If you’ve ever found yourself wondering how to transfer money from your Revolut account to your bank account, you’re in the right place. Navigating the digital world of finance can sometimes feel daunting, but it doesn’t have to be.

You’re about to learn a straightforward, step-by-step process that will make transferring your funds as easy as sending a text message. Imagine the peace of mind knowing you can effortlessly move your money wherever you need it, whenever you want.

Stick around, and you’ll soon master a skill that not only saves you time but also boosts your financial confidence. Ready to simplify your money management? Let’s dive in.

Setting Up Your Revolut Account

Transferring money from Revolut to your bank account is straightforward. Open the app and select “Transfer” to begin. Enter your bank details, specify the amount, and confirm. Enjoy quick and easy access to your funds.

Setting up your Revolut account is the first step to transferring money smoothly. This process is simple and quick, ensuring you can start using Revolut in no time. Below, we’ll guide you through each step of setting up your account. Ready to begin? Let’s dive in.

Download And Install The App

To start, find the Revolut app on your phone’s app store. The app is free and downloads quickly. Once downloaded, tap to install. Ensure your phone has enough space. The app installs within minutes. Now, open the app and proceed.

Create And Verify Your Account

Open the Revolut app. Tap “Sign Up” on the screen. Enter your phone number. You’ll receive a code via SMS. Enter this code to verify your number. Next, provide your personal details. Name, email, and date of birth are needed. Ensure details match your ID. Verification is crucial for security. Follow prompts to complete verification. Once verified, your account is ready. You can now link your bank account and start transferring funds.

Linking Your Bank Account

Linking your bank account to Revolut is a simple process. This connection allows seamless transfers between your Revolut account and your bank. Follow these easy steps to ensure a smooth transaction.

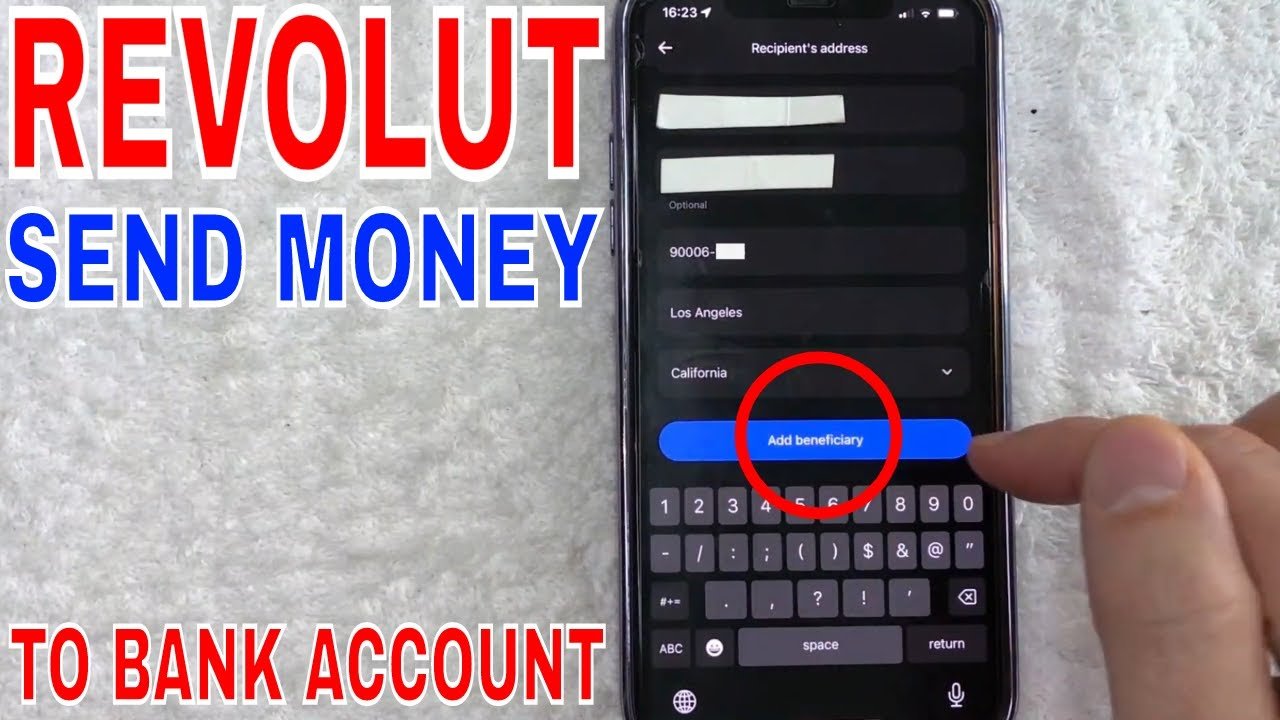

Locate The Bank Transfer Option

Open the Revolut app on your smartphone. Navigate to the main dashboard. Look for the “Payments” tab. It usually appears at the bottom of the screen. Tap on it to access more options. Find the “Bank Transfer” button. This is where you begin linking your account.

Enter Bank Account Details

Tap on “Add a Bank Account” or similar option. Have your bank details ready. You will need your account number and sort code. Enter these details carefully. Double-check to avoid errors. Once entered, tap “Continue” to proceed.

Verify Linked Account

Revolut may ask for verification. This ensures your bank account is secure. You might receive a small deposit. Check your bank account for this deposit. Enter the amount in the Revolut app. This verifies your bank account is linked.

Initiating The Transfer

Transferring money from Revolut to a bank account is simple. Start by opening the Revolut app. Navigate to the transfer section, and follow the prompts to select your bank account and enter the amount. Confirm the details, ensuring accuracy before completing the transfer.

Initiating a transfer from Revolut to your bank account is a straightforward process, but making sure you get it right is essential. Imagine the convenience of managing your finances with a few taps on your smartphone. It’s like having your bank in your pocket, ready to serve you whenever you need it. Have you ever wondered how to make these transfers smooth and error-free? Let’s dive into the steps you need to take, focusing on choosing the right amount and currency.

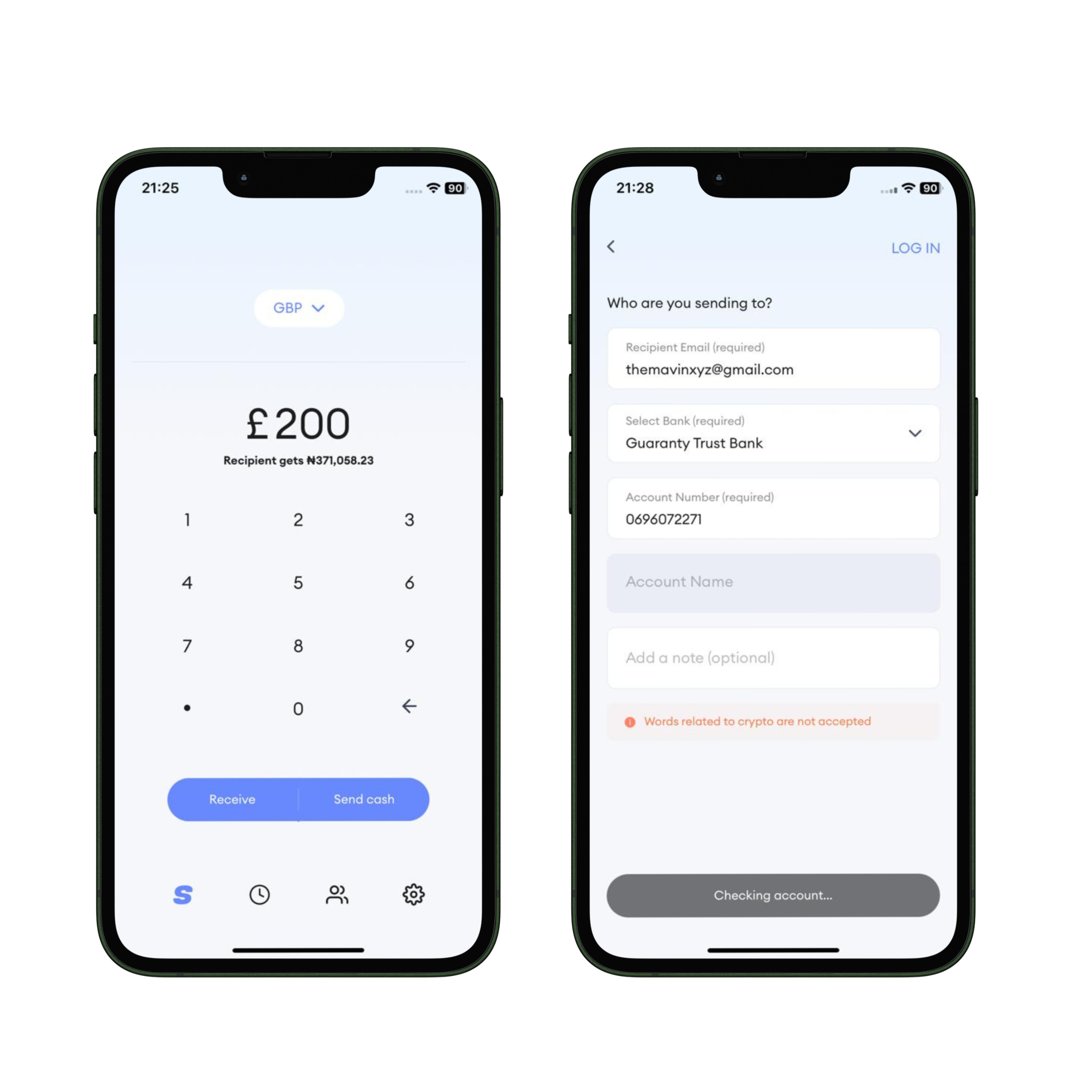

Choose The Transfer Amount

First, decide how much money you want to transfer. Be precise about the amount because a mistake here could mean transferring too much or too little.

Consider what you need the money for and ensure it aligns with your budget. You don’t want to leave your Revolut account with insufficient funds for upcoming expenses.

Double-check the amount before proceeding. A small error can lead to unnecessary hassle, such as reversing the transaction or adjusting future budgets.

Select Currency Type

Choose the currency in which you want the money to arrive in your bank account. Revolut supports multiple currencies, so pick the one that suits your needs.

Think about any potential conversion fees. If your bank account is in a different currency than your Revolut balance, the app will automatically convert it for you.

Check the exchange rate offered by Revolut. It’s often competitive, but it’s always good to be aware, especially if you frequently deal with currency exchanges.

Transferring money doesn’t have to be complicated. With the right steps, you can ensure your funds move safely and efficiently. Have you ever had a transfer go awry? Consider these tips next time to keep things on track.

Confirming The Transfer Details

Transferring money from Revolut to your bank account is easy. But before hitting the confirm button, ensure your transfer details are accurate. This step is crucial to avoid errors and ensure a smooth transaction. Check everything twice. It saves time and prevents mistakes.

Review Transfer Summary

Start by reviewing the transfer summary. Look at the amount you want to send. Verify the recipient’s bank details. Double-check the account number and routing number. Ensure they match your intended bank account. Mistakes here can lead to failed transfers.

Check Fees And Exchange Rates

Next, check any fees that apply. Revolut may charge a small fee for transfers. Know these costs beforehand. This helps you manage your finances better. Also, examine the exchange rates if sending money overseas. Rates can vary and impact the final amount received.

Understanding fees and rates makes you a smart user. It enhances your control over your money. Always be aware of these details to avoid surprises.

Completing The Transfer

Transferring money from Revolut to your bank account is simple. This final step, completing the transfer, ensures your funds move smoothly. Follow these steps to ensure a successful transaction.

Authorize The Transfer

Open your Revolut app. Tap on the ‘Payments’ tab. Select ‘Transfer’. Enter the amount you wish to transfer. Choose your bank account as the destination. Double-check the details. Confirm the transfer. A security check might appear. Complete it to authorize the transfer.

Receive Confirmation Notification

After authorizing, wait for a notification. It confirms your transfer is in progress. This message shows on your app and email. Keep it for your records. If there are any issues, contact Revolut support. Ensure your app notifications are on. This way, you won’t miss important alerts.

Troubleshooting Common Issues

Transferring money from Revolut to your bank account might face issues like incorrect details or app glitches. Ensure account numbers are correct and check for app updates. Contact support if problems persist to ensure smooth transactions.

Transferring money from Revolut to your bank account is usually a smooth process. However, there might be times when you face hiccups. It’s essential to know how to troubleshoot common issues that might arise. This section will help you navigate through potential challenges, ensuring your funds reach your bank account safely and promptly.

Resolving Transfer Delays

Transfer delays can be frustrating, especially when you need funds urgently. Always check your internet connection first; a weak connection might interfere with the process. Ensure your Revolut app is updated—outdated versions can cause unexpected glitches.

Sometimes delays happen due to bank processing times. Banks usually take a business day or more to credit your account. If your transfer is taking longer, double-check the bank details you entered. A small mistake, like a wrong digit, can hold up the process.

It’s helpful to set expectations by knowing that transfers made on weekends or holidays might take longer. Patience can be your best friend here.

Contacting Customer Support

When the app isn’t providing solutions, customer support is your ally. Reach out directly through the Revolut app. There’s a chat feature designed for quick assistance.

Before contacting support, gather necessary information like transaction ID and the exact amount transferred. Having these details ready will speed up the process.

If the chat doesn’t resolve your issue, Revolut offers email support. Ensure you’re clear and concise in your email. Explain your issue, provide relevant details, and await their response. Support teams aim to respond swiftly, so keep an eye on your inbox.

Have you ever faced a delay that made you reconsider digital banking? Remember, challenges are part of the journey. How you tackle them determines your experience.

Tips For Secure Transactions

Transferring money from Revolut to your bank account should be easy and safe. But keeping your transactions secure is important. Follow these tips to ensure your money stays protected. Understand the basics of secure transactions. This will help you avoid common pitfalls.

Protecting Your Account Information

Your account information must remain private. Do not share your login details with anyone. Use strong, unique passwords for your Revolut account. Change your password regularly to enhance security. Enable two-factor authentication for an added layer of protection. This makes it harder for unauthorized users to access your account.

Ensure your device is secure. Install antivirus software and keep it updated. Avoid using public Wi-Fi when accessing sensitive information. This can prevent hackers from intercepting your data.

Recognizing Phishing Attempts

Phishing attempts can trick you into giving away your information. Always verify the sender’s email address before clicking on any link. Legitimate companies will not ask for your password through email. If an email seems suspicious, do not open any attachments. Report it to Revolut’s support team for confirmation.

Stay informed about the latest phishing tactics. This knowledge will help you recognize and avoid scams. Be cautious with messages that create a sense of urgency. Scammers use this technique to catch you off guard.

Frequently Asked Questions

How To Initiate A Transfer From Revolut?

To start a transfer, open the Revolut app and log in. Select the ‘Payments’ tab, then choose ‘Bank Transfer. ‘ Enter your bank details, the transfer amount, and confirm. Ensure all details are correct before proceeding to avoid any errors or delays.

Are There Fees For Transferring Money From Revolut?

Revolut generally offers free transfers within certain limits. However, fees may apply for international transfers or currency exchanges. Always check the latest fee structure within the app or on Revolut’s website. This ensures you’re aware of any potential costs before initiating a transfer.

How Long Does A Revolut Transfer Take?

Transfers from Revolut to a bank account typically take one to three business days. The exact timing can depend on bank processing times and weekends. Always check with your bank for any additional delays, especially during holidays or non-business days.

Can I Transfer Money To Any Bank Account?

Yes, Revolut allows transfers to most bank accounts worldwide. Ensure you have the correct bank details, including the IBAN and SWIFT/BIC codes if required. Double-check the recipient’s information to prevent errors and ensure a successful transfer.

Conclusion

Transferring money from Revolut to your bank is simple. Follow the steps above for a smooth process. Always check your bank details before confirming. This prevents mistakes. Regular transfers are hassle-free. Keep your app updated for best results. Use Revolut’s support if you face issues.

They offer quick assistance. Secure transactions are guaranteed. Enjoy hassle-free money management. Manage your finances with ease. Stay informed about any changes in policies. This ensures seamless transfers every time. Your funds are always safe. Make your financial life simpler today.