Can My Friend Transfer Money to My Nre Account: Quick Guide

Have you ever wondered if your friend can transfer money to your NRE (Non-Resident External) account? You’re not alone.

Many people are curious about the ins and outs of managing their finances across borders. Understanding the rules and options for transferring money is crucial, especially when it involves international boundaries. In this blog post, you’ll discover everything you need to know about receiving funds in your NRE account from friends.

We’ll simplify the legal jargon, give you practical tips, and help you make informed financial decisions. Keep reading to learn how to optimize your financial transactions and avoid common pitfalls. You won’t want to miss the valuable insights that could save you time and money.

Understanding Nre Accounts

Understanding NRE accounts is essential for non-resident Indians (NRIs). These accounts are specially designed for Indians living abroad. They help manage income earned outside India. But can your friend transfer money to your NRE account? To answer that, let’s first understand the core aspects of NRE accounts.

Purpose And Benefits

NRE accounts serve a dual purpose. They allow NRIs to hold and manage income earned abroad in Indian currency. This makes it easy to remit funds to India. The benefits are significant. Funds in NRE accounts are freely repatriable. This means you can transfer money back to your country of residence without restrictions. Also, interest earned on NRE accounts is tax-free in India.

Eligibility Criteria

Not everyone can open an NRE account. Only NRIs and Persons of Indian Origin (PIOs) are eligible. To qualify, you must live outside India for more than 182 days in a year. Proof of NRI status is required during account opening. This includes documents like a valid passport and visa. Meeting these criteria ensures you enjoy the benefits of an NRE account.

Money Transfer Basics

Transferring money, whether domestically or internationally, can sometimes feel like navigating a maze. When your friend wants to transfer money to your Non-Resident External (NRE) account, understanding the basic steps can make the process smooth and efficient. Let’s break down the essentials to help you grasp the money transfer basics.

Domestic Vs. International Transfers

One key aspect to consider is whether the transfer is domestic or international. Domestic transfers occur within the same country and typically involve fewer steps and lower costs. For instance, if your friend is in India and wants to transfer money to your NRE account, this counts as a domestic transfer.

However, if they are overseas, the transfer becomes international. International transfers usually involve higher fees and longer processing times. You might want to think about how these factors affect the amount you receive and the time it takes for the money to appear in your account.

Common Transfer Methods

There are several ways your friend can transfer money to your NRE account. A popular method is through online banking, which is fast and convenient. Many banks offer mobile apps that make the process even easier, allowing your friend to transfer funds with just a few taps on their phone.

Wire transfers are another option, particularly for international transactions. Although they might take a few days and incur higher fees, they are reliable and secure. Have you ever considered using a money transfer service like Western Union or TransferWise? These services can sometimes offer better exchange rates and lower fees than traditional banks.

When choosing a method, consider factors such as speed, cost, and convenience. Each method has its pros and cons, and what works best depends on your specific situation. Have you thought about how the choice of transfer method might affect your financial plans?

Understanding these basics can make your money transfer experience more manageable. With the right knowledge, you can easily guide your friend through the process, ensuring that the money reaches your NRE account smoothly and efficiently.

Transferring Money To Nre Account

Transferring money to an NRE (Non-Resident External) account can be simple. This account is popular among NRIs (Non-Resident Indians) for managing their income earned outside India. It allows easy repatriation of funds. With an NRE account, you can hold your foreign earnings in Indian currency. Friends or family might want to transfer money to your NRE account. But, there are specific rules and documents needed.

Who Can Transfer

Any individual with a valid bank account can transfer money to an NRE account. This includes friends, relatives, or even employers. They must transfer funds through legitimate banking channels. Money can be sent from any foreign bank account to your NRE account. Ensure the sender’s bank permits international transfers.

Documentazione richiesta

Proper documentation ensures smooth money transfers to an NRE account. The sender needs basic information about your NRE account. This includes the account number and bank’s SWIFT code. Some banks might ask for the purpose of the transfer. The sender should also keep a record of the transaction. It’s crucial for future reference and tax purposes.

Choosing The Right Transfer Method

Choosing the right transfer method for sending money to your NRE account is crucial. It can impact the speed, cost, and convenience of the transaction. With various options available, it’s important to know which method suits your needs best.

Bonifici bancari

Bank transfers are a reliable and traditional way to transfer money internationally. If your friend has a bank account, this option could be straightforward. Typically, they can initiate a transfer from their bank to your NRE account.

While bank transfers are secure, they might take several days to process. Fees vary depending on the banks involved, so it’s wise to check the costs beforehand. Imagine your friend transferring money to your account as a gift for your birthday, only for the fees to eat into the amount!

Online Payment Platforms

Online payment platforms offer a quick and convenient way to transfer money. Services like PayPal or Wise are popular for their user-friendly interfaces and competitive rates. Your friend can easily send money to your account using just your email address or phone number.

These platforms often provide real-time currency conversion, ensuring transparency. However, it’s important to check if they support transfers to NRE accounts, as restrictions may apply. Have you ever tried sending money online, only to realize the platform doesn’t support your account type?

Bonifici bancari

Wire transfers are another solid option for international money transfers. They are typically faster than regular bank transfers, though they can be pricier. Your friend needs to have your NRE account details to initiate the transfer.

It’s essential to verify that your bank accepts wire transfers, as not all do. Wire transfers are ideal for large sums, but what if your friend wants to send a smaller amount? Would the fees outweigh the benefits?

When deciding, consider the trade-offs between cost, speed, and convenience. What matters most to you? The method your friend chooses should align with your priorities.

Transfer Timeframes And Costs

Transferring money to an NRE account involves time and costs. Understanding these can help you plan better. This section will break down the transfer process. It will also explain the fees involved.

Tempi di elaborazione

Transfers to NRE accounts usually take 1 to 3 working days. The speed depends on the banks involved. Local holidays can also cause delays. Always check with your bank for specific timelines.

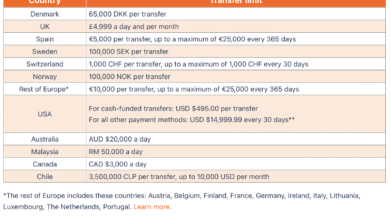

Fee Structures

Fees for transferring money can vary. Some banks charge a flat fee. Others may have a percentage-based fee. It’s important to know these before starting a transfer. Some banks offer fee waivers for certain amounts. Always read the fine print for hidden charges.

Garantire transazioni sicure

Transferring money to an NRE account can be easy and secure. This requires understanding the process and ensuring safety. Friends or relatives sending money must follow safe procedures. This guarantees the transaction remains smooth and secure. Implementing security measures protects you from potential threats. Let’s explore how to ensure safe transactions.

Safety Tips

Verify the sender’s identity before accepting any funds. Confirm personal details over a secure channel. Use strong passwords for your NRE account access. Regularly update them. Enable two-factor authentication. This provides an extra layer of security. Keep your bank’s customer service number handy. Report any suspicious activities promptly.

Avoiding Scams

Beware of phishing emails asking for sensitive information. Always double-check the sender’s email address. Avoid clicking on unknown links. Fraudsters often disguise them as legitimate. Educate your friends about common scams. They might encounter them when sending money. Use official bank websites for transactions. This reduces the risk of fraud.

Domande frequenti

Can Someone Transfer Money To My Nre Account?

Yes, your friend can transfer money to your NRE account. Transfers can be made through bank transfers or using online remittance services. Ensure that your NRE account is active and capable of receiving international transactions. Always provide accurate details to avoid transfer issues.

Are There Any Charges For Nre Account Transfers?

There might be charges for transferring money to an NRE account. The charges depend on the bank and method used. It’s advisable to check with your bank and the remittance service for exact fees. Sometimes, banks offer promotions with reduced charges for specific transactions.

What Details Are Needed For An Nre Transfer?

To transfer money, your friend needs your NRE account number, IFSC code, and bank branch details. Providing the correct details ensures successful transactions. It’s crucial to verify all information before initiating the transfer to avoid any delays or errors.

How Long Does It Take For Nre Transfers?

Transfers to an NRE account typically take 1-5 business days. The duration depends on the bank and the remittance service used. Delays may occur due to public holidays or bank processing times. Always check with your bank for specific timelines.

Conclusione

Transferring money to an NRE account is simple and secure. Friends can send funds to your account. Ensure they follow banking rules. Check for any transfer limits or fees involved. Keep your account details safe during transactions. Always verify the sender and purpose of the transfer.

This prevents potential fraud. These steps help manage transfers smoothly. The process supports easy financial connections with friends abroad. Stay informed about regulations. This ensures hassle-free transfers. It’s all about safe and efficient banking practices. Money moves easily with the right steps.

Keep your transactions secure and straightforward.