CTCの支払いはいつ開始されますか?2025年の景気刺激策の最新情報

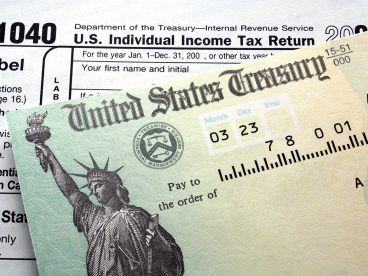

Are you eagerly waiting to find out when the 2024 Child Tax Credit (CTC) payments will start? You’re not alone.

Many families are keen to know how this financial boost will impact their budgets. Imagine the relief and possibilities that extra money could bring to your household. Whether it’s easing daily expenses, saving for the future, or treating your loved ones to something special, those CTC payments could be a game-changer.

We’ll dive into everything you need to know about the 2024 stimulus payments, ensuring you’re well-prepared and informed. Stay with us as we unravel the details and timelines so you can plan your finances with confidence.

Ctc Payments Overview

CTC payments are very important for families. They help with costs. These payments help buy food and clothes. Families need this money to live better. Each year, many families wait for these payments. They hope to get the money soon. It helps them plan better. The government sends these payments to families. They use this money to pay bills. Many families feel happy when they get the payments. They know it will help them. They want to know when the 支払い start. It is a big question each year. Everyone waits for the answer.

Legislative Background

The Child Tax Credit, or CTC, helps families with kids. It started in 1997 to support parents. Each year, the rules can change. These changes depend on new laws passed by Congress. Sometimes, the credit amount goes up. Other times, more families can get it.

In recent years, many families have relied on this credit. It helps with expenses like food and school supplies. The government decides when payments start. They check current financial needs. Then, they plan how to help families best.

In 2024, lawmakers discuss new payment schedules. They want to make sure it reaches everyone. Families should watch for updates. Knowing the timeline helps them plan better. Staying informed is key.

Key Dates For 2025

CTC payments start at different times. Always check the official dates. First payments might start in January. Some payments could be delayed. Always keep track of updates. They help you plan better. Important deadlines may change. Mark your calendar early. Stay informed through reliable sources. Government websites are good places to check. They give the most accurate info. Payments might vary by state. Each state has different rules. Families should know the rules. This helps them understand the process. 準備中 helps avoid surprises. Keep documents ready for verification. This can speed up payments. Reach out for help if needed. Many places offer guidance. Knowing the dates helps in planning. It ensures you get your payments on time.

Eligibility Criteria

その Child Tax Credit aims to help families. It’s important to know if you qualify. Families with children under 17 might be eligible. Income limits play a role. Single filers earning less than a set amount can qualify. Married couples filing jointly have a different limit. Different rules apply for head of household filers. Each child claimed must have a valid Social Security number. Families must also be US citizens or legal residents. It’s crucial to check these guidelines. Knowing them helps plan for benefits.

Application Process

Starting the CTC application is easy. Parents need to gather important documents. These include birth certificates そして Social Security numbers. They also need 収入証明. This can be a pay stub or tax return. Some families may need help. Local community centers often offer this help. It’s important to check all documents. Errors might delay your application.

Once ready, visit the official government website. Fill out the online form. Be sure to enter all details correctly. It helps to 再確認する your information. After submitting, you will get a confirmation email. This email may have a tracking number. Keep it safe. It helps in tracking your application status.

Impact On Families

その CTC payments can help many families. They provide extra money for bills, food, and other needs. This support is very important. It helps parents buy school supplies. Also, it helps families pay for healthcare. Many families need this money to live better. Without it, life can be hard. It eases stress and worries. Families can plan better with these payments. They can save for emergencies. Childcare costs can be high. This money helps cover those costs. It allows parents to work. Parents can focus on their jobs. Kids can have new clothes and toys. These payments bring hope to many homes. They make life a bit easier.

Economic Implications

Ctc payments can help families. They give money to parents. This money supports kids. It buys food, clothes, and books. Families feel less stress. They can plan better. Economies grow when families spend. Stores sell more items. Jobs increase as a result. People feel safer financially. Communities become stronger. More money means more opportunities. Kids get better education. Health improves with better access.

Businesses see more customers. They hire more workers. This helps the economy. Taxes help schools and roads. Better infrastructure benefits everyone. Local companies thrive. Families spend more at local stores. This cycle boosts the economy. It’s good for everyone. Everyone gets a chance to grow. Money boosts happiness.

Faqs About Ctc

その CTC payments are important for many families. These payments help with buying food and clothes. In 2024, the payments may start soon. Some people are waiting for the exact date. It is important to stay informed. Watching the news can help.

Families who need help can check online. Government websites have the latest information. You can ask questions there. The process is simple and easy. Many people find it helpful.

CTC payments are for children. They help parents with extra money. This money can be used for school supplies. It can also help with rent and bills. Knowing the details is important. Keep checking for updates.

Future Projections

The year 2024 brings hope for many families. CTC payments are expected to start soon. Families are eager for this support. CTC stands for Child Tax Credit. It helps families with children. The government plans to distribute these payments. タイミング is important for many people. They rely on these funds for daily needs. Experts think payments will begin early. Some say by spring, others suggest summer. Exact dates are not clear yet. Families should stay informed. Updates will come from official sources. Patience is key during this waiting period. Everyone hopes for quick action. More details will be shared soon.

よくある質問

When Will Ctc Payments Begin In 2024?

The exact start date for CTC payments in 2024 hasn’t been announced yet. Typically, payments follow legislative approval and distribution schedules. It’s advisable to stay updated through official IRS announcements. Monitoring government updates ensures you receive accurate information about payment timelines.

Are 2024 Ctc Payments Part Of A Stimulus Package?

In 2024, the CTC payments are not directly tied to a stimulus package. They are a continuation of government support for families with children. The Child Tax Credit aims to ease financial burdens and provide consistent aid.

How Do I Qualify For 2024 Ctc Payments?

Eligibility for 2024 CTC payments depends on income and family size. Generally, families with qualifying children and incomes below certain thresholds qualify. It’s important to check the latest IRS guidelines for specific eligibility criteria and ensure your information is up to date.

What Is The Maximum Ctc Amount For 2024?

The maximum CTC amount for 2024 has not been finalized yet. Typically, it considers family size and income levels. Staying informed through IRS announcements and updates will help you understand the potential benefits you might receive.

結論

The anticipation for the 2024 CTC payments is high. Knowing when they start helps families plan. Checking official updates regularly is important. Payment schedules may vary by eligibility. Stay informed through trusted sources. Understanding the process saves time and stress.

Remember to update your personal information. This ensures you receive payments on time. Planning ahead provides financial stability. Families can better prepare for future expenses. Keeping track of announcements benefits everyone. Stay proactive and informed for best results. Knowing what to expect makes a difference.

Always be ready for the next update.