Transfer Money from a Prepaid Card to a Bank Account: Quick Tips

Are you looking to transfer money from your prepaid card to your bank account but not sure where to start? You’re not alone.

Many people find themselves puzzled by the process, but it’s easier than you might think. Imagine the convenience of having your funds directly in your bank account, ready to use whenever you need them. No more juggling between cards or worrying about limited payment options.

This simple transfer can save you time and effort, making your financial life smoother and more organized. Ready to unlock the secrets of seamless money transfers? Let’s dive in and simplify the process for you, step by step.

Prepaid Cards Basics

Prepaid cards are a flexible financial tool. They work like debit cards but require preloading funds. Before using them, understand their basic features and benefits. Knowing these helps you transfer money smoothly.

What Are Prepaid Cards?

Prepaid cards are not linked to a bank account. You load cash onto them first. Then use them for purchases or payments. They provide a secure way to manage funds.

How Prepaid Cards Work

You deposit money onto the card. Spend only what you loaded. It prevents overspending. This is ideal for budgeting. Anyone can easily track expenses.

Benefits Of Using Prepaid Cards

They offer safety. No need to carry cash. Easy to replace if lost. They provide spending control. Ideal for teaching kids money management.

Types Of Prepaid Cards

General-purpose cards are popular. Gift cards serve specific stores. Reloadable cards allow multiple fund deposits. Each type meets different needs.

Linking Card To Bank Account

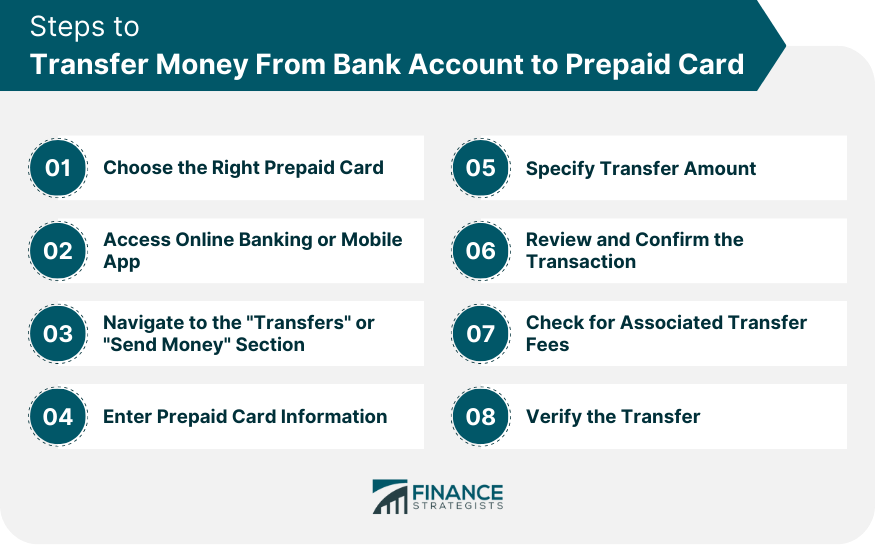

Transferring money from a prepaid card to a bank account is simple. Start by linking the card to your bank. Follow the bank’s instructions to complete the transfer securely.

Understanding The Prepaid Card

Before linking, it’s crucial to know your prepaid card’s features. Some cards allow direct transfers, while others might require an intermediary service. Check if your card supports bank account transfers; this information is typically available on the card issuer’s website or customer service.Checking Bank Compatibility

Not all banks accept prepaid cards for direct linkage. Contact your bank to confirm if they support this service. Some banks offer a seamless online process, while others might require you to visit a branch.Gathering Necessary Information

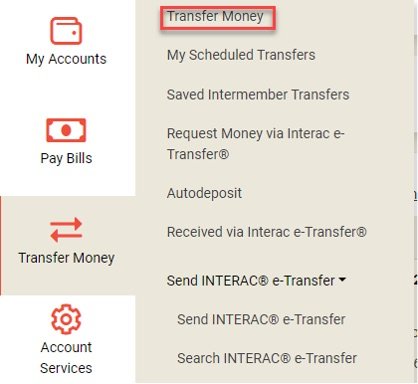

You’ll need specific details to link your card to your bank account: – Your bank account number – Routing number – Your card number Prepare these details beforehand to avoid any hiccups during the process.Steps To Link Your Card To Your Bank Account

1. Log into your bank’s online portal or mobile app. 2. Navigate to the section where you manage linked accounts or external transfers. 3. Enter your prepaid card details when prompted, including the card number and any required verification codes. 4. Verify the linkage through any security measures your bank may employ, such as a confirmation email or text.Ensuring Security

Security should be a top priority when linking financial accounts. Use secure networks and ensure your bank employs strong encryption methods. Be cautious of phishing attempts and keep your account information private.Benefits Of Linking Your Card

Linking offers numerous benefits. You can easily transfer funds, pay bills, or even save on transaction fees. It simplifies your financial life, giving you more time to focus on what truly matters.Common Issues And Troubleshooting

Sometimes, issues arise during the linking process. If you encounter problems, double-check your details and reach out to customer support. Sharing a quick personal anecdote: I once faced an issue where my card wasn’t linking due to a minor typo. A quick call to customer support resolved it instantly.Why Consider Linking?

Have you ever thought about the convenience of managing all your finances in one place? Linking your prepaid card to your bank account could be the key to simplified money management. Wouldn’t it be great to have more control over your financial transactions? Linking your prepaid card to your bank account might seem daunting at first, but with careful steps and attention to detail, it can be a smooth process. Take advantage of this integration to make your financial life more efficient and effective.Online Transfer Methods

Transferring money from a prepaid card to a bank account is simple and convenient. Users can quickly move funds using online banking platforms. This process ensures access to your money anytime, offering flexibility and control over personal finances.

Transferring money from a prepaid card to a bank account has become easier with various online transfer methods. Whether you prefer using mobile apps or your bank’s website, you can move funds seamlessly. This digital convenience has transformed the way we manage our finances, making it accessible for everyone. Imagine the ease of transferring money while sipping coffee at home. Let’s explore these methods and find the best fit for your needs. ### Using Mobile Apps Mobile apps are a game-changer for transferring funds. They offer quick and easy access right from your smartphone. Many prepaid card providers have dedicated apps that allow you to transfer money to your bank account with a few taps. Have you ever found yourself in a situation where you needed to transfer money urgently? Mobile apps are perfect for these moments. They often provide instant transactions, ensuring your funds are available when you need them. Security is crucial. These apps use encryption and other security measures to protect your financial information. Always check for app updates to ensure you have the latest security features. ### Bank’s Website Options Your bank’s website offers reliable transfer options. Most banks have user-friendly interfaces where you can log in and manage your accounts effortlessly. Transferring money from a prepaid card can be done by selecting the transfer option and following the prompts. This method is ideal if you prefer using a laptop or desktop for your banking needs. It provides a detailed view of your transactions and balances, helping you keep track of your finances. Have you explored the additional features your bank’s website offers? Many banks provide budgeting tools, spending insights, and even financial advice. Utilizing these resources can enhance your financial planning. In a world where everything is digital, how do you prefer to manage your finances? Both mobile apps and bank websites offer unique advantages. The choice depends on your lifestyle and comfort with technology.Third-party Services

Transferring money from a prepaid card to a bank account can be tricky. Third-party services simplify this process, offering convenience and flexibility. These services act as intermediaries, ensuring funds move smoothly between your prepaid card and bank account.

Popular Transfer Platforms

Several platforms specialize in transferring funds from prepaid cards. PayPal is widely recognized for its easy interface and global reach. Venmo is popular among younger users, offering a social aspect to money transfers. TransferWise provides international transfers with transparent fees. Each platform has unique features, catering to different needs.

Fees And Security Considerations

Third-party services often charge fees for transactions. These fees can vary based on the platform and transfer amount. It’s important to review fee structures before choosing a service. Security is crucial when transferring money. These platforms use encryption to protect your data. Always ensure the service you choose is reputable and secure.

Atm Transfer Process

Transferring money from a prepaid card to a bank account is convenient. The ATM transfer process is one option for completing this task. It involves using ATMs that support prepaid card transactions. Understanding the ATM transfer process can save time and effort.

Locating Compatible Atms

Finding the right ATM is essential for a smooth transfer. Not all ATMs accept prepaid cards for direct bank transfers. Check with your card provider for a list of compatible ATMs. Many banks have partnerships that allow their ATMs to accept prepaid cards. Use online maps or bank apps to locate these ATMs. Look for ATMs with features that support prepaid cards. This ensures your transaction will be successful.

Steps For Direct Transfer

Once at a compatible ATM, start the transfer process. Insert your prepaid card into the ATM slot. Enter your PIN to access the card’s functions. Look for the “Transfer” option on the ATM screen. Select “Transfer to Bank Account” if available. Enter the bank account details where you want the money sent. Double-check the information to avoid errors. Confirm the amount you wish to transfer from the card. Follow any additional prompts to complete the transaction. Keep your receipt as proof of the transfer.

Avoiding Common Mistakes

Transferring money from a prepaid card to a bank account requires attention to fees and transfer limits. Double-check card details and bank information to avoid errors. Ensure your card allows direct transfers to bank accounts for a smooth transaction process.

Understanding Transfer Limits

Many prepaid cards have specific transfer limits that can catch you off guard. These limits can be daily, weekly, or even monthly. Imagine planning to transfer a large sum, only to find out it exceeds the allowed amount. Always check the terms and conditions of your prepaid card. This will help you plan your transfers accordingly. Knowing these limits upfront prevents frustration and ensures smooth transactions. ###Verifying Bank Account Details

One of the most common mistakes is entering incorrect bank account details. A single wrong digit can send your money to the wrong account. Has this ever happened to you? It’s a nightmare you want to avoid. Double-check your bank account number and routing information before initiating a transfer. It might help to keep your bank details saved in a secure document. This simple step can save you from future headaches and potential financial loss. Avoiding these common mistakes is easier than you think. By understanding transfer limits and verifying bank details, you ensure that your money moves exactly where you want it. What other tips do you find helpful when transferring money? Share your thoughts!Monitoring Transactions

Transferring money from a prepaid card to a bank account requires careful monitoring. It ensures that funds are securely moved. Tracking helps in avoiding errors and keeps transactions smooth.

Using Alerts And Notifications

Setting up alerts and notifications can be a game changer in managing your transactions. Imagine getting an instant notification every time a transfer is made, keeping you informed in real-time. Many banks and prepaid card services offer this feature, allowing you to customize alerts for specific activities like withdrawals or deposits. These notifications can arrive via email or SMS, giving you the flexibility to choose your preferred method. It’s like having a financial watchdog at your service, ensuring you are always in the loop. Have you ever missed a crucial update because you weren’t aware of this feature?Reviewing Bank Statements

Regularly reviewing your bank statements is an essential habit for effective financial management. By doing this, you can verify that all transactions from your prepaid card to your bank account are accurate. Consider this a monthly health check-up for your finances. Look for discrepancies or unauthorized transactions and address them promptly. This proactive approach not only helps in spotting errors but also in understanding your spending patterns. How often do you sit down and go through your bank statements with a fine-tooth comb? Incorporating these practices can significantly enhance your financial security. By staying vigilant and informed, you can ensure your money is always where it should be. Remember, the key to successful money management lies in the details. Are you ready to take control of your financial transactions?

Frequently Asked Questions

Can I Transfer Money From A Prepaid Card To A Bank Account?

Yes, you can transfer money from a prepaid card to a bank account. This usually involves linking your prepaid card to your bank account through online banking or the card’s mobile app. Ensure your bank and prepaid card issuer allow such transactions to avoid any issues.

What Are The Fees For Transferring Prepaid Card Funds?

Fees vary depending on the prepaid card issuer and bank. Some issuers charge a small transaction fee, while others might not charge at all. It’s important to review the terms and conditions of both your prepaid card and bank account to understand any associated fees.

How Long Does The Transfer Take?

The transfer time can vary based on the issuer and bank. It typically takes one to three business days for the transfer to complete. Some institutions offer quicker transfers for an additional fee, so check with your issuer for more details.

Are There Transfer Limits From A Prepaid Card?

Yes, most prepaid cards have transfer limits. These limits can vary based on the card issuer and the account type. It’s important to review your card’s terms and conditions or contact customer service to understand your specific limits.

Conclusion

Transferring money from a prepaid card to a bank account is straightforward. Follow the steps outlined for a smooth transaction. Understand the fees involved to avoid surprises. Keep your card and bank details secure. Regularly check your bank account for confirmation.

This method offers convenience and flexibility for managing funds. Remember to keep track of your balance. With practice, this process becomes second nature. It’s a useful skill for everyday financial management. Explore this option for better control over your money.

Simplifying finances starts with understanding these basic steps.