Are you looking for ways to make your products or services more accessible to customers? Offering payment plans can be a game-changer for your business.

Imagine the relief your customers will feel when they realize they can purchase what they need without breaking the bank all at once. By providing flexible payment options, you’re not only increasing your sales potential but also building a loyal customer base that appreciates your understanding and support.

But how do you set up these payment plans in a way that’s beneficial for both you and your customers? Stay with us as we guide you through the simple steps of implementing payment plans that can elevate your business and foster lasting customer relationships. Don’t miss out on this opportunity to enhance your business strategy!

Benefits Of Payment Plans

Payment plans help customers buy more. They make big purchases easier. Customers can pay slowly over time. This means less stress on their wallet. Business sales often increase with payment plans. More people buy when payments are small. Trust grows between the customer and business. Customers feel safe spending money. Payment plans also attract loyal customers. People come back if they like the payment options. Businesses get more repeat buyers this way.

Cash flow improves with payment plans. Businesses get regular money. They can plan better for future expenses. Payment plans also help in building customer relationships. Customers like businesses that offer flexible payment. It shows the business cares about their needs. Overall, payment plans create a win-win situation.

Types Of Payment Plans

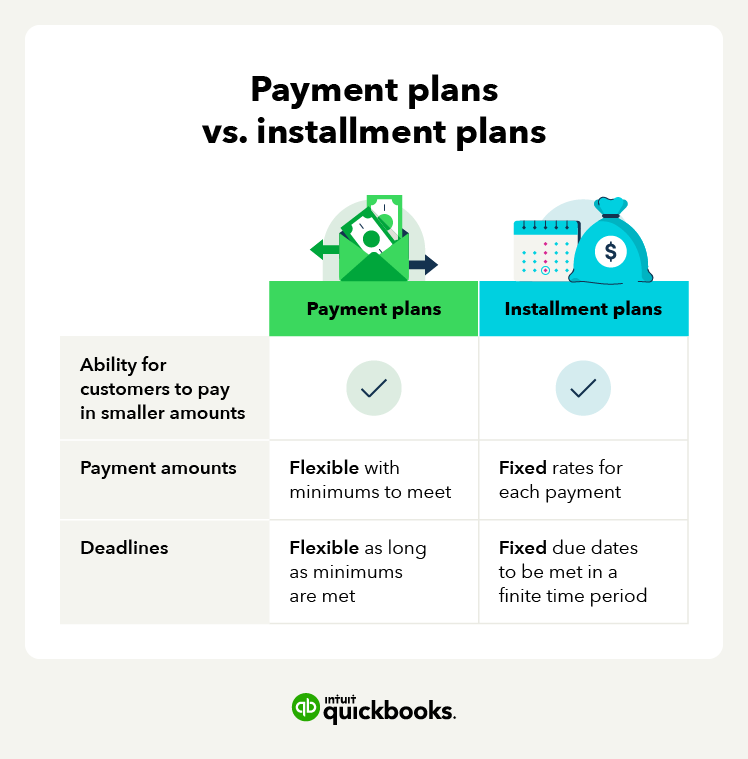

Installment plans let customers pay in parts. They spread costs over months. This makes big buys easier. Customers feel less stress. Each payment is equal. It is fixed. No surprises. This plan works for costly items.

Deferred plans delay payment. Customers buy now, pay later. This plan helps in tight budgets. It gives time to save money. Payments start after a set period. It is good for seasonal purchases.

Subscription models are for ongoing services. Customers pay monthly or yearly. This suits digital services. It can be for streaming. It can be for news sites. It makes payments easy. No need to pay all at once.

Assessing Customer Needs

Knowing your customer’s age and location helps a lot. Younger people may prefer online payments. Older customers might like traditional methods. Different locations have different payment preferences. Urban areas often have access to more payment options. Rural areas might rely on cash or checks. Understand these differences for better service.

Study how much your customers usually spend. Bigger spenders might need larger payment plans. Those who spend less prefer smaller plans. Track their purchase frequency too. Regular shoppers might want ongoing plans. Occasional buyers may need one-time options. Offer choices that match their habits.

Ask your customers what they like best. Surveys are a good way to know their thoughts. Listen to their feedback on existing payment options. Adjust your plans based on their suggestions. This keeps them happy and loyal. Happy customers often return and buy more.

Setting Up Payment Plans

Selecting a good payment processor is important. It should be easy to use and safe. Look for one that handles different payment methods. Credit cards, debit cards, and online payments should be included. Fees are important too. Find a processor with low fees. It helps save money. Customer support is another key factor. A processor with 24/7 support can be very helpful.

Clear terms and conditions protect both parties. They explain payment dates and amounts. Late fees and penalties should be included. This keeps the rules clear. Make sure customers understand these terms. Use simple language so everyone can understand. Written agreements can prevent misunderstandings. They are important for trust and clarity.

The new payment plan should fit into current systems. It should work well with your accounting software. This makes tracking easier. Avoid manual data entry. Automation saves time and reduces errors. Connect with your sales and customer service tools. This provides a smooth experience for everyone. Integration helps keep everything organized.

Legal And Financial Considerations

Offering payment plans requires careful consideration of legal and financial aspects. Ensure compliance with regulations and maintain transparent communication. Clear terms help build trust and prevent misunderstandings.

Regulatory Compliance

Understanding laws is very important. Different places have different rules. Businesses must follow these rules. This keeps them out of trouble. It also builds trust with customers. Always check local laws and rules. This helps businesses stay safe.

Risk Management

Risks are everywhere in business. Offering payment plans can have risks. To manage risks, plan well. Think about what could go wrong. Have a backup plan ready. This makes sure businesses are ready for anything. Smart planning keeps businesses safe.

Financial Monitoring

Watching money is very important. Businesses should keep an eye on payments. This helps them know if they are getting paid on time. Monitoring helps find problems early. Fixing problems quickly saves money and time.

Marketing Payment Plans

Payment plans make buying easy. Customers like flexible payment options. Easy payment means less stress. Buyers can afford big items. More people will buy. Tell customers about these benefits. Simple payments help budgets. Customers feel happy with easy payments.

Use online ads to share payment plans. Websites reach many people. Social media is good for sharing. Email campaigns can inform customers. Online ads show payment details clearly. Customers like easy online info. They learn about payment options. Online is fast and easy.

Influencers can help share payment plans. They reach many followers. Trustworthy influencers mean more interest. Influencers talk about payment ease. Their followers trust them. Influencers share messages clearly. More people will know about easy payments. It’s smart to work with them.

Training Staff

Staff must understand every payment plan. They should know the terms and conditions. Training helps them explain these details clearly. Clarity builds customer trust. Customers feel secure with clear information. Honesty is vital in sharing plan details. Staff must be ready to answer questions. Learning these details is important. It makes staff confident in their role.

Polite staff make customers happy. They should listen to customer needs. Empathy is key in customer service. Patience helps handle tough situations. Skills training can improve service quality. Staff should practice kindness always. Understanding customer concerns is important. Good service leads to satisfied customers.

Staff face many questions. They should give clear answers. Confidence helps in handling objections. Training prepares staff for any inquiry. Respect is crucial in addressing objections. Staff should remain calm and helpful. Proper handling builds customer trust. They should offer solutions to problems. Handling inquiries well leads to happy customers.

Monitoring And Adjusting Plans

Creating flexible payment options helps customers manage their purchases effectively. Regularly monitor payment plans to ensure they meet customer needs and business goals. Adjust strategies based on feedback and performance to maintain satisfaction and financial balance.

Analyzing Sales Data

Sales data shows how well plans work. Look at the numbers. Check which plans sell the most. See how quickly customers pay. Use graphs to spot trends. This helps in making smart choices.

Customer Feedback Analysis

Listen to what customers say. Feedback tells what they like or dislike. Ask them simple questions. Use surveys or emails. Understanding feedback helps in improving plans. Happy customers stay longer.

Plan Adjustment Strategies

Change plans based on what you learn. Add or remove features if needed. Make plans easier to understand. Simple changes can make a big difference. Keep testing to find the best fit for everyone.

Frequently Asked Questions

What Are Payment Plans?

Payment plans allow customers to pay for products or services over time. They break down the total cost into manageable installments. This method helps customers afford larger purchases without paying the full amount upfront. Businesses benefit from offering flexible payment options.

It’s a win-win for both parties.

How Do Payment Plans Benefit Businesses?

Payment plans increase sales by making purchases more accessible. They attract customers who might hesitate due to cost. Businesses can reach a broader audience and boost customer satisfaction. Offering flexibility enhances brand loyalty. Payment plans also provide steady cash flow through regular payments.

Are There Risks In Offering Payment Plans?

Yes, there are risks like late payments or defaults. Businesses might face cash flow issues if customers delay payments. Properly structuring payment plans can mitigate these risks. Businesses should conduct credit checks and set clear terms. Using payment processing services can also help manage risks.

How Can I Implement Payment Plans Effectively?

Start by assessing your business’s financial capacity and customer needs. Choose a reliable payment processing service. Clearly define terms, interest rates, and penalties. Communicate these details to customers upfront. Regularly monitor and adjust your payment plans based on market trends and customer feedback.

Conclusion

Offering payment plans boosts customer satisfaction. It makes purchases more accessible. Customers appreciate flexibility and choice. Businesses can see increased sales and loyalty. Payment plans suit various customer needs. They help ease financial stress. Implementing them can benefit both parties.

Choose the right plan for your business. Consider customer feedback and preferences. Keep terms clear and straightforward. This builds trust and encourages repeat business. Payment plans are a win-win strategy. They improve relationships and drive growth. Start today and make a positive impact.

Your customers will thank you.