Frais de clôture et acompte : le même prix ? Révélation des faits

Are you ready to buy a home but feeling overwhelmed by the financial jargon? Terms like “closing costs” and “down payment” might sound similar, but they play very different roles in your home-buying journey.

Understanding these differences is crucial, not just for your peace of mind but for your wallet, too. Imagine this: you’ve found your dream home, but unexpected costs suddenly appear, throwing your budget into chaos. No one wants that! By the end of this article, you’ll have a clear picture of what each term means, how they impact your finances, and why knowing the difference could save you from unwanted surprises.

So, stick around—your future self will thank you!

Defining Closing Costs

Closing costs are fees paid when buying a home. These fees are separate from a acompte. They include charges like loan origination fees et title insurance. Other costs might be appraisal fees et inspection fees. Closing costs are paid at the end of the buying process. They usually add up to 2% to 5% of the home price.

Buyers need to budget for these costs. They are important for completing a home purchase. Understanding closing costs helps avoid surprises. It makes buying a home smoother and easier. Many people confuse them with the down payment. But they are two different things.

Understanding Down Payment

Acompte is the amount you pay upfront when buying a house. This amount is a percentage of the home’s price. A common down payment is 20% of the home’s price. Paying more can be better. It may help you avoid paying extra fees.

Some people use économies for their down payment. Others may get help from family. It is important to plan and save. This helps ensure you have enough when buying a home. Saving early is a smart idea. It makes the process easier.

Key Differences

Le purpose of a down payment is to reduce the loan amount. It shows the buyer’s commitment. Closing costs cover fees for the transaction. These include inspections and lender fees. The timing is also different. Down payments are paid before getting the loan. Closing costs are paid at the final stage.

A down payment is a percentage of the home’s price. It is usually 20%. On the other hand, closing costs include many components. These are appraisal fees, title insurance, and credit report fees. It also includes attorney fees and taxes. Closing costs can be 2-5% of the home’s price. This makes it important to save for both.

Idées fausses courantes

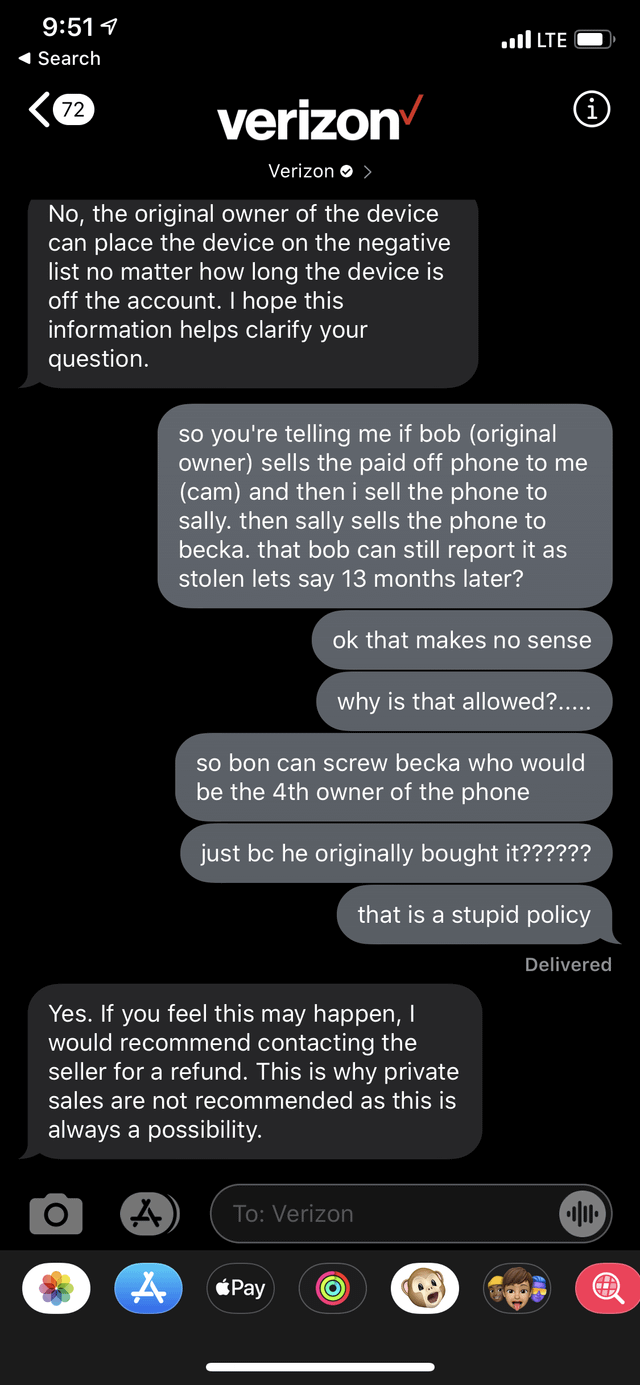

Closing costs et acomptes are often confused. People think they mean the same thing. They do not. These terms are different in home buying.

Closing costs are fees to finish buying a home. Down payments are money paid upfront for the home. People mix them up. It’s easy to do this. But knowing the difference is important. It helps in budgeting and planning.

Both require money. But they affect finances differently. Closing costs can surprise buyers. They are extra fees. Down payments reduce loan amounts. Each impacts finances in its own way. It’s wise to prepare for both.

Calculating Costs

Closing costs are fees paid at the end of a home purchase. These costs include inspection fees, appraisal fees, et loan origination fees. Buyers pay these costs to complete the home purchase. The total can be 2% to 5% of the home price. Always check with your lender about the exact costs. They can vary based on location and lender.

The down payment is the money you pay upfront for the home. It’s usually a percentage of the home’s price. Many loans require at least 3% to 20% down. A higher down payment can lower your monthly mortgage. It can also help avoid private mortgage insurance. Saving for a down payment is important. It helps in buying your dream home.

Funding Strategies

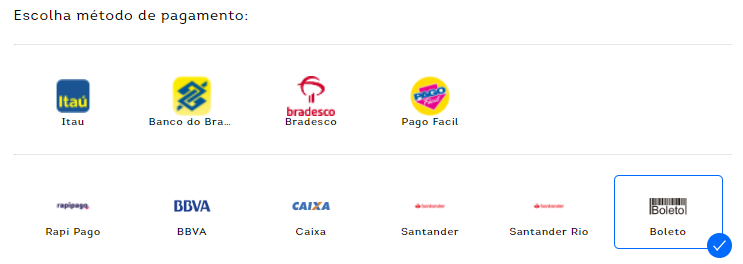

Saving for a acompte can be a big job. Start small. Save a little each month. Use a special bank account. Watch the money grow. Skip buying toys and snacks. Put that money in the bank. Birthday money counts too. Every penny helps. Ask family for help. Big savings come from small steps.

Closing costs are extra fees. These are not part of the down payment. Pay attention to these fees. They can add up fast. Ask the bank for details. They can explain each fee. Some fees can be reduced. Negotiate with the bank. Always check the numbers. Make sure you can pay them.

Expert Tips

Understanding the difference between closing costs and down payments is crucial for homebuyers. Closing costs cover fees related to finalizing a home purchase, while a down payment is the initial amount paid towards the home’s price. Both are essential financial components but serve distinct purposes in the buying process.

Negotiating Closing Costs

Closing costs can be expensive. Ask your lender for a detailed list. Compare costs from different lenders. Negotiate with them for better deals. Sometimes, sellers may aide with these costs. Request them to cover some expenses. Be polite and clear in your requests. Choisir a lender with fewer fees if possible. Read all terms carefully before signing.

Optimizing Down Payment

A down payment is important. It affects your loan. Sauvegarder money early for a bigger down payment. Vérifier if you qualify for special programs. Some programs help with down payment. Ask your lender about these programs. A larger down payment lowers your monthly payments. Plan your budget wisely. Éviter spending on unnecessary items. Piste your expenses to save more.

Real-life Examples

Alice wanted to buy her first home. She saved for the acompte. This is the money she needed to pay upfront. The down payment was 20% of the house price. She also had to pay frais de clôture. These were extra fees for paperwork and legal work. Closing costs were about 3% of the house price. Alice was surprised by these costs. She thought the down payment was the only big cost. Now she knows they are not the same.

Bob bought a second house. He knew about the acompte et frais de clôture. This time he planned better. Bob saved extra money for both. He used 15% for the down payment. He also set aside 2% for closing costs. Bob learned from his first experience. He realized both costs are important. Now he advises others to plan for both. Understanding these costs helps avoid surprises.

Questions fréquemment posées

What Is The Difference Between Closing Costs And Down Payment?

Closing costs are fees for finalizing a real estate transaction, while a down payment is the upfront money paid for the property. Closing costs cover services like appraisals and inspections. The down payment reduces the loan amount. Both are essential but serve different purposes in a home purchase process.

Are Closing Costs Included In The Down Payment?

No, closing costs are not included in the down payment. They are separate expenses. The down payment reduces the loan amount. Closing costs cover transaction fees like appraisals. Both are necessary but must be budgeted independently when buying a home.

Can Closing Costs Be Negotiated?

Yes, closing costs can often be negotiated. Buyers can ask sellers to cover some fees. Lenders may also offer discounts on certain costs. It’s beneficial to compare lenders and negotiate terms. This can potentially lower the overall cost of purchasing a home.

How Much Are Typical Closing Costs?

Typical closing costs range from 2% to 5% of the home’s purchase price. These costs include various fees like appraisals, inspections, and title insurance. The exact amount can vary based on location, lender, and other factors. It’s crucial to budget for these costs in addition to the down payment.

Conclusion

Understanding closing costs and down payments is crucial. They serve different purposes. Down payments reduce loan amounts. Closing costs cover transaction fees. Both impact your total home buying budget. Knowing the difference helps in planning. It aids in financial preparedness.

Make sure you budget for both. It ensures smoother home buying experiences. Talk to a financial advisor for guidance. Stay informed and ask questions. This knowledge empowers better decisions. Your home buying journey will be clearer. Happy house hunting!