Combien de paiements de voiture en retard avant la reprise de possession : informations essentielles

Are you worried about falling behind on your car payments? You’re not alone.

It’s a situation that many people face, and it can feel overwhelming. But how many missed payments does it take before your car is at risk of repossession? Understanding this process can help you navigate your financial challenges more effectively.

We’ll break down exactly what you need to know about car payments and repossession timelines. You’ll discover the warning signs to watch for, and learn practical steps to protect your vehicle and your credit score. By the end, you’ll have a clearer picture of your options and how to take control of your financial situation. Let’s dive in and explore what you can do to safeguard your car and your peace of mind.

Repossession Basics

Missing car payments peut conduire à repossession. Lenders want their money back. If payments are not made, they take action. Usually, three missed payments are enough. Some lenders act faster. Others wait longer. Communication with your lender is key. They may offer help. Repossession is costly. It affects credit scores. It can also lead to stress. Keep track of your due dates. Set reminders if needed. Always read your contract. Understand your rights. Repossession rules can vary. Know your state’s laws.

Loan Agreement Terms

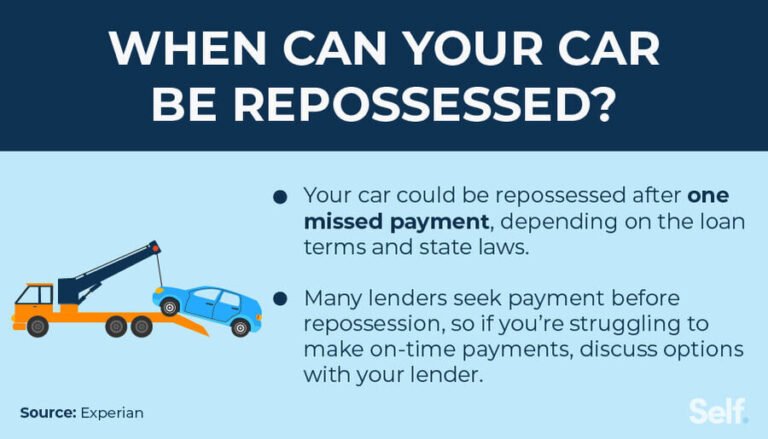

It’s important to read your loan agreement carefully. It tells you when your car may be taken. Many lenders can start repossession after one missed payment. But some wait until two or three payments are late. Toujours check your loan details.

Communication with your lender is key. If you have trouble paying, contact them. They might help you with a new plan. Some lenders offer grace periods. This means they give extra time before taking your car. But this is not always true. It depends on your loan terms.

Remember, each lender is different. Some may be strict, others lenient. Knowing your terms can help you avoid losing your car. Stay informed and stay ahead.

Grace Periods And Late Fees

Car loans often have a grace period. This is a time before you pay late fees. It is usually around 10 to 15 days. Paying within this time stops extra charges. Late fees can add up quickly. They make it harder to catch up on payments.

Missing a payment starts the repossession process

Communicate with your lender if you struggle. Often, they can help. They might offer solutions. Like adjusting your payment plan. This can stop repossession and keep your car safe.

Factors Influencing Repossession Timing

Lenders have different rules. Some are strict. Others are more lenient. Retards de paiement affect these rules. The lender’s reputation matters. Big banks might have tough policies. Smaller lenders may give more time. Written agreements are important. They explain what happens if you miss payments. Communication with the lender helps. It can prevent repossession. Always read your loan contract.

State laws are crucial. They vary across regions. Some states protect car owners. Others favor lenders. Repossession laws differ. Notice periods may be required. Legal actions can be involved. Knowing your state’s laws is key. Research is necessary. Contact a lawyer if unsure. Your rights depend on where you live.

Communication With Lenders

Being open with your lender is key. Tell them if you face money problems. They might help you with plans de paiement. Missing payments is common. But talking early can help. Lenders want their money back, not your car. They may give you more time. But only if you ask.

Stay honest about your situation. Hide nothing from them. They can work with you if they know the truth. Tenir des registres of all talks. Emails, calls, everything. This helps if problems come up later. Communication saves cars. It keeps you in the driver’s seat.

Financial Hardship Options

Loan Modifications help when payments are tough. They change loan terms. This can mean lower monthly payments. Sometimes, the interest rate is changed. This helps people keep their cars. Banks offer this option. It helps avoid repossession.

Forbearance Agreements give a break from payments. It’s temporary help. Banks pause or reduce payments for a while. This helps during hard times. It’s a short-term solution. People need to pay later. This helps keep cars safe. It prevents losing the car.

Preventing Repossession

Keeping track of your money can help stop car loss. Make a liste of all your expenses. See where you can save. Cut down on things you don’t need. This will help you payer your car bills on time. A good budget can keep your car safe.

Talking to a money expert can be very helpful. They can guide you on how to handle your bills. Experts can help you create a plan. This plan makes sure your car payments are on time. Seeking advice can protect your car from repossession.

Legal Rights And Protections

Car repossession is a serious matter. Lenders can take back your car if payments are missed. Many people wonder how far behind you can be. The answer varies. Some lenders act after one missed payment. Others may wait until two or three are missed. Know your loan agreement. It has rules for missed payments. This helps you understand when repossession can happen.

You have rights. Lenders must follow the law. They cannot break into your garage. They cannot use force to take your car. If you feel your rights are violated, you can seek help. Talking to a lawyer can provide guidance. It is important to communicate with your lender. Sometimes, they can offer a plan to help you catch up on payments.

Impact On Credit Score

Missing car payments can hurt your cote de crédit. Even one missed payment can cause damage. Credit scores drop when payments are late. Lenders report missed payments to credit bureaus. The more payments missed, the worse the score gets. A low credit score affects many aspects of life. It can make getting loans harder. Even renting a house might be tough. Paying on time helps keep scores good. Staying current on payments is wise. Setting reminders can help avoid late payments. Budgeting is also important. It ensures that you have enough money for payments.

Steps After Repossession

Falling two or three car payments behind can lead to repossession. After repossession, understanding your rights is crucial. Explore options like negotiating with lenders or considering alternative transportation solutions.

Redeeming The Vehicle

The car is taken. You might still get it back. This is called redeeming the vehicle. Pay the full amount owed. Include late fees and repo costs. This gives you the car again.

Some people choose loan reinstatement. Pay missed payments. Pay repo fees. Keep making regular payments. The car stays with you. Understand which option works best.

Alternative Transportation

Life goes on without a car. Find a bus route nearby. Use it to get around town. Ask friends for rides. Share fuel costs. It’s cheaper than a taxi.

Bicycles are good for short trips. They save money. They keep you fit. Walking is free. It’s great exercise. Plan your trips carefully. Avoid long distances without a car.

Questions fréquemment posées

How Many Payments Can You Miss Before Repossession?

Typically, missing three consecutive payments can lead to repossession. However, this varies by lender and state laws. It’s crucial to contact your lender at the first sign of trouble. Open communication may provide options like deferred payments or restructuring to avoid repossession.

What Happens If You Miss A Car Payment?

Missing a car payment can damage your credit score and trigger late fees. After several missed payments, the lender might initiate repossession. It’s important to address missed payments quickly. Communicating with your lender can help find solutions like payment plans or extensions.

Can Repossession Happen After One Missed Payment?

Repossession can technically happen after one missed payment, but it’s rare. Most lenders allow some leeway, typically after two or three missed payments. It’s advisable to contact your lender immediately if you anticipate missing a payment. Early communication can help prevent repossession.

How Does Repossession Affect Your Credit Score?

Repossession significantly impacts your credit score, often dropping it by 100 points or more. It remains on your credit report for seven years. This can make it difficult to secure future loans. To mitigate damage, consider negotiating payment terms with your lender before repossession occurs.

Conclusion

Understanding car payments and repossession is crucial. Stay informed about loan terms. Missing payments can lead to repossession. It’s vital to communicate with your lender early. They might offer solutions or adjustments. Keep track of your payment schedule. Create a budget to manage expenses.

This helps prevent future missed payments. Seek financial advice if needed. Awareness and proactive actions can save your car. Make informed decisions to secure your financial future. Protect your investment by staying on top of payments. Remember, knowledge is power when managing finances.

Stay alert and responsible to avoid repossession.