Quel est le montant de l'acompte pour un prêt de construction ? : guide essentiel

Are you planning to build your dream home but wondering how much down payment you’ll need for a construction loan? You’re not alone.

Navigating the world of construction loans can be overwhelming, especially when it comes to understanding the financial commitments involved. Knowing the right down payment can make or break your plans, and that’s why it’s crucial to get it right from the start.

In this guide, we’ll unravel the mysteries of construction loan down payments, helping you make informed decisions with confidence. By the end, you’ll have a clear picture of what to expect, empowering you to take the next steps toward turning your dream into reality. So, let’s dive in and decode the numbers together!

Construction Loan Basics

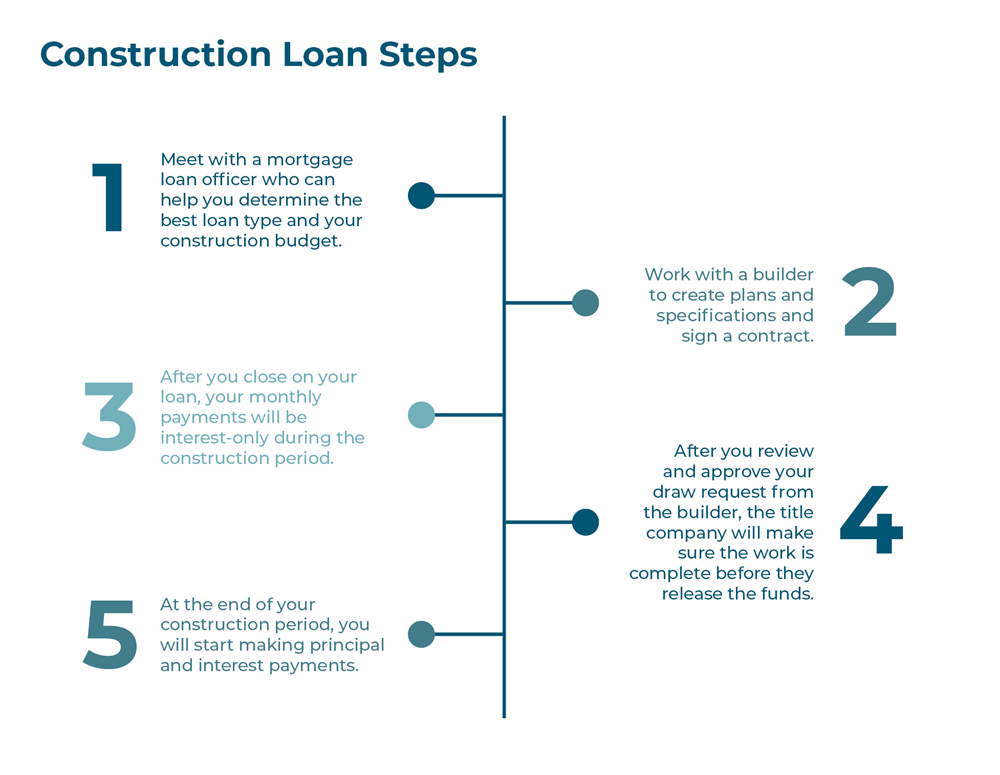

Construction loans help people build new homes. These loans are different from regular home loans. They cover the cost of building materials and labor. Banks give these loans for short periods. Borrowers often pay only interest during construction. Once the building is done, the loan changes. It becomes a regular home loan.

Down payments on construction loans are usually higher. Most banks ask for at least 20% down. This is to reduce risk. Lenders feel safer when borrowers invest more money. Down payments show the borrower’s commitment. They help secure the loan.

Borrowers should check loan terms. Different banks may have different rules. It’s important to understand these terms. This helps avoid surprises later.

Importance Of Down Payment

Down payment is the first step in getting a loan. It shows your commitment to the project. Banks need assurance that you are serious. Lower risk for them if you pay more. Sometimes, down payments are 20% of the loan. It depends on the lender. Higher down payments can mean better loan terms. It might reduce monthly payments. Économiser de l'argent on interest is possible. Budgétisation for a down payment is smart. Planning ahead helps avoid stress. Ask lenders about their specific requirements. Each lender may have different rules. Research is key before choosing a lender.

Standard Down Payment Percentages

Construction loans often need a higher down payment. Most lenders ask for 20% to 30% of the total loan amount. This amount shows the lender you are serious. A larger down payment lowers your monthly payments. Smaller loans might need less money down. It’s important to check with different lenders. Each might have different rules. Always plan your budget well. This will help avoid surprises later. Make sure you save enough before applying. Having a good credit score can also help. It might reduce the amount you need to pay upfront.

Factors Affecting Down Payment Amount

Ton cote de crédit is very important. It shows how you handle money. A good credit score can help. You might pay less down payment. A bad score can mean more money needed. Lenders feel safer with good scores. They trust you more.

Different loans need different down payments. Some loans need more money. Others need less. It’s important to know your loan type. Ask your lender about the loan. They will tell you the details. This helps you plan your budget.

Le value of the property matters a lot. Expensive properties need more money down. Cheaper ones need less. The lender checks the property value. This helps them decide the down payment. Higher values mean higher payments. Plan ahead for this.

Comparing Construction Loans To Traditional Mortgages

Construction loans and traditional mortgages are not the same. Construction loans are for building new homes. Traditional mortgages are for buying homes. You need a down payment for both. But the amount can be different. For construction loans, you might need 20% down payment. Traditional mortgages can need less, sometimes 3% or 5%.

Taux d'intérêt can be higher for construction loans. This is because they are riskier for banks. Banks want to make sure the home is built well. Paiements can be different too. You might pay only interest during the build. After building, you start paying both principal and interest.

Ways To Fund Your Down Payment

Save money every month for your down payment. Make a plan that fits your budget. Start with small amounts and increase them. Use a savings account with good interest. Avoid spending on things you don’t need. Cut down on extra expenses. Every dollar saved helps you reach your goal faster. Stay focused and motivated.

Family can help with money gifts. These gifts can be part of your payment. Some programs offer help too. Look for local assistance programs. They might give you funds or loans. Check their rules before applying. Get all the information you need. These funds can ease your financial burden.

Your home’s value can fund your new loan. Use the equity you’ve built up. It acts like a strong financial tool. You can borrow against it. Understand the terms and interest rates. This method can be helpful if used wisely. Consult experts if unsure about decisions.

Impact Of Down Payment On Loan Terms

A larger acompte can lead to better loan terms. Lenders see less risk with more money upfront. This can mean lower taux d'intérêt. Monthly payments might be smaller. You could save more over time. With less borrowed, loan approval is easier. Bigger down payments show financial strength. This can impress lenders. It may also increase your negotiating power. More equity in the property can also be a benefit. You own more of the home from the start.

Some loans require a minimum down payment. It’s important to know these rules. Check with your lender for details. They can explain what is needed. Understanding this can help plan your budget. A good plan makes the process smoother.

Tips For Reducing Down Payment Requirements

Talk to your lender about lowering the down payment. They might have special plans. Show good credit and you might get a better deal. Compare offers from different lenders. This can help find the best option. Always ask if there are any remises spéciales.

Some government programs can help reduce the down payment. FHA loans might offer lower payments. Check if you qualify for these programs. Some programs are made for first-time buyers. Look into local housing programs too. They might have special offers in your area.

Potential Pitfalls To Avoid

Many people borrow too much for their construction loan. This can cause serious problems. Borrowing more than you can repay is risky. It may lead to stress financier. Always check your budget first. Make sure you can handle the payments. Think about your regular expenses too. Food, bills, and other costs don’t stop. They add up each month.

Some forget about future costs when building a home. These costs can be unexpected and large. Things like repairs and maintenance. They might not seem big now but can grow over time. Be sure to plan for these costs. Set aside some money just in case. It helps avoid surprises later.

Questions fréquemment posées

What Is A Typical Down Payment For Construction Loans?

A typical down payment for construction loans is usually 20% to 25%. Lenders require this to mitigate risks. The exact percentage can vary based on the lender and borrower’s creditworthiness. It’s crucial to check with different lenders for specific requirements and options available to you.

Can I Get A Construction Loan With 10% Down?

Yes, some lenders offer construction loans with 10% down. However, this might require excellent credit. Additionally, you may need to pay for private mortgage insurance (PMI). It’s essential to shop around and discuss options with different lenders to find the best terms for your situation.

Does Credit Score Affect Down Payment?

Yes, your credit score significantly affects your down payment amount. A higher credit score often results in a lower down payment requirement. Lenders perceive borrowers with excellent credit as less risky. Therefore, it’s beneficial to maintain a good credit score before applying for a construction loan.

Are Down Payments On Construction Loans Refundable?

Down payments on construction loans are generally non-refundable. They serve as an assurance to the lender. If the loan doesn’t close, you might lose this money. It’s vital to understand all terms and conditions before committing to a down payment on a construction loan.

Conclusion

Understanding construction loan down payments is crucial for future homeowners. Planning is key. Research and compare different lenders. Each might have unique requirements. Save diligently to meet these demands. A higher down payment often means better loan terms. Prioritize budgeting to reduce financial stress.

Always consult with a financial advisor. They can provide personalized advice. Remember, every step brings you closer to your dream home. Stay informed and confident in your decisions. With careful preparation, securing a construction loan becomes manageable. Your dream home is within reach.

Keep these insights in mind as you proceed.