Transferring money from the USA to a business account in India might seem like a daunting task, but it doesn’t have to be. Whether you’re a business owner looking to pay vendors, an entrepreneur investing in a new venture, or someone managing international financial transactions, ensuring your money reaches its destination safely and efficiently is crucial.

You might wonder about the best methods, potential pitfalls, and how to get the most value for your money. This guide will walk you through everything you need to know, from choosing the right transfer service to understanding exchange rates and fees.

You’ll gain the confidence to make informed decisions, ensuring your business thrives without getting lost in financial complexities. Ready to make your money move smarter? Let’s dive in.

Choosing The Right Transfer Method

When transferring money from the USA to an Indian business account, selecting the right method is crucial for efficiency and cost-effectiveness. Whether you’re a business owner or an individual managing international transactions, understanding the different options can save you time and money. This guide will explore several methods, helping you decide which is best for your needs.

Bank Wire Transfers

Bank wire transfers are a traditional method used by many businesses. They are reliable and secure, offering a direct way to send large sums of money. One advantage is the familiarity; most banks offer this service, making it accessible. However, fees can be high, especially for international transfers.

Have you ever wondered why banks charge so much for wire transfers? The reason lies in their thorough verification process, which ensures the safety of your funds. If your priority is security and you’re willing to pay a bit extra, bank wire transfers might be your best bet.

Online Money Transfer Services

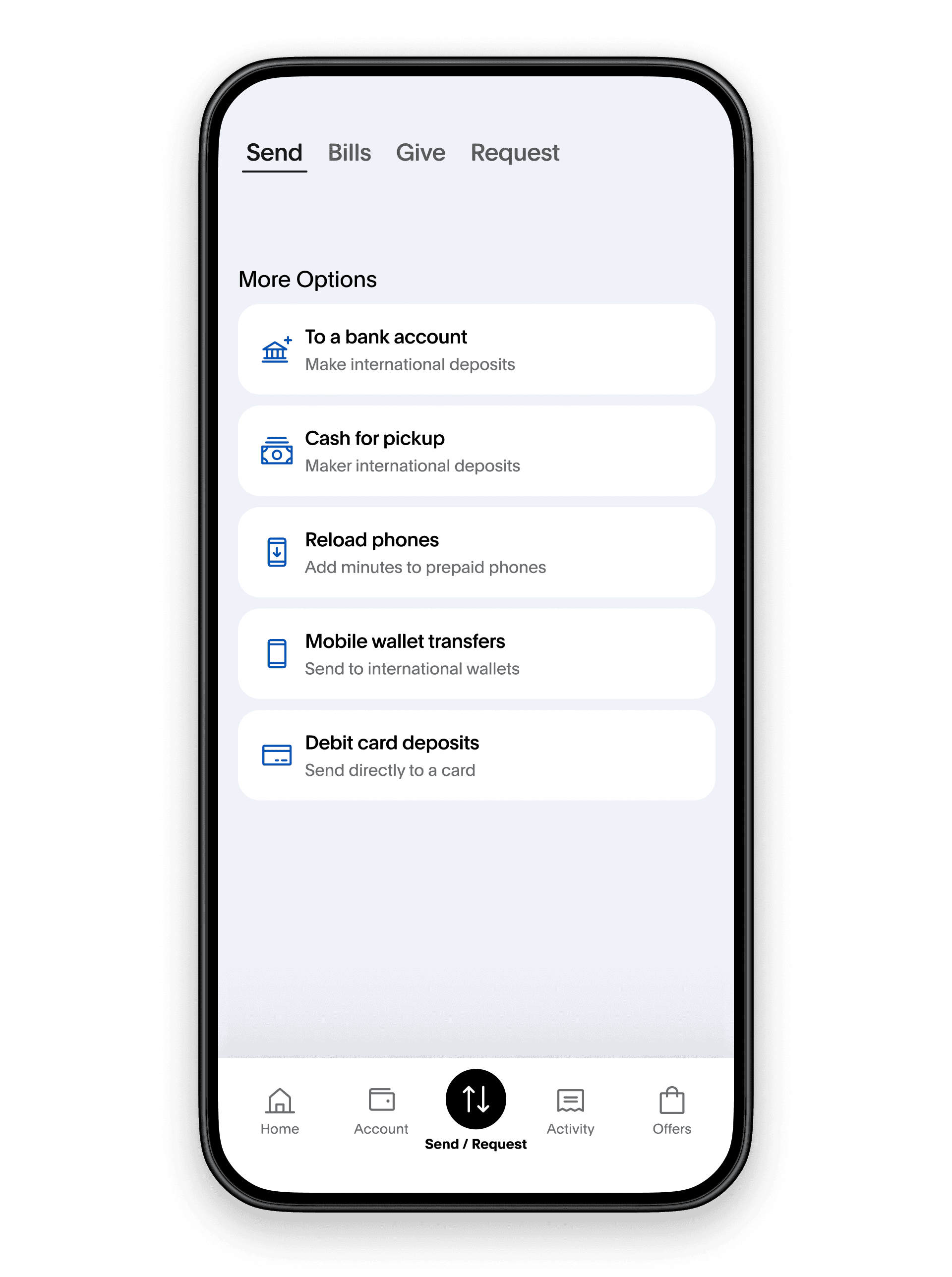

Online money transfer services are gaining popularity due to their convenience and competitive rates. Services like PayPal, TransferWise, and Xoom offer quick transfers with lower fees. They are perfect for small to medium-sized transactions.

Imagine sending money to India with just a few clicks and receiving it within hours. This is the reality with online transfer services. However, be aware of exchange rates, as they can affect the total amount received. These services often provide a real-time currency conversion rate, making it easy to compare costs.

Cryptocurrency Options

Cryptocurrency offers a modern alternative for transferring money internationally. Bitcoin and Ethereum are popular choices, allowing for fast transfers without traditional banking fees. But, the volatility of cryptocurrencies can be a concern.

Have you considered using cryptocurrency for your business transactions? It’s an option worth exploring, especially for tech-savvy individuals who understand digital currencies. But remember, while the fees are low, the value of your transfer can fluctuate dramatically.

Which method suits your needs the best? Evaluate each option based on your priorities—security, cost, speed, and familiarity. Your decision can make a significant impact on your business’s financial efficiency.

Understanding Exchange Rates And Fees

Transferring money from the USA to a business account in India involves understanding exchange rates and fees. Choose a reliable service to ensure competitive rates and lower charges. Always compare options to find the most cost-effective way to send funds.

When you’re transferring money from the USA to a business account in India, understanding exchange rates and fees is crucial. These factors can significantly impact the final amount your recipient gets. A clear grasp of these elements can save you from unexpected surprises and help you make informed decisions.

Current Exchange Rates

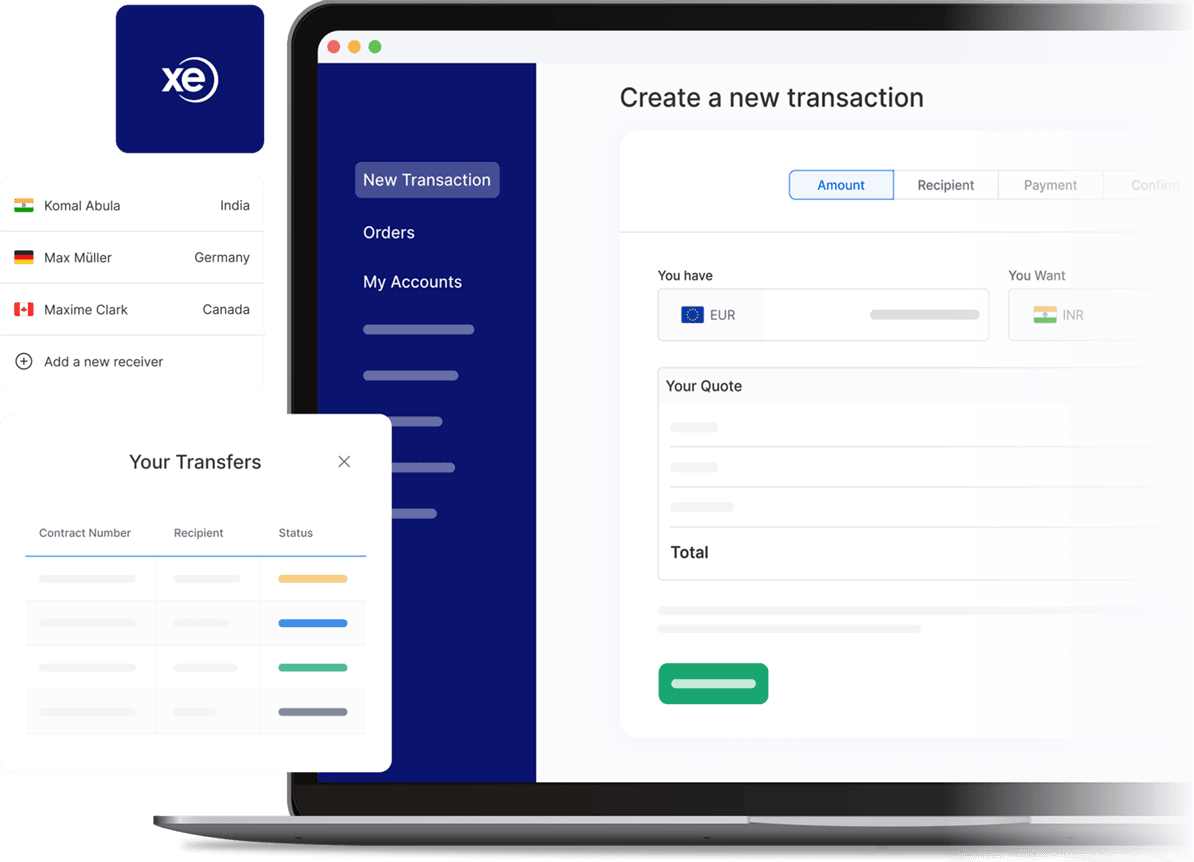

Exchange rates fluctuate constantly. They determine how much Indian Rupees your US Dollars will get you. Keeping an eye on the current rates is essential. Websites like XE.com or financial news portals can provide real-time updates. Even a small difference in the rate can lead to a substantial change in the transferred amount. Before making a transfer, compare rates offered by different banks and services to ensure you’re getting a favorable deal.

Transfer Fees And Hidden Costs

Transfer fees are the charges levied by banks and financial services for processing your transaction. These can vary widely depending on the method you choose. Some services might offer lower fees but a less favorable exchange rate, which can end up costing more. Additionally, watch out for hidden costs like intermediary bank charges, which can crop up unexpectedly.

It’s helpful to list down all potential costs before proceeding. Transparent services will provide a breakdown of all fees upfront. Have you ever thought about how small fees can accumulate over multiple transactions? Small business owners often overlook this, only to realize later how much they could have saved.

Understanding these financial nuances can empower you to make smarter choices. Have you ever faced a situation where unexpected fees ate into your profits? Share your experiences in the comments, and let’s learn from each other.

Setting Up A Business Account

Transferring money from the USA to an Indian business account requires a secure process. Choose a reliable bank or service. Follow their instructions for currency conversion and fees.

Setting up a business account is a crucial step in transferring money from the USA to India. This account serves as the foundation for secure and efficient transactions. You want everything in place to ensure that your funds transfer smoothly and without any hiccups. A well-organized business account not only simplifies the process but also provides peace of mind. Let’s dive into what you need to know.

Necessary Documentation

To set up a business account, having the right documentation is essential. Typically, banks will require your business registration papers and identification proof. For instance, documents like your business license and passport can help verify your identity and the legitimacy of your business.

Make sure you have tax identification numbers on hand. These are crucial for compliance with both US and Indian regulations. Each document serves a specific purpose, so double-check to avoid any missing pieces.

Wouldn’t it be frustrating to have a delay just because of a missing document? Getting everything ready beforehand saves you time and stress.

Verifying Account Details

Once your documents are in order, the next step is to verify your account details. Banks usually ask you to confirm your business name, account number, and other relevant information. Accuracy here is key to avoid any future mishaps during transactions.

Always double-check the spelling of your business name and account number. Even a small typo can lead to significant issues. It’s a good idea to keep a list of all your account details for easy reference.

Why risk financial errors when a simple verification can prevent them? Taking a few extra minutes now could save you a lot of headaches later.

Setting up a business account involves careful planning and attention to detail. By ensuring you have all the necessary documentation and verifying your account details, you pave the way for seamless money transfers. Have you taken these steps yet? If not, now’s the perfect time to get started.

Initiating The Transfer

Transferring money from the USA to an Indian business account involves choosing a reliable service. Ensure accuracy in account details and amount. Initiate the transfer by following the service provider’s instructions. This process is straightforward, ensuring your funds reach the desired account securely.

Transferring money from the USA to a business account in India can seem daunting at first. However, initiating the transfer is simpler than you might think. Whether you’re expanding your business operations or paying suppliers, understanding the steps involved can make the process smoother. Ready to dive in? Let’s explore how you can kickstart your transfer efficiently.

###

Filling Out Transfer Forms

Begin with the necessary paperwork. The transfer forms are the backbone of your transaction. Each bank or service provider will have specific forms for international transfers.

It’s crucial to know which form to use. Check with your bank or online service provider for the correct documentation. Using the wrong form could delay your transfer.

Pay special attention to detail. Small mistakes on forms can lead to big headaches later. Have you ever filled out a form only to realize you missed a key detail? Double-checking your entries can save you time and hassle.

###

Providing Accurate Information

Accuracy is your best friend here. Ensure all the information you provide matches your official records. Incorrect data can result in failed transactions or even legal issues.

Verify details such as your business account number and the recipient’s bank information. Do you know the specific SWIFT code for the Indian bank? Ensure it’s correct; this unique code ensures your money lands in the right place.

Updating your records is crucial. Is your contact information up-to-date? Making sure your bank has your current details can prevent any communication mishaps during the transfer process.

Initiating a money transfer doesn’t have to be intimidating. With the right forms and accurate information, you are well on your way to a successful transaction. Are you ready to make your international business dealings seamless?

Ensuring Transaction Security

Secure money transfers from the USA to an Indian business account by choosing reliable banks or financial services. Ensure your transaction is protected by using strong passwords and enabling two-factor authentication. Keep track of exchange rates for better financial planning.

Transferring money from the USA to a business account in India involves more than just pressing a button. Ensuring transaction security is crucial. It helps protect your funds and personal information from potential threats. But how do you ensure your transactions remain secure? By focusing on key areas like using secure platforms and double-checking transfer details, you can safeguard your money effectively.

Using Secure Platforms

Choosing the right platform is critical. Ensure that the service you use is reputable and has strong security measures. Platforms like PayPal or TransferWise offer robust encryption and are trusted worldwide.

Look for services that provide two-factor authentication. This adds an extra layer of security by requiring you to verify your identity through another device or app. It’s a simple step that can make a big difference.

Consider reading reviews and asking for recommendations. Your peers might have valuable insights based on their experiences, helping you choose a secure platform.

Double-checking Transfer Details

Before confirming any transfer, verify all details. Even a minor mistake in account numbers or names can lead to failed transactions or funds landing in the wrong account.

Pay close attention to the currency conversion rates. Some platforms may not offer the best rates, affecting the amount received in India. Compare rates to ensure you’re getting the best deal.

Ask yourself: Have you double-checked the recipient’s details? Mistakes can be costly and time-consuming to fix. Ensuring accuracy the first time saves you from potential headaches.

Transaction security is not just about technology. It’s also about diligence and attention to detail. By following these steps, you can transfer money with peace of mind, knowing your funds are secure.

Tracking The Transfer Status

Transferring money from the USA to an Indian business account involves using reliable banking services. Ensure you track the transfer status through your bank’s online portal. This helps in monitoring the transaction and ensuring your funds reach safely.

Transferring money from the USA to a business account in India is a process that requires careful tracking to ensure your funds reach their destination securely and on time. Keeping an eye on the transfer status can save you from unnecessary stress and help address any issues promptly. Whether you’re sending money for a business deal or paying suppliers, knowing how to track your transfer provides peace of mind.

Using Tracking Numbers

Most banks and money transfer services provide a tracking number once you initiate a transfer. This number is your gateway to knowing exactly where your money is at any given moment.

Log into your account online or use the service’s app. Enter your tracking number to see real-time updates. You’ll know if the money is still in transit or has been deposited into the recipient’s account.

Always keep your tracking number safe. It’s crucial for resolving any disputes or delays. Have you ever lost a tracking number and felt the panic set in? Avoid this by storing it in a secure digital note or email.

Contacting Customer Support

Sometimes, technology fails us. If your transfer status isn’t updating or you’re concerned about a delay, reaching out to customer support is your next step.

Most banks and transfer services have dedicated support teams. They can provide insights and help resolve issues. It can be as simple as dialing a number or using a chat feature on their website.

Share your tracking number and any other relevant details. Clear communication can speed up the resolution process. Ever had a situation where a quick call saved you hours of worry? It’s worth picking up the phone.

Dealing With Transfer Issues

Transferring money from the USA to an Indian business account requires careful planning. Use reliable services like banks or online platforms that offer competitive rates. Ensure all legal and regulatory requirements are met to avoid complications.

Transferring money from the USA to an Indian business account can be a seamless process, but sometimes hiccups occur. These transfer issues can be frustrating, especially when you are relying on timely payments to keep your business operations smooth. Understanding how to deal with these problems is crucial to maintaining your financial flow and ensuring that your business remains unhindered. Let’s dive into the common problems you might encounter and how to effectively solve them, along with advice on escalating complaints if necessary.

Common Problems And Solutions

Transfers can hit a snag for various reasons. Sometimes, it’s as simple as entering incorrect banking details. Double-check your account numbers and swift codes to prevent these errors.

Currency conversion rates can also be a headache. They fluctuate, affecting the final amount received. Keep an eye on rates and consider timing your transfers when rates are favorable.

Technical glitches are another common issue. These may arise from the bank’s end or due to online platform errors. Refresh your browser or app, and if the problem persists, reach out to customer support immediately.

Bank policies can vary. Some banks may require additional documentation for international transactions. Make sure you have all necessary paperwork ready to avoid delays.

Have you ever felt stuck dealing with any of these problems? How did you overcome them? Share your experiences in the comments below.

Escalating Complaints

If your transfer issues aren’t resolved promptly, it may be time to escalate your complaint. Start by contacting your bank’s customer service. Be clear and concise in explaining the issue.

Document all interactions. This includes dates, names of representatives, and any promises made. This record is vital if you need to take further action.

Consider speaking to a manager or supervisor if the initial response is unsatisfactory. Sometimes, a higher authority can expedite the resolution process.

If your issue remains unresolved, explore filing a formal complaint with the financial ombudsman or relevant authority. They can provide mediation and ensure your complaint is addressed.

What steps would you take if faced with a stubborn transfer issue? Would you escalate, or try a different approach first? Share your thoughts below.

By proactively tackling these transfer issues, you can minimize disruptions and keep your business running smoothly.

Frequently Asked Questions

How Can I Transfer Money From Usa To India?

Transferring money from the USA to India involves choosing a reliable service provider. Options include banks, online platforms, or money transfer apps. Compare fees, exchange rates, and processing times. Ensure the service supports business accounts. Follow the provider’s instructions to complete the transfer securely.

What Are The Cheapest Ways To Transfer Money?

To find the cheapest way to transfer money, compare fees, exchange rates, and transfer methods. Online platforms like Wise, Remitly, and PayPal often offer competitive rates. Avoid unnecessary charges by selecting a service tailored to your business needs.

How Long Does A Transfer Take To India?

The time taken for a transfer varies based on the provider and method chosen. Bank transfers may take 2-5 business days. Online transfer services could complete transactions within minutes to 24 hours. Always check with your provider for accurate timelines.

Are There Limits On Transferring Money?

Yes, limits exist for money transfers based on the provider and regulations. Ensure the chosen service supports the amount you wish to send. Verify compliance with both US and Indian regulations for business account transfers. Contact customer support for specific limit details.

Conclusion

Transferring money from the USA to India for business is simple now. Choose a reliable service. Always check exchange rates and fees. Understand the process and required documents. Ensure accuracy in account details to avoid delays. Keep track of your transfers for records.

Stay informed about any changes in international transfer regulations. This saves time and prevents errors. With the right approach, you ensure smooth transactions. Your business in India will benefit from secure and timely transfers. Focus on building strong financial connections across borders.

References

- Doing business in India

- How to do business in India

- Making it easier to apply for a bank account: a study of the Indian market

- Money flows two ways between transnational families in Australia and India

- The India way: Lessons for the US