グリーンライトカードから銀行に送金する方法:簡単ガイド

Transferring money from your Greenlight Card to your bank account might seem a bit daunting at first, but it doesn’t have to be. Whether you’re a parent managing allowances or a teen keeping track of your earnings, understanding how to move your funds efficiently is essential.

Imagine the ease and peace of mind when you know exactly how to navigate this process seamlessly. You’ll gain not just the practical skills, but also the confidence to handle your finances smartly. In this guide, we’ll break it all down into simple steps, ensuring you can transfer money with ease and control.

Ready to take charge of your money management? Let’s get started!

Greenlight Card Basics

The Greenlight Card is a modern tool that’s changing how families manage finances. It’s not just a debit card; it’s a comprehensive money management system for families. Whether you’re teaching your kids about money or simply want a convenient way to track their spending, the Greenlight Card offers unique features that make it a valuable asset. But how does it stand out, and what can it do for your family?

Features Of Greenlight Card

The Greenlight Card is packed with features designed to make financial management easy and fun. One of its standout features is the ability to set spending limits and allowances. This means you can control how much your child spends on specific categories like entertainment or groceries.

You also get real-time notifications for every transaction. This keeps you informed and involved without hovering over your child’s shoulder. The app associated with the card is intuitive and user-friendly, making it easy for both parents and kids to navigate.

Moreover, the Greenlight Card allows for savings goals. This empowers children to save for things they want and teaches them the value of delayed gratification. It’s like having a personal finance coach in your pocket!

Benefits For Families

Using the Greenlight Card can transform your family’s approach to money. It’s a tool for teaching financial responsibility in a hands-on way. When your child knows their spending is monitored, they are more likely to make thoughtful choices.

Families benefit from the card’s flexibility, as parents can adjust spending limits anytime through the app. This means you can adapt to changing needs or situations without hassle. Plus, the card can be used almost anywhere, providing convenience and peace of mind.

You might find that using the Greenlight Card fosters better communication about money. It opens up opportunities for discussions about budgeting, saving, and smart spending. Imagine your family sitting down to review the week’s expenses together—what insights might you gain from that shared experience?

Have you considered how involving your kids in financial decisions might impact their future? With the Greenlight Card, you’re not just managing money; you’re shaping your child’s financial habits for life.

Setting Up Your Greenlight Account

Setting up your Greenlight account is the first step to managing your child’s finances efficiently. This process ensures you can transfer money smoothly from the Greenlight card to a bank account. Below, you will find a detailed guide on the account registration process and linking bank accounts.

Account Registration Process

Begin by downloading the Greenlight app on your smartphone. Open the app and tap on the “Sign Up” button. Enter your email address and create a strong password. Next, provide your personal information such as name, address, and phone number. Follow the prompts to verify your email and phone number. Verification is essential for security. Once verified, proceed to set parental controls and preferences.

Linking Bank Accounts

Log in to your Greenlight account. Navigate to the “Settings” option from the home screen. Select “Link Bank Account” to start the process. Enter your bank account details carefully. Double-check for accuracy to avoid errors. Follow any additional instructions for verification. This step allows seamless transfers between the Greenlight card and your bank account. Ensure your bank account is active and ready for transactions. Linking a bank account enhances the functionality of your Greenlight account.

Transferring Money To Bank

Transferring money from a Greenlight card to a bank account is straightforward. Start by logging into your Greenlight app. Select the option to transfer funds. Follow the prompts to enter your bank account details. Confirm the transaction to successfully move your money.

転送の開始

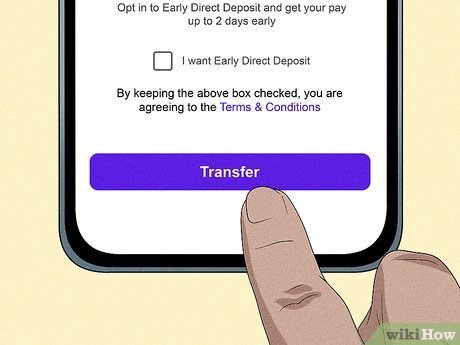

First, ensure your Greenlight app is updated to the latest version. This prevents any app-related glitches. Open the app and navigate to the “Transfer” section. Input the amount you wish to transfer. Double-check this figure to avoid errors. Select the bank account you want to transfer to, ensuring it’s already linked to your Greenlight account. After confirming the details, hit “Transfer”. You should receive a confirmation message instantly. If not, check your internet connection and try again.よくある転送の問題

Have you ever experienced a transfer delay? You’re not alone. Sometimes, bank processing times can cause unexpected delays. This usually resolves within a day or two. Another common issue is entering incorrect bank details. Double-check these to prevent failed transfers. If a transfer fails, the funds typically return to your Greenlight Card, but always verify with your bank. Ever wondered why some transfers have fees? While Greenlight typically offers free transfers, your bank may charge a fee, so it’s wise to check their policy beforehand. Being proactive can save you from unnecessary headaches. What steps do you take to ensure smooth transfers? Share your experiences and tips in the comments!

Fees And Transfer Limits

Transferring money from a Greenlight Card to a bank account involves specific fees and limits. Typically, users might face small fees based on transfer amounts. Limits can vary, often depending on the account type and the age of the cardholder.

Understanding these details ensures a smooth transaction process.

Understanding Applicable Fees

When transferring money from your Greenlight Card to a bank account, it’s important to be aware of any potential fees. Greenlight is known for its transparency, yet fees can sneak up on you if you’re not cautious. Some users have found themselves surprised by small charges that accumulate over time. It’s always a good idea to check the latest fee structure directly on Greenlight’s website or app. Are you paying more than you need to for transfers? Understanding these fees upfront can help you make informed decisions.Daily And Monthly Transfer Limits

Greenlight imposes certain limits on daily and monthly transfers, which can affect how you manage your money. These limits are in place to prevent fraud and ensure secure transactions. For instance, if you need to transfer a significant amount for an urgent payment, knowing the daily limit can help you plan ahead. Consider if these limits align with your financial habits. Could they impact your ability to access funds when you need them? By understanding these limits, you can strategize your transfers, ensuring they complement rather than hinder your financial goals. Incorporating this knowledge into your financial planning can lead to smoother transactions and avoid unnecessary delays. Knowing fees and limits is not just about saving money, but also about optimizing your financial strategy.セキュリティ対策

Transferring money from your Greenlight Card to a bank account requires security. Understanding the security measures ensures your transactions remain safe. Greenlight provides robust security features to protect your funds.

Ensuring Safe Transactions

Greenlight employs advanced encryption technology. This keeps your personal and financial information secure. Every transaction is monitored in real-time. This helps detect any unusual activity quickly. Greenlight uses two-factor authentication. It adds an extra layer of security to your account.

Fraud Protection Features

Greenlight offers comprehensive fraud protection. It safeguards your financial activities. If suspicious activity is detected, you get instant alerts. This allows you to take quick action. Greenlight also provides zero-liability protection. You won’t be responsible for unauthorized transactions. Regular account monitoring helps maintain security. These features ensure your money stays safe.

Troubleshooting And Support

Transferring money from a Greenlight card to a bank account is straightforward. Begin by logging into your Greenlight app. Follow the prompts to initiate the transfer, ensuring your bank details are accurate for smooth processing.

カスタマーサービスへのお問い合わせ

When you run into a problem, reaching out to customer service can feel like a lifeline. Greenlight offers various ways to contact their support team. You can call them directly or use their chat feature through the app for quick assistance. If you prefer written communication, email support is a reliable option. Make sure to have your account details ready. This helps them assist you faster. Have you ever had to wait on hold forever? Consider calling during less busy hours, like early morning, to get quicker responses.Faqs And Common Solutions

Before contacting support, check out the FAQs section. It’s often packed with solutions to common problems. You might find answers to questions like, “Why is my transfer taking so long?” or “What do I do if my transfer fails?” Sometimes the issue is as simple as entering incorrect bank details. Double-check everything—it’s a simple step that can save a lot of time. Have you tried restarting the app? It might sound basic, but this often resolves minor glitches. Do you know what to do if your card is lost or stolen? FAQs can guide you on steps to freeze your card and prevent unauthorized access. Troubleshooting can be frustrating, but with the right support, you’re never alone. What’s been your most challenging issue with money transfers? Share your experiences and solutions to help others on their journey.よくある質問

How To Link Greenlight Card To Bank Account?

To link your Greenlight card to a bank account, log into the Greenlight app. Navigate to the settings and select ‘Bank Accounts. ‘ Follow the prompts to add your bank account details. Ensure you have your bank routing and account numbers ready for a smooth setup.

Can You Transfer Money From Greenlight To Bank?

Yes, you can transfer money from your Greenlight card to a bank account. Access the Greenlight app, select ‘Transfer Funds,’ and choose your linked bank account. Follow the on-screen instructions to complete the transfer. Ensure your bank account is verified for a successful transaction.

送金には手数料がかかりますか?

Greenlight typically does not charge fees for transferring money to a bank account. However, check your bank’s policies for any potential fees on receiving transfers. Always review the latest Greenlight terms for any fee updates. Ensure you understand any costs involved before proceeding with the transfer.

送金にはどれくらい時間がかかりますか?

Transfers from Greenlight to a bank account usually take 3 to 5 business days. The exact time can vary based on your bank’s processing speed. Always monitor your app for updates on transfer status. If delays occur, contact Greenlight support for assistance.

結論

Transferring money from a Greenlight card to a bank account is simple. Follow the steps outlined, and you will complete the transfer smoothly. Remember to double-check your bank details for accuracy. This ensures your money reaches the right place. Always keep your Greenlight and bank account information secure.

Understanding the process can save you time and stress. Now, you can manage your finances with ease. Feel confident in handling your money transfers. Financial control is at your fingertips. Happy banking!