頭金にハードマネーローンは使える?今すぐチェック

Are you on the brink of purchasing your dream property but facing challenges with the down payment? You’re not alone.

Many prospective homeowners like you often find themselves in a tight spot when it comes to gathering enough funds to cover that initial payment. This is where the concept of using a hard money loan for your down payment comes into play.

But is it a viable option? Could it unlock the doors to your new home? As you explore this intriguing possibility, you’ll want to understand both the potential benefits and the pitfalls. Let’s dive into whether a hard money loan might just be the key to making your homeownership dreams a reality. Stay with us as we uncover the ins and outs of this financial strategy that could potentially transform your path to homeownership.

What Is A Hard Money Loan?

A hard money loan is a type of short-term loan. It is secured by real estate. Private investors or companies give these loans. They do not focus on credit scores. The property value matters more to them. Interest rates are usually higher. The loan period is often short, like 1 to 5 years. Borrowers use their property as 担保. Quick approval can be a benefit. This loan is helpful for real estate investors.

These loans have 高金利. Lenders focus on property value. Credit scores matter less. The loan term is short, often 1 to 5 years. Borrowers use property as 担保. Approval is faster than traditional loans. Private lenders offer hard money loans. They are not banks. These loans are used for quick real estate deals. They require large down payments.

Hard money loans help in house flipping. Investors buy and fix homes quickly. They sell them for profit. These loans are good for quick purchases. Investors buy properties without waiting for bank approvals. They are useful for auctioned properties. Investors can buy properties at real estate auctions. Hard money loans are also used for commercial real estate. Investors use them to buy, fix, and sell buildings. Fast action is often needed in real estate. Hard money loans help with fast buying.

How Hard Money Loans Work

Hard money loans have different rules. Traditional banks use credit scores. Hard money lenders focus on property value. They care less about your credit. These loans are often short-term. Terms can last from six months to a few years. Borrowers get funds quickly. They must show the property as 担保.

Interest rates are higher than bank loans. Rates can be between 10% and 15%. Borrowers need to repay fast. Payments are often monthly. Some loans require a balloon payment. This means paying off the rest at the end. If you miss payments, you might lose your property. Borrowers must plan carefully.

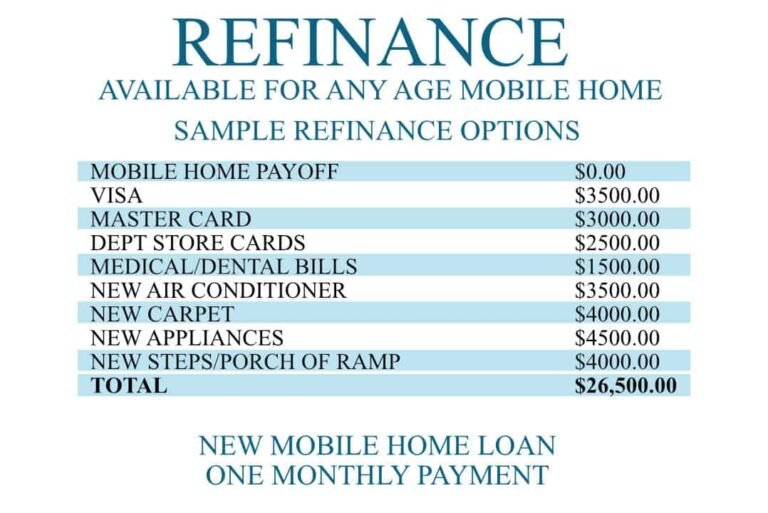

Using Hard Money For Down Payments

Hard money loans are quick to get. Approval is fast. Often within days. This helps buyers act fast on deals. No credit score needed. Instead, the property is the focus. This can be good for those with poor credit. 柔軟な条件 make these loans attractive. Lenders might be more open to negotiation. This can help tailor the loan to your needs. Hard money loans can also offer a chance to buy properties that banks refuse.

Hard money loans often have 高金利. This means paying more over time. Short repayment periods can be stressful. Borrowers might need to pay back in a year or less. Fees can be many. Think about origination fees and closing costs. These add up fast. Risk of losing the property is high if you can’t pay. Lenders can take it back if payments are missed. Always weigh the risks before deciding.

Legal And Financial Considerations

理解 規則 is key when using hard money loans. Some loans have strict rules. These rules can vary from place to place. It’s important to know local laws. Hard money lenders might have different requirements. Always check if you need a license. Some places demand permits for certain loans. Talk with a lawyer if you need help. They can explain complex rules.

Hard money loans can affect your 財務計画. They often have high interest rates. This can change your budget. Plan for 追加費用. Loans may need quick repayment. Check your cash flow before deciding. Calculate how it affects your savings. It’s wise to think ahead. Understanding loan terms is crucial. Make sure your plan is clear. This way, you avoid surprises.

Alternatives To Hard Money Loans

Banks offer loans for buying homes. These loans have 低金利. But they need good credit scores. People also need to show 安定した収入. Another option is 信用組合. They work like banks but might offer better deals. They are good if you are a member.

Seller financing is one option. Here, the seller acts like the bank. This can be faster and easier. Then there is lease-to-own. Renters can buy the house after renting. It helps save for a down payment. Peer-to-peer lending is another choice. People lend money to each other online. It might have higher rates but can be flexible.

Expert Opinions And Advice

Real estate professionals often suggest caution with hard money loans. They are quick and easy but come with higher risks. These loans have 高金利. Understand the terms fully before deciding. Experts warn about 潜在的な落とし穴. It’s important to weigh the pros and cons.

- Read the loan agreement 気をつけて。

- Ask for clarifications if unsure.

- Consult with a financial advisor.

- Compare with other loan options.

- Understand the repayment schedule.

Case Studies And Examples

Exploring the use of hard money loans for a down payment reveals varied case studies. Some show success, while others highlight risks. Understanding these examples can help you decide if this financing option fits your needs.

Successful Uses Of Hard Money

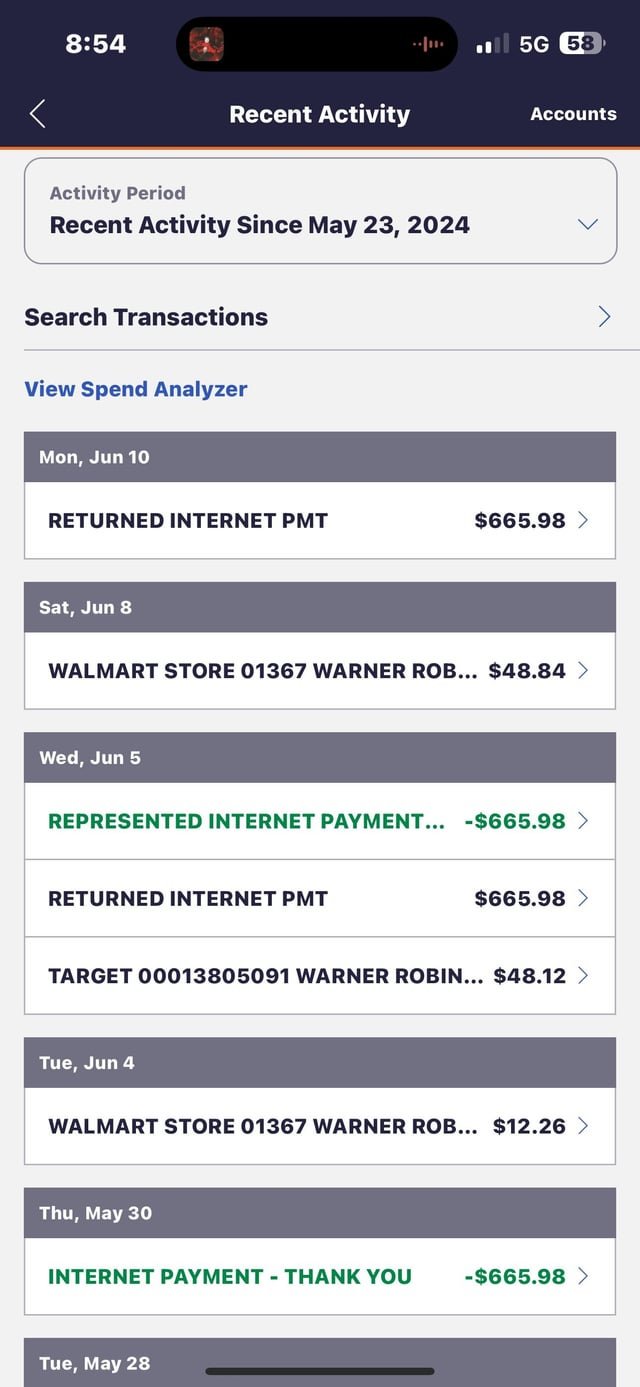

Many people use hard money loans for down payments. This helps them buy properties. Jane used a hard money loan for her first home. She paid back the loan quickly. Her success shows that hard money can work well. John also used hard money for his business. He bought a shop with this loan. John paid the loan back fast. This helped him grow his business. Many people find hard money loans helpful. They use them to start projects. These loans are not for everyone. But they can be helpful for some.

Lessons From Failed Attempts

Some people fail with hard money loans. They can’t pay back the money. Sam borrowed too much. He lost his property. Hard money loans have high interest rates. This makes them risky. Tina used a hard money loan for a home. She didn’t plan well. Tina lost her home because of the loan. It’s important to plan and budget. Hard money loans need careful use. Some people fail when they rush. They don’t think about risks. Hard money loans can be tricky.

:max_bytes(150000):strip_icc()/terms_h_hard_money_loan-FINAL-b9af7690939e45d5a80e25ee55c83d40.jpg)

よくある質問

What Is A Hard Money Loan?

A hard money loan is a short-term, asset-based financing option. It’s primarily secured by real estate. Investors or individuals with poor credit often use it. It usually comes with higher interest rates. Hard money loans are popular in real estate investment.

They offer quick access to funds.

Can Hard Money Loans Cover Down Payments?

Hard money loans rarely cover down payments directly. They’re typically used for purchase and renovation costs. Lenders usually require a significant down payment from the borrower. This reduces their risk. However, borrowing for a down payment might be possible through creative financing strategies.

Are There Alternatives To Using Hard Money?

Yes, there are alternatives to hard money loans. Consider conventional mortgages, FHA loans, or VA loans. These options often have lower interest rates. They’re also more suitable for long-term financing. Each has specific requirements, so evaluate your financial situation carefully.

Do Hard Money Loans Require Good Credit?

Hard money loans do not typically require good credit. Lenders focus more on the property’s value than credit scores. This makes them appealing to individuals with poor credit. However, borrowers might face higher interest rates and fees. Always assess the loan terms carefully.

結論

Hard money loans can help with down payments. They offer quick funds. But, they come with high interest rates. Borrowers should weigh pros and cons. Research is key. Understand terms before deciding. Consider your financial situation. Seek expert advice if needed.

Always make informed choices. Ensure the loan fits your needs. Smart planning leads to wise investments. Choose what benefits you most. Stay informed and prepared. Making the right decision matters. Financial health is crucial. With proper steps, you can achieve your goals.

Keep learning, keep growing. Your future depends on today’s choices. Make them wisely.