タイトルローンの返済はいつまで遅れても大丈夫:ペナルティを回避するには

Finding yourself a bit behind on a title loan payment can be stressful. You’re likely worried about what happens next and how it might impact your financial future.

Relax—you’re not alone in this. Many people face similar challenges, and there are ways to navigate through them. This article will delve into just how late you can be on a title loan payment, what the consequences might be, and how you can manage the situation effectively.

By understanding your options, you can take control of the situation and make informed decisions. Stick with us to learn everything you need to know to ease your mind and regain your financial footing.

Title Loan Basics

あ title loan lets you borrow money using your car’s title. It’s a way to get cash fast. You need to own your car outright. Lenders keep your title until you pay back the loan. Interest rates can be high, so it’s important to be careful.

You give your car title to the lender. They give you money based on your car’s value. You must repay the loan to get your title back. You can still use your car during the loan period. Make sure to understand all terms before accepting the loan.

| Term | 説明 |

|---|---|

| 金利 | Can be very high. Compare before choosing. |

| ローン期間 | Usually 30 days. Some loans may be longer. |

| 返済オプション | Pay monthly or when the loan ends. |

| 延滞料金 | Fees for missing payment deadlines. |

Grace Periods Explained

Lenders often give a grace period for late payments. This is usually a few days. It can be up to 15 days. During this time, you won’t face extra charges. This helps if you are late once or twice.

Grace periods can vary by lender. Some offer a week. Others might give 10 days. Always check with your lender first. Each lender has different rules. This can change how you pay.

Your loan agreement tells you the grace period. Always read it carefully. It shows how much time you have. This helps you avoid late fees. It is important to know your terms. This keeps you safe from extra costs.

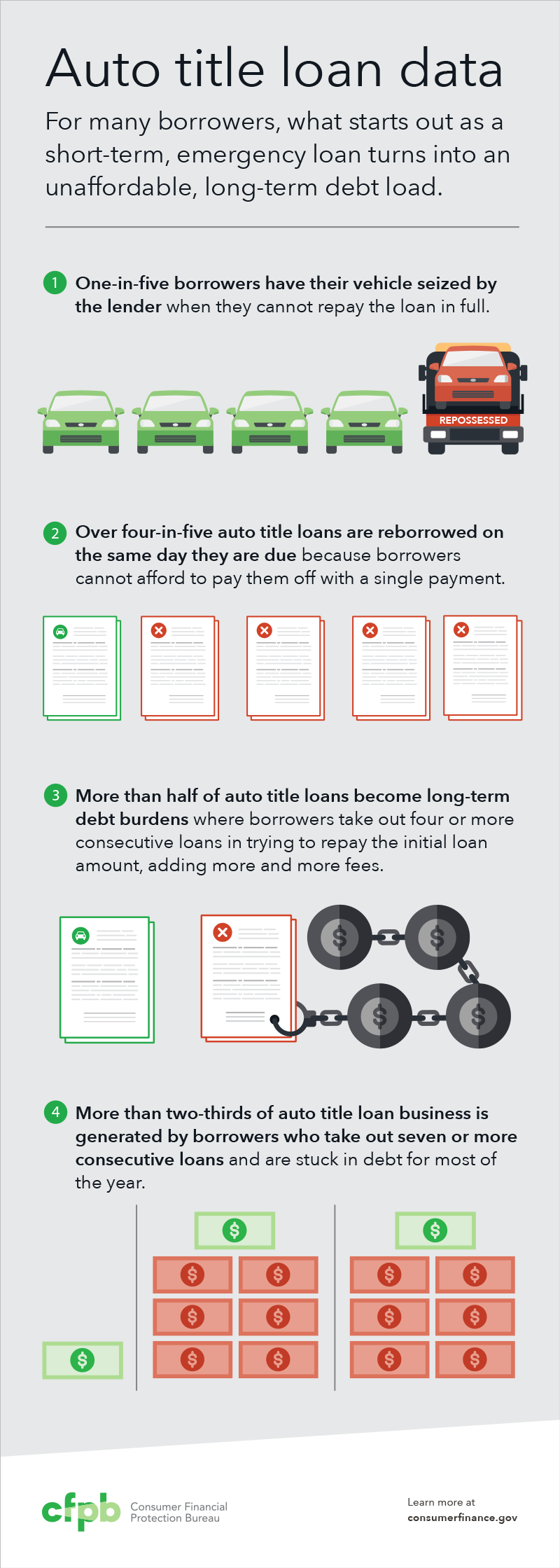

Consequences Of Late Payments

Paying late can cost you a lot. Late fees add up quickly. They increase the total amount you owe. This makes it harder to pay back your loan. Some lenders charge daily late fees. So, the more days you wait, the more you pay. Penalties can also be harsh. They might include extra charges or higher interest rates. It’s important to pay on time to avoid these extra costs.

Late payments hurt your 信用スコア. This score shows how well you handle money. A low score can make life difficult. It may be harder to get loans or credit cards. Even one late payment can lower your score. 貸し手 check this score before giving you money. So, paying late can make future borrowing difficult.

Not paying on time may lead to vehicle repossession. The lender can take your car away. This is because your car is the loan’s security. Without a car, getting to work or school is hard. Losing a vehicle causes big problems in daily life. It’s important to pay on time to keep your car safe.

Strategies To Avoid Penalties

Always talk to your lender. They can help find a solution. 説明する why you are late. 聞く for more time. 貸し手 often understand and might offer help. Keeping them informed is very important. 信頼 is key in any relationship. This includes money matters.

Never miss a payment again. セット reminders on your phone. Use calendars to mark due dates. Apps can help you remember. They send alerts when it’s time to pay. Staying on track is easier with reminders. プラン ahead and avoid stress.

Refinancing means changing your loan. It can give you better terms. Lower monthly payments make things easier. 話す to your lender about this option. They might have special offers. Refinancing can help you save money and time. It is worth checking out.

Legal Protections And Rights

Each state has its own rules. Some states have strict laws for title loans. Others may be more lenient. It’s important to know your state’s 規則. These rules can protect you. You may get extra time to pay. Or, there might be limits on fees. Always check the rules where you live.

Borrowers have rights. Lenders must follow the law. They cannot take your car without notice. You should get a chance to pay late fees. Understanding these rights helps you. You can act if a lender breaks the rules. Keep records of payments and talks with the lender. This is important if there are problems.

Sometimes, talking to a lawyer helps. They know the laws. They can explain your options. A lawyer can guide you in tough situations. They can also help if you face unfair practices. It’s good to have someone on your side. It makes you feel more secure.

Alternatives To Title Loans

Personal loans can be a good choice. Banks そして オンライン貸金業者 offer them. They can have lower 金利 than title loans. You don’t need to use your car as 担保. This means your car is safe. Choose terms that fit your budget.

Credit unions might offer better deals. They often have lower 手数料 そして 金利. Members get special benefits. You can apply easily. Credit unions care about helping people. They are community-focused.

Peer-to-peer lending connects you with individual lenders. You borrow directly from people, not banks. This can lead to better rates and terms. It’s all done online, which is convenient. You can find competitive offers that meet your needs.

Managing Financial Challenges

Budgeting Tips help you keep track of your money. Write down all your expenses and income. This shows where you can save money. Use a simple notebook or a free app. Make sure your budget is easy to understand. Try to spend less than you earn. This is a key tip. It helps you avoid late title loan payments.

緊急資金 are like safety nets. Save a little bit of money each month. Even small amounts can help. This fund is for emergencies only. It keeps you from borrowing more money. You feel safe knowing you have this money. It helps you stay calm during financial troubles.

Seeking Financial Counseling can be very helpful. Experts give advice on managing money. They help you make smart choices. They teach you how to plan your budget. You learn how to save and spend wisely. Find a counselor at local community centers. They offer free or low-cost services. These experts can guide you through tough times.

よくある質問

How Late Can I Be On Title Loan Payments?

Most lenders offer a grace period of 10 to 15 days. However, it’s crucial to check your loan agreement. Late payments can lead to additional fees and impact your credit score. If you anticipate delays, communicate with your lender immediately to explore possible solutions.

What Happens If I Miss A Payment?

Missing a payment can lead to late fees and penalties. Your lender might contact you for payment arrangements. If unresolved, there’s a risk of vehicle repossession. It’s essential to address missed payments promptly to avoid further financial consequences.

How Can I Avoid Late Payment Fees?

To avoid late fees, set reminders for due dates. Consider automatic payments for your title loan. If you foresee payment difficulties, contact your lender in advance. They might offer extensions or modified payment plans, helping you avoid extra charges.

Can Late Payments Affect My Credit Score?

Yes, late payments can negatively impact your credit score. Lenders may report missed payments to credit bureaus. This can lower your score and affect future loan opportunities. Always strive to make timely payments to maintain a good credit standing.

結論

Paying title loans on time is crucial. Late payments can lead to penalties. It may also affect your credit score. Always communicate with your lender if facing delays. They might offer solutions. This can help avoid extra fees. Prioritize your payments to avoid stress.

Understand your loan terms clearly. Keep track of due dates. Financial responsibility ensures a smoother experience. Stay informed and proactive. This will help manage your finances better. Remember, timely payments safeguard your assets. Make sure to plan ahead. Be diligent with your financial commitments.

It can save you from future troubles.