Imagine you’re planning for your child’s future, diligently saving in a 529 college savings plan. But then, life throws you a curveball.

Perhaps your child decides to take a different educational path, or maybe a sibling could use some of those funds. What do you do? Can you transfer money between 529 accounts? This question might be lingering in your mind, and you’re not alone.

Many parents and guardians face this dilemma, pondering over the flexibility of 529 plans. Discover how easy it can be to realign your savings strategy without losing the benefits you’ve worked so hard to accumulate. Stay tuned as we unravel the answers to ease your financial planning woes and empower you to make informed decisions about your family’s educational future.

Understanding 529 Accounts

Understanding 529 accounts can be crucial for saving for education. These accounts are designed to help families plan and fund education expenses. They offer tax advantages which make them appealing to many families.

What Are 529 Accounts?

529 accounts are savings plans for education. They help parents save money for college expenses. These accounts are sponsored by states, so they come with state-specific benefits. They offer tax-free growth and withdrawals for qualified expenses.

Benefits Of Using 529 Accounts

529 accounts provide several financial benefits. Contributions grow tax-free over time. Withdrawals for education expenses are also tax-free. Some states offer tax deductions for contributions. This can lead to significant savings.

Types Of 529 Accounts

There are two main types of 529 accounts. Prepaid tuition plans allow you to pay for future tuition at current rates. Savings plans invest in mutual funds or similar investments. Each type has its own benefits and limitations.

Transferring Money Between 529 Accounts

Transferring money between 529 accounts is possible. This can be useful if beneficiaries change. It helps families adjust to new financial plans. Transfers must meet certain requirements to avoid penalties.

Types Of 529 Plans

Understanding the different types of 529 plans is crucial for parents. These plans help save for a child’s education. Each type offers unique benefits and features.

Prepaid Tuition Plans

Prepaid tuition plans let families pay for future college costs at today’s rates. These plans cover tuition and fees at in-state public colleges. Some plans also work with private and out-of-state schools. They offer a hedge against rising tuition costs. Prepaid plans provide peace of mind. They ensure that college costs are covered. But they do have some limitations. They might not cover room, board, or other expenses.

Education Savings Plans

Education savings plans are more flexible. They let families save for a range of college expenses. These include tuition, fees, room, and board. The funds can be used at any eligible institution. This includes most accredited colleges and universities. Education savings plans offer investment options. Families can choose how to invest their savings. These plans come with potential growth based on investments. They do carry some risk, as investments can fluctuate.

Reasons For Transferring Funds

Transferring money between 529 accounts offers flexibility for families. It allows funds to be shifted between beneficiaries. This ensures that education savings are maximized according to individual needs and circumstances.

Transferring funds between 529 accounts is a strategic decision many families consider. Whether you’re adjusting to new education plans or seeking tax benefits, it’s essential to understand why these transfers can be beneficial. By examining the reasons for transferring funds, you can make informed choices that support your family’s educational goals.

Change In Beneficiary’s Education Plans

Education plans can change unexpectedly. Your child might decide to attend a different university, or perhaps they choose a vocational path instead of a traditional four-year program. When plans shift, transferring funds between 529 accounts allows you to adapt.

Consider this: your niece initially planned to attend a private college but opted for a state university. Transferring funds could better align with tuition costs, ensuring her education fund is used optimally. Have you faced a similar situation where education plans changed suddenly?

Maximizing Tax Benefits

Transferring funds between 529 accounts can also help you maximize tax benefits. Different states offer various tax advantages for 529 plan contributions. By moving funds to a plan in a state with better tax incentives, you could enhance your savings.

Imagine you live in a state where tax deductions for 529 contributions are generous. Transferring funds to a plan in your state might boost your tax savings significantly. Are you leveraging the tax benefits available in your state to the fullest?

Understanding the reasons behind transferring funds can empower you to make wise financial decisions. By considering changes in education plans and tax benefits, you can ensure your 529 accounts are working effectively for you and your family.

Eligibility For Transfers

Transferring funds between 529 accounts can be a strategic move for families looking to optimize their education savings. However, understanding the eligibility criteria for such transfers is crucial to avoid any unforeseen complications. So, what makes you eligible to transfer money between 529 accounts?

Family Member Designation

The first key aspect to consider is the family member designation. Only specific relatives can be beneficiaries of a 529 account transfer. This includes siblings, parents, children, and even cousins. Imagine you have saved diligently in a 529 account for your eldest child, but they receive a scholarship covering most of their expenses. You can transfer the remaining funds to a younger sibling’s 529 account without penalty.

Think of the possibilities this flexibility offers. It allows you to support multiple family members efficiently, ensuring that no educational funds go to waste.

Age And Relationship Criteria

Age and relationship play a crucial role in determining eligibility. The IRS has guidelines that ensure the new beneficiary is a family member as defined under tax law. Have you ever wondered if you can transfer funds to a niece or nephew? You can, as long as they fit within the defined family parameters.

Consider the age factor too. If your child decides to take a gap year and the funds need to be redirected to a sibling’s account, the age of the new beneficiary does not impact eligibility. This opens up avenues for families to adapt their educational savings to changing circumstances without financial penalty.

It’s essential to stay informed about these criteria. How might your family’s educational needs change over time? Understanding eligibility can empower you to make the most of your 529 savings, ensuring every dollar serves its purpose effectively.

How To Transfer Funds

Transferring funds between 529 accounts can be a simple task. It helps manage your savings effectively. This process allows for better financial planning. You can move funds between accounts for different beneficiaries. It is a convenient way to adjust your savings strategy.

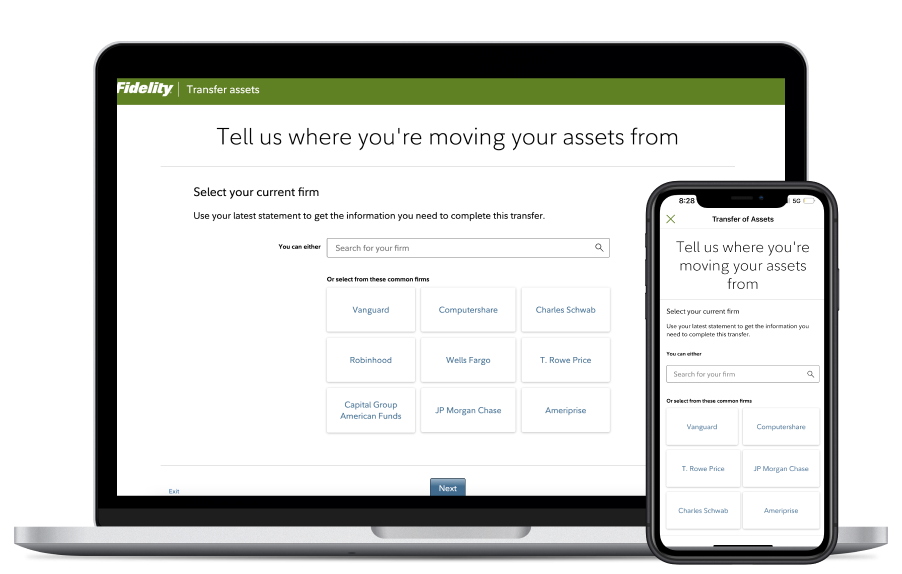

Step-by-step Process

First, contact your 529 plan provider. They will guide you on their specific process. Typically, you need to fill out a transfer request form. Ensure all details are accurate to avoid delays. Submit the form through the required channel. This might be online or via mail.

Next, verify if any fees apply. Some plans may charge for transfers. Check your plan’s guidelines. After submitting the form, wait for confirmation. It can take several days to process. Monitor your accounts to ensure funds are transferred successfully.

Required Documentation

You will need identification details. This includes your account number. Also, provide the beneficiary’s information. You may need their Social Security Number. Keep a copy of your form for records. Some providers may ask for additional documents.

Have these ready to speed up the process. Documentation helps verify your identity. It ensures the security of your funds. Always check with your provider for specific requirements.

Tax Implications

Transferring money between 529 accounts is a common decision for families. The tax implications of such transfers are important to understand. This section breaks down the federal and state tax implications.

Federal Tax Considerations

Federal tax laws offer flexibility with 529 account transfers. The IRS allows tax-free transfers between beneficiaries. The new beneficiary must be a relative of the current one. This includes siblings, cousins, or even parents. No federal taxes are due if these conditions are met.

It’s crucial to follow IRS guidelines carefully. Incorrect transfers might result in penalties. Ensure the new beneficiary qualifies under IRS rules. This prevents unexpected federal tax charges.

State Tax Consequences

State tax rules vary significantly. Each state has its own regulations for 529 transfers. Some states offer tax deductions for contributions. A transfer might affect these deductions.

Transferring funds to a different state could impact tax benefits. The original state’s tax benefits might be lost. It’s wise to check state tax laws before making a transfer. Consult with a tax advisor for personalized advice.

Understanding state-specific rules is vital. They can influence the tax outcome of a transfer. Proper planning ensures you maximize tax benefits.

Potential Penalties

Transferring money between 529 accounts can lead to potential penalties. Understanding these penalties helps in making informed decisions. The IRS imposes a 10% penalty on non-qualified withdrawals. This can significantly impact your savings.

Non-qualified Withdrawals

Non-qualified withdrawals occur when funds are used for non-educational purposes. This includes using the money for travel or personal expenses. In these cases, a 10% penalty is applied. Additionally, any earnings are subject to income tax.

It’s important to plan withdrawals carefully. Ensure the funds are used for qualified expenses. This can help avoid unnecessary penalties. Review your 529 plan guidelines regularly.

Exceptions To Penalties

Some situations offer exceptions to the penalty rule. If the beneficiary receives a scholarship, the penalty may be waived. The same applies if the beneficiary attends a U.S. military academy.

Other exceptions include the beneficiary’s death or disability. In these cases, withdrawals may be penalty-free. Always check with a tax advisor for specific situations. Knowing these exceptions can save money and stress.

Tips For Managing 529 Accounts

Transferring money between 529 accounts can simplify managing education funds. It’s possible to move funds between accounts for eligible family members. This flexibility helps in adjusting financial plans efficiently.

Managing 529 accounts effectively can significantly impact your family’s financial future. Whether you’re saving for your child’s college education or planning for another beneficiary, it’s essential to stay on top of your 529 accounts. Here are some practical tips to help you navigate and optimize these valuable savings plans.

Monitoring Investment Options

Investment choices within a 529 plan can greatly influence the growth of your funds. Regularly evaluate the performance of your current investments. Consider whether they align with your financial goals and risk tolerance.

For instance, if your child is still young, you might opt for more aggressive investment options. These can potentially yield higher returns over time. However, as college draws nearer, you might prefer a more conservative approach to protect your savings.

Are you unsure about which investment strategy suits your needs? Many 529 plans offer age-based portfolios that automatically adjust the asset mix as your child approaches college age. These can be an excellent choice if you prefer a hands-off approach.

Regularly Reviewing Beneficiary’s Needs

Life changes, and so do your beneficiary’s educational needs. Regularly assess whether your 529 account is still aligned with your beneficiary’s current and future aspirations.

For example, what if your child decides to attend a more expensive college or pursue a postgraduate degree? You may need to adjust your contributions or transfer funds between 529 accounts to cover the increased costs.

Do you have more than one child or potential beneficiary? It’s crucial to periodically review and possibly update beneficiary designations. This ensures that your savings are allocated in the most beneficial way for your family’s circumstances.

By staying proactive and informed, you can make the most of your 529 accounts. Remember, each decision you make today can pave the way for a brighter educational future for your loved ones. What steps will you take to optimize your 529 accounts?

Frequently Asked Questions

Can You Switch Funds Between 529 Plans?

Yes, you can transfer funds between 529 accounts. The beneficiary must be a family member. This allows flexibility in funding education for different family members. Always consult with a financial advisor to ensure compliance with regulations.

How Often Can You Transfer 529 Account Funds?

You can transfer funds once per year without tax consequences. This rule ensures that the accounts are used appropriately. Always check with your plan for specific policies and procedures.

Are There Tax Implications When Transferring 529 Funds?

Transferring funds within family members typically avoids taxes. However, improper transfers may incur taxes and penalties. It’s crucial to follow IRS guidelines and seek advice from a tax professional.

Can Siblings Share A 529 Account?

Yes, siblings can share 529 funds by changing the beneficiary. This flexibility helps families manage educational expenses. Ensure the new beneficiary is an eligible family member to avoid penalties.

Conclusion

Transferring money between 529 accounts is possible. It’s a useful option for families. You can manage education savings flexibly. This helps when plans change for a child’s education. Check your state’s rules. They can vary. It’s crucial to avoid penalties.

Keep track of any tax implications. Consulting a financial advisor is wise. They offer guidance tailored to your situation. Planning ensures funds are used effectively. Education costs can be unpredictable. Being prepared makes a difference. Remember, 529 plans support your child’s future.

Proper management provides peace of mind.