Have you ever wondered how your credit report impacts your financial well-being? If so, you’re not alone.

Many people are curious about the intricacies of credit laws and how they affect their everyday lives. One such law, 15 U. S. C. 1681, often leaves individuals scratching their heads, especially when it comes to understanding its relation to late payments.

Is it possible that this legal code holds the key to managing your credit history more effectively? By the end of this article, you’ll uncover the truth behind 15 U. S. C. 1681 and its implications on late payments, potentially transforming the way you handle your financial future. Stay with us as we demystify this crucial legal statute and empower you to take control of your credit health.

The Essentials Of 15 U.s.c. 1681

15 U.S.C. 1681 is about credit reports. It helps keep your credit data safe. It tells how businesses must handle your credit information. Businesses need to be careful. They can’t just share your data with anyone.

This law also gives you rights. You can see your credit report. You can fix mistakes in it. You can stop unwanted credit offers. This makes it easier to manage your credit.

Credit reports are important. They affect loans and credit cards. They can affect where you live and work. So, protecting your credit data is crucial.

Understanding Credit Reporting Laws

The Fair Credit Reporting Act is a U.S. law. It controls the use of credit reports. This law helps protect people’s privacy. It makes sure reports are accurate and fair. Credit agencies must follow strict rules. They must fix mistakes fast. People can see their reports for free once a year. They can also dispute errors. The law keeps personal data safe. It limits who can see credit reports. Only approved people can access them.

Credit reporting agencies gather your credit information. They make credit reports. These reports show your payment history. Lenders use them to decide on loans. Agencies must ensure data is correct. They must update records often. Agencies must also delete old data. This keeps reports clean and current. They help in identifying fraud. They alert you if something is wrong. Agencies have a big role in your financial life.

Decoding Late Payments

A late payment happens when you don’t pay on time. Bills have a due date. Missing this date means your payment is late. Credit cards, loans, and utilities need timely payments. Even a day late can count. Always check your bill statements. Set reminders to avoid late payments. It’s important to pay on time.

Late payments can hurt your credit score. Scores drop when bills are paid late. Credit scores are important for loans. A lower score means higher interest rates. Late payments stay on records for a long time. Paying bills on time keeps scores healthy. Good credit scores help in many ways. Always pay before the due date.

Clarifying 15 U.s.c. 1681’s Stance On Late Payments

15 U.S.C. 1681, also called the Fair Credit Reporting Act, protects consumers.

It helps ensure accuracy and privacy in credit reports.

People think it handles late payments. But it mainly guides credit report practices.

It ensures only correct information is shared.

Many believe 15 U.S.C. 1681 erases late payments. That’s not true.

It does not remove late payment records. Instead, it ensures the data is accurate.

Some think it stops lenders from reporting. But lenders can share late payment info.

The law ensures fairness, but does not hide facts.

Consumer Rights Under 15 U.s.c. 1681

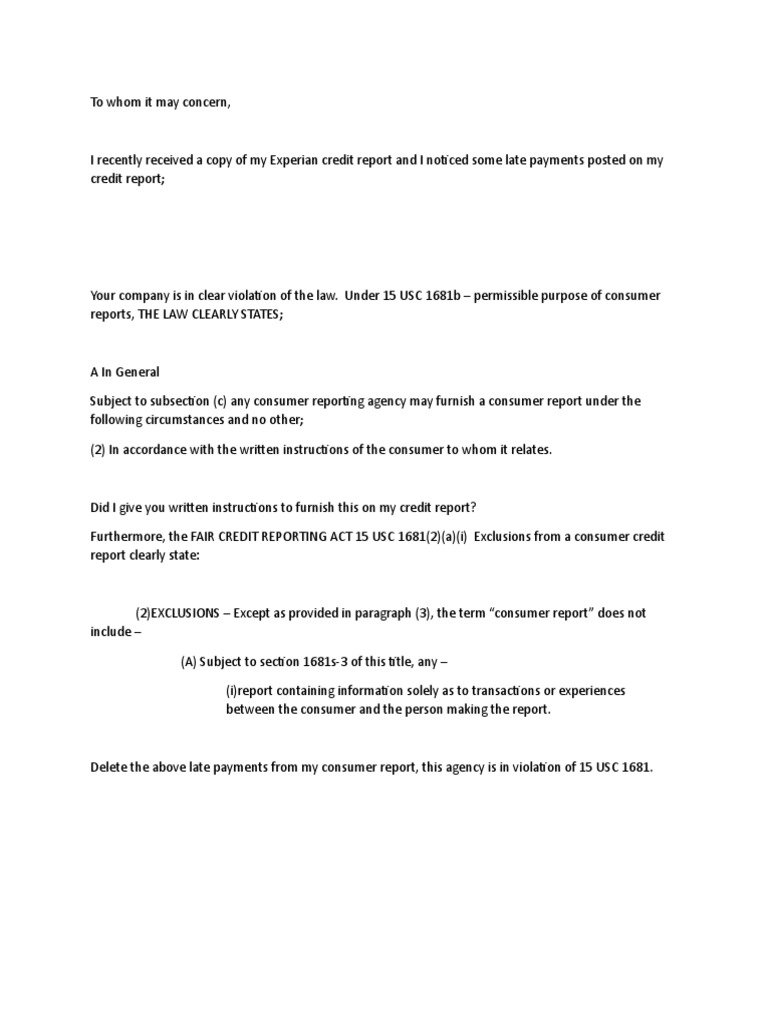

You can challenge wrong information on your credit report. This is your right under 15 U.S.C. 1681. Credit bureaus must fix mistakes. They have 30 days to do this. You need to write to them. Tell them what is wrong. Include copies of proof. Keep the originals safe. Send your letter by certified mail. Keep the receipt.

Creditors must give accurate details about your payments. Wrong information can hurt your credit score. You have the right to be protected. If errors happen, you can dispute them. This law helps you. It keeps your credit record fair. Always check your credit report. Look for mistakes. Act quickly if you find any.

Navigating Credit Report Disputes

Errors on credit reports can harm your credit score. Start by getting a free credit report. Check it carefully. Look for mistakes or wrong entries. Write a letter to the credit bureau. Explain the errors clearly. Include copies of documents that prove your claim. Send the letter by certified mail. Keep a copy for your records.

Credit bureaus must investigate within 30 days. They will contact the company that reported the error. If the error is confirmed, they will fix it. You will get a free updated report. Check this report again. Make sure all errors are corrected. Repeat the process for other bureaus if needed.

Help is available for fixing credit report errors. The Federal Trade Commission offers guidance online. Consumer protection agencies can assist. Some non-profit groups provide free advice. You can also consult a credit repair professional. Make sure they are trustworthy. Avoid scams that promise quick fixes.

Future Of Credit Reporting And Legal Reforms

Exploring the future of credit reporting reveals key legal reforms. The 15 U. S. C. 1681 addresses late payment issues. These reforms aim to enhance transparency and fairness for consumers. Understanding these changes is crucial for navigating credit landscapes effectively.

Proposed Changes To The Fair Credit Reporting Act

Experts suggest changes to the Fair Credit Reporting Act. These changes may affect how credit is reported. Late payments could be reported differently. Some proposals suggest more time before reporting late payments. This could help people avoid negative marks on credit reports.

Changes may also impact financial institutions. They might need to update systems. Reporting rules could become stricter. These changes could affect how banks decide on loans. Customers may get more accurate credit scores.

Consumers might benefit from these changes. Better credit reporting can help them get loans. It may also reduce stress. They can pay bills without worry. Financial health can improve for many people.

Frequently Asked Questions

What Is 15 U.s.c. 1681?

15 U. S. C. 1681 refers to the Fair Credit Reporting Act (FCRA). It regulates the collection and use of consumer credit information. The act ensures accuracy, fairness, and privacy of consumer information.

Does 15 U.s.c. 1681 Cover Late Payments?

Yes, 15 U. S. C. 1681 covers late payments by regulating how they are reported. Credit bureaus must ensure accuracy. Consumers have the right to dispute inaccurate reports.

How Does 15 U.s.c. 1681 Affect Credit Reports?

15 U. S. C. 1681 ensures credit reports are accurate and fair. It allows consumers to dispute inaccuracies. This act protects consumer privacy and prevents misuse of information.

Can I Dispute A Late Payment Under 15 U.s.c. 1681?

Yes, you can dispute a late payment under 15 U. S. C. 1681. Contact the credit bureau with evidence. They must investigate and correct any inaccuracies.

Conclusion

Understanding 15 U. S. C. 1681 is crucial for managing credit reports. It doesn’t directly address late payments. Instead, it focuses on fair and accurate credit reporting. Knowing your rights under this law helps protect your credit profile. Regularly check your credit report for errors.

Dispute any inaccuracies promptly. Timely payments improve your credit score over time. Stay informed and proactive. Protect your financial health. Credit impacts many aspects of life. Good credit opens doors to better opportunities. Always prioritize financial responsibility. Stay educated on credit laws and practices.

It benefits you in the long run.