Transferring money from PayPal to your bank account might seem like a daunting task at first, but it doesn’t have to be. Imagine the freedom of having your funds readily accessible, ready to be used for that special purchase or to cover an unexpected expense.

This guide will show you how simple and straightforward it really is. You’ll discover the step-by-step process that transforms your digital dollars into tangible cash in your bank account. By the end of this article, you’ll feel confident and empowered, ready to manage your finances with ease.

So, if you’ve ever wondered how to make this transfer happen seamlessly, you’re in the right place. Let’s dive into the details and take the mystery out of moving your money from PayPal to your bank account.

Setting Up Your Paypal Account

Setting up your PayPal account is the first step towards making seamless money transfers to your bank account. Whether you’re new to PayPal or have been using it for online shopping, ensuring your account is properly configured is crucial. Have you ever wondered how a small oversight can delay your transaction?

Linking Your Bank Account

To start, you’ll need to link your bank account to PayPal. This process is straightforward but requires attention to detail. Begin by logging into your PayPal account and navigating to the “Wallet” section.

Here, you can add a bank account by entering your bank details. Be sure to double-check your account number and routing number. A simple typo can lead to frustration later. Wouldn’t you prefer the transfer to go smoothly?

Once you’ve entered the details, PayPal will initiate two small deposits into your bank account. These deposits usually appear within a couple of days. Keep an eye on your bank statements to catch them.

Verifying Bank Account Details

After receiving the small deposits, it’s time to verify your bank account. Log back into PayPal and go to the “Wallet” section again. Click on the bank account you’ve added, and you’ll be prompted to enter the exact amounts of the deposits.

This step confirms that you’ve correctly linked your bank account and ensures that you’re the rightful owner. Have you ever experienced the relief when everything checks out perfectly?

With your bank account verified, transferring money becomes a breeze. You can initiate transfers any time you need funds in your bank account. Isn’t it satisfying knowing that your hard-earned money is just a few clicks away?

Setting up PayPal correctly not only saves time but also prevents unnecessary stress. Have you checked your account settings lately to ensure everything’s in order?

Navigating The Paypal Interface

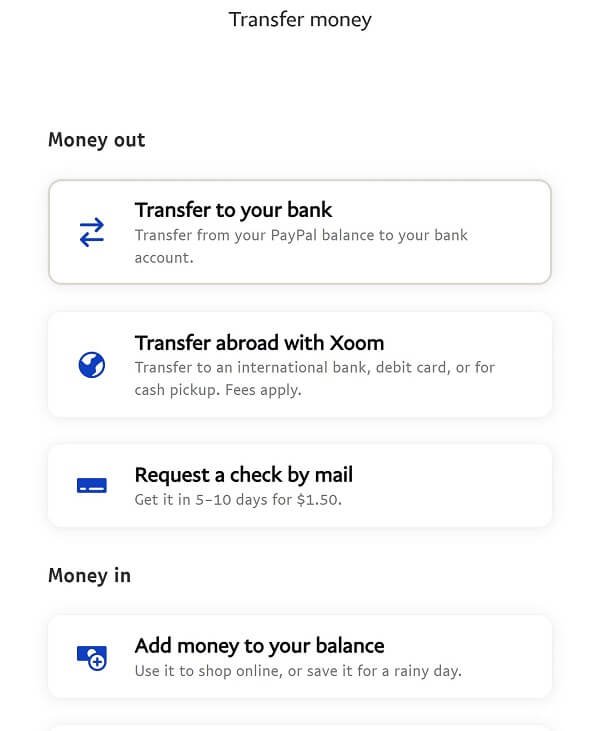

To transfer money from PayPal to your bank, log in and select the ‘Transfer Money’ option. Enter your bank details and the amount to transfer. Confirm the transaction and wait for the funds to appear in your account.

Navigating the PayPal interface can seem daunting at first. Yet, it’s simple once you know where to look. Many users struggle to find the right options. This guide will help you with clear steps. You’ll soon feel more confident. Let’s dive into the details.

Accessing The Transfer Money Option

First, log into your PayPal account. Look at the top of the page. You’ll see a menu with several options. Click on “Wallet.” This will open your financial overview. Find the “Transfer Money” button. It’s usually on the right side. Clicking this takes you to the next step.

Choosing The Correct Account

You need to pick the right bank account. PayPal will show you a list. These are accounts you’ve linked before. Not linked yet? No worries. You can add a new account here. Select the account you want. Double-check to avoid mistakes. Once selected, confirm your choice. Your money will soon be on its way.

Initiating A Transfer

Initiating a transfer from PayPal to your bank account is a straightforward process, but knowing the steps can save you time and hassle. Whether you’re transferring funds from a recent sale or withdrawing a gift from a friend, understanding the process ensures your money moves smoothly. Here’s how you can get started and make sure your funds land safely in your bank account.

Entering Transfer Amount

The first step in initiating your transfer is deciding how much money you want to move. Log into your PayPal account and navigate to the ‘Wallet’ section. You’ll see your available balance prominently displayed. Consider how much you need to transfer. Do you need all of it, or just a portion?

Once you’ve decided, click on ‘Transfer Money’. You’ll be prompted to enter the transfer amount. PayPal gives you the flexibility to transfer as little or as much as you need. Double-check your entry to avoid transferring more than intended.

Selecting Transfer Speed

After entering the amount, the next choice is the speed of your transfer. PayPal typically offers two options: standard transfer or instant transfer. Standard transfers usually take 1-3 business days, while instant transfers can reach your bank account within minutes.

Think about your urgency. Are you okay with waiting a few days, or do you need the funds immediately? Instant transfers may incur a small fee, but the convenience can be worth it if you’re in a pinch.

Choosing the right transfer speed can make a big difference. Have you ever been stuck waiting for a payment when you really needed it? Selecting the right option ensures you’re never left hanging.

In today’s fast-paced world, how quickly do you need access to your funds? By understanding these steps, you can make informed decisions and manage your finances effectively. What would you do differently now that you know how easy it is to transfer money from PayPal to your bank account?

Confirming Transfer Details

Transfer money from PayPal to your bank account by linking your bank details in the PayPal account settings. Enter the transfer amount, confirm, and wait for the funds to appear in your bank within a few days.

Transferring money from PayPal to your bank account might feel like a routine task, but it’s essential to ensure every detail is accurate. One small mistake can lead to delays or errors. Before hitting that ‘transfer’ button, take a moment to confirm all the transfer details. This step can save you time and prevent headaches later. Let’s dive into the specifics of confirming transfer details to make your financial transactions smooth and stress-free.

Reviewing Transaction Summary

Before you proceed with transferring money from PayPal to your bank, carefully review the transaction summary.

This summary provides a snapshot of the amount, destination account, and any fees involved.

Ensure the details match your intentions. For example, double-check the bank account number and the transfer amount.

A quick glance can help you avoid costly mistakes. Have you ever accidentally sent money to the wrong account? It happens more often than you think.

Confirming The Transfer

Once you’re satisfied with the transaction summary, it’s time to confirm the transfer.

Click the ‘Confirm’ button, but only do so after ensuring everything is correct.

You might wonder, “Is there a chance for reversal if I make a mistake?” While some errors can be corrected, it’s better to avoid them altogether.

Consider setting a reminder to check your bank account after a day or two to see if the transfer has successfully been completed.

What steps do you take to ensure your transfer details are accurate?

Being meticulous can save you from unnecessary stress and confusion.

Tracking Your Transfer

Transfer money from PayPal to your bank account easily. Log in, select ‘Transfer Money,’ choose ‘Transfer to your bank,’ and follow instructions. Funds usually arrive within 3-5 business days.

Transferring money from PayPal to your bank account is a straightforward process, but keeping track of your transfer can sometimes feel like a small adventure. You hit that transfer button and wait, but what if you want to ensure everything’s on track? Tracking your transfer is crucial to ensure your money reaches your account without a hitch. Whether you’re dealing with a large sum or just a small balance, knowing how to monitor your transfer can save you from unnecessary stress. Let’s dive into how you can efficiently track your transfer and what to do if something goes amiss.

Checking Transfer Status

After initiating a transfer, you might wonder, “Where is my money now?” Luckily, PayPal provides a simple way to check the status. Log in to your PayPal account and head to the “Activity” section. Here, you’ll find a list of your recent transactions, including your transfer.

Look for the status update next to your transfer. It may say “Pending,” “Completed,” or “Failed.” Each status gives you a clue about the progress. For example, if it’s “Pending,” it means the transfer is still in process. “Completed” assures you the money should be in your bank soon.

Sometimes, you may receive email notifications updating you on the transfer status. These are handy for keeping tabs without logging in every time. Have you ever thought about setting up alerts for such updates? It might save you from the constant checking.

Resolving Common Issues

Occasionally, a transfer might hit a snag. If your transfer shows “Failed,” don’t panic. First, double-check your bank details in PayPal to ensure they’re correct. A simple typo could be the culprit.

Next, contact your bank to see if there were any issues on their end. Sometimes, banks have security checks that can delay or block transfers.

If everything seems right but the transfer still hasn’t gone through, reach out to PayPal’s customer service. They can provide insights or help resolve the issue. Remember, you’re not alone; many users face similar challenges, and solutions are often just a call or message away.

Have you ever had a transfer delay that turned out to be a minor error on your part? Such experiences remind us of the importance of double-checking details. Always ensure your banking information is up-to-date to avoid these hiccups.

Tracking your transfer might seem like a small task, but it’s essential for peace of mind. By staying informed and ready to tackle common issues, you can ensure your money safely reaches its destination. Have you ever had to track a transfer? What did you learn from the experience?

:max_bytes(150000):strip_icc()/002_transfer-money-from-paypal-to-bank-account-4582759-ccada152c5dc4c9fa4a38a5d0c536cc0.jpg)

Enhancing Transfer Security

Transferring money from PayPal to your bank account is easy. But ensuring security is crucial. Protecting your funds involves understanding and using available safety features. This section explores ways to enhance transfer security. Focus on these aspects to keep your transactions safe and secure.

Using Two-factor Authentication

Two-factor authentication adds an extra security layer. It requires two types of verification. First, your password. Second, a code sent to your phone. This prevents unauthorized access. Even if someone knows your password, they need the code. This method reduces risks significantly. Enable it in your PayPal settings for better protection.

Recognizing Fraudulent Activities

Fraudulent activities are common online. Recognizing them is vital. Watch out for suspicious emails and links. They often ask for personal information. PayPal will never ask for your password via email. Always check the sender’s email address. Look for signs of phishing attempts. Report anything suspicious immediately. Staying alert can save you from fraud.

Maximizing Transfer Efficiency

Transferring money from PayPal to a bank account can be simple. But ensuring efficiency requires understanding several key aspects. Knowing the fees involved and selecting the right transfer options is crucial. These factors can affect the speed and cost of your transactions.

Understanding Fees And Limits

PayPal charges fees for certain transactions. It’s important to know these fees. They can vary based on the transaction type. Also, PayPal has transfer limits. These limits can affect how much you can send at once. Check your account settings for specific details. Understanding these elements helps in planning your transfers better.

Choosing Best Transfer Options

There are different ways to transfer money from PayPal. Direct transfers to a bank account are common. They are usually fast and secure. Instant transfers are available but might cost more. Consider the timing and fees before choosing. Compare options to see what works best for your needs. This can save time and money.

Frequently Asked Questions

How Do I Link My Bank To Paypal?

To link your bank account to PayPal, log in to your PayPal account. Navigate to “Wallet” and click “Link a bank. ” Enter your bank’s information and follow the prompts. PayPal will verify your bank details with small deposits. Confirm the amounts to complete the process.

Is There A Fee For Transferring Money?

Transferring money from PayPal to your bank account is typically free. However, instant transfers may incur a small fee. Always check PayPal’s latest fee structure for precise information. Standard transfers usually take 1-3 business days and are free of charge.

How Long Does A Paypal Transfer Take?

A standard transfer from PayPal to your bank account usually takes 1-3 business days. Instant transfers are quicker but may incur a fee. The exact time can vary depending on your bank’s processing times and PayPal’s policies.

Can I Use Paypal On Mobile For Transfers?

Yes, you can transfer money using the PayPal mobile app. Open the app, tap “Transfer Money,” and follow the instructions. It’s a convenient way to manage your finances on the go. Ensure your app is updated for the best experience.

Conclusion

Transferring money from PayPal to your bank is simple. Follow the steps carefully. Ensure your bank account is linked to PayPal. Check for any transfer fees. Confirm the transaction details before submitting. Transfers usually take one to three days. Monitor your bank account for updates.

Contact PayPal support for any issues. Remember to keep your login details secure. This process helps you access funds easily. With practice, it becomes quick and stress-free. Now, you can manage your finances better. Enjoy the convenience of online banking.

Keep exploring more efficient ways to handle money.