Puis-je acheter un Scooty sans acompte : le guide ultime

Are you dreaming of zooming through the city streets on a brand-new scooty, but the thought of a hefty down payment is holding you back? You’re not alone.

Many people wonder if it’s possible to get their hands on a sleek, efficient scooty without having to empty their savings upfront. The good news is, there are options available that might just turn this dream into reality. We’ll explore the various ways you can own a scooty without paying a large sum upfront.

Imagine the freedom and excitement of hitting the road on your new ride without the stress of financial strain. Keep reading to discover how you can make this happen and take the first step towards your new scooty adventure!

Understanding Zero Down Payment

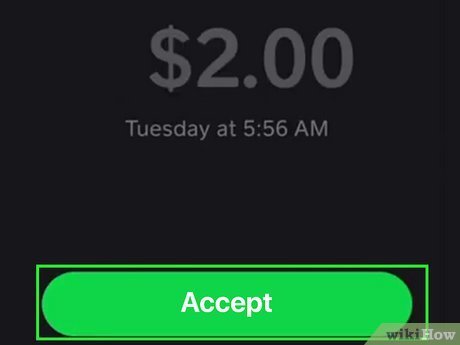

Zero down payment means buying without paying upfront. You start without any initial cost. This concept helps many people buy things they need. But it is important to know the details.

Benefits: You can get your scooty fast. No need to save first. It is also easier for people with less money.

Drawbacks: You might pay more later. Monthly payments can be high. Interest rates may increase total cost.

| Aspect | Détails |

|---|---|

| Immediate Access | Get your scooty without delay. |

| Financial Impact | Can lead to higher overall costs. |

Critères d'éligibilité

A good credit score is important. It shows you pay bills on time. Most lenders want a score of 700 or more. A higher score means better chances. But, some places accept lower scores. Always check before applying.

Lenders need proof of income. This shows you can pay back the loan. They may ask for bank statements. Or, pay stubs. These documents show your earnings. Make sure they are recent. Having a steady job helps too.

You must be at least 18 years old. This is the legal age to sign a contract. Some lenders may want you to be older. Employment is also key. A stable job makes you a safer bet. This lowers the risk for lenders.

Options de financement

De nombreuses banques proposent loans for buying a scooty. The taux d'intérêt can be low. Banks might need you to have a good cote de crédit. They often ask for income proof. Some banks allow you to buy without a down payment.

NBFCs also provide loans. They are flexible with rules. These companies might offer taux d'intérêt plus élevés. Yet, they can give loans rapidement. Not much paperwork is needed. They are a good choice if banks do not approve your loan.

Some dealerships offer financement interne. This means they give you a loan directly. The process is simple. You might need to pay more in the end. Taux d'intérêt could be higher. But it is a fast way to get your scooty.

Key Considerations

Taux d'intérêt are important. They affect your payment amount. Compare different banks. Some offer lower rates. This helps save money.

Loan tenure matters too. Longer tenures mean smaller monthly payments. But, you pay more interest. Short tenures mean higher payments. But less total interest.

Hidden charges can surprise you. Check for extra fees. Processing fees are common. Late payment fees can be high. Read terms carefully. Avoid unexpected costs.

Processus de candidature

To buy a scooty with no down payment, have your ID card ready. A preuve de revenu is also needed. Show your address proof as well. All documents should be up-to-date.

First, visit the dealership. Ask for the scooty application form. Fill the form with care. Submit the form with documents. Wait for the dealer to process.

Approval takes 3 to 5 days. Sometimes, it takes a week. Keep your phone nearby. The dealer will call you. Get ready to ride your scooty.

Tips For Successful Purchase

UN bonne cote de crédit helps in buying a scooty. Pay your bills on time. Clear dettes impayées quickly. Try not to borrow too much money. A higher score means better offers.

Talk with the seller for better terms. Ask for zero down payment options. Check for frais cachés. Discuss interest rates. Ensure terms benefit you. Always read the agreement carefully.

Compare different scooty offers. Look for low interest rates. Consider coût total over time. Some deals may seem cheap but cost more later. Choose the meilleure affaire for your budget.

Questions fréquemment posées

Can I Buy A Scooty With Zero Down Payment?

Yes, many financial institutions offer zero down payment options for scooty purchases. Check with banks or NBFCs for specific plans. These plans may require a good credit score and stable income. Always read terms and conditions carefully before opting for such financing options.

What Are The Benefits Of No Down Payment?

No down payment allows immediate purchase without upfront costs. It frees up cash for other expenses. However, it might lead to higher monthly payments. Ensure that the interest rates and overall financial terms are favorable before committing to such a plan.

Are There Any Hidden Charges In Zero Down Payment Offers?

Yes, there might be hidden charges like processing fees or higher interest rates. Always read the fine print carefully. Discuss with the lender all potential fees involved. Transparent communication helps avoid unexpected costs later.

How Does Zero Down Payment Affect Loan Tenure?

Zero down payment can extend the loan tenure, resulting in smaller monthly payments. However, a longer tenure may increase overall interest paid. Evaluate your financial situation and discuss options with your lender to find a suitable tenure.

Conclusion

Exploring options for buying a scooty without a down payment is important. You can find many financing solutions that fit your budget. Research different lenders and their terms carefully. Compare interest rates and repayment plans. Always read the fine print before signing any agreement.

This ensures you make a wise financial decision. Remember, a little effort now can save you trouble later. Buying a scooty without a down payment is possible. It just requires smart planning and careful choices. Enjoy the freedom and convenience your new scooty offers! Safe travels on your new ride!