How to Transfer Money From Fintwist

Maneuvering financial transactions online can sometimes feel like finding your way through a maze – you know where you want to go, but the path isn't always clear. When you want to transfer money from Fintwist, you're likely looking for a straightforward, efficient process. You start by setting up your account, an essential step that lays the groundwork for all your future transactions. As you prepare to move your money, you'll need to make a few key decisions. But what are the options available to you, and how do you guarantee your transaction is secure?

Understanding Fintwist Transfer Options

Your ability to transfer money from Fintwist depends on understanding the various options available to you, including the types of transfers supported, transfer limits, and any associated fees. You'll want to know what types of transfers Fintwist offers, such as bank transfers, wire transfers, or peer-to-peer transfers. You should also be aware of the transfer limits, including the minimum and maximum amounts you can transfer in a single transaction or within a certain time frame. Additionally, you'll want to understand any fees associated with transfers, such as processing fees or transfer fees. Understanding these options will help you make informed decisions and guarantee secure transactions. By reviewing Fintwist's transfer options, you'll be better equipped to manage your money and avoid potential issues.

Setting Up Your Fintwist Account

Setting up a Fintwist account is a straightforward process that enables you to transfer money securely and efficiently. You'll start by downloading the Fintwist app or visiting the website. Then, click "Sign Up" and provide basic information, such as your name, email address, and phone number. Create a strong password and confirm your account. To add an extra layer of security, you'll be prompted to set up two-factor authentication. After verifying your identity, you'll link a bank account or debit card to your Fintwist account. This process typically takes a few minutes. Once you've completed these steps, your Fintwist account will be active, and you'll be ready to initiate transfers. Be sure to review Fintwist's terms and conditions before activating your account.

Adding Recipients to Fintwist

To initiate a transfer, you'll need to add the recipient's information to your Fintwist account, which can be done by clicking on the 'Add Recipient' button and entering their details. This step guarantees that you can send money securely and accurately. When adding a recipient, you'll typically need to provide their name, email address, and bank account information or other relevant payment details. Fintwist will guide you through the process, and the information you provide will be encrypted for security. Make sure to double-check the recipient's details for accuracy to prevent any issues with the transfer. Once you've successfully added a recipient, they'll be saved in your Fintwist account for future transfers.

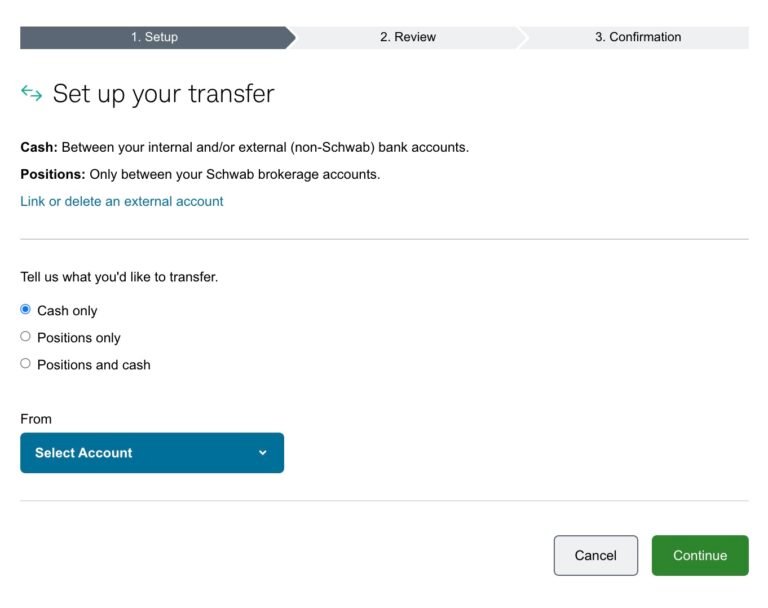

Choosing a Transfer Method

Fintwist offers various transfer methods, allowing you to choose the one that best suits your needs and preferences. You can select from options like instant transfers, standard transfers, or even international transfers. Each method has its own processing time and potential fees, so you'll want to review these details before making a decision. Consider the urgency of the transfer and the recipient's needs. If you're short on time, an instant transfer might be the way to go. On the other hand, if you're looking to save on fees, a standard transfer could be the better option. By choosing the right transfer method, you can guarantee a smooth and secure transaction. Take a moment to evaluate your options and pick the one that works best for you.

Entering Transfer Details

Once you've selected a transfer method, you'll need to enter the recipient's information and transfer details to complete the transaction. You'll be asked to provide the recipient's name, email address or phone number, and bank account information, if applicable. Make sure to double-check the recipient's details to guarantee accuracy and avoid any potential issues. You'll also need to enter the transfer amount and select the currency, if different from your account's default currency. Additionally, you may be asked to provide a transfer description or reference number. Fill in all the required fields carefully and accurately to guarantee a smooth and secure transfer process. Fintwist's system will guide you through the process, and you can contact their support team if you need assistance.

Reviewing and Confirming Transfers

Accuracy is essential at this stage, as you review the transfer details to verify that everything is correct before finalizing the transaction. You'll want to double-check the recipient's information, the transfer amount, and any applicable fees. Make certain you've selected the correct transfer method and that the estimated delivery time meets your needs. If you're sending money internationally, verify the exchange rate and any additional fees associated with the transfer. Take your time and carefully review each detail. If you spot an error, you can edit the transfer details before proceeding. Once you're satisfied that everything is accurate, you can confirm the transfer and complete the transaction. By doing so, you'll guarantee a smooth and secure transfer process.

Understanding Transfer Limits

You should be aware of the transfer limits that apply to your Fintwist account, as they can affect the amount of money you can send or receive. Fintwist sets these limits to protect you and others from potential scams and to comply with regulatory requirements. To check your transfer limits, log in to your account and navigate to the 'Transfer' or 'Setting' section. You can also contact Fintwist's customer support to ask about the specific limits that apply to your account. It's important to note that exceeding these limits may lead to transfer delays or rejection. By understanding your transfer limits, you'll be able to plan your transactions accordingly and avoid any potential issues. Make sure to review the limits before initiating a transfer.

Tracking Transfer Status

Monitoring the status of your transfer is essential to ensuring a smooth and successful transaction from your Fintwist account. You can track the status of your transfer in real-time to stay informed. Here are three ways to do so:

- Check your Fintwist account online: Log in to your Fintwist account and navigate to the "Transfers" section to view the status of your transfer.

- Use the Fintwist mobile app: Open the Fintwist mobile app and check the "Transfers" section to track the status of your transfer on-the-go.

- Contact Fintwist customer support: Reach out to Fintwist's customer support team to inquire about the status of your transfer if you have any concerns or issues.

Receiving Money on Fintwist

Receiving money on Fintwist involves a straightforward process that guarantees funds are deposited directly into your account, making them readily available for use or transfer. You'll receive a notification once the funds are deposited, ensuring you stay updated on your account activity. To confirm receipt of the funds, you can log in to your Fintwist account and check your balance. The funds will be reflected in your account immediately after transfer, allowing you to use them as needed. With Fintwist's secure transfer process, you can trust that your funds are safe and easily accessible. By following these simple steps, you'll have access to your received funds in no time, giving you peace of mind and control over your finances.

Troubleshooting Transfer Issues

When transfer issues arise, identifying the root cause of the problem is crucial to resolving it efficiently. You'll want to determine if the issue is related to your Fintwist account, the recipient's account, or the transfer process itself.

To troubleshoot transfer issues, you can try the following steps:

- Verify account information: Double-check that the recipient's account details are accurate, including their name, address, and account number.

- Check transaction limits: Confirm that the transfer amount is within your account's transaction limits.

- Review transfer status: Check the transfer status in your Fintwist account to see if there are any error messages or updates.