SSDIの遡及給付はどこまで遡れるのか:限度額を明らかにする

Imagine finally receiving the news that your Social Security Disability Insurance (SSDI) application has been approved. Relief washes over you, but then another pressing question arises: How far back can retroactive SSDI payments go?

Understanding this could mean a significant financial relief for you and your family. We’ll unravel the complexities of retroactive payments and help you uncover what you rightfully deserve. Your financial stability and peace of mind are just a few paragraphs away.

Dive in to ensure you’re not leaving any money on the table.

Retroactive Ssdi Payments Explained

Retroactive SSDI payments help people who waited for approval. These payments cover the time before getting benefits. The Social Security Administration decides the start date. This date is called the onset date. Onset date is when the disability began. Payments can go back up to 12 months. It depends on when the application was filed. Approval process can take a long time. This affects how far back payments go. Understanding retroactive payments is important. It helps claimants plan their finances. Knowing these rules can ease stress. It ensures proper support during waiting periods.

Eligibility Criteria

その disability onset date is very important. It is the day your disability began. Social Security uses this date to decide your benefits. The earlier this date, the more retroactive payments you might get. So, knowing the exact date can help you a lot.

あなたの application date affects your payments too. You can get benefits up to 12 months before this date. But only if your disability started earlier. This means applying soon is very important. Waiting too long might mean less money.

Look-back Period

The typical look-back period for SSDI is 12 months. This means you can get payments for up to one year before applying. The Social Security Administration checks if you were eligible during this time. 資格 depends on your disability and work history.

In certain cases, the period can be longer. For example, if a disability was hard to diagnose, you might qualify for more months. Some medical conditions take time to confirm. Your doctor’s reports can help in such cases. Always provide complete medical records. It can make a difference in your case.

Calculating Retroactive Payments

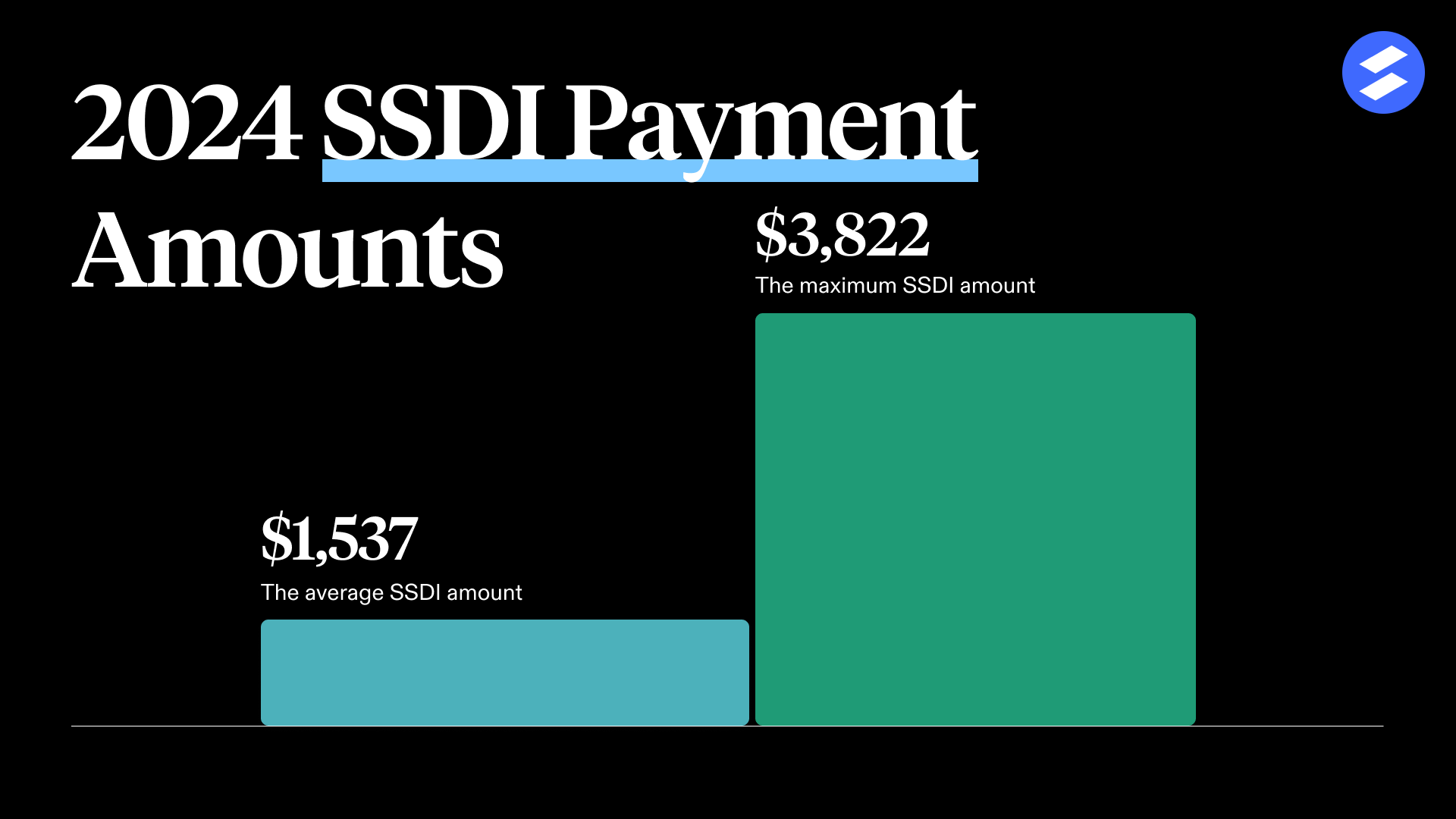

その Monthly Benefit Amount is crucial for calculating retroactive payments. Social Security Disability Insurance (SSDI) provides monthly payments. Each payment depends on the earnings record. Higher past earnings mean larger benefits. The amount can change due to cost-of-living adjustments. Understanding this helps in calculating the total retroactive payment.

その Total Retroactive Amount combines all past unpaid benefits. It includes monthly benefits from the date of disability approval. Retroactive payments can be for up to 12 months before application. This ensures fairness and support for those waiting for approval. Knowing the total helps manage finances wisely.

よくある誤解

Many people think they can get unlimited back pay from SSDI. This is not true. The maximum is usually 12 months. People believe they can get more if they wait. This is a myth. The waiting does not increase the maximum months. The rule remains the same. Understanding this can help manage expectations.

Some believe applying sooner gets them more money. This is not correct. Timing affects when you start getting paid, not how much. The retroactive pay still has limits. It does not depend on how early you apply. Knowing this can help in planning. It helps avoid confusion about SSDI payments.

Legal And Policy Framework

その Social Security Act sets rules for SSDI payments. It defines how far back payments can go. Retroactive payments depend on the application date. These payments may go back up to 12 months. Claimants need medical proof of disability. This proof must show disability before application date. Medical evidence is very important.

New policies affect SSDI payments. They may change how payments are calculated. Recent changes focus on speeding up the approval process. Faster approvals mean quicker payments. テクノロジー helps in faster processing. Electronic records make things easier. These records reduce errors. Changes improve access to benefits. Easier processes help many people.

受益者への影響

Retroactive SSDI payments can reach back up to 12 months before the application date. These payments significantly affect beneficiaries, providing crucial financial relief for past months without income support. Understanding this timeline is vital for applicants seeking compensation for prior periods of disability.

Financial Relief

Retroactive SSDI payments offer vital financial relief for beneficiaries. These payments help people catch up on bills そして debts. Many depend on this money for 必需品の費用. Rent, food, and health care are important needs.

These funds can ease stress and worry. They provide a safety net during tough times. This relief can help families feel more secure and stable. It is a chance to breathe easier and plan better.

Budgeting Considerations

It is smart to think about 予算編成 when receiving retroactive payments. Planning can make sure money lasts longer. Set aside funds for future bills and needs. Save a part for emergencies.

Making a list of priorities can help. Decide what is most important to spend on first. It ensures the payments are used wisely and effectively. This approach leads to better 財務管理 そして心の平安。

Steps To Maximize Payments

Keeping records is very important. Collect all medical reports and test results. This helps in showing your condition. Dates matter. Make sure to note when symptoms started. Add details about doctor visits. Organized files make the process smooth. Use folders or binders. Attach any letters from doctors. These letters should explain your health issues. Proof of work history is also needed. This includes pay stubs or tax records. The more accurate, the better your chances.

Talking to experts is helpful. They know the rules well. Lawyers understand the system. They can guide you. They check your paperwork for mistakes. Social workers can provide advice too. Their experience helps in preparing your case. Consulting them early saves time. They help in gathering important documents. Their support can reduce stress. 質問する and clear doubts. This ensures you understand every step.

よくある質問

What Is Retroactive Ssdi Payment?

Retroactive SSDI payments are benefits owed from before the claim approval. They cover the period between application and approval. These payments help bridge the financial gap for applicants. Eligibility depends on the onset date of the disability. Typically, retroactive payments can cover up to 12 months prior.

How Is Ssdi Retroactive Period Determined?

The retroactive period is determined by the disability onset date. It involves a waiting period of five months. Payments can go back up to 12 months before application. The Social Security Administration assesses medical records. Accurate documentation is crucial for determining the correct retroactive period.

Can Ssdi Payments Go Back 2 Years?

No, SSDI payments typically don’t go back 2 years. Retroactive payments can cover up to 12 months prior to application. The period is limited by the disability onset date and application timing. Understanding the rules helps manage expectations for retroactive benefits.

Are Retroactive Ssdi Payments Taxable?

Yes, retroactive SSDI payments can be taxable. Taxability depends on total income and filing status. It’s important to consult a tax professional. They can provide guidance on reporting and potential liabilities. Keeping records of payments received is essential for accurate tax filing.

結論

Understanding retroactive SSDI payments is crucial for beneficiaries. It determines past due benefits. Knowing the time frame helps in planning finances better. Retroactive payments can ease financial stress. They cover months waiting for approval. Always check eligibility for these benefits.

Consulting an expert can clarify your rights. It ensures you receive what you’re owed. This knowledge empowers your financial decisions. Stay informed and proactive. It helps secure your rightful benefits.