Chimeから銀行口座への送金:簡単ガイド

Have you ever found yourself needing to transfer money from your Chime account to your bank account, but not sure where to start? You’re not alone.

Many people, just like you, are looking for a quick and easy way to move their money. Imagine the relief of having your funds exactly where you need them, without any hiccups or hassles. In this guide, you’ll discover the simple steps to make this process a breeze.

Whether you’re handling an emergency expense or just organizing your finances, understanding how to transfer money efficiently can save you time and stress. Keep reading to uncover the secrets of seamless money transfers with Chime. Your financial peace of mind is just a few clicks away.

Chime Account Basics

Understanding the basics of a Chime account can simplify your financial life. Chime is an online bank offering a user-friendly interface and modern banking features. It’s designed to make managing money easier, with no hidden fees and straightforward services. Whether new to online banking or seeking convenience, Chime provides a streamlined experience. Learn how to set up your account and explore its features.

Setting Up Chime

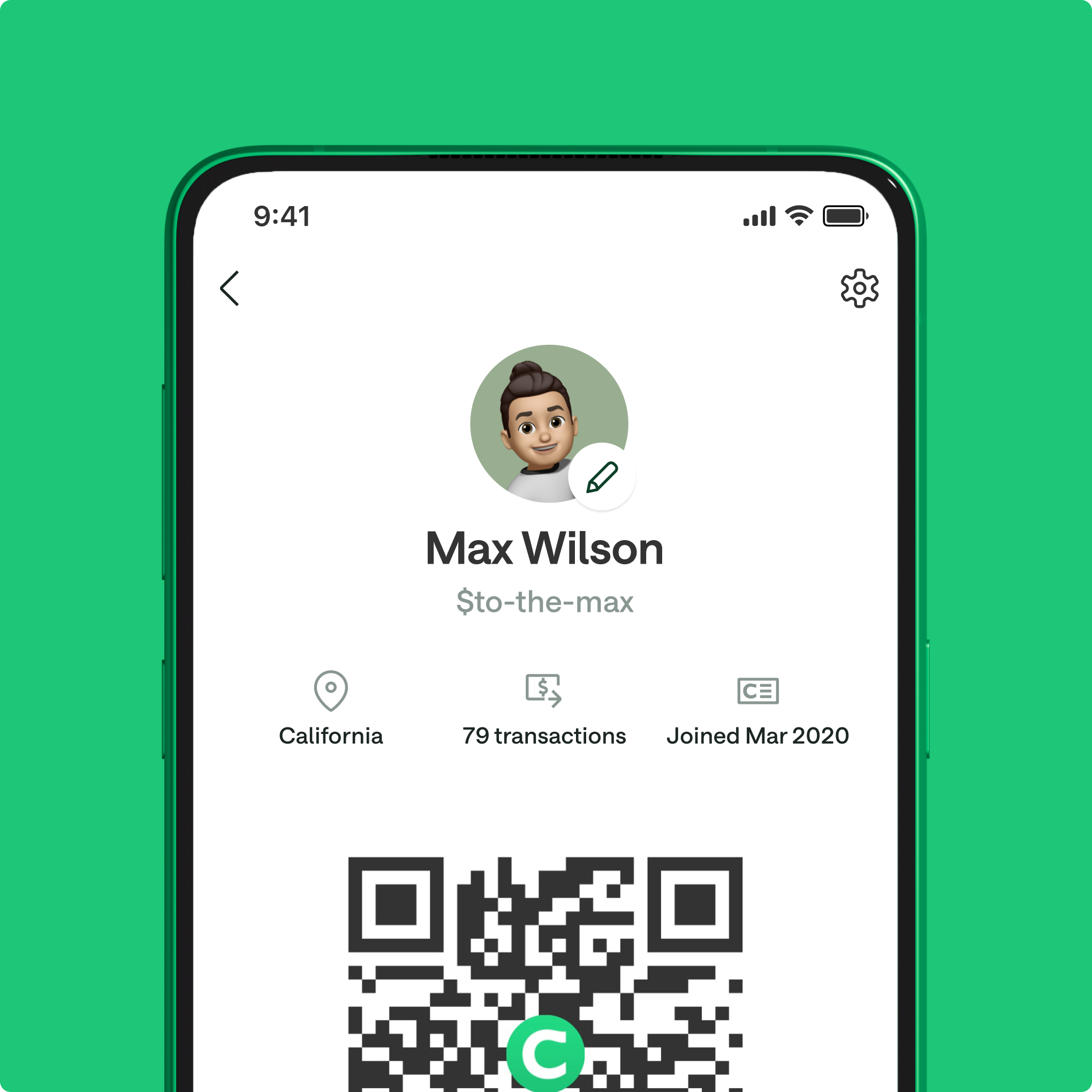

Setting up a Chime account is straightforward. Begin by downloading the Chime mobile app. The app is available for both iOS and Android devices. Follow the instructions on the app to create your account. You’ll need to provide basic personal information, such as your name and email address. Chime requires verification of identity, which is done securely within the app. Once verified, your account is ready to use.

機能と利点

Chime offers several features designed for easy banking. One popular feature is the automatic savings program. This allows you to save money effortlessly. Another feature is the early direct deposit option. It lets you access funds up to two days earlier. Chime has no monthly fees or overdraft fees. This makes it an attractive choice for budget-conscious users. The app also provides real-time alerts for transactions. These alerts help you stay informed about your account activities. Chime’s user-friendly interface enhances the overall banking experience.

Linking Bank Account

Transferring money from Chime to a bank account is straightforward. First, link your bank account to Chime. Then, use the Chime app to initiate the transfer. Funds typically arrive within one to two business days, ensuring a smooth transaction experience.

Choosing The Right Bank

Selecting a bank to link with your Chime account is a crucial step. You want a bank that aligns with your financial goals and offers the features you need. Consider factors like convenience, fees, and customer service. Think about your daily banking needs. Do you prefer a bank with a local branch for in-person visits, or are you more inclined towards online banking? Researching banks can be overwhelming, but narrowing down your priorities simplifies the decision. A friend once shared how switching to an online bank saved her time and fees. What matters most to you?検証プロセス

The verification process is essential for linking your accounts securely. It usually involves confirming your identity and bank details. You’ll typically need to provide your bank account number and routing number. Some banks might ask for additional information or small test deposits to verify ownership. This process ensures that your funds are safe and helps prevent fraud. Remember, patience is key here. A secure connection paves the way for smooth transactions. Linking your Chime account to a bank is not just about moving money. It’s about making sure your financial life is streamlined and secure. Have you ever faced challenges while linking accounts? Share your thoughts and let’s learn together.送金の開始

Transferring money from Chime to your bank account is simple and fast. Just link your accounts and select the transfer option. Follow the prompts to complete the process smoothly.

Initiating a transfer from Chime to your bank account is simple. It allows you to move funds with ease. Whether for savings or daily expenses, transferring money is essential. With Chime, the process is straightforward and user-friendly. Let’s dive into the details. ###ステップバイステップのプロセス

Begin by logging into your Chime account. Ensure your account is active. Next, navigate to the ‘Move Money’ section. This is where you start the transfer process. Select ‘Transfer Funds’ to proceed further. Choose the bank account you want to transfer to. You should have it linked already. Enter the amount you wish to transfer. Double-check the details to avoid errors. Once satisfied, confirm the transfer. Chime will initiate the process promptly. ###Using The Chime App

Open the Chime app on your smartphone. It offers a seamless experience. Tap on the ‘Move Money’ option. This is where you manage your transfers. Select ‘Transfer Funds’ to start. Choose your linked bank account as the recipient. Enter the desired amount carefully. Verify all details before proceeding. Tap ‘Confirm’ to finalize the transfer. The app will notify you once done. Transferring money via the Chime app is efficient. It provides real-time updates. You can track your transfer easily. The process is designed to be hassle-free.Transfer Timeframe

Understanding the transfer timeframe is crucial for managing your finances effectively. Knowing how long it takes to move money from Chime to a bank account helps plan ahead. This section explores the time involved and factors influencing the transfer speed.

Standard Processing Times

Transfers from Chime to a bank usually take 1-3 business days. This duration is typical for most transactions. It’s important to initiate transfers during business hours. Transfers started late may take longer due to processing delays.

Factors Affecting Speed

Several factors can impact the speed of your transfer. Bank holidays can delay the process, extending the transfer timeframe. The bank’s processing capabilities also play a role. Some banks might process transfers faster than others.

Another factor is the day and time you initiate the transfer. Transfers requested on weekends or after hours may take longer. Your internet connection and device performance can also affect the speed. A slow connection might delay the transfer request.

Keeping these factors in mind helps ensure smooth and timely money transfers. Plan your transfers accordingly for faster results.

問題のトラブルシューティング

Transferring money from Chime to a bank account should be easy. Sometimes, issues can arise. These issues can stop or delay your transfer. This section helps you solve common problems. It will guide you in contacting support if needed.

Common Problems

Incorrect bank details can cause a failed transfer. Double-check your bank account number and routing number. Make sure they are correct. Another issue is insufficient funds in your Chime account. Ensure you have enough balance before transferring. Network problems can also affect the transfer process. Try again if the transfer fails due to connectivity issues.

Contacting Support

If problems persist, contact Chime support. They are available to help. You can reach them through the Chime app. Go to the support section in the app. You may also call their customer service number. Have your account details ready when you contact support. This helps them assist you quickly and effectively.

Tips For Seamless Transfers

Transferring money from Chime to a bank account should be easy. Following simple tips can make the process smooth and hassle-free. This section offers practical advice to help users avoid common mistakes and ensure their transactions are secure.

Avoiding Common Mistakes

Double-check account numbers before starting a transfer. Incorrect numbers cause delays or failed transfers. Verify your bank account is active and can receive funds. Some accounts may have restrictions. Keep track of transfer limits on your Chime account. Exceeding these limits can lead to errors. Always review transaction details before confirming.

セキュリティの確保

Use strong passwords for your Chime account. This helps protect against unauthorized access. Change passwords regularly for added security. Enable two-factor authentication for extra protection. This adds a layer of security to your account. Never share your login credentials with anyone. Keep your account information private. Monitor transactions regularly to spot any suspicious activity. Report unusual transactions immediately.

よくある質問

How Do I Transfer Money From Chime To My Bank?

To transfer money from Chime to your bank account, open the Chime app. Tap on ‘Move Money’, then select ‘Transfers’. Enter your bank details, specify the amount, and confirm. The process typically takes 1-3 business days. Ensure your bank account is linked correctly to avoid issues.

Is There A Fee To Transfer From Chime?

No, Chime does not charge a fee for transferring money to another bank account. You can move funds without worrying about extra costs. This feature makes it convenient for users who frequently need to transfer money. Always check for any changes in terms or conditions.

How Long Does Chime Transfer Take?

Chime transfers to a bank account usually take 1-3 business days. The exact time can vary based on your bank’s processing speed. It’s important to initiate transfers early if you need funds by a specific date. Always verify your bank details for a smooth transaction.

Can I Cancel A Chime Transfer?

Yes, you can cancel a Chime transfer if it’s still pending. Go to the ‘Move Money’ section in the app, select the transaction, and choose ‘Cancel’. Once processed, cancellations may not be possible. Always double-check details before confirming any transfer to avoid errors.

結論

Transferring money from Chime to your bank is simple and efficient. Follow the steps outlined, and your funds will reach the bank smoothly. This process ensures your money moves safely and quickly. You can now manage your finances with ease.

No need to worry about complicated banking tasks. With Chime, it’s straightforward. Always double-check your details to avoid errors. Keep track of your transactions for peace of mind. Enjoy the convenience of modern banking. Your financial life just got easier.