Puis-je configurer facilement des paiements Zelle récurrents ?

Are you tired of the monthly hassle of manually transferring money for your regular expenses? Imagine a world where your payments happen automatically, without the constant reminders or last-minute rushes.

The good news is, you’re not alone in wondering, “Can I set up recurring Zelle payments? ” This question is on the minds of many who crave convenience and efficiency in their financial routines. We’ll explore the possibilities and solutions that can simplify your life and help you take control of your finances with ease.

Stick around to discover how you can make recurring payments a breeze, freeing up your time and reducing stress.

Setting Up Zelle

To create a Zelle account, visit the app or website. S'inscrire using your email or phone number. Next, verify your account through a confirmation code. Follow the instructions for easy setup. Ensure your details are correct. This helps avoid issues later.

Linking your bank is important for transactions. Choose your bank from the list. Enter your bank credentials carefully. Verify your account to complete linking. This step is crucial for sending money. If you face issues, contact your bank for help.

Recurring Payment Options

Zelle does not support recurring payments. Users must send money manually each time. This can be a hassle for regular payments. Many people seek other ways to handle this. Banks often offer automatic transfers. These can be set for regular intervals. Using a bank’s option might be easier. It saves time and effort.

Some users set reminders to send money. This helps keep track of payments. Another way is using banking apps with auto-pay features. These apps can pay bills or send money at set times. It’s important to check fees with each method. Ensure you choose a trusted service. Safety and security are key. Regular checks can avoid mistakes.

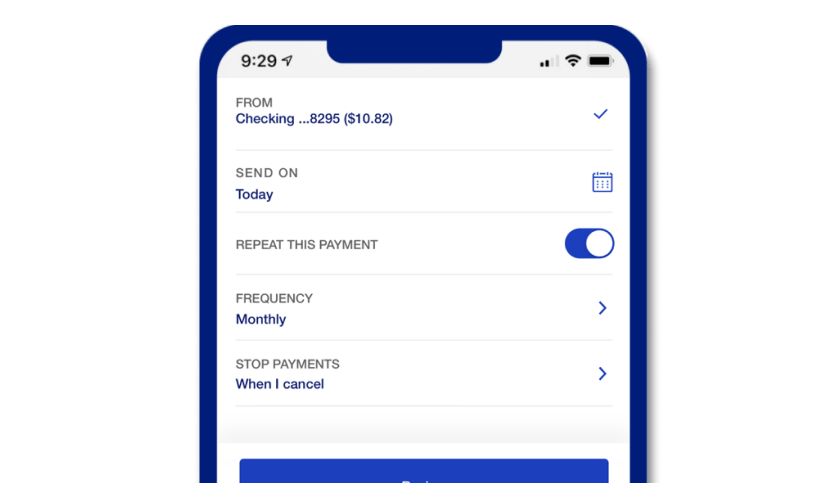

Using Bank Apps

Wondering about setting up recurring Zelle payments using bank apps? Currently, most bank apps do not support this feature. Checking your specific bank’s app for updates is wise, as features can change.

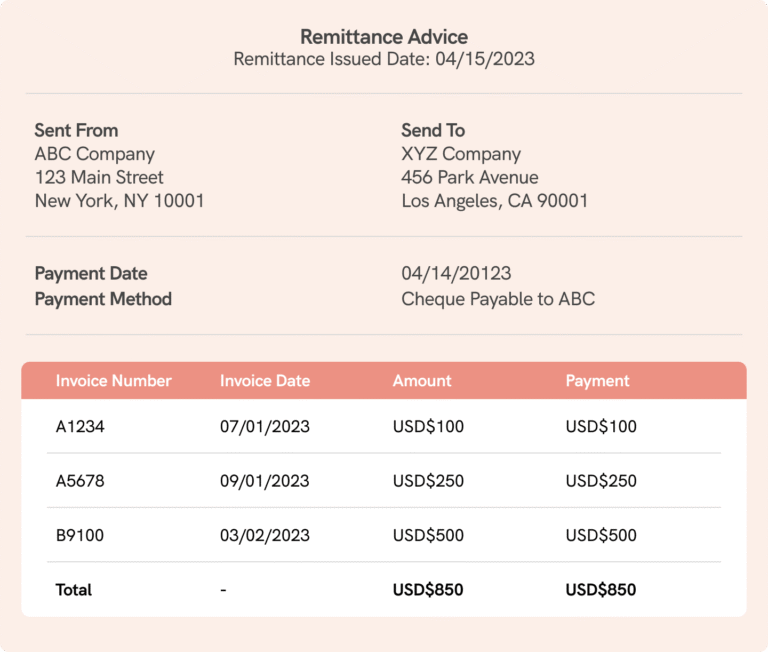

Supported Banks For Recurring Payments

Many banks allow paiements récurrents with Zelle. Not all banks do. Common banks include Chase, Bank of America, and Wells Fargo. Check your bank’s website for details. Some banks have special options for recurring transfers. Look for them in the app settings.

Step-by-step Process

Setting up Zelle payments is easy. First, open your bank app. Find the Zelle option. Choose “Send Money.” Select “Recurring Payment.” Enter the recipient’s details. Choose the payment frequency. Weekly, monthly, or yearly. Confirm your choice. Make sure all information is correct. Check your email for confirmation. You can change settings anytime. Just go back to the app.

Third-party Tools

Financial apps can help set up recurring payments. These apps work with Zelle. They make money transfers easy. You can link your bank account. Then, set up paiements automatiques. This saves time and effort.

Some apps offer outils de budgétisation. These tools track spending. They help manage money better. You can see where your money goes. This helps in planning for the future. Keeping track is important.

Choose the right app. Make sure it supports Zelle. Check reviews before downloading. User feedback is helpful. It shows the app’s reliability. A good app makes payments smooth.

Integration With Financial Apps

Many apps now support Zelle integration. This makes recurring payments easy. Apps like Menthe et YNAB offer these features. They keep everything organized. You can also track your expenses. It’s all in one place.

These apps have user-friendly interfaces. They are simple to navigate. Setting up recurring payments is quick. You can manage finances without much hassle. The app does the hard work.

Automation Software Options

Automation software can schedule payments. These tools work with Zelle. They make life easier. You set a date and time. The software handles the rest. It sends money automatically.

Zapier is a popular choice. It connects different apps. This allows seamless integration. You set the rules. The software follows them. Payment is sent on the scheduled date. This reduces manual work.

Considérations de sécurité

Transactions sécurisées are very important. Always use a strong password. Change it often. Never share your password with anyone. Use two-step verification. It adds extra security. Always check for secure sites. Look for “https” in the URL. This means it is secure.

Be careful of strange messages. Do not click on unknown links. They might be bad. Always verify the sender. Ask if unsure. Check your bank statements often. Look for anything odd. Report it right away. This helps stop fraud. Use trusted apps only. Download from official stores. This keeps your device safe.

Troubleshooting Issues

Setting up recurring Zelle payments is not possible. Zelle allows only one-time transfers. Users must manually send payments each time.

Common Problems

Sometimes, setting up paiements récurrents with Zelle can be tricky. People might face connection issues ou app glitches. Ensure your internet is stable. Check if your app is up-to-date. Keep your phone’s software updated too. Another problem is incorrect recipient info. Double-check the phone number or email. Make sure it is correct.

Service client

If problems persist, reach out to Zelle support. They can help you solve issues. Look for the help section in the app. It has useful tips. You can also contact your bank. They might assist with transaction problems. Always keep your account info handy when asking for help. This makes it easier for support teams to assist you.

Alternatives To Zelle

Explore alternatives to Zelle for setting up recurring payments. Options like PayPal, Venmo, or Cash App offer user-friendly solutions. These platforms often provide easy ways to automate payments, making them ideal for regular transactions.

Other Payment Platforms

Pros and Cons Comparison

There are many plateformes de paiement besides Zelle. Each has its own pros et cons. PayPal is popular worldwide. It allows you to send money easily. But sometimes, fees can be high. Venmo is fun with its social feature. It’s great for friends and small payments. Privacy concerns exist, though. Cash App is simple to use. It offers a free debit card. Some people worry about security.

Google Pay works with many banks. It’s fast and safe. Not everyone uses it. Apple Pay is secure and private. It works only with Apple devices. Many people use it for shopping.

Choose the right platform for your needs. Consider fees, security, and features. Think about how friends pay. Find what works best for you.

Questions fréquemment posées

Can I Automate Zelle Payments Monthly?

Zelle currently doesn’t support automatic recurring payments. Users need to manually send each payment. You can set reminders to ensure timely transactions. Some banking apps might offer features to streamline this process.

How Do I Set Up Zelle Payments?

To set up Zelle payments, access your bank’s mobile app or website. Register with your email or phone number. Ensure the recipient is enrolled with Zelle. Enter the payment amount and confirm the transaction.

Are Zelle Payments Secure?

Zelle payments are secure and use encryption to protect transactions. It’s crucial to send money only to trusted recipients. Double-check details before confirming. Banks often provide additional security features for added protection.

Can I Use Zelle For Business Transactions?

Zelle is primarily for personal use between friends and family. Some banks offer Zelle for small businesses. Check with your bank if they support business transactions. Always review the terms before using for business purposes.

Conclusion

Setting up recurring payments with Zelle isn’t possible yet. It supports one-time payments only. For recurring transactions, explore other options like your bank’s bill pay service. Always check your bank’s features and fees. Using Zelle is quick and easy for one-time payments.

It’s a reliable service for transferring funds. Make sure both parties have Zelle access. This ensures smooth transactions. Stay updated with Zelle for new features. Always prioritize security. Keep your account safe. Enjoy the convenience of digital payments.