How to Transfer Money to a Chime Account: Easy Steps

Picture this: you’re ready to send money to a friend or pay a bill, and you’ve chosen to use Chime for its simplicity and convenience. But the question arises: how do you actually transfer money to a Chime account?

You’re not alone in this, and the good news is that transferring money to Chime is easier than you might think. By the end of this article, you’ll not only know how to transfer money swiftly and securely but will also gain confidence in managing your finances with ease.

Ready to master the art of money transfers? Let’s dive in and simplify the process together!

Setting Up Your Chime Account

Setting up a Chime account is simple and quick. This guide will help you start. You’ll be ready to transfer money easily and securely.

Creating A Chime Account

Visit the Chime website or download the app. Click ‘Sign Up’ to begin. Fill in your personal details like name and email. Choose a strong password for security. Read and accept the terms and conditions. Click ‘Submit’ to create your account.

Vérification de votre identité

Chime needs to verify your identity for safety. Provide a valid ID like a driver’s license. Follow the instructions to upload your ID. Ensure all information is clear and visible. Wait for Chime to confirm your identity. This process ensures your account is protected.

Linking A Bank Account

Transferring money to a Chime account is easy and secure. First, link your bank account to Chime through the app. Then, follow prompts to initiate the transfer, ensuring a seamless transaction.

Choosing The Right Bank

Before you rush to link any bank account, take a moment to evaluate your options. Consider the banks you frequently use, their transfer fees, and processing times. Does your current bank offer a user-friendly app or online platform? These factors can significantly impact your experience. Some people prefer to use their primary bank for all transactions due to familiarity and convenience. Others might opt for a different bank that offers better transfer rates or faster processing times. What matters most to you? Weigh these aspects carefully to make the best decision.Connecting Your Bank To Chime

Once you’ve chosen the right bank, connecting it to your Chime account is straightforward. Begin by logging into your Chime app and navigating to the ‘Move Money’ section. From there, select ‘Transfers’ and then ‘Link a Bank Account’. You’ll need to provide your bank’s login credentials or account and routing numbers. Concerned about security? Chime uses encryption to safeguard your information. This step ensures your details are safe while enabling easy transfers. After successfully linking, test the connection with a small transfer. This not only confirms the setup but also gives you peace of mind that your transactions will go smoothly. Have you ever experienced a bank transfer delay? Testing can prevent such inconveniences. Ready to link your bank account with Chime? With these actionable steps, you’ll be able to manage your finances more efficiently, ensuring your money is always where you need it.Using The Chime Mobile App

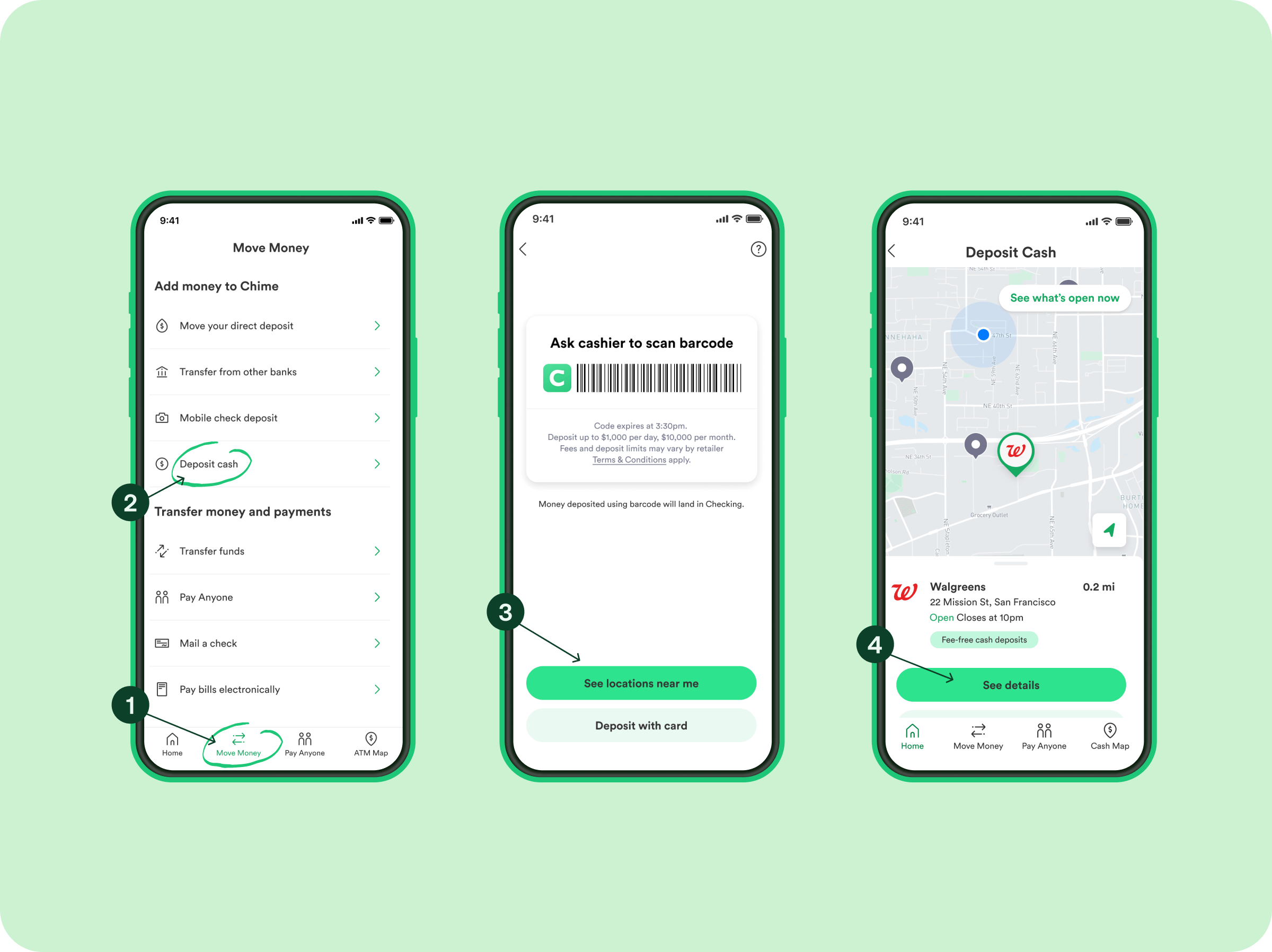

Transferring money to a Chime account is simple with the Chime mobile app. The app offers a user-friendly interface, making transactions quick and easy. With just a few taps, you can move funds effortlessly. Let’s explore how to navigate the app and initiate a transfer.

Open the Chime app on your smartphone. The home screen displays your account balance. Icons at the bottom help you access different features. Choose the “Move Money” icon. This will direct you to the transfer section. Everything is clearly labeled for easy use.

Initiating A Transfer

To start a transfer, tap “Transfer Money”. Enter the amount you wish to transfer. Select the account you are moving money from. Confirm the transaction details. Review everything for accuracy. Hit “Confirm” to complete the transfer. Funds will move swiftly to your Chime account.

Transferring Money Via Direct Deposit

Transferring money to a Chime account is simple. Set up direct deposit through your employer or financial institution. Provide your Chime account details, including the routing and account numbers, for a seamless transaction.

Configuration du dépôt direct

Setting up direct deposit with Chime is simple. First, access your Chime account online or through the app. Find your account number and Chime’s routing number. These are essential for direct deposit. Share these details with your employer or the payer. Fill out any required direct deposit forms. This ensures your funds are sent correctly. Confirm the details are accurate before submission. Once set up, your money will flow into your Chime account automatically.Managing Direct Deposit Transfers

Managing direct deposit transfers is straightforward. Check your Chime account regularly. This lets you confirm your funds are deposited on time. If you notice any issues, contact your payer immediately. Chime provides notifications for each deposit. This helps you stay informed. Use Chime’s app features to track your balance. You can also set alerts for large deposits. This keeps your finances organized. Adjust your direct deposit settings anytime through Chime. This flexibility ensures your financial needs are always met.Transferring Money Via Ach

Transferring money to a Chime account using ACH is simple. ACH, or Automated Clearing House, is a popular way to move funds. It is secure and reliable. Many users prefer ACH for its ease and efficiency. You can send money directly from your bank to your Chime account. Let’s explore how to do this effectively.

Understanding Ach Transfers

ACH transfers are electronic money transfers. They occur between banks through the ACH network. This method is common for direct deposits and bill payments. It is cost-effective and safe for users. Transfers usually take 1-2 business days to complete. Some banks might charge fees for ACH services.

Scheduling An Ach Transfer

Scheduling an ACH transfer is straightforward. First, log in to your bank’s online portal. Find the option for external transfers or ACH. Enter your Chime account details. Make sure the information is correct. Select the amount you wish to transfer. Choose the date for the transfer. Confirm your transfer details. Submit the transfer request. You will receive confirmation from your bank. Monitor your Chime account for the incoming funds.

Using Third-party Payment Services

Transferring money to a Chime account through third-party payment services is simple. Start by linking your Chime account to the service. Next, follow the service’s instructions to transfer funds. Ensure all details are correct to avoid delays. This process is straightforward and user-friendly.

Selecting A Payment Service

Choosing the right payment service is crucial. Some popular options include PayPal, Venmo, and Cash App. Each has its own features, fees, and transfer times. Consider what matters most to you. Is it the speed of transfer, the lowest fees, or the ease of use? For instance, PayPal is widely accepted and offers robust security features, while Venmo is known for its social sharing capabilities. You might also want to think about the ecosystem you’re already part of. If your friends and family use a particular service, it might be easier to choose the same one.Connecting Services To Chime

Once you’ve chosen a payment service, the next step is to connect it to your Chime account. Most services make this process simple and intuitive. Start by opening the payment service app and navigate to the settings or account section. Look for an option to link a bank account and select Chime from the list. You’ll likely need your Chime account number and routing number, which you can easily find in the Chime app. After entering these details, verify the connection, which sometimes involves small test transactions. Have you ever wondered how secure these connections are? Rest assured, most payment services use encryption to protect your data. Just ensure you’re using official apps and websites to minimize risk. Transferring money this way can be a game changer, especially when you need to send or receive funds quickly. What’s your favorite third-party service to use with Chime, and why?Dépannage des problèmes courants

Transferring money to a Chime account is usually a smooth process. However, like any financial transaction, you might occasionally encounter hiccups. Understanding how to troubleshoot these common issues can save you time and stress. Whether it’s a delay in the transfer or needing to contact support, being prepared can make all the difference.

Résoudre les retards de transfert

Transfer delays can be frustrating, especially when you’re counting on the funds to arrive promptly. The first step is to check your bank account for any pending transactions. Sometimes, the delay might be on the sending bank’s end.

Ensure that all account details are correct. A single digit error can hold up your transfer. Double-check the routing number and account number for accuracy.

Consider the timing of your transfer. Transfers initiated on weekends or holidays might take longer due to banking schedules. It’s always a good idea to plan transfers during business days.

If you frequently face delays, assess your internet connection and ensure your banking app is updated. An outdated app can cause processing delays.

Contacting Chime Support

If your transfer is still unresolved, reaching out to Chime’s support team is the next step. They can provide insights into any internal issues affecting your transfer.

Chime offers multiple support channels, including phone and chat. Choose the method that suits your preference for a quicker resolution.

When contacting support, have your account details ready. This includes transaction ID and any correspondence related to the issue. This helps expedite the process.

Consider asking Chime support about any known issues or maintenance updates that might affect transfers. This can give you a clearer picture of the situation.

Have you ever faced a transfer delay with Chime? What steps did you take to resolve it? Sharing your experiences in the comments can help others navigate similar issues.

Questions fréquemment posées

How Can I Transfer Money To Chime?

To transfer money to a Chime account, you can use the Chime app. Link your external bank account, then select “Move Money. ” Follow the prompts to complete the transfer. Ensure your external bank supports ACH transfers. It usually takes 3-5 business days for the transfer to process.

Is There A Fee To Transfer Money To Chime?

Chime does not charge fees for transferring money to your account. However, your external bank might charge a fee for the transfer. Always check with your bank for any potential charges. Chime is known for its low-fee structure, making it a cost-effective option for many users.

How Long Does A Chime Transfer Take?

Transfers to a Chime account typically take 3-5 business days to complete. The exact time depends on your external bank’s processing speed. It’s advisable to initiate transfers during business days to avoid delays. Chime aims to make the process as quick and seamless as possible for its users.

Can I Transfer Money To Chime From Paypal?

Yes, you can transfer money from PayPal to your Chime account. First, link your Chime account to PayPal. Then, initiate the transfer from your PayPal account. It may take a few days to process. Ensure all account details are accurate to avoid any issues with the transfer.

Conclusion

Transferring money to a Chime account is straightforward. Follow simple steps, and your funds arrive quickly. Start by linking your bank account to Chime. Use the mobile app for easy access. Double-check details to avoid errors. Enjoy the convenience of managing your finances smoothly.

With Chime, money transfers become stress-free. Whether sending or receiving funds, the process is user-friendly. Remember, understanding the steps ensures a successful transaction. Now, you’re ready to manage your money with confidence. Embrace the ease and simplicity of Chime for all your banking needs.