Struggling to figure out how to transfer money from your EDD card to your bank account? You’re not alone.

Navigating the maze of financial transactions can often feel overwhelming, but it doesn’t have to be. Imagine the convenience of accessing your funds whenever you need them, without any hassle. This guide is here to make that a reality for you.

With clear, step-by-step instructions, you’ll soon be able to move your money with ease and confidence. Don’t let confusion keep your cash locked away—unlock the secrets to seamless transfers and take control of your finances today. Dive in, and discover how simple managing your money can truly be.

Understanding The Edd Card

Transferring money from an EDD card to a bank account is straightforward. Begin by accessing your EDD online account, then follow prompts to input your bank details. Ensure accuracy to avoid delays in processing the transfer.

Understanding the EDD Card

Navigating the ins and outs of financial tools can sometimes be daunting, especially when you’re dealing with something specific like the EDD card. This card is not just a piece of plastic; it’s a lifeline for many, facilitating seamless transactions and providing financial security during challenging times. As you learn how to transfer money from your EDD card to your bank account, understanding its workings can make the process much smoother. Let’s break it down into manageable bits.

What Is An Edd Card?

An EDD card is essentially a prepaid debit card issued by the Employment Development Department (EDD) of California. It is used to distribute unemployment benefits, disability insurance, and paid family leave payments.

The convenience of this card lies in its ability to be used just like any regular debit card. You can make purchases, withdraw cash, and monitor transactions online. If you’ve ever been in a situation where you needed quick access to funds, the EDD card is your go-to resource.

Moreover, it eliminates the need for paper checks. With funds directly deposited onto the card, you can avoid waiting periods and potential postal delays. This card can simplify your financial management during periods of unemployment or disability.

Benefits Of Using An Edd Card

One major perk of using the EDD card is immediate access to funds. Imagine needing to pay bills or buy groceries and the relief of having money available without the hassle of waiting for a check to clear. This immediacy is invaluable.

Security is another aspect where the EDD card shines. You don’t have to worry about losing a check or dealing with the risks of carrying large sums of cash. The card is protected by a PIN, adding a layer of safety to your transactions.

Additionally, tracking your spending becomes easier. With online account management, you can see exactly where your money goes. This can help you budget better and ensure your benefits are put to good use.

Have you ever wondered if there was a simpler way to manage your unemployment benefits? The EDD card might be your answer. Its ease and security can transform how you handle your finances during uncertain times.

Preparing For The Transfer

Transferring money from an EDD card to a bank account is simple. Start by logging into your EDD account. Then, choose the transfer option and enter your bank details. Confirm the transaction, and your money will soon be in your bank.

Transferring money from your EDD card to your bank account can be a straightforward process if you know the steps and prepare properly. A little preparation goes a long way in ensuring that the transfer is smooth and hassle-free. As you embark on this financial task, think of it as setting the stage for a seamless transaction that supports your financial well-being. Imagine the relief when you see the funds safely nestled in your bank account, ready for use. Here’s how you can make this happen with ease.

Gather Required Information

Start by gathering all the necessary information. You’ll need your EDD card details, such as the card number and security code.

Have your bank account information handy, including the account number and routing number.

Consider jotting these down in a secure place to avoid last-minute scrambling.

Think about it: Wouldn’t it be frustrating to start the process only to realize you’re missing a crucial piece of information?

Check Account Details

Double-check your bank account details to ensure accuracy. A small mistake can lead to delays or errors in the transfer.

Review your account number and routing number carefully; even a single digit error can cause headaches.

Reflect on how much smoother everything will be when you know your details are correct.

Wouldn’t you prefer peace of mind over the hassle of fixing a mistake later?

Make sure to communicate clearly with your bank if you have any doubts about the process.

By preparing thoroughly, you’re setting yourself up for a successful transfer.

Transfer Methods

Transferring money from an EDD card to a bank account is straightforward. Begin by logging into your online EDD account. Then, select the transfer option, enter your bank details, and confirm the transaction.

Transferring money from your EDD card to your bank account can be straightforward if you understand the different methods available. Whether you prefer handling transactions online, over the phone, or through an ATM, there’s a way that suits your comfort level. Discovering the right transfer method for you can save time and reduce stress. Let’s dive into each option to find the most efficient way to move your money.

Online Transfer Process

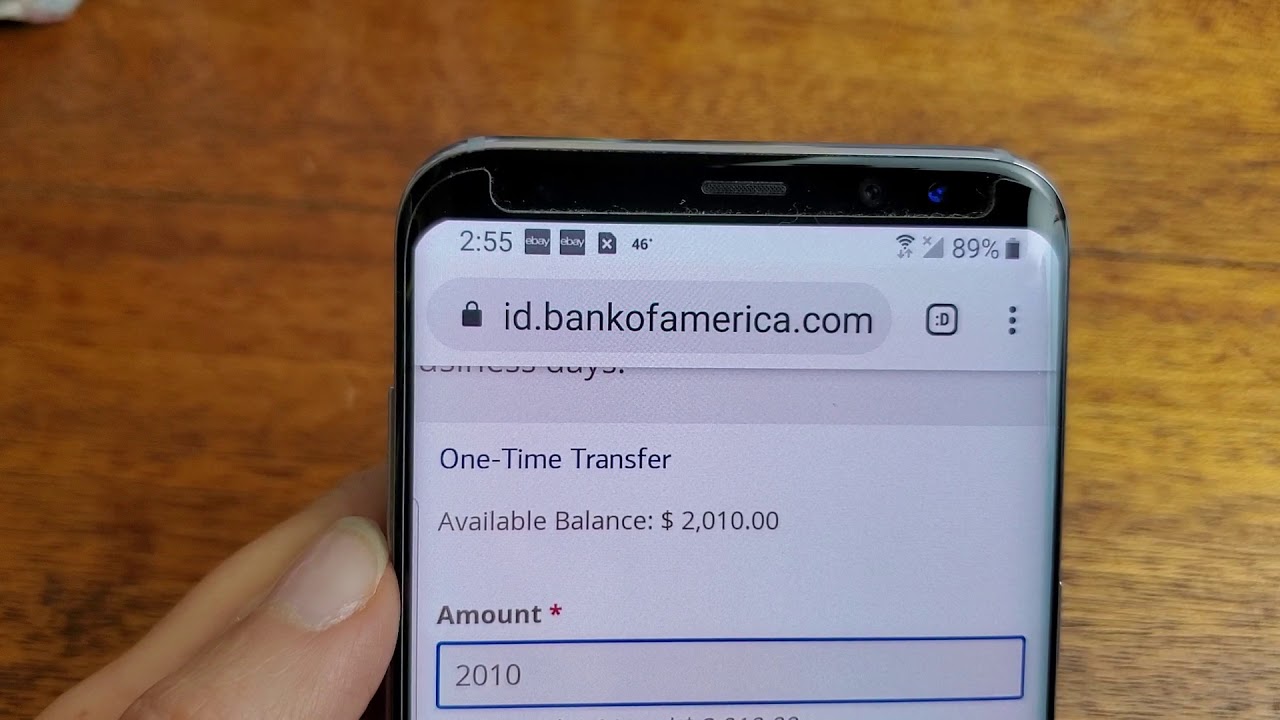

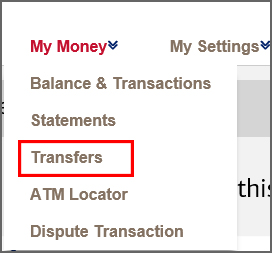

Transferring money online from your EDD card to your bank account is convenient and fast. Start by logging into the website associated with your EDD card. You’ll need your card details and bank account information at hand.

Once logged in, navigate to the transfer section. Here, you’ll add your bank details, including your routing and account numbers. Double-check all the information to avoid errors.

The final step involves confirming the transfer amount and initiating the transaction. Most transfers reflect in your bank account within one to two business days.

Telephone Transfer Steps

If you prefer speaking to someone, a telephone transfer might be your best bet. Start by calling the customer service number on the back of your EDD card. Be prepared to verify your identity with personal information.

The representative will guide you through the process. You’ll need to provide your bank account details, so have your checkbook or bank statement ready.

After confirming the transfer details, the representative will process the transaction. This approach often provides peace of mind, knowing your transfer is handled by a professional.

Atm Transfer Option

For those who prefer a hands-on approach, using an ATM is a viable option. Locate an ATM that supports your EDD card network. Insert your card and enter your PIN.

Select the option to transfer funds and input your bank account details. Make sure to verify the routing and account numbers before proceeding.

ATMs offer immediate processing, which can be beneficial if you need quick access to your funds. However, ensure you’re aware of any potential fees associated with ATM transfers.

Which method resonates with you the most? Each has its unique advantages, so consider what aligns best with your lifestyle and needs. Whether you choose online, phone, or ATM, knowing these methods empowers you to make informed financial decisions.

Ensuring Security

Transferring money from your EDD card to a bank account is a straightforward process, but ensuring the security of your funds during the transfer is crucial. With the rise of online transactions, cyber threats are more prevalent than ever. Your money is valuable, and taking steps to protect it should be your top priority. Let’s explore how you can keep your funds secure while making this transfer.

Avoiding Scams

Scammers are constantly looking for opportunities to exploit unsuspecting individuals. They may pose as customer service representatives or send phishing emails to trick you into sharing your personal information. Be cautious of unsolicited communications and never divulge sensitive details. If something feels off, it probably is. Trust your instincts and verify the authenticity of any contact claiming to be from your bank or the EDD.

Secure Online Practices

When transferring money online, ensure you are using a secure internet connection. Public Wi-Fi networks can expose your data to hackers. It’s wise to perform transactions on a private network whenever possible. Additionally, use strong and unique passwords for your online accounts. Consider enabling two-factor authentication for an extra layer of security. These practices can significantly reduce the risk of unauthorized access.

Monitoring Account Activity

Regularly check your bank account for any unusual activity. Small unauthorized transactions can be a sign of a bigger problem. Set up alerts to notify you of any changes in your account balance. Being proactive in monitoring your account can help you detect and address issues promptly. Have you ever noticed a transaction you didn’t authorize? Act quickly to report it and protect your hard-earned money.

By taking these precautions, you can ensure that your funds are safe as they move from your EDD card to your bank account. Remember, vigilance and secure practices are key in safeguarding your financial well-being. What steps do you take to protect your money online?

Troubleshooting Common Issues

Transferring money from your EDD card to a bank account can sometimes be tricky. First, ensure your bank details are correct. Then, follow the online instructions carefully to avoid any errors.

Transferring money from your EDD card to a bank account should be a straightforward process. But like all things tech-related, there can be hiccups along the way. Troubleshooting these common issues can save you time and frustration. Understanding why these problems occur and how to solve them can make all the difference. Let’s dive into some of the most frequent challenges you might face.

Failed Transfers

Failed transfers can be a real headache. They can happen for a variety of reasons, including system errors or connectivity issues. Always ensure that you have a stable internet connection before initiating a transfer.

Sometimes, the EDD system may be down for maintenance. It’s worth checking their website or social media for any announcements. If the problem persists, reaching out to customer support can provide clarity.

Incorrect Account Details

Entering incorrect account details is a common mistake. Double-check your bank account number and routing number before pressing send. Even a small typo can lead to failed transfers or money being sent to the wrong account.

If you notice an error after the transfer, contact your bank immediately. They might be able to reverse the transaction if it hasn’t been processed. Have you ever typed your account number so quickly that you missed a digit? Taking an extra moment to verify can prevent this.

Delayed Transactions

Sometimes, transfers take longer than expected. This can be due to bank processing times, especially over weekends or holidays. Patience is key, but it’s also helpful to know the typical processing times for your bank.

If a transaction is delayed beyond the expected timeframe, contact your bank to ensure everything is in order. Have you ever waited for a transfer, only to find it stuck? It might be worth considering setting up transfers during regular business hours.

Remember, while these issues can be frustrating, they’re usually solvable with a little patience and diligence. Have you encountered any other challenges when transferring money from your EDD card?

Customer Support And Resources

Learn to transfer money from your EDD card to a bank account with ease. Access simple, step-by-step instructions and helpful resources. Customer support is available for any questions or assistance needed.

Transferring money from your EDD card to a bank account might seem straightforward, but sometimes challenges arise. Knowing where to turn for help and what resources are available can save you time and frustration. Whether you’re a first-timer or have done this before, having the right support can make all the difference.

When To Contact Customer Service

Reaching out to customer service can be crucial, especially if you encounter issues like transaction errors or account discrepancies. Imagine trying to transfer funds late at night and the transaction fails—what would you do?

If your card is lost or stolen, contacting customer service immediately is vital. They can freeze your account and prevent unauthorized transactions.

Not sure about transfer limits or fees? Customer service can provide the most accurate and up-to-date information. Always feel empowered to ask questions; it’s your money and your peace of mind.

Helpful Online Resources

The internet is filled with resources that can guide you through the transfer process. The official EDD website is a great starting point; it often has step-by-step guides and FAQs that address common concerns.

Online forums and community boards can also be invaluable. These platforms allow you to learn from others’ experiences, offering practical tips that aren’t always found in official documentation.

Video tutorials can be particularly helpful if you’re a visual learner. Watching someone else complete a transfer can provide clarity and boost your confidence. Have you explored all these resources before reaching out for help?

By utilizing customer support and online resources effectively, you can ensure smooth transactions and avoid unnecessary stress. Remember, the right information is just a call or click away.

Frequently Asked Questions

How Can I Transfer Money From My Edd Card?

Transferring money from your EDD card to a bank account is straightforward. Log into your EDD account online, select the transfer option, and input your bank details. Confirm the transaction, and the funds will be transferred typically within one to two business days.

Are There Fees For Transferring Edd Funds?

Transferring funds from your EDD card to a bank account usually incurs no fees. However, check with your bank for possible transaction fees. Always review terms to ensure there are no unexpected charges during the transfer process.

How Long Does Edd Transfer Take?

The transfer from your EDD card to a bank account typically takes one to two business days. Timing can vary based on banking protocols and holidays. Ensure your bank details are correct to avoid delays during the transfer process.

Can I Transfer Edd Money To Any Bank?

Yes, you can transfer EDD funds to any bank account in your name. Ensure your bank is compatible with direct deposits. Verify your account details to prevent errors or delays during the transfer process.

Conclusion

Transferring money from your EDD card to a bank account is simple. Just follow the steps outlined, and your funds will move quickly. It’s important to keep your account details handy. This ensures a smooth transaction. Double-check your bank information before proceeding.

This prevents any errors. Remember, transferring money helps manage your finances better. It offers convenience and security. Always ensure you have a stable internet connection during the process. This helps avoid interruptions. With these tips, you can easily access your funds.

Enjoy the ease and efficiency of online banking.