Are you wondering if you’ll need to pay extra when using your credit card to settle your ComEd bills? You’re not alone.

Many customers have this question on their minds, and understanding the costs associated with your utility payments is crucial for managing your household budget effectively. We’ll uncover whether ComEd charges for credit card payments and what this means for you.

By the end, you’ll know exactly how to navigate your payment options without facing unexpected fees. Keep reading to make sure you’re making the most informed financial decisions when it comes to your energy bills.

Comed Payment Options

ComEd offers different ways to pay bills. Paying by credit card is one option. It’s convenient for many users. But, there might be extra fees for using credit cards. Always check the payment terms. Understanding these terms can avoid surprises. ComEd also accepts payments by debit cards. Debit card payments are often free. This might be a better choice for some. Electronic checks are another option. They also come without extra costs. Users can set up automatic payments. This ensures bills are paid on time. Cash payments are accepted at certain locations. Always choose the best option for you.

Credit Card Payment Process

ComEd accepts credit card payments for bills. It’s a simple process. Customers can pay online or by phone. Online payments are made through ComEd’s website. They need to log in to their account. Then choose the payment method. Payment by phone needs a call to ComEd’s service number. A service representative will help. Paying with a credit card is quick and easy.

ComEd may charge a small fee for credit card payments. This fee covers processing costs. It’s important to check the fee amount. Some customers prefer other payment methods. These might include bank transfers or checks. Each method has pros and cons. Choose what’s best for you.

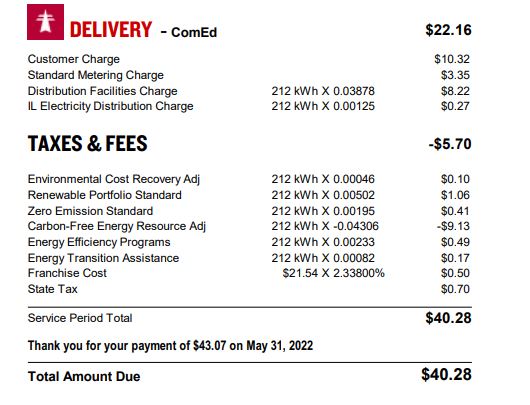

Fees Associated With Credit Card Payments

Comed may charge a fee for using a credit card. This fee is often a small percentage of your bill. Credit card companies charge Comed for processing payments. To cover this, Comed adds a fee. Paying with a bank account may avoid this fee. Always check your bill for any extra costs. Knowing these charges helps you manage your money. Budgeting becomes easier when you know the full cost. If unsure, contact Comed for details. They can explain any fees or charges. Understanding these fees can save you money. Make informed choices when paying bills.

Alternatives To Credit Card Payments

Many people use credit cards for paying bills. But there are other ways to pay. Some prefer to use bank transfers. It’s safe and fast. Direct debit is another option. It’s automatic and easy. No need to remember due dates. Online payment platforms are popular too. They offer various choices. Some might charge a fee. It’s best to check first. Using mobile payment apps is convenient. It’s quick and simple. Many find it handy for small payments. Cash payments are also an option. But it’s less common now. Many places accept cash for bills. Prepaid cards can be used too. They work like credit cards. But you load money beforehand. Choosing the right method saves time.

Benefits Of Using Credit Cards

Credit cards are easy to use. They fit in your pocket. No need to carry cash. You can buy things online. Some cards give you points. You can use points to get rewards. Like gift cards or discounts.

Paying on time builds a good credit score. A good score helps you in the future. You might get a loan easier. Or pay less interest. Remember, always pay your bill. This way, you avoid extra charges.

Potential Drawbacks

Credit card payments might have extra fees. These fees make bills higher. Some people find it hard to pay more. Monthly bills can get confusing. It is hard to track extra charges. Not everyone likes paying this way. Some prefer checks or cash. Credit cards can be risky. They might have interest rates. Interest rates make payments bigger. Saving money becomes tough.

Some people worry about security. They fear losing card information. Others think about card limits. Limits stop people from paying big bills. Choosing how to pay is important. Everyone wants to make smart choices.

How To Reduce Payment Fees

Paying bills can be costly. Credit card payments sometimes have extra charges. It’s important to know how to reduce these fees. Always check if there are hidden charges. Using direct debit can be cheaper. Plan payments in advance. Avoid paying late. Late payments can cost more. Some companies offer discounts for early payment. Look out for these deals. Check if your bank offers cashback on utility payments. A small saving can add up over time. Sometimes, changing payment methods helps. Use a bank transfer instead of a card. This can reduce fees. Ask for advice from customer service. They might have tips to lower costs. Keep an eye on your bill. Make sure there are no surprise charges. Follow these steps to keep payment fees low.

Customer Feedback And Experiences

Many people share their experiences about Comed’s payment options. Some say they were surprised by the extra fees. Others felt it was not clear at first. Most agree that using a credit card is simple. But they wish for more transparency on charges. They like the ease but not the costs. Many customers prefer direct bank payments. It helps them avoid extra fees. They find it more cost-effective. Some customers are happy with Comed’s customer service. They feel their questions get answered quickly. They appreciate the support provided. Overall, customers have mixed feelings. They enjoy the convenience but dislike the extra costs. This feedback helps Comed improve their services.

Frequently Asked Questions

Does Comed Charge A Fee For Credit Card Payments?

Yes, ComEd charges a convenience fee for credit card payments. The fee is typically a small percentage of the payment amount. This fee is applied to cover processing costs. It’s always good to check ComEd’s website for the most up-to-date fee information.

How Can I Pay Comed Without A Fee?

To avoid fees, consider paying through ComEd’s online portal using a bank account. Alternatively, you can pay by mail, phone, or in person at authorized locations. These methods typically do not incur additional fees, making them cost-effective options for customers.

Are Credit Card Payments To Comed Secure?

Yes, ComEd ensures that credit card payments are secure. They use encryption and other security measures to protect your information. Always ensure you’re using ComEd’s official website or authorized payment methods to guarantee the safety of your transaction.

What Is The Benefit Of Paying Comed By Credit Card?

Paying by credit card can offer convenience and potentially earn rewards. It allows for quick payments and can help manage cash flow. However, consider the convenience fee when opting for this payment method, as it may offset any potential rewards.

Conclusion

Understanding ComEd’s credit card payment policy is crucial. It affects your billing process. Knowing any fees helps plan your budget better. Always check for updates on their website. Policies can change, impacting your monthly expenses. Consider all payment options available.

Some might save you money. Using a credit card can be convenient. But, be mindful of any additional charges. Stay informed to make the best decision for your payments. This ensures a smooth and cost-effective experience. Keep track of your bills and payment methods.

Knowledge empowers you to manage your finances wisely.