Imagine this: you’re planning a big project or a significant purchase. Everything seems perfect until you hit a roadblock—how and when will you pay for it all?

This is where a payment schedule becomes your best friend. A payment schedule is more than just a series of dates and amounts. It’s a strategic tool that can give you peace of mind and control over your finances. By understanding what a payment schedule is, you’re not just keeping track of payments—you’re empowering yourself to manage your cash flow, avoid financial stress, and ensure that your projects run smoothly.

Whether you’re managing a construction project, handling a business transaction, or simply organizing your personal budget, mastering the concept of a payment schedule can be a game-changer. Are you ready to discover how to take charge of your financial commitments with confidence? Let’s dive into the world of payment schedules and unlock the benefits that await you.

Payment Schedule Basics

A payment schedule tells when you pay money. It helps you know the dates to pay for things. It keeps you on track. You won’t forget to pay. You can plan your money better.

Most payment schedules are monthly. Some are weekly. Others are yearly. You see how much to pay each time. You know the total amount. This way, budgeting is easy.

Payment schedules are important for bills. They help you pay rent, electricity, and water. Companies use them for big projects. They help manage money and time. Everyone stays happy.

Types Of Payment Schedules

Fixed payment schedules have set amounts and dates. These payments are made regularly. The amount does not change. This helps with planning and budgeting. It’s simple and predictable. Many loans use fixed schedules. You always know what to pay each time.

Variable schedules can change over time. Payments may go up or down. They depend on certain factors. Interest rates can affect payments. Sometimes income affects payment amounts. This type can be less predictable. It’s important to track changes closely.

Milestone schedules depend on completed tasks. Payments are made after each milestone. Each task has a set value. You pay once a task is done. It’s used in projects or contracts. This schedule keeps track of progress. You only pay for completed work.

Benefits Of Payment Schedules

Payment schedules help with financial planning. They show when money comes in and goes out. This helps people know what they can spend. Saving becomes easier. Planning for big expenses is less scary.

Managing cash flow is important. Payment schedules show how money flows. This helps in knowing when to pay bills. It also helps in avoiding late fees. Keeping track of money is simple with a schedule.

Payment schedules bring predictability. People know when they get paid. This makes life easier. Planning for events or trips is smoother. Surprises with money are less likely.

.webp)

Creating A Payment Schedule

List all your bills and payments. Rent, utilities, and phone bills are common. Know what you need to pay each month. This helps you stay organized. Track each payment so you don’t forget. Ask yourself, “What do I pay regularly?” Write them down.

Choose dates for each payment. Align payment dates with your payday. This ensures you have money. Some bills need monthly payments. Others might be quarterly. Check each bill to know when it’s due. Set reminders to avoid late fees.

Sometimes, bills change. New expenses may appear. Adjust your schedule as needed. Stay flexible. Life can surprise you. Keep track of any changes. Update your list to reflect these changes. This way, you stay prepared.

Common Challenges

Late payments can cause big problems. Cash flow becomes tight. Bills may not get paid on time. This affects businesses badly. They might need to borrow money. Borrowing can cost extra. So, keeping track of payments is important.

Disputes can arise easily. One party may feel unfairly treated. Resolving disputes takes time and effort. Clear communication helps avoid misunderstandings. Having a fair agreement can prevent issues. If disputes arise, a good plan helps solve them quickly.

Adjustments can happen for many reasons. Some payments might need change. This can be due to errors. Or because of new agreements. Adjustments need careful attention. Making changes can be tricky. It’s best to check details closely.

Tools For Managing Payment Schedules

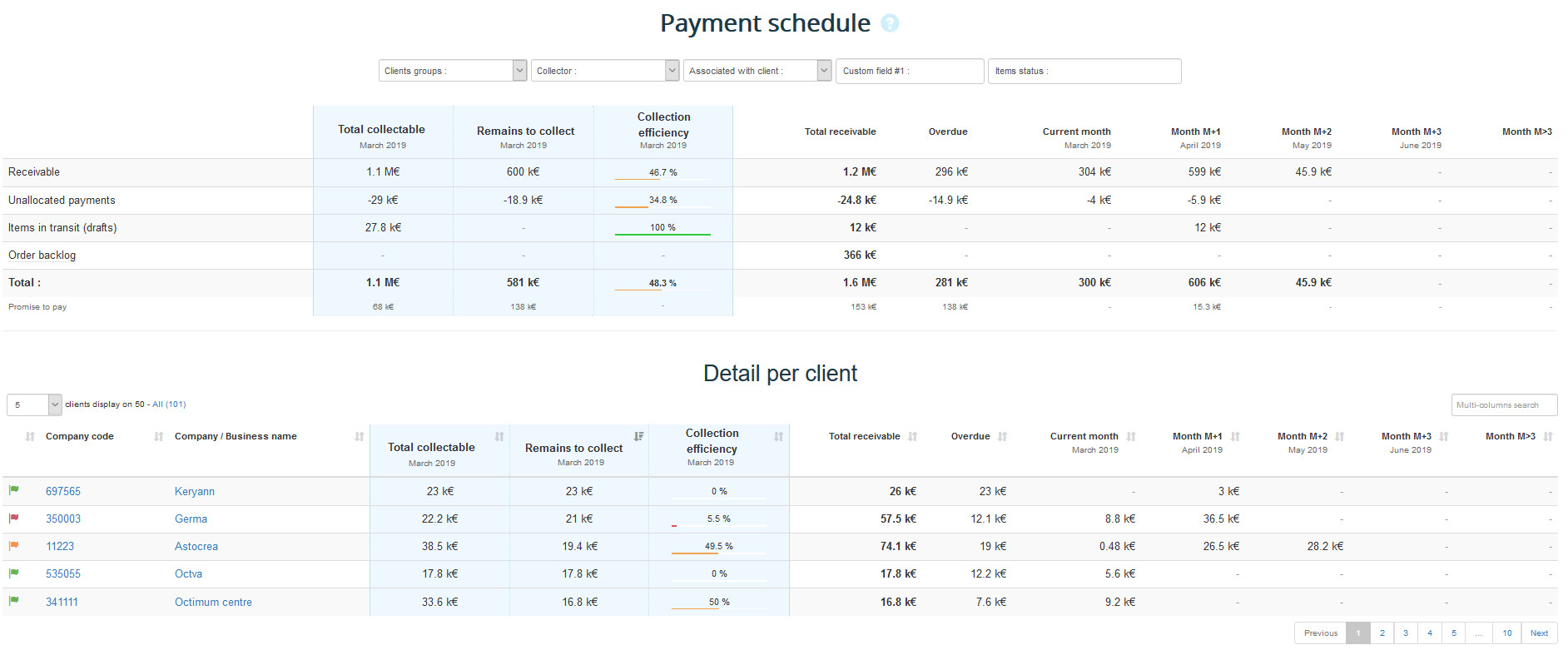

Software can help keep payment schedules organized. Many programs offer automatic reminders. This helps prevent missed payments. Some software solutions offer customizable features. Users can track payments in different ways. It’s easy to view payment history. Software can also generate reports. Reports show payment trends over time. This is useful for budgeting and planning. Most programs are user-friendly. They are simple to learn and use.

Tracking payments manually can be effective. Some people use spreadsheets. Spreadsheets are easy to update. Others prefer using calendars. Calendars can show payment dates clearly. Notebooks are another option. Writing down payments can help remember them. Manual tracking requires more effort. It’s important to check records often. This ensures all payments are up to date.

Best Practices

Clear communication keeps everyone informed. Stakeholders need updates on payment schedules. Share changes promptly. Use simple words. Avoid jargon. Ask questions. Ensure understanding. Listen to feedback. Build trust with open dialogue. A strong relationship helps avoid confusion.

Review payment schedules often. Check dates and amounts. Adjust plans as needed. Stay organized. Avoid mistakes. Ensure accuracy. Review helps catch errors. Keeps schedules up-to-date. Saves time and money. Regular checks are smart practice.

Frequently Asked Questions

What Is A Payment Schedule?

A payment schedule is a detailed plan outlining payment dates and amounts. It helps manage finances and ensures timely payments. Often used in contracts, it provides clarity for both parties. Payment schedules can be found in various financial agreements, including loans, mortgages, and construction projects.

Why Are Payment Schedules Important?

Payment schedules are crucial for financial organization and predictability. They help avoid missed payments and associated penalties. By providing a clear timeline, they enhance transparency and trust between parties. A well-structured payment schedule ensures smooth transactions and aids in effective budgeting.

How Is A Payment Schedule Created?

Creating a payment schedule involves outlining payment amounts and dates. Start by identifying total payment, then divide into installments. Consider factors like due dates and frequency. Use tools like spreadsheets or software for accuracy. Ensure both parties agree to the terms for a successful schedule.

Can Payment Schedules Vary By Agreement Type?

Yes, payment schedules can vary based on agreement type. Different agreements, like loans or construction contracts, have unique schedules. They may differ in frequency, amount, and duration. Tailoring schedules to specific agreements ensures they meet contractual obligations and financial needs.

Conclusion

A payment schedule makes managing finances easier. It provides clear payment timelines. This helps avoid late fees and ensures timely payments. Businesses and individuals benefit from organized payment plans. Tracking expenses becomes straightforward. Peace of mind increases as financial obligations are met.

Understanding payment schedules boosts financial planning skills. It leads to better budgeting and spending habits. Regular reviews of your payment schedule are essential. Adjust as needed to fit changing financial situations. Stay proactive with payments and reap the benefits. A well-managed payment schedule supports financial stability.