Comment signaler les paiements de votre voiture à un bureau de crédit : améliorez votre score

Are you looking to boost your credit score or simply want to ensure that your financial activities are accurately reflected on your credit report? Understanding how to report car payments to the credit bureau can be a game-changer.

Whether you’ve just purchased a new vehicle or are managing an existing loan, knowing the ins and outs of credit reporting can help you take control of your financial future. Imagine the satisfaction of seeing your credit score rise, opening doors to better loan rates and financial opportunities.

This guide will walk you through the steps you need to take to make sure your car payments contribute positively to your credit history. Ready to unlock the secrets to a healthier credit score? Let’s dive in!

Importance Of Reporting Car Payments

Reporting car payments helps build credit history. It shows that you pay your bills on time. Credit bureaus use this information to decide your credit score. A bonne cote de crédit can help you get loans. It may also give you better interest rates. This saves money over time. Late payments can hurt your score. Always pay your car bills on time.

Missing car payments can lower your score. This makes it hard to get loans. Some lenders do not report payments. Ask your lender if they report to bureaus. If they do not report, you can ask them to start. Good payment history is important for future loans. Keep track of your payments. This helps you avoid late fees.

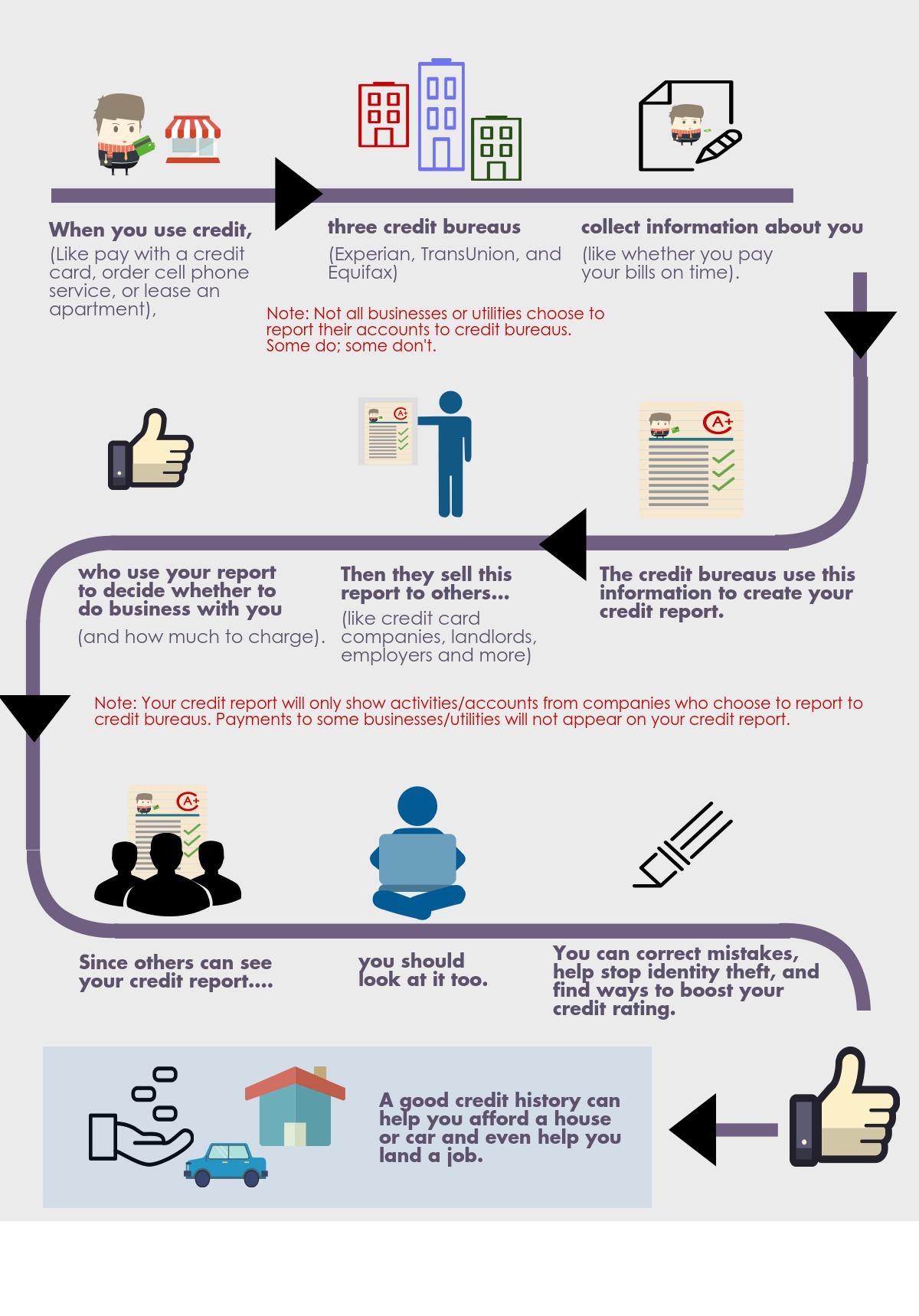

Understanding Credit Bureaus

Credit bureaus collect information about how people use credit. They track loans et paiements. Three main bureaus are Equifax, Experian, and TransUnion. They create reports about your antécédents de crédit. These reports help lenders decide if you can get a loan. Good reports can help you get meilleures offres on loans. Bad reports may make it harder to get credit.

People must check their credit reports. Errors can happen. Mistakes can hurt your credit score. Fixing errors can improve your credit. It is important to know what is on your report. This helps you understand your financial health. Always keep an eye on your credit reports.

How Car Payments Impact Credit Scores

Paying your car loan on time is very important. This helps your cote de crédit a lot. A good credit score is a number that shows how well you pay bills.

If you pay late, it can hurt your score. A low score means you might pay more money for loans.

Car payments show you can manage money. Lenders want to see you pay on time. This makes them trust you more.

Methods To Report Car Payments

Banks and lenders usually report car payments. They send updates to credit bureaus. This is done monthly. It helps in building your credit score. They track your payment history. Paying on time is very important. Retards de paiement can hurt your credit. It’s smart to keep track of your payments. Always pay on or before the due date. This way, you build a good credit profile.

Some services let you report payments yourself. Not all bureaus accept self-reports. It’s wise to check before you start. Self-reporting helps if lenders do not report. Rent payments can also be reported this way. It’s a good idea to keep records. Use these records to report if needed. Keep receipts and documents safe. They are very useful for self-reporting. They prove your payment history.

Steps To Ensure Accurate Reporting

Always double-check your car payment details. Make sure amounts are correct. Verify dates of each payment. It’s important that the lender’s records match yours. Mistakes can happen. Contact the lender if you see any errors. Keep a record of all communications. This helps in case of disputes. Also, save your payment receipts. These are important for proof.

Check your credit report often. This helps spot mistakes early. Make sure your car payments show up. If they don’t, your score may suffer. You can get free reports each year. Use these to ensure accuracy. Look for unknown accounts or errors. Report them quickly. This keeps your credit healthy.

Défis et solutions communs

Car payment reports can sometimes have errors. These errors may confuse the credit bureau. Fixing them is important. Double-check numbers and dates in reports. Ensure all details match what you paid. Contact your lender if you find mistakes. Ask them to update your report. Clear reports help build good credit. Stay alert for any errors.

Pay car bills on time. Every month. Late payments affect credit scores. Set reminders for payment dates. Use autopay if possible. Never miss a payment. Consistent payments show responsibility. A good payment record helps credit scores grow. Check your account balance before paying. Always pay the full amount. Consistency is key.

Tips To Boost Credit Scores With Car Payments

Pay your car loan on time. This helps your credit score. Late payments hurt scores. Mark dates on a calendar. This keeps you on track. Use reminders on your phone. This prevents missed payments. On-time payments build trust with lenders. Good habits are important. They improve your financial health.

Keep your debt low. High debt affects your credit score. Pay off small loans first. This reduces stress. Debt management is key. It keeps your score high. Lenders trust those with low debt. Try not to borrow too much. Borrow only what you need. Make a budget. Stick to it.

Role Of Financial Advisors

Financial advisors help you manage money better. They guide you in making smart choices. One important task is to report car payments to credit bureaus. This can help improve your credit score. A good credit score means you can borrow money easily. Advisors know how to do this correctly. They ensure that your payments are reported on time. This is crucial for building a strong credit history.

They also help explain the credit report. You can see if there are any mistakes. Fixing these mistakes can make your credit score better. conseillers financiers are like money teachers. They help you understand and manage your finances.

Questions fréquemment posées

How Do I Report Car Payments To Credit Bureaus?

To report car payments, contact your lender. Most lenders report payments automatically. Ensure your lender is connected with major credit bureaus. Regular, on-time payments will reflect positively. Check your credit report to verify the information.

Can I Self-report Car Payments To Credit Bureaus?

Self-reporting car payments directly is not possible. Use third-party services to report utility or rent payments. These services may include car payments. Always verify their legitimacy and ensure they report to major bureaus.

Why Are Car Payments Not On My Credit Report?

Car payments may not appear due to lender non-reporting. Some lenders report only to specific bureaus. Ensure your lender reports to major bureaus. Contact your lender for clarification and request them to report.

How Often Are Car Payments Reported To Credit Bureaus?

Car payments are typically reported monthly. Reporting frequency depends on the lender’s policies. Timely payments can improve your credit score. Ensure your lender regularly reports to keep your credit profile updated.

Conclusion

Reporting car payments to credit bureaus can boost your credit score. It’s essential to stay informed and proactive. Regularly check your credit reports for accuracy. Contact your lender if payments aren’t reported. Timely payments show financial responsibility. This can improve your creditworthiness over time.

Clear communication with your lender is key. Understanding the process helps you manage your credit better. This knowledge empowers you to make informed decisions. Building a strong credit history takes time and patience. Stay committed to responsible financial habits. Your efforts will pay off in the long run.