Are you dreaming of buying your own home or car, but find yourself puzzled by financial jargon like “down payment”? You’re not alone.

This term often pops up when discussing loans and purchases, yet its true meaning can seem elusive. Understanding a down payment is crucial because it directly impacts your financial future and purchasing power. Imagine stepping into the world of ownership with confidence, knowing exactly how much you need to save and why it matters.

We’ll demystify the concept of down payments, breaking it down into simple terms so that you can make informed decisions and move closer to achieving your dreams. Stay with us, and you’ll uncover how mastering this one financial element can unlock a world of opportunities for you.

Down Payment Definition

A down payment is the money paid upfront. It is usually a big part of the total cost. People pay this when they buy something expensive. Like a house or a car. The rest is paid over time. This is called financing. It helps show you are serious about buying.

Most times, down payments are a fixed percent. Ten percent is common. Sometimes more, sometimes less. It depends on the item and seller. Saving for a down payment is important. Banks and lenders like it when you save money. It shows you can handle money well.

Importance Of Down Payments

Down payments are a big part of buying things. They help show you are serious. They also make it easier to get a loan. The bigger the down payment, the smaller the loan. This means you pay less in the long run. Smaller loans have smaller monthly payments. This saves you money each month.

Many people save for a down payment over time. It can take a while. But it is worth it. A good down payment can help you get a better deal. It can make buying a home or car easier. Always try to save as much as you can. It makes a big difference.

Common Down Payment Percentages

Many people pay a down payment when buying a house. This is a part of the total price. It shows the bank you are serious. Typical down payments are 20% of the home’s price. Some people pay less. For example, 5% or 10% are also common. Bigger down payments can make monthly payments smaller.

People with good credit might pay less. Special programs help first-time buyers. These programs often ask for lower down payments. Check with banks to find out more. Every situation is different. Ask questions before choosing how much to pay.

Impact On Loan Terms

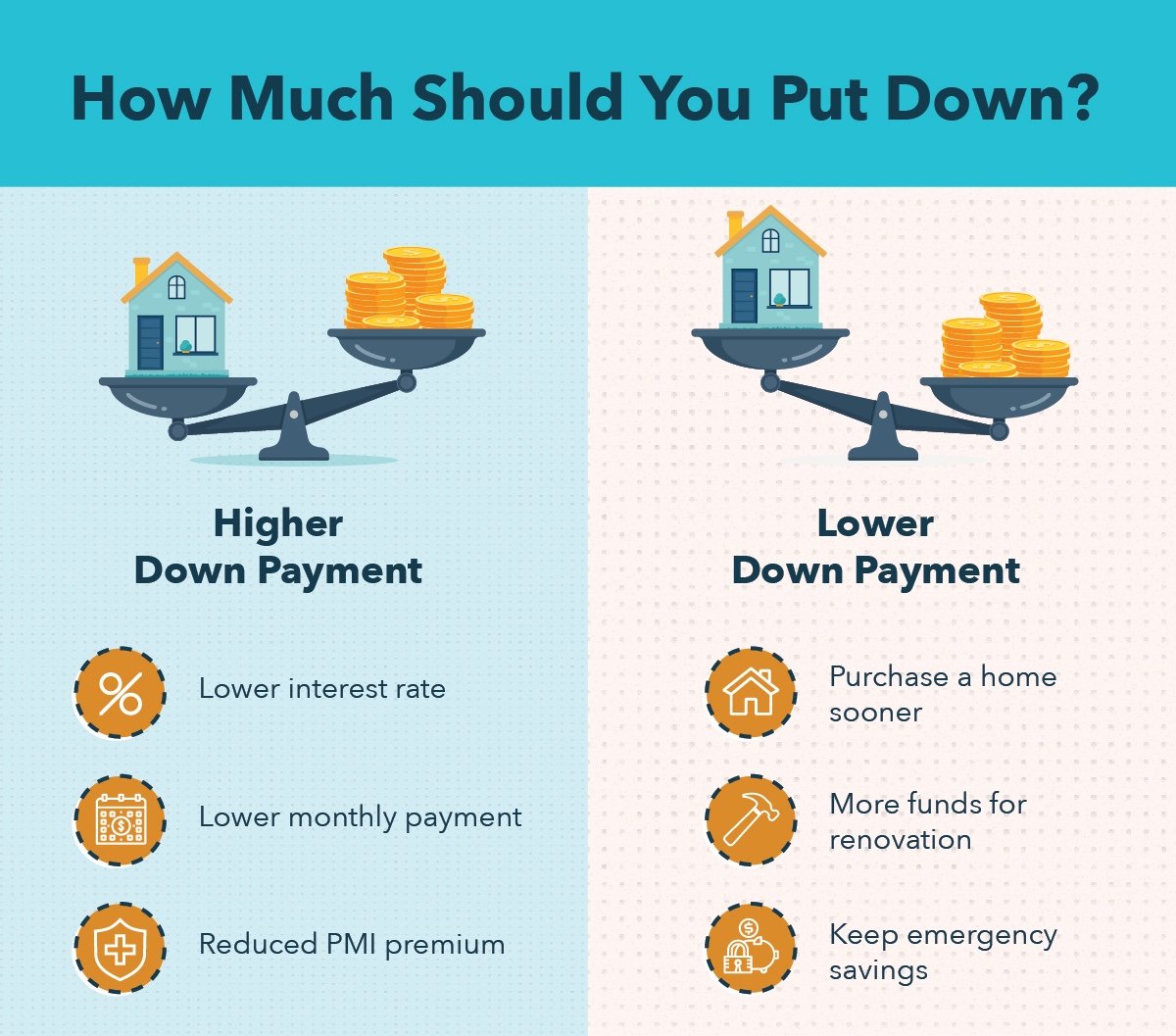

Down payment affects the interest rates on your loan. A larger down payment often means a lower interest rate. This can save money over the loan’s life. Smaller down payments might lead to higher interest rates. Banks see smaller down payments as risky. Risk often leads to higher rates.

Down payment changes the total loan amount. Paying more upfront reduces the loan size. This means smaller monthly payments. Less down payment means a bigger loan. Bigger loans can be harder to pay back. It’s important to understand how down payment affects the loan.

Factors Influencing Down Payment Size

Credit Score is very important for down payments. A higher score means you can pay less upfront. Lenders trust you more when your score is good. A low score can mean a bigger down payment.

Your Income Level affects how much you pay first. People with more money can pay more upfront. This can help get better deals. Less income might mean higher monthly payments.

The Property Type also matters. Houses and condos need different down payments. A small house might need less. Bigger or special homes might need more. Always check the type before buying.

Down Payment Assistance Programs

Many governments offer help to buy homes. These programs assist with the down payment. Some programs give grants. Others offer loans. The goal is to make buying easier. This helps families own homes. It supports local economies. Eligibility often depends on income. Some programs target first-time buyers. Each program has different rules. It is important to check details. Look for options in your area.

Many non-profits offer help for home buyers. They provide funds for down payments. Some even educate buyers. This includes workshops and counseling. Non-profits aim to support communities. They collaborate with banks and governments. These organizations focus on those in need. They help people achieve home ownership. This promotes stability and growth in communities. Always research eligibility requirements. Ensure you meet their criteria. This can be a great resource for new buyers.

Saving For A Down Payment

Making a budget is a smart way to save. Write down what you earn and spend. Find ways to spend less. Save a little each week. Watch your spending closely. Avoid buying things you don’t need. Every dollar counts. Save those dollars for your down payment.

Put your money in a safe place. Banks are good. Look for accounts that grow your money. Interest helps your money grow. Some people buy stocks. Stocks can be risky. Talk to someone who knows about stocks. Only invest what you can lose. Try saving in bonds. Bonds are safer than stocks.

Alternatives To Traditional Down Payments

Understanding “Qué Significa down Payment” opens doors to various financial options. Buyers can explore grants, negotiate seller contributions, or consider lease-to-own agreements. These alternatives make homeownership more accessible and less daunting.

Zero Down Payment Loans

Some loans need no upfront money. These are called zero down payment loans. They help people buy homes without saving a lot first. This is good for those with steady jobs but little savings. But, these loans may have stricter rules. They often require higher credit scores. The interest rates might be higher, too. So, it’s important to think carefully before choosing this option.

Private Mortgage Insurance

Private Mortgage Insurance (PMI) helps people buy homes with small down payments. It protects lenders if borrowers stop paying. People with less than 20% down payment often need PMI. PMI adds to monthly costs. But, it allows buying a home sooner. Once enough equity is built, PMI can be removed. Always check if PMI is right for you.

Common Myths About Down Payments

Many people think a down payment is always 20%. This is not true. Some loans need less than 20%. Others might need more. Some believe that first-time buyers need more money. This is also a myth. In fact, there are loans designed just for them. These loans often require less money upfront. Another myth is that gifts cannot be used as a down payment. This is false. Many loans allow gift money. But, there are rules to follow. Some also think you need perfect credit. Good credit helps, but it is not a must. Different loans have different requirements. It’s important to know the truth about down payments. Knowing the truth can save money and time.

Frequently Asked Questions

What Is A Down Payment?

A down payment is an upfront cash payment made during a large purchase, like a home. It represents a percentage of the total price. Lenders often require it to reduce risk. A higher down payment can result in better loan terms.

How Does A Down Payment Work?

A down payment reduces the amount you need to borrow. It’s paid at the closing of a purchase. Lenders use it to assess risk and determine loan terms. A larger down payment can lower your interest rates and monthly payments.

Why Is A Down Payment Important?

A down payment shows your financial commitment and reduces lender risk. It can improve your loan terms, lowering interest rates and monthly payments. A substantial down payment can also help you avoid paying private mortgage insurance (PMI).

How Much Should A Down Payment Be?

The recommended down payment is typically 20% of the purchase price. However, it can vary based on the lender and loan type. Some loans allow for lower down payments, but this might increase your interest rates or require PMI.

Conclusion

Understanding the term “down payment” is crucial for financial planning. It impacts loans, mortgages, and large purchases. A down payment often reduces the total amount financed. This, in turn, can lower monthly payments. Saving for a down payment requires discipline and planning.

It can lead to better loan terms and interest rates. Knowing its significance can empower smarter financial decisions. Always consider how much you can afford to put down. This knowledge helps in making wise investments. A well-prepared down payment strategy can ease your financial journey.