Un retard de paiement de loyer affecte-t-il votre cote de crédit ? Découvrez les faits.

You’re juggling bills, managing daily expenses, and trying to keep your financial life in order. But then it happens—you miss a rent payment.

You might be wondering, “Does this slip affect my credit score? ” It’s a question that can cause a lot of stress, especially when your credit score is a crucial part of your financial health. Imagine the relief of knowing exactly how late rent payments impact your credit.

Understanding this can empower you to take control and protect your financial future. We’ll unravel the mystery surrounding late rent payments and their effects on your credit score. We’ll provide you with the knowledge you need to avoid surprises and keep your financial life on track. So, let’s dive in and discover how late rent payments might affect your credit score and what steps you can take to manage any potential impact.

Impact Of Late Rent On Credit Score

Paying rent late can affect your credit score. Landlords might report late payments to credit bureaus. This makes your credit score go down. A low credit score makes it hard to get loans. Paying rent on time is important. It keeps your credit score healthy.

Some landlords do not report late payments. This does not hurt your credit score. But late fees can add up. You might have to pay more money. Always check your rental agreement. See if they report late payments.

Paying on time is smart. It saves money and keeps your score safe. It also shows you are responsible. This is good for future renting.

How Rental Payments Are Reported

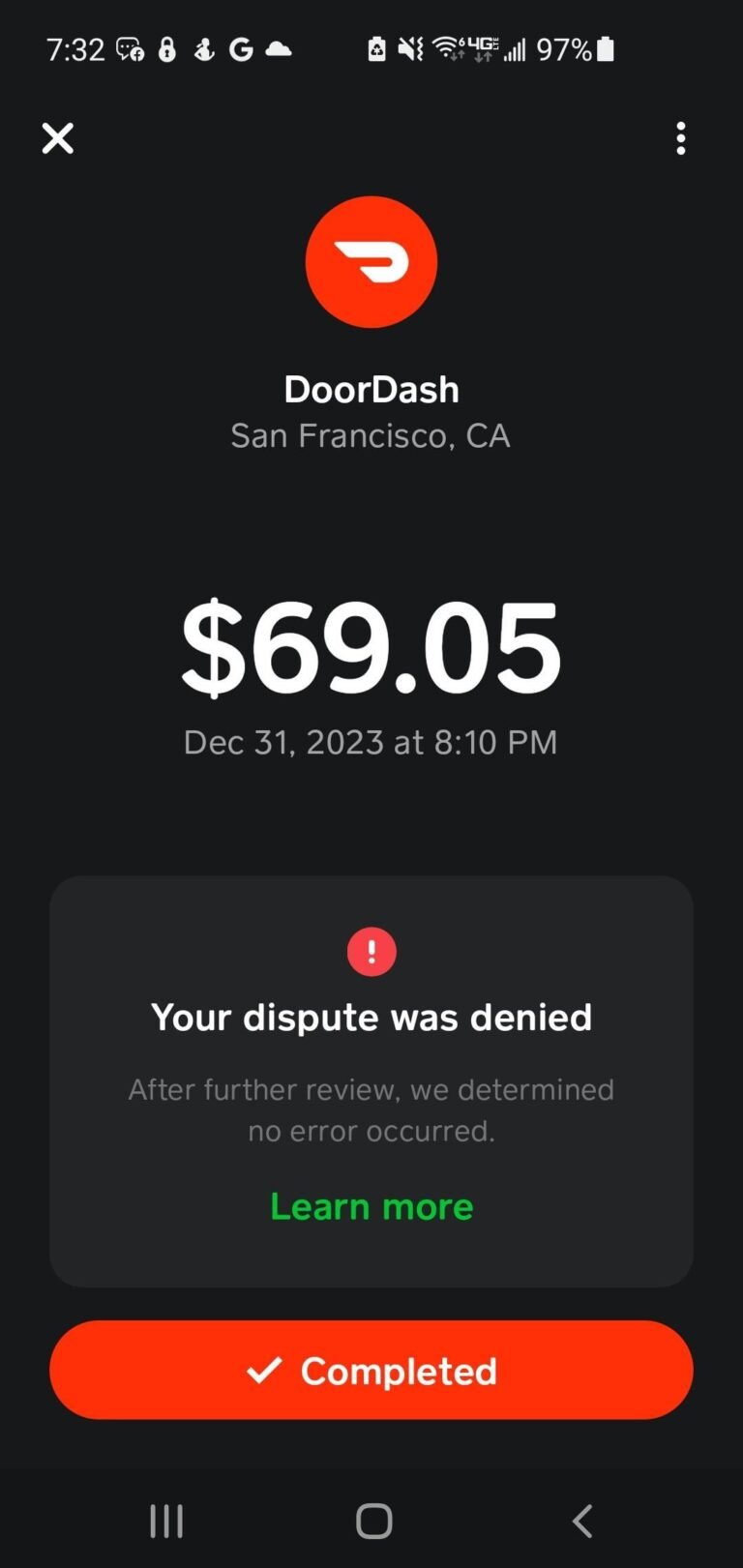

Traditional reporting often misses rent payments. Banks and credit bureaus focus on loans. Rent is not usually included. This means late rent may not show up on your credit report. But landlords may still report it. They can tell a debt collector. This can affect your credit score. So, it’s important to pay rent on time.

Quelques new systems now include rent payments. They help renters build credit. These systems report rent like a loan payment. Paying rent on time can improve your credit score. But not all landlords use these systems. Ask your landlord if they report rent. It can be a good way to build your credit history.

Factors Influencing Credit Score Changes

Credit reporting agencies keep track of your financial actions. These agencies collect data like loans and credit card use. They also check if you pay bills on time. Retards de paiement can be reported to these agencies. This affects your cote de crédit. They use this score to decide if you are a good borrower. So, paying late can make your score drop.

Not all landlords report late rent payments. But some do. If your landlord reports, your cote de crédit might be affected. Paying rent on time is important. It shows you are responsible. This can help keep your credit score safe. Always check with your landlord about their reporting practices.

Rent Payment History And Credit Building

Paying rent on time can be good for your credit score. Your rent payments can show that you are responsible. This can help build confiance with lenders. Some rent reporting services send your payment history to credit bureaus. This can improve your score over time. Regular payments are very important. They show that you can manage money well. Always pay rent avant the due date. This habit can make a big difference.

Missing rent payments can hurt your credit score. Late payments show you may have inquiéter with money. Some landlords report missed payments to credit bureaus. This can lower your score. Éviter missing payments to keep your score safe. Even one late payment can be bad. It may take months to fix your score. Pay rent on time to protect your credit. Your future loans depend on it.

Ways To Mitigate Impact On Credit

Talking to landlords helps a lot. Explain why rent is late. Be honest about your situation. Ask for a little more time. Many landlords understand. They want rent paid. Not to cause trouble. Good communication is key. It shows responsibility. Helps in maintaining trust. Always keep it polite. This approach can ease stress.

Plans de paiement can help manage late rent. Ask landlords if they agree. Split the amount into parts. Pay a bit each month. This shows you care. You are trying to fix things. It keeps your credit safe. It also makes landlords happy. They see you are responsible. Such steps help build trust.

Alternative Solutions For Rent Reporting

Late rent payments might not directly impact your credit score. Many landlords do not report to credit bureaus. Alternative solutions for rent reporting can help you build credit by ensuring timely payments are recorded.

Third-party Rent Reporting Services

Third-party services report rent payments to credit bureaus. These services help improve your credit score. On-time rent payments show responsibility. Some landlords use these services. Tenants can opt-in too.

Benefits of choosing these services include better credit history. Rent payments become part of your credit report. This helps when applying for loans. Access to credit might increase. No more worries about rent affecting your score.

These services have a fee. Choose one that fits your budget. Not all bureaus accept rent data. Check which ones do before opting in.

Legal Rights And Tenant Protections

Late rent payments might not instantly affect your credit score. Landlords typically report to credit bureaus only after significant delays. Staying informed about your rights as a tenant helps protect your credit health.

Understanding Lease Agreements

Lease agreements hold important rules. Read the lease carefully. It tells what you must do. It tells what the landlord must do. Rent payment rules are in the lease. Some leases have grace periods. These are extra days to pay rent. Late fees can apply if you pay late. Know your rights. Your lease is your guide. It protects both you and the landlord.

State And Federal Laws

State laws protect tenants. They set rules for landlords. Federal laws also protect renters. These laws help against unfair treatment. They keep landlords from being too harsh. Late rent may not affect credit score directly. State rules decide what landlords can do. Know your state laws. They provide safety. They offer rights. They ensure fair treatment for tenants.

Questions fréquemment posées

Does A Late Rent Payment Show On Credit Reports?

Late rent payments typically don’t appear on credit reports. However, if your landlord reports it or sends it to collections, it can impact your credit score. It’s essential to communicate with your landlord to avoid this situation.

Can Landlords Report Late Rent To Credit Bureaus?

Yes, landlords can report late rent to credit bureaus if they use a reporting service. This can negatively affect your credit score. Consistent communication with your landlord can help prevent this from happening.

How Long Does A Late Rent Affect Your Credit?

A reported late rent payment can impact your credit score for up to seven years. However, its influence decreases over time. Maintaining a good payment history can help mitigate its effects.

Do Rental Payments Improve Your Credit Score?

Paying rent on time can improve your credit score if reported to bureaus. Some services allow rent payments to be included in your credit report. This can boost your creditworthiness over time.

Conclusion

Paying rent late can impact your finances. Protect your credit score. Timely payments help maintain a good credit history. Avoid late fees and stress. Set reminders or automate payments. Communicate with your landlord if issues arise. Understanding the impact of late payments is crucial.

Stay informed and proactive in managing your finances. This ensures financial stability and peace of mind. Remember, your credit score affects future opportunities. Make it a priority to pay on time. It’s a simple step for a secure financial future.