If you’ve ever accepted a credit card payment for your business, you’ve likely heard whispers about the Payment Card Interchange Fee Settlement. It’s a topic that has sparked curiosity and confusion in equal measure.

Is it a groundbreaking legal resolution or just another complex financial concept? More importantly, is it something you should be concerned about? Your curiosity might be tingling, and rightfully so. Understanding this settlement could potentially impact your business transactions and financial strategy.

We will peel back the layers of the Payment Card Interchange Fee Settlement, examining its legitimacy and what it means for you. Get ready to dive deep into a subject that could change the way you look at credit card fees forever.

History Of The Settlement

The payment card interchange fee settlement started many years ago. Banks and card companies were involved. They charged fees for using credit and debit cards. These fees were paid by stores. Stores felt these fees were too high. So, they took legal action. The case included many big names. Visa, MasterCard, and many banks were part of it. They had to discuss and settle the fees.

| Year | Event |

|---|---|

| 2005 | Stores filed a lawsuit against banks. |

| 2012 | Initial settlement was proposed. |

| 2013 | Settlement was rejected by many stores. |

| 2019 | New settlement was agreed upon. |

Details Of The Settlement

The settlement includes a large amount of money. Credit card companies will pay this money. The money is for merchants. Merchants are people who sell things. They have been charged high fees. These fees are for using credit cards. The settlement aims to reduce these fees.

Some rules will change. This change helps merchants. They can now show the true cost of fees. Merchants can pass these costs to customers. It makes pricing clear. This helps everyone understand prices better.

Legal Challenges

Determining the legitimacy of the Payment Card Interchange Fee Settlement involves understanding its legal aspects. This settlement addresses disputes between merchants and credit card companies over fees. It aims to resolve long-standing conflicts and ensure fair practices in the payment industry.

Major Lawsuits

Big lawsuits have happened over interchange fees. Many businesses think these fees are too high. They say the fees hurt their profits. They want fair fees that help all. Some lawsuits have been in court for a long time. Many companies are waiting for the final decision. They hope for a positive outcome.

Court Decisions

Courts have looked at these fees closely. Some decisions have changed fee rules. Judges want to make sure fees are fair. They look at all the facts. Sometimes, they ask companies to change their fees. Other times, they support the fees. Each decision is important for future rules. Everyone watches the courts closely. They want to know what comes next.

Stakeholders’ Perspectives

Merchants often feel the interchange fee is too high. It cuts into their profits. They want a fairer system. Lower fees could mean better prices for shoppers. Merchants also need transparency. Understanding fee calculations is important. Many believe this settlement might help. It could lead to fairer fee practices. Merchants hope for positive changes.

Credit card companies defend the fees. They say fees cover transaction costs. Security and technology are important. Fees help maintain these services. Companies believe fees are fair. They argue that the system is balanced. The settlement might bring changes. Yet, companies feel the current structure works. They prioritize safety and efficiency.

Economic Impact

Small businesses face big challenges with interchange fees. These fees cut into profits. Higher costs mean less money for growth. Small shops often pay more than big stores. This makes it hard to compete. Some shops raise prices to cover fees. Customers might shop elsewhere. Small businesses need fair fees to thrive.

Consumers feel the impact of interchange fees too. Prices can go up because of these fees. Some stores charge extra for card payments. This makes shopping more expensive. Consumers might carry more cash to avoid fees. Not everyone likes this. Fair fees help keep prices low. They benefit both shoppers and shops.

Controversies And Criticisms

Many people think the settlement is not fair. Some say big companies benefit more than small businesses. Merchants argue they pay too much in fees. They feel these fees are hidden. Others believe the process lacks transparency. Many lawsuits try to fix these issues. People want better terms for all.

Some people support the settlement. They think it helps businesses. Others disagree with the outcome. They feel small shops suffer. Many ask if the settlement is just. Others question the effects on prices. Is it good for consumers? People wonder if fees will drop. Debates continue in public spaces. Many have strong opinions.

Future Implications

The legitimacy of the Payment Card Interchange Fee Settlement raises future concerns. Understanding its impact on merchants and consumers is crucial. Potential changes in fees and business practices are worth considering.

Potential Legal Precedents

The settlement could set new legal rules for future cases. Many businesses might face similar legal challenges. Others may adapt to these new legal standards. Legal experts watch these changes closely. They want to understand the impact on laws.

Influence On Payment Systems

Payment systems might change due to this important settlement. Banks and card companies need to adapt to new rules. Transactions could become simpler or more complex. Consumers may see changes in fees or services. Businesses might adjust their payment options. Everyone waits to see what happens next.

Frequently Asked Questions

What Is The Payment Card Interchange Fee Settlement?

The Payment Card Interchange Fee Settlement is a legal agreement. It resolves claims related to interchange fees. Merchants allege that Visa and Mastercard fixed these fees. The settlement provides compensation to affected merchants. It’s part of a long-standing antitrust litigation.

How Does The Settlement Affect Merchants?

The settlement offers financial compensation to eligible merchants. Merchants must have accepted Visa or Mastercard since 2004. They can file claims to receive their share. This compensation aims to address the overcharged interchange fees. It’s a significant financial relief for many businesses.

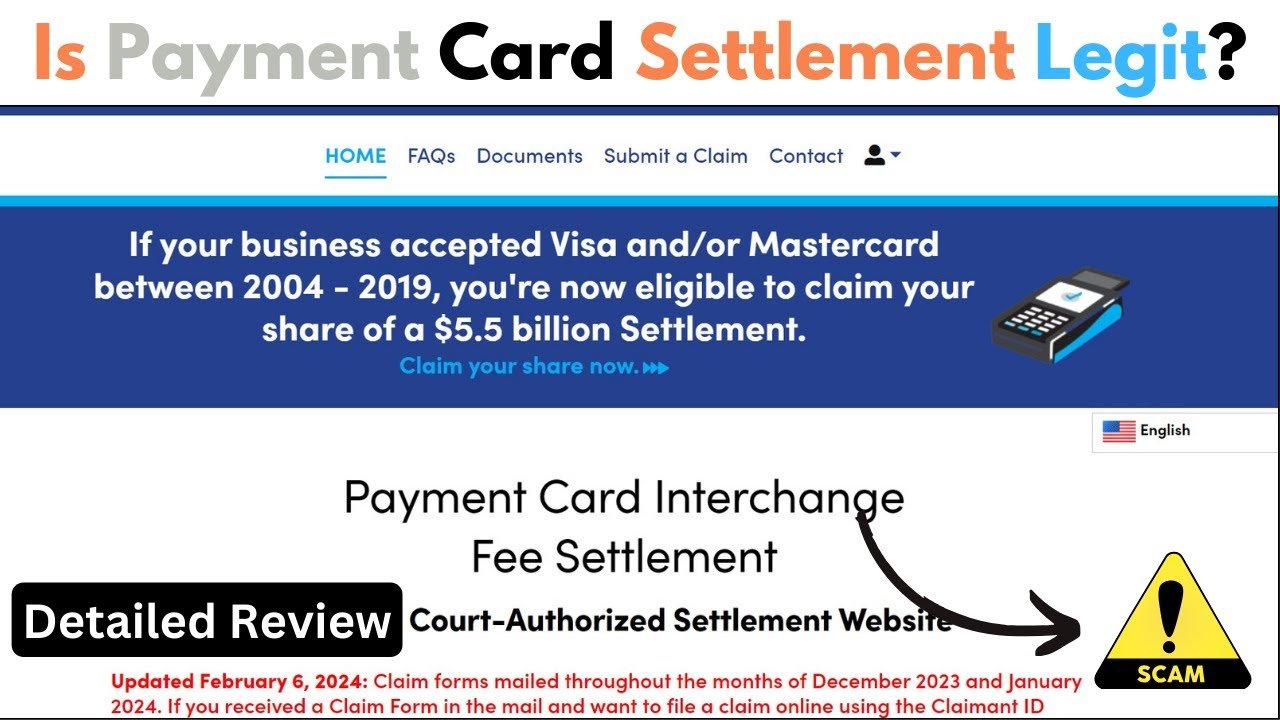

Is The Settlement Legitimate And Trustworthy?

Yes, the settlement is legitimate and court-approved. It resolves a long-standing antitrust lawsuit. The court provided preliminary approval for the settlement. It’s a legal agreement between merchants and card networks. Merchants should consult their legal advisors for more details.

How Can Merchants File A Claim?

Merchants can file a claim through the official settlement website. The website provides detailed instructions and necessary forms. It’s important to submit claims before the deadline. Merchants should gather relevant transaction records. Consulting legal counsel is advisable for accurate submissions.

Conclusion

The Payment Card Interchange Fee Settlement raises important questions. Many wonder about its legitimacy. It affects businesses and consumers alike. Understanding its implications is crucial. Some see it as a necessary step. Others remain skeptical. Legal experts have differing opinions.

Businesses should stay informed about updates. Consumers should understand their rights. Seeking professional advice can help. Staying informed is key. This settlement could have lasting impacts. Making informed decisions benefits everyone involved. Keep an eye on developments. Your awareness can make a difference.