Keep records of chats with clients. Records help resolve issues later.

Expert Tips For Cash Management

Training your staff is very important. Well-trained employees handle cash better. They know the right steps. They make fewer mistakes. Clear instructions help a lot. Regular training keeps skills sharp. Practice sessions are useful. Staff should know how to track payments. They must understand cash flow. They should learn how to report errors quickly. Teamwork is key. Everyone should work together. Communication matters too. Staff should ask questions. They should feel comfortable. Encourage them to learn and improve.

Internal controls are like safety rules. They protect your money. Strong controls prevent errors. They stop fraud. Check payments regularly. Use double-check systems. Record all transactions. Audit cash often. Keep records safe. Make sure they are accurate. Separate duties among staff. No one person should handle everything. Review processes often. Update them as needed. Good controls build trust. They keep your business healthy. Everyone should follow them. Be strict with rules. It helps a lot.

Case Studies: Real-world Solutions

A small business had issues with unapplied cash. They noticed wrong entries in their system. The team worked to identify incorrect transactions. They corrected these errors by matching payments to invoices. This action reduced their financial confusion.

Another company experienced similar problems. They used accounting software to track payments. This software helped them find unapplied cash easily. They trained their staff to avoid future mistakes.

Regular checks are vital. Businesses must ensure all payments match invoices. Training staff can help prevent errors. Using software can simplify this process. Always update your payment records.

These steps save time and reduce stress. They improve cash flow and accuracy. Businesses feel more confident with their finances. Proper management makes a big difference.

Frequently Asked Questions

What Is Unapplied Cash Payment Income?

Unapplied cash payment income occurs when a payment is received but not matched to an invoice. This can lead to discrepancies in financial records. It’s crucial to address these promptly to ensure accurate accounting and reporting.

How Can I Identify Unapplied Cash Payments?

To identify unapplied cash payments, review your financial statements regularly. Look for any payments that aren’t linked to invoices. Using accounting software can help automate this process, providing alerts for unmatched transactions.

Why Is Fixing Unapplied Cash Important?

Fixing unapplied cash payments is vital to maintain accurate financial records. It prevents revenue misstatements and ensures compliance with financial reporting standards. Correcting these errors helps in making informed business decisions.

What Tools Can Help In Fixing Unapplied Payments?

Accounting software like QuickBooks or Xero can assist in fixing unapplied payments. These tools automatically track and match payments with invoices. They provide real-time insights and help maintain financial accuracy.

Conclusion

Fixing unapplied cash payment issues can boost your business efficiency. By following the steps discussed, you can streamline your accounting process. Remember to regularly review your transactions. This helps in identifying and correcting errors quickly. Stay organized to prevent future issues.

Simple accounting practices make a big difference. Use the right tools to track payments accurately. Regular training for your team can be beneficial. It ensures everyone is on the same page. With these tips, managing unapplied cash becomes straightforward. Keep your financial records clean and transparent.

A little effort now saves time later.