How to Transfer Money from LLC to Personal Account: Safely

Have you ever wondered how to smoothly transfer money from your LLC to your personal account? You’re not alone.

Navigating the financial landscape can feel overwhelming, especially when it involves your hard-earned business profits. You might worry about making a mistake that could cost you money or even attract unwanted attention from the IRS. But, rest assured, you’re about to discover a simple and efficient way to handle these transfers without stress or confusion.

By understanding the correct processes, you can ensure your transactions are not only legal but also optimized for your financial benefit. Stick with us as we demystify this process, empowering you to handle your finances with confidence and clarity. Your peace of mind is just a few steps away.

Understanding Llc And Personal Accounts

Transferring money from an LLC to a personal account involves careful steps. Understand tax implications and consult with a financial advisor for guidance. Ensure all transactions comply with legal requirements to avoid penalties.

Understanding the distinction between an LLC and a personal account is crucial when you aim to transfer money between the two. Having clarity on these accounts not only helps in maintaining legal and financial compliance but also optimizes your financial management. Let’s break down what each account entails and how they function in a business context.What Is An Llc Account?

An LLC, or Limited Liability Company, is a business structure that offers personal liability protection to its owners. An LLC account is used to manage the finances of this entity separately from personal funds. It helps in keeping business transactions transparent and organized. LLC accounts are essential for tax purposes and can simplify the process of tax filing. Imagine having all your business expenses neatly recorded in one place—no more scrambling through personal expenses to find that one business receipt.What Is A Personal Account?

A personal account is your individual bank account, used to manage personal finances. This account is crucial for day-to-day transactions, savings, and personal financial management. Using a personal account for business purposes can complicate things. Mixing business and personal funds can lead to accounting errors and legal issues, especially during tax season.The Importance Of Keeping Them Separate

Keeping LLC and personal accounts separate is not just a best practice; it’s a necessity. This separation ensures clarity, protects personal assets, and simplifies financial tracking. For instance, when I first started my business, I learned the hard way how intertwined finances could lead to confusion. By separating my accounts, I gained better control over both my personal and business finances.Legal Implications Of Mixing Accounts

Mixing personal and LLC accounts can lead to legal complications. It can potentially result in what’s known as “piercing the corporate veil,” where your personal assets might be at risk if your business is sued. To avoid this, it’s vital to maintain a clear boundary between your personal and business finances. Would you risk your personal savings over a simple oversight?Practical Steps To Maintain Separation

– Open Separate Accounts: Ensure you have both personal and LLC accounts with distinct account numbers. – Use Business Credit Cards: This helps in tracking business expenses and building business credit. – Document Transactions: Keep detailed records of all transactions between your LLC and personal account. – Consult Professionals: Regularly consult with a financial advisor or accountant to ensure compliance and optimal financial practices.Why This Matters For Your Financial Health

Managing separate accounts is not just about compliance; it’s about peace of mind. When your personal and business finances are well-organized, it reflects positively on your financial health. This organized approach can lead to better financial decisions and ultimately, a more successful business. How do you plan to manage your accounts to ensure financial clarity and security?

Considerazioni legali

Transferring money from an LLC to a personal account involves understanding legal considerations. Ensure compliance with tax laws and maintain clear records. This helps avoid potential legal issues and keeps financial transactions transparent.

Implicazioni fiscali

Moving funds from your LLC to your personal account can have tax consequences. You might wonder if these transfers are taxable. The answer depends on your LLC’s tax classification and how you report income. If your LLC is a pass-through entity, you might already be taxed on the income whether or not you withdraw it. If it’s taxed as a corporation, dividends can lead to double taxation. Understanding your tax obligations is essential to avoid surprises during tax season.Conformità alle normative

Are you aware of the regulations governing LLC transactions? Failing to comply can lead to penalties or legal troubles. It’s vital to ensure that the transfer aligns with your LLC’s operating agreement and state laws. For instance, some states require detailed records of financial transactions to maintain limited liability status. Keeping meticulous records of your transfers not only ensures compliance but also protects your LLC’s integrity. Consider if there are any restrictions in your operating agreement regarding distributions. Are there specific conditions under which you can move funds? Clarifying these points can save you from potential legal headaches. Navigating the legal landscape of transferring money from your LLC requires careful attention. Have you checked with a legal advisor to ensure all your actions are above board? This step might be the difference between smooth operations and future complications. Understanding these legal considerations can help you manage your finances more effectively and avoid unnecessary risks. Are you prepared to make informed decisions when transferring money from your LLC?Methods Of Transferring Money

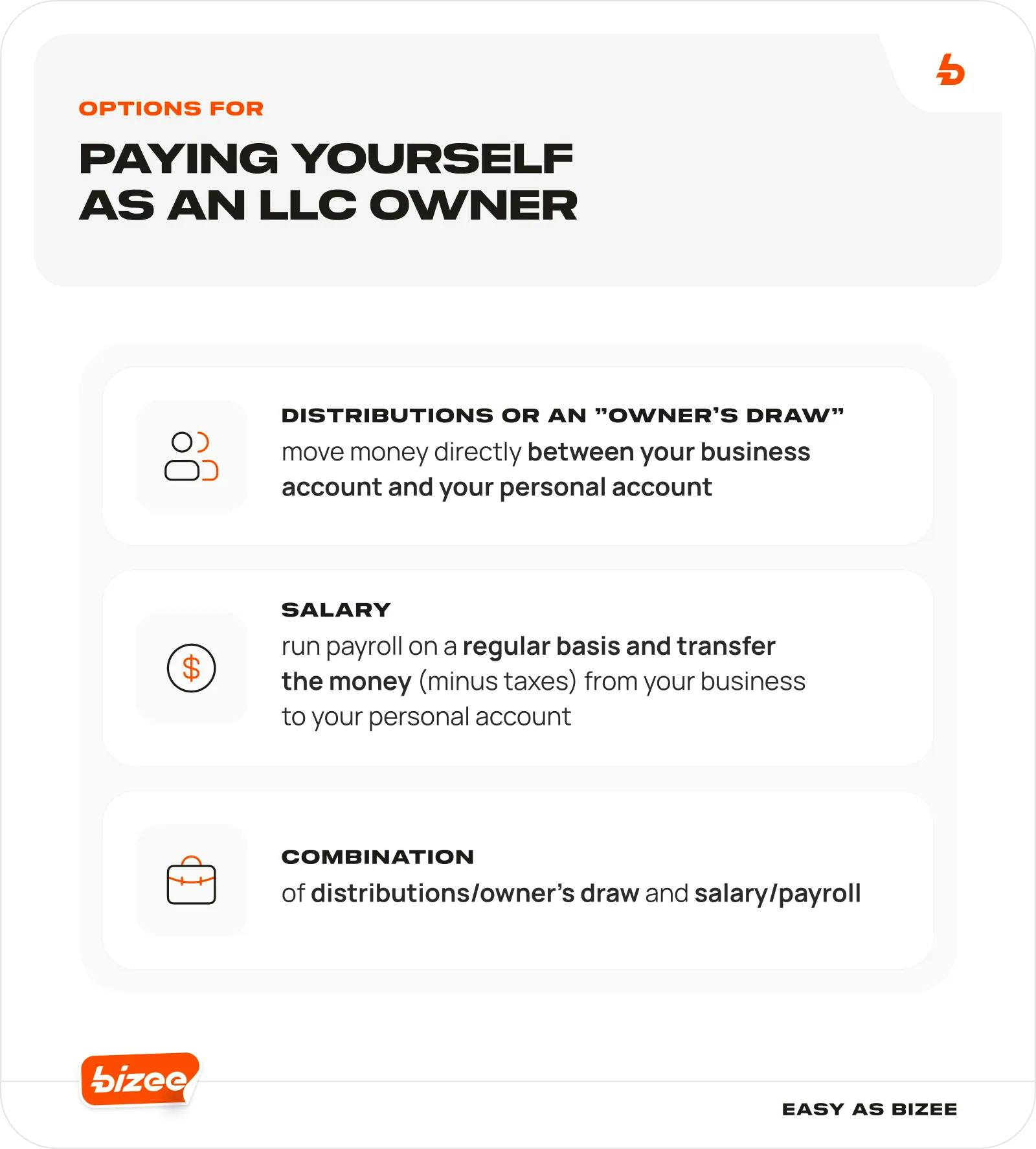

Transferring money from an LLC to a personal account is a common need for business owners. Understanding the right methods to do this legally and efficiently is crucial. Whether it’s compensating yourself for your hard work or reimbursing business expenses, choosing the appropriate method can save you from future headaches. Let’s dive into some practical ways you can make these transfers smoothly and without any tax issues.

Sorteggio del proprietario

Owner’s draw is one of the simplest ways to move money from your LLC to your personal account. It’s straightforward and flexible, allowing you to take out funds as needed. Just remember to keep records of each draw to avoid any tax complications. For instance, if your LLC made a profit and you want to pay yourself, an owner’s draw is an ideal way.

Think about how often you should draw money. Does a monthly draw suit your lifestyle, or do you prefer taking smaller amounts more frequently? Balancing your personal needs with the business cash flow is key.

Payroll Distribution

Paying yourself through payroll can be a structured way to transfer money. This method involves setting a regular salary, which can help with budgeting and planning. It’s also advantageous for tax purposes, as payroll taxes are automatically deducted.

If your LLC is taxed as an S Corporation, this method becomes almost essential. It helps you comply with IRS regulations by paying yourself a reasonable salary. Is your salary reflecting the value you bring to your business?

Reimbursement For Expenses

Reimbursement for expenses is a practical method when you’ve used personal funds for business expenses. Keep meticulous records of these expenses to ensure smooth reimbursements. This method not only transfers money but also keeps your business finances transparent.

Think about the last time you paid for a business trip or office supplies out of pocket. Submitting these expenses for reimbursement can ease your personal cash flow. Are you keeping track of all deductible expenses to maximize your reimbursements?

In considering these methods, it’s important to choose what aligns best with your business structure and personal financial goals. How will you ensure that your method of transferring money supports both your business growth and personal financial health?

Documenting Transactions

Transferring money from an LLC to a personal account requires careful documentation. It’s important to ensure proper records for tax purposes. Always consult with a financial advisor to follow legal guidelines and maintain accurate transaction logs.

Transferring money from your LLC to your personal account involves more than just hitting a transfer button. It requires careful documentation to ensure everything is above board and transparent. Documenting transactions is not just a bureaucratic necessity; it’s your shield against potential legal and tax issues. It provides a clear picture of your financial landscape, helping you navigate the complexities of business ownership with confidence. ###Maintaining Accurate Records

Keeping accurate records is your first line of defense in documenting transactions. Each transfer should be recorded meticulously, noting the amount, date, and purpose. Imagine if a tax audit happened tomorrow. Would your records hold up? Your LLC’s financial health depends on it. Ensure each transaction is logged in your accounting software, or keep a dedicated ledger. This practice not only protects you but also helps in analyzing cash flow patterns. ###Creating A Paper Trail

A well-documented paper trail is crucial. It’s like leaving breadcrumbs for future reference. You’ll want to have detailed documentation for each transfer, such as invoices or memos, stating the business reason for the movement of funds. Think of this as storytelling with numbers. Each document serves as a chapter in your LLC’s financial narrative. Even if it seems tedious now, you’ll thank yourself later when everything is easily traceable. Have you ever scrambled to find old receipts or emails? Avoid this stress by organizing your documents systematically. Use folders, both digital and physical, labeled with dates and transaction types. This practice not only aids in clarity but also saves you time during tax season or financial reviews. In documenting your transactions, you’re not just ticking boxes. You’re building a foundation of trust and reliability for your business and personal finances.Evitare le insidie più comuni

Transferring money from an LLC to a personal account requires understanding tax implications and maintaining proper documentation. Ensure compliance with IRS guidelines to avoid penalties. Clear records and distinguishing between business and personal funds help prevent common mistakes.

Co-mingling Funds

Keeping your business and personal finances separate is crucial. Co-mingling funds, or mixing your LLC’s money with your personal finances, can lead to legal and tax complications. Imagine receiving an IRS audit and failing to clearly differentiate between personal and business expenses—this could lead to fines or penalties. To avoid this, maintain distinct bank accounts for your LLC and personal finances. Document every transaction meticulously. Use bookkeeping software or hire a professional to track your expenses. This will make tax season less stressful and help your business appear more credible.Ignoring Legal Advice

Ignoring legal advice might seem like a shortcut, but it often leads to bigger problems. Transferring funds without consulting a legal expert could mean overlooking key regulations that protect your LLC’s limited liability status. This could expose your personal assets to unnecessary risk. Consider consulting with a lawyer who specializes in business law. They can guide you on the proper way to document transfers and ensure compliance with state laws. You might think skipping this step saves money, but how much is peace of mind worth to you? When did you last review your operating agreement? It’s a document that outlines how your LLC operates, including financial transactions. Make sure it’s up to date and reflects any changes in your business operations. Avoid these pitfalls to keep your business and personal finances in good standing. Have you encountered any of these issues before? How did you handle them? Share your experiences in the comments below.

Consulenza con professionisti

Consulting with professionals ensures proper money transfer from an LLC to a personal account. Experts guide through legal and tax implications. Simple steps protect assets and comply with regulations.

Transferring money from your LLC to your personal account might seem straightforward, but it can be fraught with complexities. Navigating these financial waters requires more than just a basic understanding of business operations. Consulting with professionals is a crucial step to ensure you’re not only complying with legal requirements but also optimizing your financial strategies. Whether it’s hiring an accountant or seeking legal guidance, having the right experts by your side can make all the difference.Hiring An Accountant

An accountant is not just a number cruncher. They’re your financial strategist. They can help you understand the intricate tax implications of moving money between accounts. Imagine you’re planning a vacation but you’re not sure about the budget. Your accountant can guide you on how much you can safely transfer, ensuring you’re not jeopardizing your LLC’s financial health. Accountants can also suggest tax-efficient methods to make these transfers. This can save you money and prevent potential issues with the IRS. Wouldn’t it be reassuring to have someone who knows the ins and outs of tax codes?Seeking Legal Guidance

Legal guidance is equally important. Lawyers can help you navigate the legal requirements and potential pitfalls. Each state may have different regulations regarding money transfers from LLCs to personal accounts. Picture yourself in a situation where you inadvertently breach legal boundaries. A lawyer can help you understand the specifics of corporate law, ensuring you’re compliant and protecting your personal assets. Have you ever thought about the consequences of mixing personal and business funds? Legal professionals can provide clarity on maintaining the integrity of your LLC and personal finances. Seeking advice from accountants and lawyers may seem like an extra step, but can you afford to overlook the complexities of financial compliance?

Domande frequenti

Can I Transfer Money From Llc To Personal Account?

Yes, you can transfer money from an LLC to a personal account. Ensure it’s a legitimate business expense or distribution. Maintain accurate records for tax purposes. Consult a financial advisor or accountant to understand tax implications and ensure compliance with legal requirements.

What Are The Tax Implications Of Transferring Funds?

Transferring funds from an LLC to a personal account can have tax implications. Distributions may be subject to income tax. It’s crucial to categorize transactions correctly and consult a tax professional to understand potential tax liabilities and ensure compliance with IRS regulations.

How Do I Record The Transfer In Accounting Books?

Record the transfer as a member’s draw or distribution in your accounting books. Ensure it aligns with your LLC’s operating agreement. Maintain clear documentation to support the transaction. Proper bookkeeping is essential for financial transparency and compliance with tax regulations.

Is It Legal To Transfer Llc Funds To Personal Accounts?

Yes, it’s legal to transfer LLC funds to personal accounts if done correctly. Ensure transfers are authorized and properly documented. Follow your LLC’s operating agreement and consult legal or financial advisors to comply with state laws and avoid potential legal issues.

Conclusione

Transferring money from an LLC to a personal account requires careful planning. Follow legal guidelines to avoid problems. Keep records of each transaction for future reference. Consult a financial advisor if unsure about the process. Use transparent methods to ensure smooth transfers.

Always stay informed about tax implications. Protect your finances by understanding all rules involved. This helps maintain the health of both your business and personal finances. Making informed decisions ensures peace of mind. With these tips, manage your money confidently and efficiently.