Navigating the world of finance can sometimes feel like deciphering a secret code. You’re constantly juggling terms, abbreviations, and numbers that seem to blur together.

Among these, “payment” is a term you encounter almost daily, but have you ever wondered how to abbreviate it effectively? Abbreviating payment might seem trivial, but mastering this small detail can save you time and make your communication more efficient.

Imagine sending out invoices, writing emails, or keeping track of transactions with ease and clarity. In this guide, we’ll unravel the mystery behind abbreviating payment, giving you the tools to streamline your financial communications. Stick with us, and you’ll discover how a simple abbreviation can transform the way you manage payments, enhancing both your personal and professional life.

Importance Of Abbreviations

Abbreviations make writing shorter and easier. People use them to save time. Instead of long words, use short forms. This helps in fast reading. Many terms are shortened in business. Payment is often abbreviated to “pmt” or “paymt”. This saves space in documents. Important for quick communication. Abbreviations are common in texts and emails. They help people understand quickly. Everyone uses them daily. They are part of everyday language. Easy to learn and use. Businesses use abbreviations to make work faster. Helps in making things clear. Saves time for everyone involved.

Common Payment Abbreviations

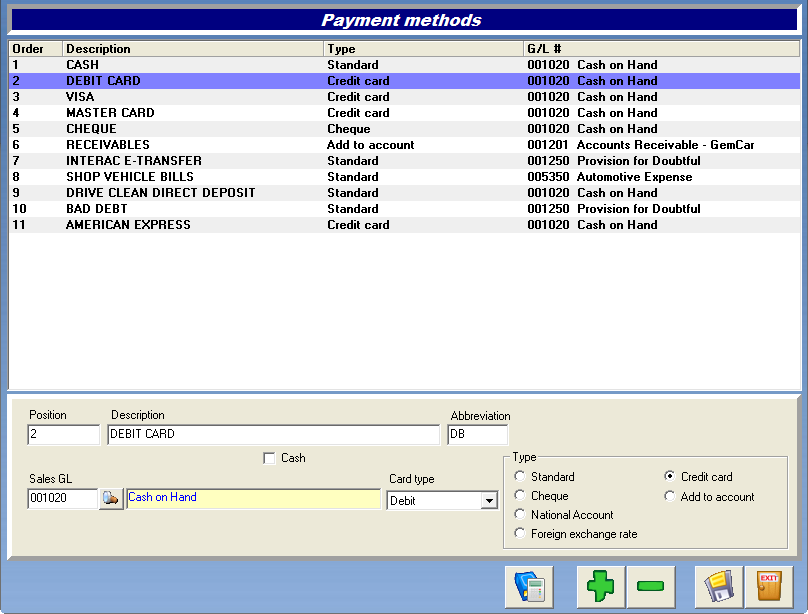

Credit often shortens to “CR”. Debit becomes “DR”. These are simple banking terms. CR means you get money. DR means you pay money. APR stands for Annual Percentage Rate. It shows the cost of credit. PIN is a Personal Identification Number. You use it with cards. Keep your PIN secret. Remember these terms. They help with money.

IFSC stands for Indian Financial System Code. SWIFT is for international transfers. It means Society for Worldwide Interbank Financial Telecommunication. IBAN is the International Bank Account Number. It helps with overseas payments. MICR means Magnetic Ink Character Recognition. Banks use it to process cheques. These codes are important. They make banking easy.

OTP means One-Time Password. It helps secure online payments. CVV is on the back of your card. It stands for Card Verification Value. EMI is for Equated Monthly Installment. It splits big payments. UPI means Unified Payments Interface. It makes transfers quick. These shortcuts save time. They make online payments simple.

Creating Effective Abbreviations

Short words are easy to remember. Use one or two letters for abbreviations.

Pay can be short for payment. Simple abbreviations help everyone understand.

Confusing ones make it hard for people.

Clear abbreviations are important. Ambiguity can cause confusion.

Make sure people know what the letters mean. Consistent use helps avoid mistakes.

Always use the same abbreviation. This keeps things consistent.

It’s important to not change it often. Consistency helps people learn it fast.

Industry-specific Abbreviations

In the retail world, abbreviations make work easier. “POS” stands for Point of Sale. “SKU” means Stock Keeping Unit. These are common terms. “RRP” is another one. It means Recommended Retail Price. Understanding these helps in daily tasks. It makes communication faster.

Finance and banking use many short forms. “ATM” stands for Automated Teller Machine. “APR” is Annual Percentage Rate. It is important for loans. Another term is “ROI”. It means Return on Investment. Knowing these terms is helpful. It makes banking simpler.

E-commerce uses special abbreviations too. “COD” stands for Cash on Delivery. “B2C” means Business to Consumer. It describes sales type. “AOV” is another term. It stands for Average Order Value. These terms make online shopping clear. They help sellers and buyers.

Benefits Of Using Abbreviations

Abbreviations help people talk and write better. They make words shorter. This helps everyone understand faster. Long words can be hard to say. Short words are easy. This makes chatting simple and fun.

Time-saving is a big bonus. Short forms save time. You can write or say things quickly. This helps when you are in a hurry. Everyone likes to save time.

Abbreviations bring enhanced clarity to messages. They make words clearer. Sometimes words can be confusing. Short forms remove confusion. This helps everyone understand the same thing.

Challenges And Solutions

Abbreviating payment can be tricky. It’s often shortened to “pmt” or “paymt” in financial documents. Using the right abbreviation helps in clear communication.

Misinterpretation Risks

Abbreviations can cause confusion. People might get the wrong meaning. Payment terms need clarity. Misunderstanding can lead to errors in transactions. Simple words can help avoid mistakes. Clear communication is key. Short forms should be widely known. This reduces misinterpretation.

Standardization Efforts

Many groups work on standard rules. They aim for uniformity in payment terms. This helps everyone understand each other. Standard terms are easier to learn. They make transactions smooth. Consistent abbreviations aid global business. Standardization reduces errors and saves time.

Educational Resources

Learning materials are available. They teach common payment terms. Guides help users understand abbreviations. Education improves clarity. Training sessions help businesses. Resources are easy to access online. Many sites offer free learning tools. Knowledge prevents costly mistakes.

Future Trends In Financial Abbreviations

Technology changes how we use abbreviations. Apps make things faster. They use short codes for payments. This helps save time. People like fast payments. Tech makes it easy. Abbreviations help with speed. Everyone can use them. Smartphones are popular. They use payment codes often. This makes money tasks simple. Tech tools make money tasks simple.

Countries want standard payment codes. This helps everyone understand them. It makes money tasks easier. Banks use these codes too. Businesses like them. They use them everywhere. Codes help people in different places. They work the same way. Clear codes help people understand money tasks. Everyone uses them.

New ideas change payment codes. Creative minds think of new ways. They use codes in different ways. Abbreviations can be fun. They make money tasks interesting. People use them in new ways. Simple codes are popular. They make life easier. Creativity helps everyone. It brings new ways to use abbreviations.

Frequently Asked Questions

What Is The Abbreviation For Payment?

The common abbreviation for payment is “pmt. ” It’s widely used in financial documents. This abbreviation helps in reducing space and maintaining clarity. When using “pmt,” ensure that it’s understood by your audience. In professional writing, always define abbreviations upon first use.

How Do You Abbreviate Payment In Accounting?

In accounting, “pmt” is the standard abbreviation for payment. Accountants use it to streamline documentation. It ensures consistency and clarity in financial records. Always clarify abbreviations in reports for better comprehension. This practice aids in maintaining accurate financial statements.

Is “pmt” A Universal Abbreviation For Payment?

Yes, “pmt” is universally recognized as an abbreviation for payment. It’s commonly used across various industries. While it’s widely accepted, always confirm its understanding with your audience. This ensures effective communication and avoids potential misunderstandings.

Why Abbreviate Payment In Documents?

Abbreviating payment saves space and enhances readability in documents. It helps in maintaining a clean and organized layout. Using “pmt” consistently also aids in faster data processing. However, always introduce the abbreviation initially for clarity.

Conclusion

Abbreviating payment terms can simplify your business communication. Clear and concise terms help avoid confusion. Use common abbreviations like “Pmt” or “PYMT” for clarity. Ensure your team understands these abbreviations. Consistency is key in all documents and communications. Simple terms make processes smoother.

Easier for everyone involved. This saves time and reduces errors. Remember to always clarify the meaning if needed. Clear communication builds trust with clients and partners. Effective abbreviations can enhance efficiency. So, incorporate these tips for better business interactions. Keep communication straightforward and professional.

Your business will benefit greatly.