Are you dreaming of owning a home priced at $800,000, but unsure about the mortgage payment it entails? You’re not alone.

Navigating the world of home loans can be daunting, especially when dealing with such significant figures. But don’t worry; understanding your potential monthly payments is easier than you might think. We’ll break down the factors influencing your mortgage payment, helping you make informed decisions about your financial future.

By the end, you’ll have a clear picture of what to expect each month, empowering you to take the next step in your home-buying journey with confidence. Keep reading to discover how much owning that dream home could cost you monthly.

Factors Influencing Mortgage Payments

Interest rates are crucial for mortgage payments. Higher rates mean bigger payments. Lower rates mean smaller payments. Rates depend on economic factors. Your credit score matters too. Good credit can lower your rate. Bad credit might increase it.

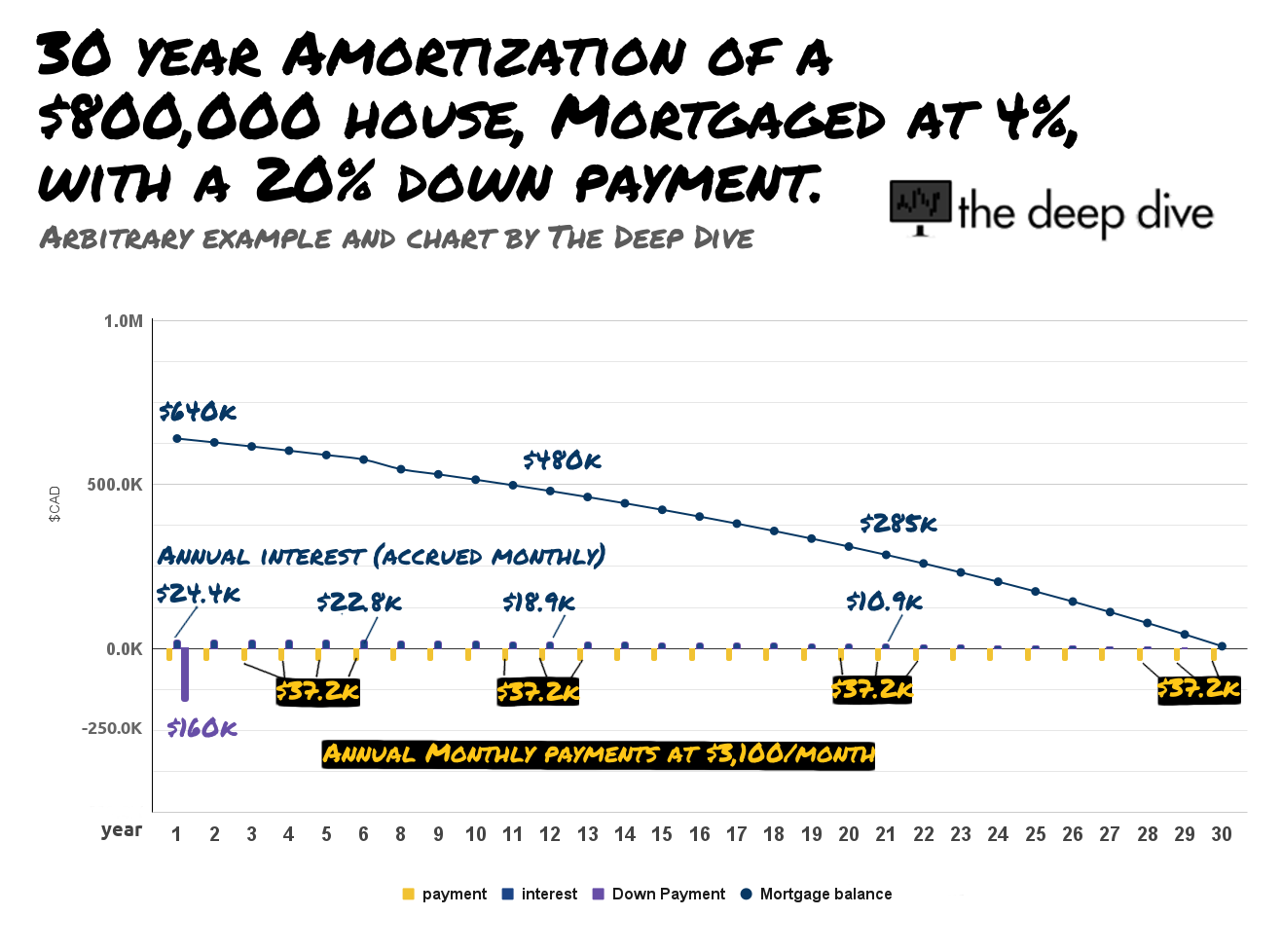

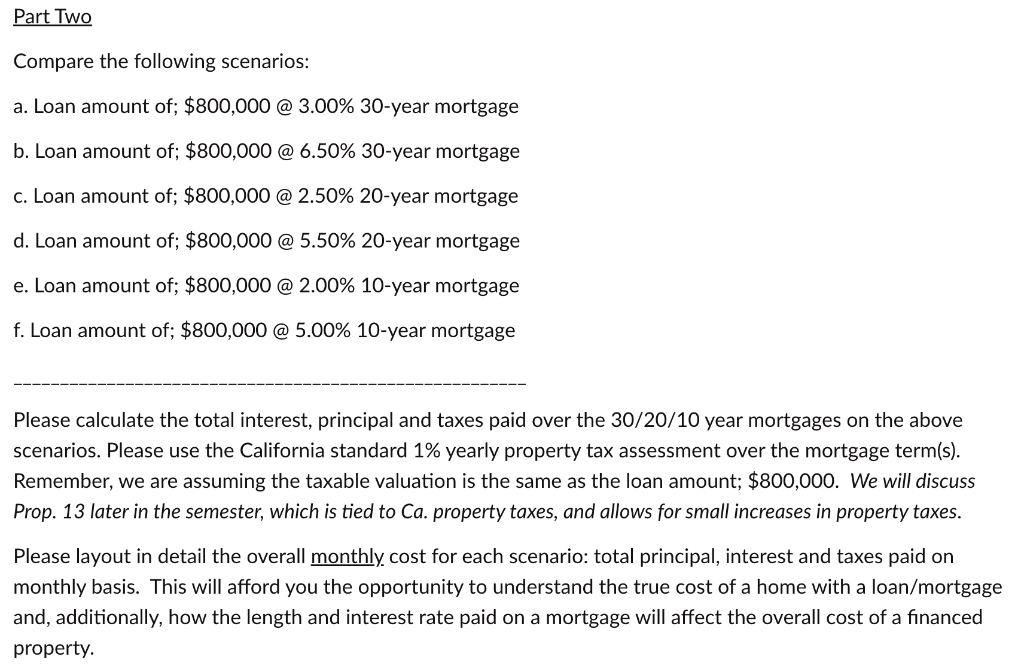

Loan terms affect payments. A 30-year term usually means lower monthly payments. But, you pay more over time. A 15-year term means higher monthly payments. It saves money overall. Choose wisely based on your budget.

Your down payment impacts the mortgage. A large down payment means smaller monthly payments. A small down payment means bigger payments. Save for a larger down payment if possible. It helps reduce monthly costs.

Property taxes add to mortgage payments. Taxes vary by location. Some areas have higher taxes. Others have lower taxes. Check local tax rates. This helps estimate your total payment.

Homeowners insurance is part of mortgage payments. It protects your home. Costs depend on coverage and location. Some areas cost more. Others cost less. Compare insurance rates for better deals.

Types Of Mortgage Loans

Discovering mortgage options for an $800,000 property involves understanding fixed-rate, adjustable-rate, and interest-only loans. Monthly payments depend on interest rates and loan terms, affecting total affordability. Calculate payments using online tools for precise budgeting.

Fixed-rate Mortgages

Fixed-rate mortgages offer stable payments. The interest rate stays the same. Monthly payments never change. This helps families budget better. Fixed-rate loans are often 15 or 30 years long. They are popular for their predictability.

Adjustable-rate Mortgages

Adjustable-rate mortgages start with low rates. Rates change over time. They often rise after a few years. Payment amounts can vary a lot. These loans are risky for some people. They suit short-term plans better.

Interest-only Loans

Interest-only loans have low payments at first. You pay only interest for a set time. Then, you pay the principal amount. Monthly costs rise later on. They are good for short-term needs. They can be risky if the home value drops.

Fha And Va Loans

FHA loans help first-time buyers. They need lower down payments. They have easier credit requirements. VA loans are for veterans. They offer special benefits. VA loans often have no down payment. Both loans help people buy homes more easily.

Calculating Monthly Payments

The principal is the amount you borrow. For an $800,000 loan, this is the base. Interest is what the bank charges for lending you money. It is usually a percentage of the principal. Together, they make up most of the monthly mortgage payment. This payment stays the same each month.

A mortgage calculator is a helpful tool. It can show you the monthly payment. You need to enter the loan amount, interest rate, and loan term. It quickly calculates the payment amount. This helps you plan your budget. Calculators are often free to use online.

Escrow payments cover property taxes and insurance. These are added to the mortgage payment. The lender collects these funds. They pay the taxes and insurance when due. This ensures payments are made on time. These costs can vary each year. It is important to estimate them when budgeting.

Strategies To Lower Payments

Refinancing can help lower monthly payments. It changes your loan terms. This might reduce your interest rate. It can make payments more manageable. Fixed rates can offer stability. Adjustable rates might offer lower payments at first. Always check fees before refinancing. You might save money in the long run.

Switching to bi-weekly payments can be smart. You pay half your monthly amount every two weeks. This means 26 payments a year. It’s like making an extra payment each year. It can reduce the principal faster. This might lead to paying less in interest.

Making extra payments can be beneficial. Pay a little more each month. It reduces the loan balance quicker. Less balance means less interest over time. You might pay off the loan sooner. Always check if there are any prepayment penalties. Paying extra can save money.

Potential Hidden Costs

Buying a house? You might need Private Mortgage Insurance. This is true when your down payment is less than 20%. This insurance protects the lender, not you. It can add hundreds of dollars to your monthly payment. This is a big cost many people forget.

Closing costs are fees you pay at the final step of buying. These include loan fees, taxes, and insurance. They can be 2% to 5% of the loan amount. On an $800,000 home, that’s a lot. Always budget for these costs in advance.

Houses need maintenance and repairs. Things break and wear out over time. You might need to fix the roof or replace the heater. These costs can add up quickly. It’s wise to save money for these unexpected expenses.

Expert Tips For First-time Buyers

A budget helps manage your money. Know your monthly income and expenses. Save for unexpected costs. Monthly mortgage payments can be high. Plan how much you can pay each month. Include taxes and insurance. Track spending to stay on budget. Be ready for changes in expenses.

A good credit score is important. It lowers your mortgage interest rate. Pay bills on time to boost your score. Keep credit card balances low. Avoid applying for new credit before buying a home. Check your credit report for mistakes. Fix any errors you find. A higher score saves money.

The right lender is key. Research lenders before choosing. Compare interest rates and fees. Ask friends and family for lender suggestions. Read reviews online. Meet with lenders to ask questions. Choose one that fits your needs. A good lender helps with the process. It makes buying a home easier.

Frequently Asked Questions

What Is The Monthly Payment On $800,000 Mortgage?

The monthly payment on an $800,000 mortgage depends on the interest rate and loan term. For a 30-year fixed mortgage at 3. 5% interest, the payment would be around $3,592. Rates can vary, so it’s best to use a mortgage calculator for accurate estimates.

How Do Interest Rates Affect Mortgage Payments?

Interest rates significantly impact your monthly mortgage payments. Higher interest rates mean higher payments and more paid over the loan’s life. Conversely, lower rates reduce payments, saving you money in the long term. Always compare rates from different lenders to find the best deal.

What Is Included In A Mortgage Payment?

A mortgage payment typically includes principal, interest, taxes, and insurance, often referred to as PITI. Principal and interest go toward repaying your lender, while taxes and insurance cover property taxes and homeowner’s insurance. Some lenders require escrow for these additional costs, affecting your monthly payment.

Can I Afford An $800,000 Mortgage?

Affording an $800,000 mortgage depends on your income, debt, and credit score. Generally, lenders suggest keeping housing expenses below 28% of your income. A mortgage affordability calculator can provide a detailed assessment. Ensure you have a stable financial situation before committing to such a significant investment.

Conclusion

Calculating a mortgage on $800,000 can seem tough. Yet, understanding basic factors helps. Interest rates, loan terms, and down payments play key roles. You now know what affects your monthly payment. Always consult with a financial advisor. They offer guidance tailored to your needs.

Don’t rush the decision. Take your time to evaluate options. A well-informed choice saves money in the long run. Remember, a mortgage is a big commitment. Stay informed, and you’ll make the best choice for you. Make sure to revisit these steps before deciding.

Your future self will thank you.